There was not much you needed to actively do toady except avoid any urges to take action. If you came into today long, your primary objective was to sit put while the Nasdaq slowly trended higher. This is the holiday drift, a contextual environment unlike most with its calm demeanor and consistent appreciation.

If you managed to sit out the carnage earlier this year and instead wait for The PPT to give an all clear signal, then you could easily be up 15% on the year. I was able to regain some losses, but still sit -19% on the year.

There is more than half a year left, and if I can diligently execute on only the solid opportunities in the marketplace then I can regain green by the end of the year.

I took a scale on the YELP calls I bought yesterday. There was not much power on the late-day new high and we were trading up into my favorite moving average, the daily 33 exponential. I will always take a scale at this spaghetti string.

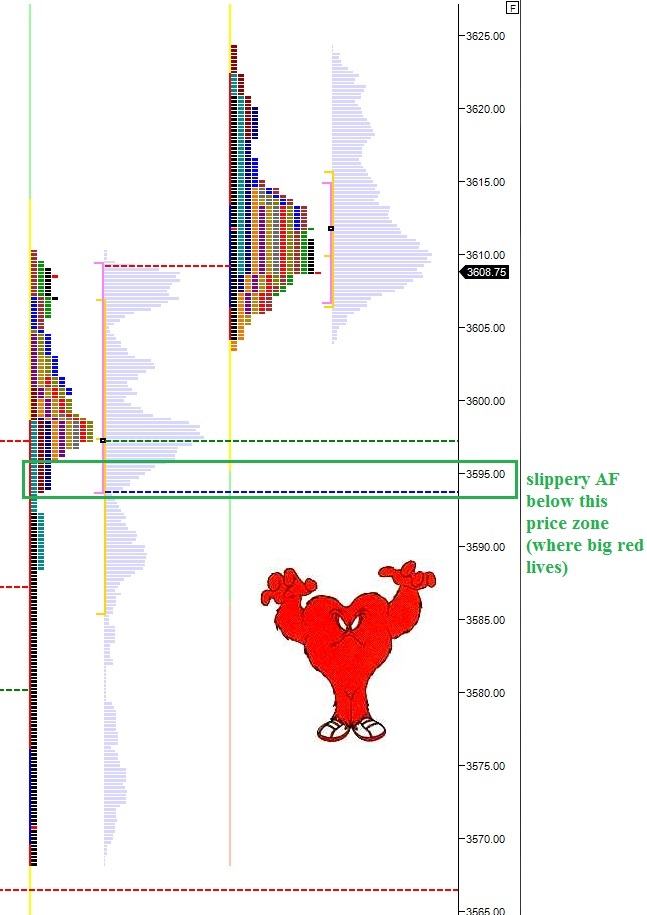

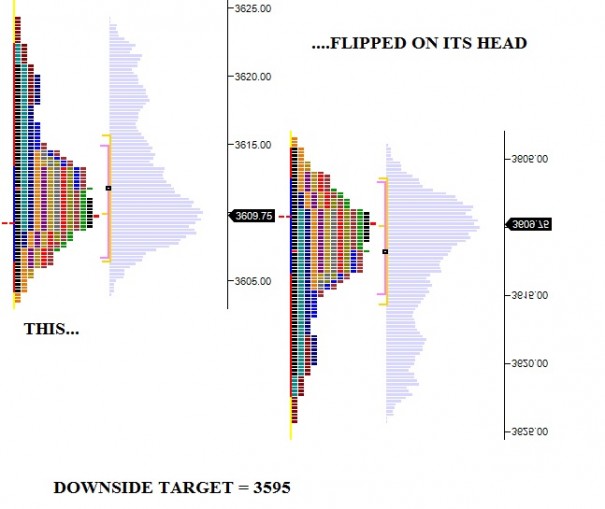

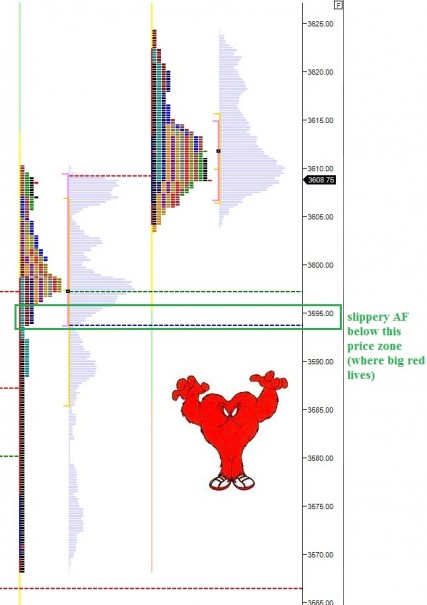

Enjoy your holiday weekend and stop by the Raul blog if you want to study auction theory pertaining to opening swings. This stuff has become super useful in guiding my morning trading and this week was no exception. Stop by to see some of the opportunities I traded.

Comments »