If consistent profitability as a futures trader was easy then everyone would do it. Volatility is so low right now that most traders are frustrated by the dead index markets. The more versed players have taken their trading elsewhere to crude oil and metals to hunt down some volatility to trade. I still like what is happening in the Nasdaq.

Swing traders are back in the captain’s chair, beguiled by the warm drift of the summer tape. Meanwhile Janet Yellen has been watching us kick bears up slides inside the schoolyard. She blew her whistle today, sending a few ADD addled speculators to the principal’s office. The clever swingers are getting away with rolling bears up hills behind the gymnasium. The downright shameless have taken to the trash heaps, having their kicks just beyond 4th grade teacher Yellen’s watch.

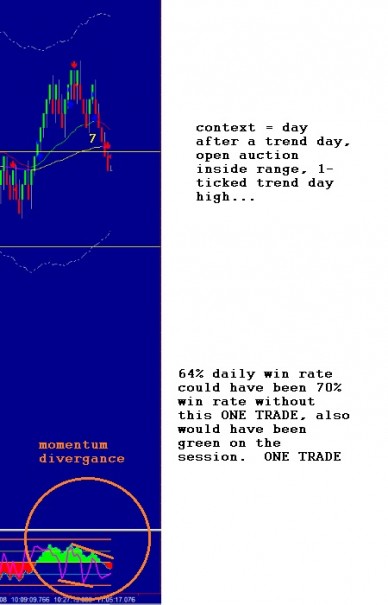

This is the market we are in. Today was the day after a trend day. We had below average volume during the opening hour, we had an in-range open auction (scalpers paradise, the best days to fade extremes back to the mean, and just before I took trade #7 we one ticked yesterday’s high of the session.

Let all of that context settle in a bit, it really is a mind full.

Had I resisted just this one trade, trade #7, my day would have been profitable. Had I exercised a proper flex of my contextual research, work I take great pride in, my win rate would have been 70% on the session instead of a failing 63.6%.

Here’s trade # 7:

In summary, although we are near record lows in volatility, am still 1 trade away from being able to turn a profitable trick. I am pretty sure I can figure out one less trade to take with a consistent enforcement of context.

DEVELOPING…

If you enjoy the content at iBankCoin, please follow us on Twitter

nice broham. sorry about (un)lucky #7, its all asian now, according to dear leader, seven is generally understood as lucky in most cultures so i don’t properly understand how that went wrong. i’ll admit i don’t have the cajones to trade futures like this so i’ll have to stick to degenerate options trades in chinese burrito factories and hope one out of seven pulls through. I do certainly enjoy the play by play, the charts, and the insights and i check your blog as semi-religiously. many thanks!

Lol, that trade #7 entry is the difference between almost understanding day trading and being a successful operator. I am actually quite satisfied to see such a slap in the face, now I might dodge said slap in the future. The joy of full disclosure. I am thrilled you enjoy my bloggery, have a great holiday USA!