What has the market done?

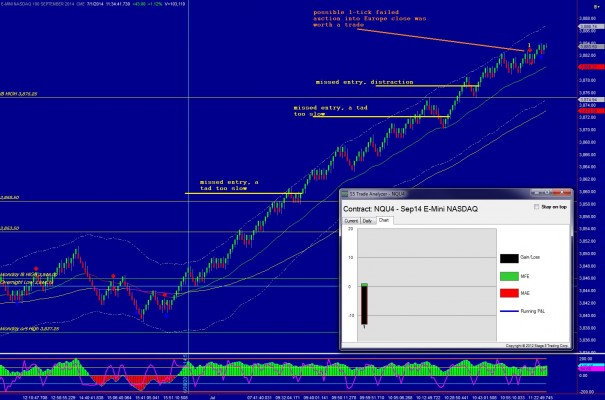

Big gap lower overnight on fundamental news. Open auction outside of range finds strong conviction responsive buying. Nasdaq futures opened at a perceived discount to value.

What is it trying to do?

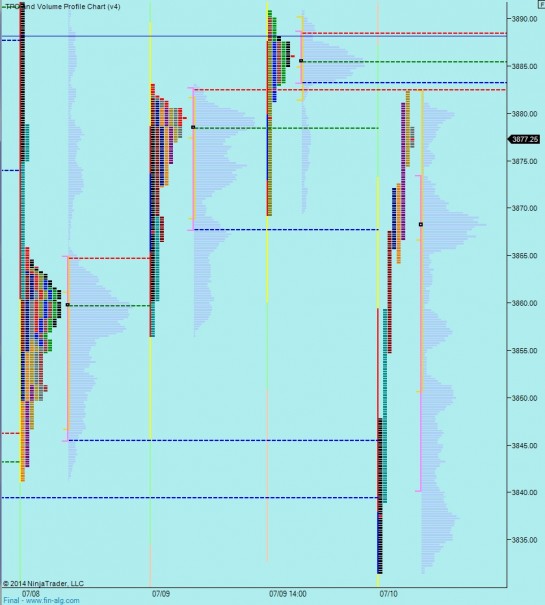

The market is now attempting to discover what the value of the contract is. We are out of balance and thus we attempting to define key responsive sellers after a drive higher. We are starting to see counter rotations lower since the close of the European session, especially before the low volume node at 3883.

How good of a job is it doing?

We are doing a good job bidding higher, the volume is average and the rotations are enticing the other time frame to participate.

What is more likely to happen from here?

From here we are likely to begin coming into balance. The range on the NQ is already 50 points wide. The short term trend is up making the possibility of a complete gap fill to 3886 distinct, especially if we trade through this LVN at 3883. Otherwise we retrace back to today’s current VPOC at 3868.25 and balance out into the close.

CHARTS:

Comments »