Apple is out with their earnings and share price is headed lower. I could begin to speculate as to why, but the short of it is simple—there are more people selling shares of AAPL than buying. I got off half my positon today, taken Friday amdist the calamity, but that will do very little to shield the loser. This will end up being a losing trade.

The question becomes, does the NASDAQ get lit up tomorrow? The market stopped its one-directional jaunt this afternoon, of only briefly, which allowed individual stocks to behave a bit. However, tomorrow is news heavy and price could get loose.

I have lots of exposure to the long side. For me to sit here, in my underpriced chair and tell you I am comfortable with my position would be a lie. I would like to have more cash and less call positions in the red.

However, I am still green year-to-date, odd as it may seem. This may change tomorrow.

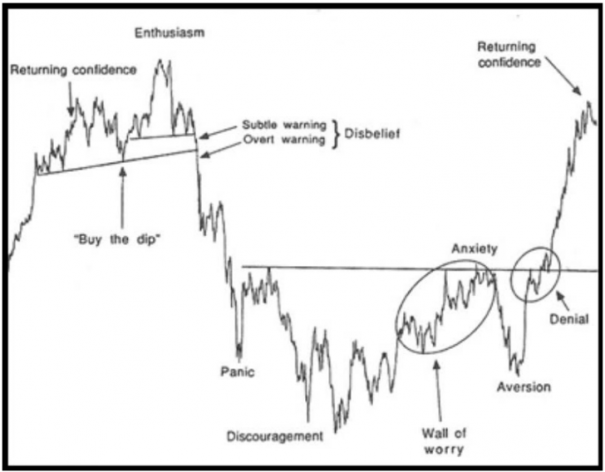

Intermediate term balance is teetering on the edge of the abyss—the abyss being prices we have not seen since November. Living to fight another day is always paramount, even if you are wrong on a trade. I may be wrong in expecting a revision to the mean on intermediate term balance. At least, that is what the market information to- this point is leading me to believe.

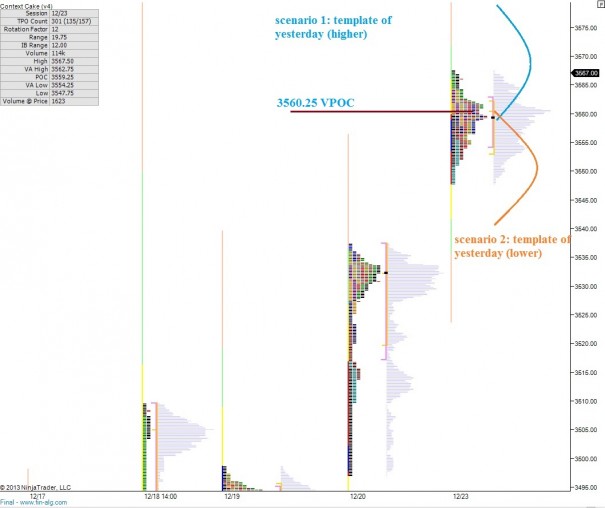

On a more positive front, Elroi caught the turn higher this afternoon while I was freezing myself in the arctic cold. He earns a gold star. May he continue to labor through the night, trading opportunities he sees fit for algorithmic success.

Comments »