Today is the first day of the third quarter and also the second day of a holiday shortened week. Nasdaq futures are currently priced to gap higher into the session by just over 10 points. The important economic releases scheduled for today happen early during our session, with PMI Manufacturing index at 9:45 and more importantly ISM Manufacturing Index and Construction Spending at 10am. There is a 4-Week T-bill auction at 11:30am. Janet Yellen is set to speak tomorrow at 11am.

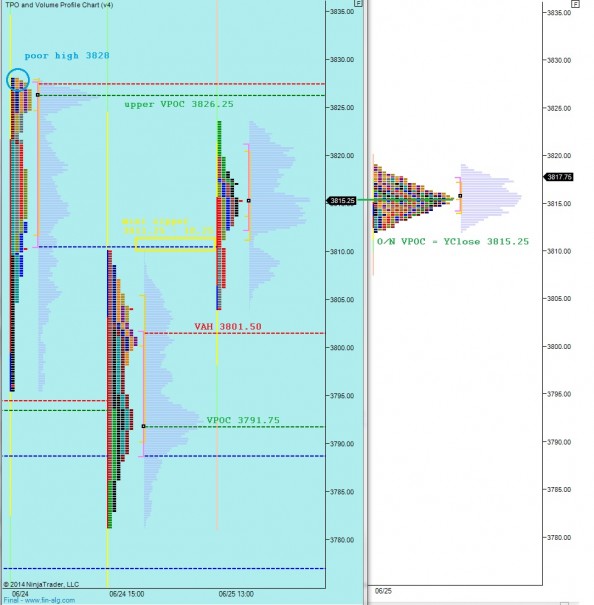

Price drifted higher overnight, and given the context of a poor high, the acceptance of value as evident by the clean distribution yesterday, and late responsive buyer the drift was expected. These few days ahead of the 4th of July tend to be bullish, but with money managers eager to start the new month/quarter off we can see some bigger swings in both directions intraday.

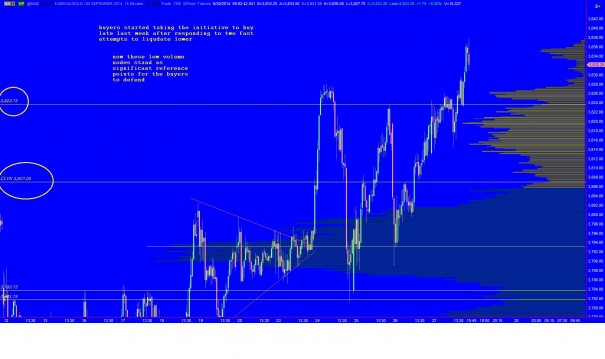

The long term and intermediate timeframes are buyer controlled meaning prices are not balanced nor are they making lower lows and lower highs. Instead we are making higher highs and higher lows on a weekly chart of the composite (see yesterday morning’s premarket analysis) and the intermediate term chart is doing the same. If the market sees some selling today, there are some interesting low volume nodes we could test out while still retaining buyer control. I have highlighted these levels on the following intermediate term composite:

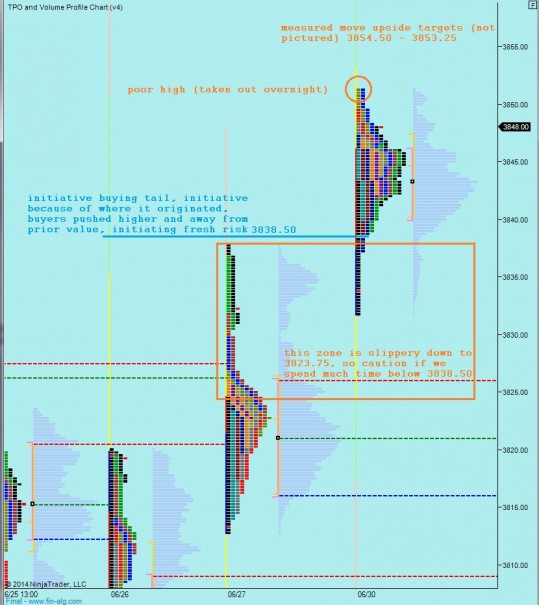

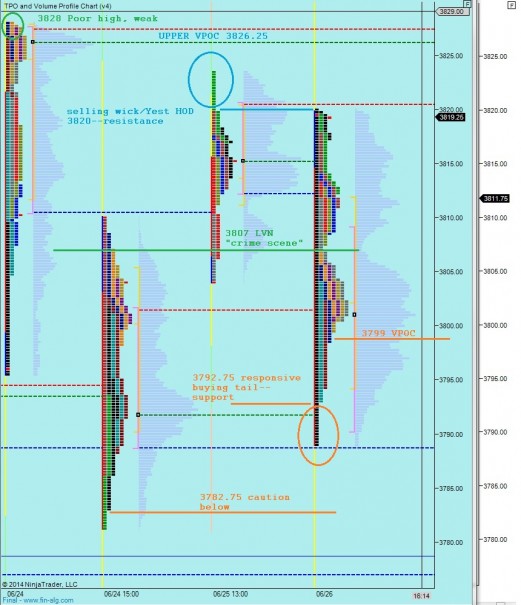

There is a slippery zone on the market profile. This is a price area where buyers were very confident yesterday. However, should we trade back into this region and not observe the same level of confidence from the buyers, they we are likely to see a fast liquidation take hold, something to shake out weak handed longs perhaps. On the upside we are working with measured moves. I have noted the measured move targets, as well as a few other observations on the following market profile chart:

Comments »