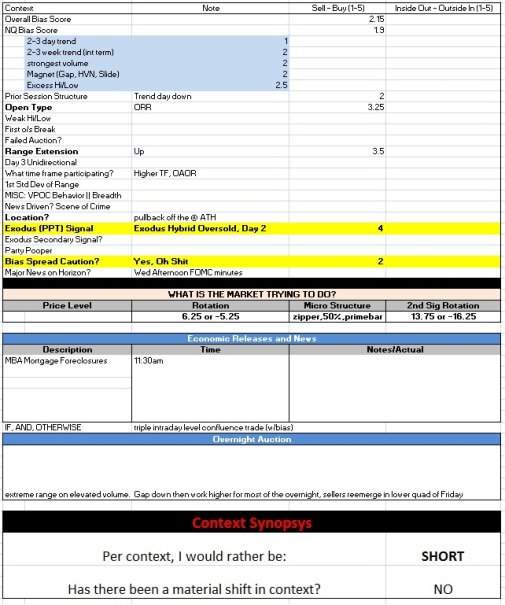

You want to keep the mind game simple when trading. I have concentrated my technique down to bias, hypothesis, level, then trade. I have done my best to codify bias with Switchboard. Below I highlighted the two major cross currents which are in conflict and make me question my overall short bias:

Having the wrong bias means you are only looking for small scalps on the side that is running while trying to press position trades in the side that is being run over. This makes trading NASDAQ futures suck, but it usually does not end up a losing endeavor. However it carries more significant implications for the 10-12 day horizon.

Back on Friday I was buying longs by the afternoon for the 10 day hold via the Exodus Hybrid oversold. Then, seeing us trend down into the close I relied on market profile theory to ensure me the high probability I could re-initiate my longs at least one tick below the Friday low. The logic played out, but all the sudden I was not interested because Oh shit short caution was activated on Sunday AND all things considered the Switchboard bias was short.

So I missed my swing entry. Therefore I ask two questions of you, if you are willing to help me. I know most of you root for my demise. but a few on the same journey as mine are allies.

If you enjoy the content at iBankCoin, please follow us on TwitterQUESTION ONE: How do I handle mixed signals?

A. Completely separate behavior – use Exodus for swing and my model for working NASDAQs

B. Do not trade – too mixed a message, just do nothing

C. Shit can the model

D.Rely on the Context Synopsis (final call of Switchboard) and fiddle with the amount of weight each item earns (i.e. Exodus 5 instead of 4)QUESTION TWO: Does anyone have a better name for the Oh shit signal? I am so sick of calling it that. Offer a new name in the comments below.

The easiest way to get killed on a battlefield is to fucking run around too much without a direction of attack. Do not trade into conflicting signals. It will make you insane. Use the time saved to figure out how to untangle.

I agree. I need a consistent way of behaving when the streams cross. Thanks for casting your vote for letter B.

Raul – I don’t trade futures. Went long some TNA calls via the Exodus signal, so I guess my answer is when in doubt, defer to the archons that reside withing the holy algorithm.

As for the OhS? http://i.imgur.com/BDT4Byu.png If you can imagine the red zero line being ground level, can you see the way the signal is acting as a “Bunker Buster”? http://i.imgur.com/KXlq6k3.jpg

Ooooh, I like bunker buster

I would vote for option D. The model you’ve created is statistical in nature but essentially empirically derived. Creating weights for your Exodus and Nasdaq inputs is necessary to capture the systematic behaviors behind overbought / oversold conditions. It’s essentially a ‘fudge factor’, but some back testing may tune your model for these extreme conditions.

I find it’s better to stay away when I don’t have a good read on the market. Like today I went to the gym instead of trying trades that would have been more gambles as I didn’t have a good feel for direction. Missed a good entry, but also didn’t make stupid mistakes or get shaken out of a position I didn’t have a good enough thesis for.

That said, with all the data you track, there must be a way to tweak something without muddling the objectivity of your model. Perhaps predefine signals that would negate one side or the other of the conflicting bias if triggered for the day so that you can trade with a clear direction?

Instead of OhS – Maybe Trap Door Short Signal? As in the model signaling the market could fall through one easily if it steps in the wrong spot.

I like UB’s Bunker Buster idea as well

For Q1 I can only suggest how maybe your readers/subscribers can handle mixed signals… newer traders should opt for B, stand back and observe. For more experienced traders, A, be nimble and follow this blog.

I am an ally and read your posts everyday. Great work and I thoroughly enjoy stopping by!

I trade NQ primarily, and other futures throughout the week sometimes. For me, I try to keep it simple as possible with my trading. Essentially, I get up each day, have an idea of what may happen, and attack that direction. I am either right or wrong. I don’t use any complex models or indicators because I do not know how long of a lifespan they will have. In my mind, finding areas on a chart where traders will get raped the most seems to work best. Seems like that has always held true with trading since its inception. When I am right, I try and murder it. It just takes one day killing it a month and that evaporates days/weeks of losses if they happen. When I am wrong, I try to keep my losses small(still working on this because I have become more proficient at digging myself out lately so it is tempting to keep attacking). I got my ass kicked last Friday trying to do this and I should have just stopped:(.

I started a short campaign today around 4592 after covering all longs from Sunday and Monday. Still holding half, hoping for some long covering going into the fed bs tomorrow. I want 4525ish, minimum. I did not see follow through today like I wanted and feel that we must retest last week lows at a minimum before any type of serious move up. The gap I was anticipating today just did not happen. My anchor chart was screaming short too. Let’s see what happens.