We started out last Thursday with a 50 point gap down. The move was partially attributed to questions of insolvency at Espirito Santo, one of Europe’s largest banks which is located in Portugal. This morning we wake to see Euro-Zone stimulus announced by “Super” Mario Draghi, one trillion. Central banks continue to be the primary driver of market prices, and we are waking up to nearly 20 points of upside in the Nasdaq futures.

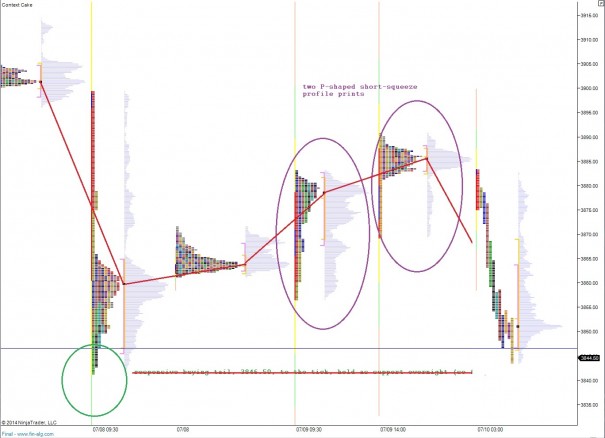

Price stalled out overnight after taking out prior swing high by one tick. The 1-tick is sometimes the preclusion to a failed auction. However swing highs and lows are rarely made outside of the cash session.

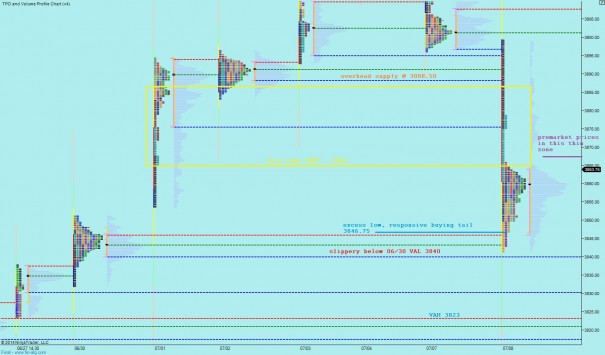

The monthly volume profile chart shows us forming a high quality distribution up here at the highs. This suggests market acceptance of these prices and is a positive as we go forward. Whether we go higher today from here or retrace a bit first, seeing this type of distribution form tells us a sharp rejection of these prices has not occurred:

On a weekly chart of the Nasdaq, we can see a responsive bid coming in last week (seen as a long tail on the red candle). There was an uptick in volatility yet buyers continue asserting a control on the long term, see below:

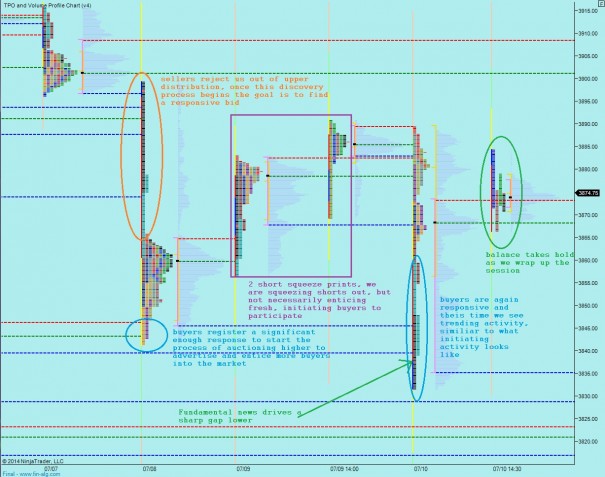

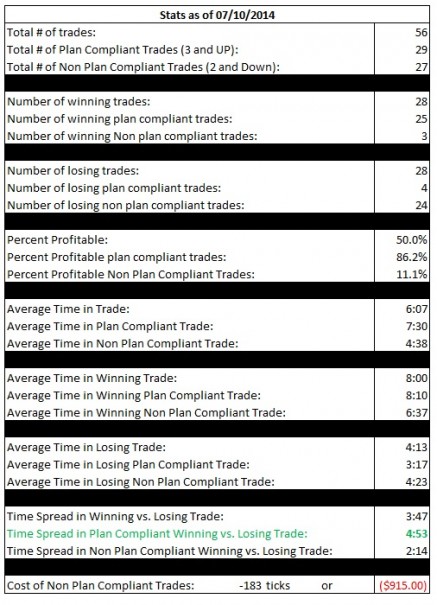

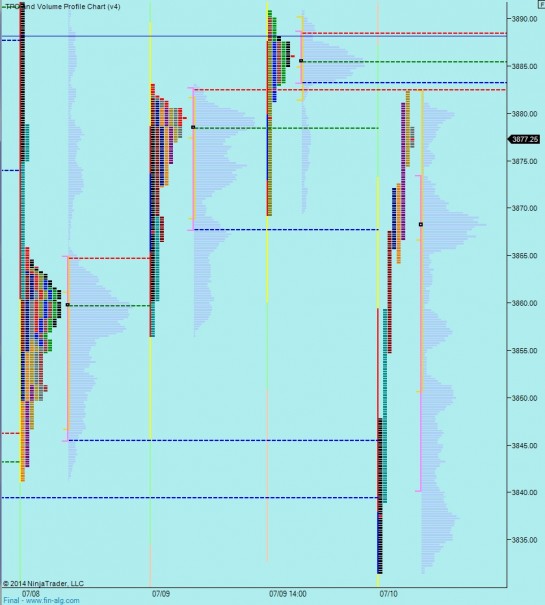

The auction can be seen best on the intermediate term. The last nine sessions have done a wonderful, albeit fast, job of establishing a low bid and then beginning the process of auctioning higher in search of an upper boundary. The net action has produced balance for the month of July. We are coming into today’s session much like last Thrusday, only with the gap pressing us up against the high of intermediate term balance. We do not have quality markers above for assessing whether we are leaving intermediate term balance. Instead I will look for sustained trade above our current swing high at 3918 and a measured move higher without sharp responsive selling. I have highlighted the measured move targets below, as well as the nearest low volume nodes for assessing any selling back into the intermediate term range:

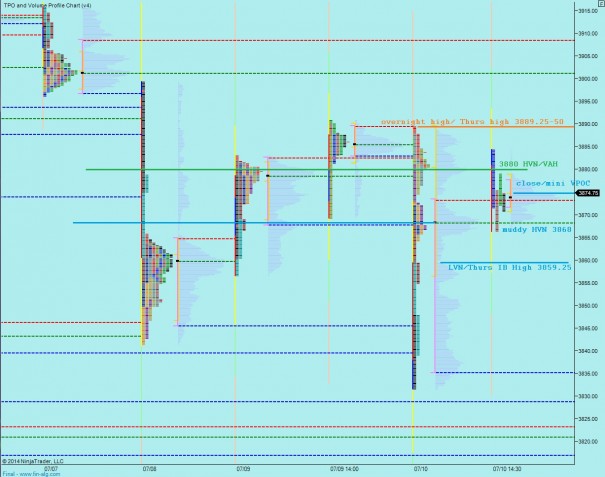

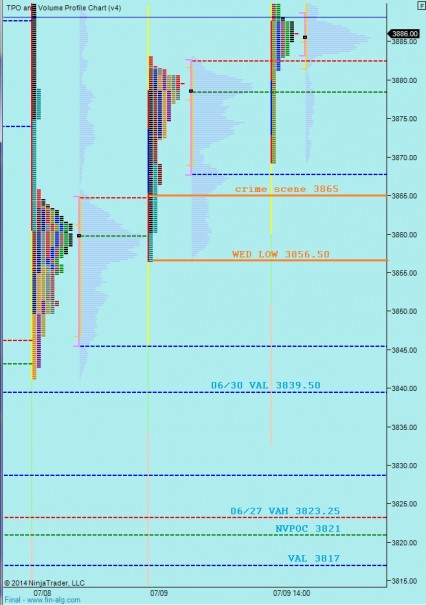

Finally, here is a snapshot of the market profile heading into the week. I have noted the price levels of interest as well as a few other observations below:

Comments »