Yes yes, I know, Twitter is absurdly overvalued. The insiders are nerdy scumbags (the worst kind of scumbag) and are liquidating in droves as they no longer here the music. The whole business is plum toxic, what with the easily replicated service and all. I heard they even stopped offering free Cliff bars in the break room. Here comes a glasshouse revolt!

These jackoffs can’t even make money. Pathetic.

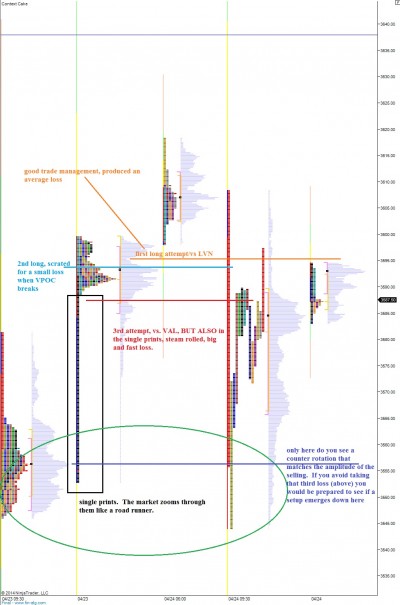

Traders who took the obvious position of shorting into lockup expiration were rewarded handsomely this week after shares of TWTR plunged. Mom and pop saw the headline and trampled one another the following day to liquidate the ticker away from their person.

Now the questions start because we all know Twitter is some kind of media phenomenon. After all, it was only two Super Bowls ago that ads never featured the hash tag. Celebrities have accepted the product one-by-one, and most breaking news originates on Twitter. CEOs use the service to promote and defend their companies. Politicians drum up support and test slogans. Robots follow hundreds of thousands of humans and then tell odd jokes. This service is broadly used, useful for reaching likeminded conversations, and essential for branding.

Therefore I consider the company a going concern. I have been long Twitter since IPO, at times larger than others and I have sold some shares along the way. My position was full size going into this downturn, so you could consider me biased. However, I will ride Twitter to zero. That being said, I see this weakness as an opportunity to buy more shares.

Am I buying the current weakness? Absolutely not.

What we are seeing is a news driven reaction in the market. There is no telling how far this move can go. We will only know it is complete when prices have gone much higher. However, being a news driven move, it is very likely to be retested. And when we retest these lows, either in weeks or months, I will be keen on buying more shares. Until then, I brood.

If you really want to scare the last strong hands out of momentum, then blow the bird hole to smithereens. The scene in most momentum stocks currently resembles Alfred Hitchcock horror. Thousands of angry algos are intent on fleecing you of your favorite shares. This was a very public dismantling and it is very effective in returning shares to their proper owners—banksters.

http://youtu.be/x4e53wnInX4

Comments »