News flow starts to accelerate a bit today. At 10:30am the weekly energy statistics (oil and gas inventory) will be released. At 2pm there is a monthly budget statement from the Department of the Treasury. Than ahead of the open tomorrow there is a Swiss rate decision, ECB Monthly Report, and US Advanced Retail Sales for November.

Also note that tomorrow futures trades will roll forward to the March 2015 contract. This can cause some wacky delta readings and offset order flow as positions are moved to the new front month contract.

Turning our attention to the market, Nasdaq prices are a bit lower from where they left off Tuesday afternoon and have traded in a balanced range for most of the session. Range and volume are normal and the low of the session looks a bit weaker than the high.

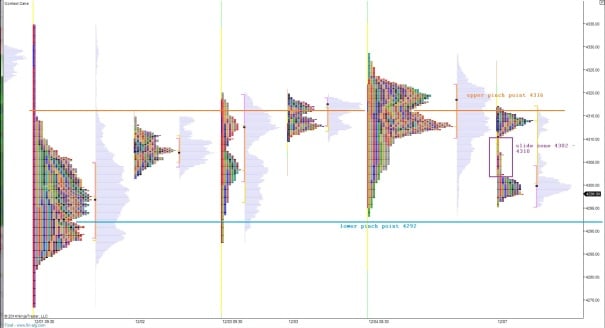

If you recall on Monday we discussed how once price entered the below pocket we were likely to test through to the other side down to 4242. Yesterday prices went gap down below this level and found responsive buyers. What followed was a stronger-than-expected neutral extreme day type which recovered the entire gap (recapturing the volume pocket) and more.

It was an interesting profile print because it spent nearly 2 hours building value down near 4242 before accelerating into the pocket/gap zone. This left the VPOC of the session down at 4239.25 almost 50 points away from current prices.

My primary expectation for today is to see a constructive inside day with buyers defending the upper half of yesterday’s range. Typically the day after a neutral extreme or trend day I look for continuation or exceeding the prior day high but the curious nature of yesterday’s print has tempered my expectation a bit.

I have highlighted the key levels I will be observing on the following volume profile chart:

Comments »