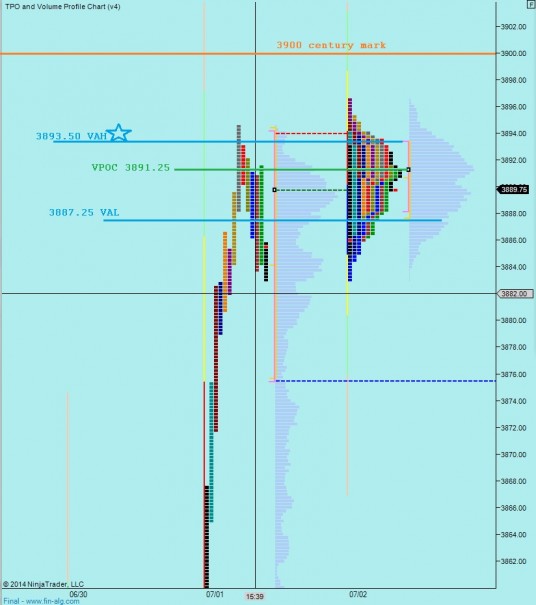

Nasdaq futures are trading a bit lower overnight on a balanced session of trade. Before weakening, the prices rose to the Monday opening swing low (also initial balance low) at 3906.75 to the tick. There was a slew of weak economic data out of Europe overnight, we have JOLTS Job Openings at 10:00 am, Consumer Credit at 3pm, and key Chinese PPI statistics this evening at 9:30pm.

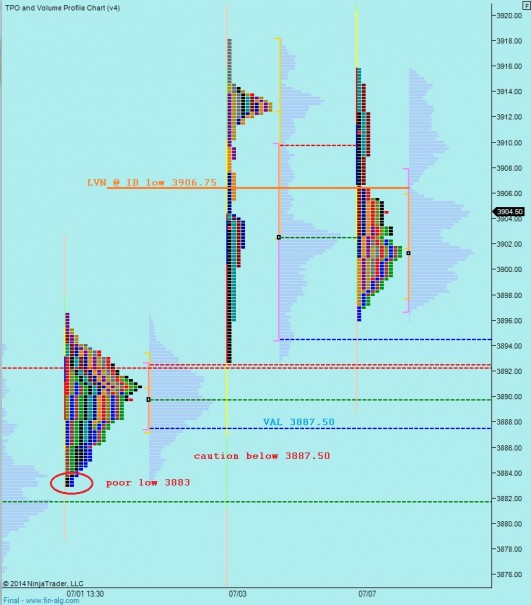

The intermediate term auction was set into balance yesterday. The early action was successful in discovering a responsive seller and once that was established we saw a successful discovery process lower. It took some time to entice buyer back into the market however once they were found a modest response was registered. Overall it left a key LVN above at 3906.75 (same level as mentioned earlier), see below:

The market profile print yesterday has a slight b-shape suggesting a long liquidation took place. The action was relatively dynamic, however sell flow was not overwhelming the bid enough for prices to continue exploring lower. Instead we formed a lower distribution. If we take out yesterday’s low I could see it sparking another exploration lower. I have highlighted the levels I see potential to test on the following market profile chart:

Comments »