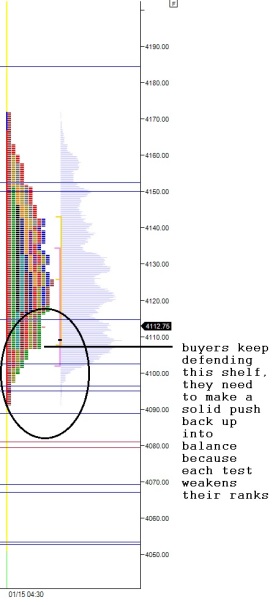

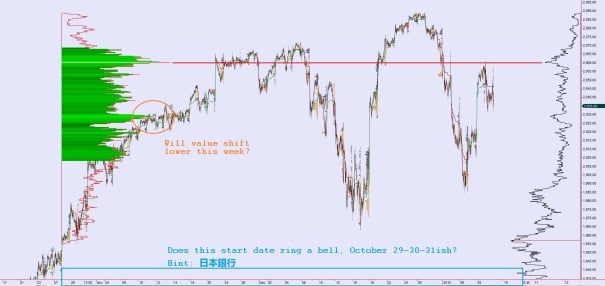

You take what you can get and adjust to your conditions. The sooner you tune into a paradigm shift, the better.

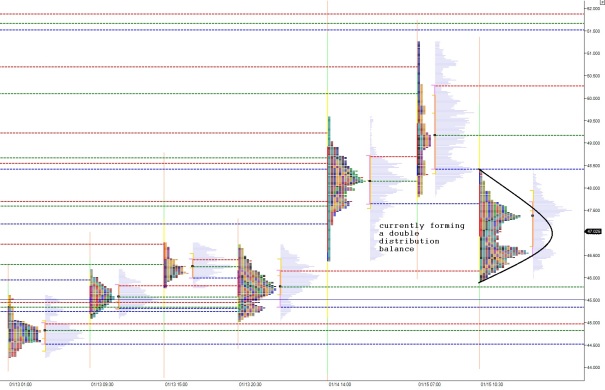

Information costs money. Sensing the proclivity of a certain asset class, we shall call it MOMO, to form ‘fake moves’ before making ‘real moves’ was not a free lesson. Quite the contrary, mates.

Nevertheless we must will ourselves into accepting external events one way or another and on we go. Fungula, that is the pet name. It also harks to tones from the underworld, earning it the persona of a succubus.

It’s fast as is the evidence of whether your right or wrong. None of this waiting around, wringing your hat baloney. And I appear to have acclimated to it.

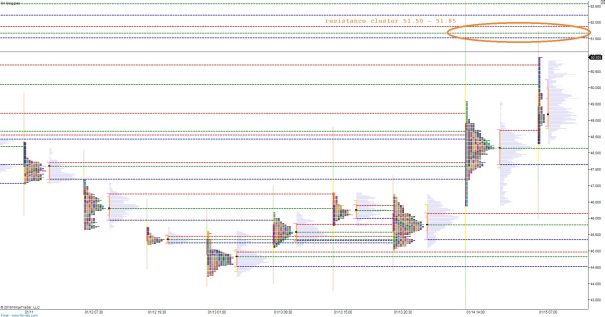

In short, now would be a perfect time for volatility to vanish entirely and put me back on the drawing board. FML, I suppose that’s why I toil away 10 hours of my weekend on the WSS.

Comments »