The NASDAQ futures are priced to gap up this morning after an evening of balance gave way to buying early this morning. Range and volume are both slightly elevated above normal on a session that managed to push up and test the low from last Thursday. At 8:30am Consumer Price Index data came out slightly better than expected. The number brought in a small spurt of buying that was faded.

On the economic calendar today are a slew of low/medium impact events. At 9:15am we hear the Industrial/Manufacturing Production read. At 10am NAHB Housing Market Index, and at 4pm the Net Long-term TIC Flows. Keep in mind we also have FOMC minutes out tomorrow afternoon.

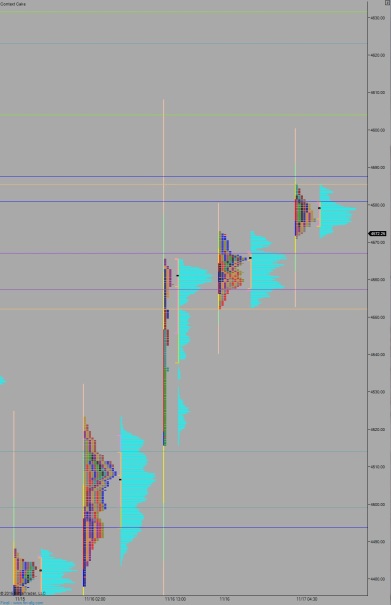

Yesterday we printed a trend day up. The session started flat and the early attempts of sellers to press lower were defended. Before lunchtime buyers were in control and they continued initiating higher prices through the close.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 4561.75. Look for responsive buyer just below at 4557.25 who work to take out overnight high 4585.75 but achieve little more as the market enters a wait and see grind ahead of tomorrow FOMC minutes.

Hypo 2 buyers gap and go. Take out overnight high 4585.75 early and press up to target the HVN at 4603.75 before two way trade ensues north of the overnight high.

Hypo 3 sellers become aggressive. After closing the gap down to 4561.75 they set their sights on overnight low 4552. Below here are single prints which price accelerates into, pressing the market down to 4517.25 before two way trade ensues.

Levels, note-the gods are testing me this week. Yesterday market profile was broken, today Multicharts is broken. I cannot make this stuff up:

If you enjoy the content at iBankCoin, please follow us on Twitter