For the quarter soaked in gasoline to end without combustion would have been a disappointment. It would be like a firework show without a finale. This is America, dammit, we like grande completions.

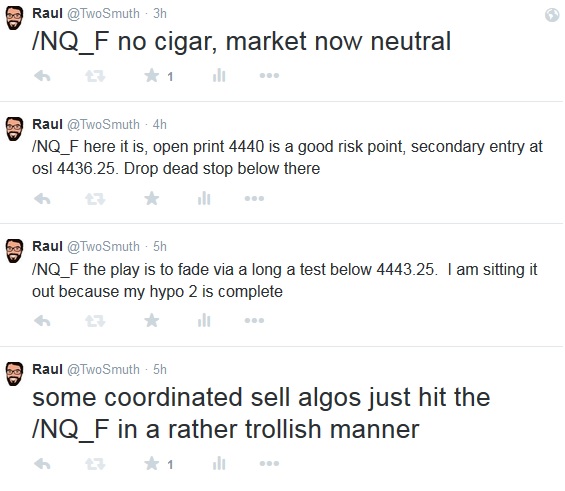

Since I returned from Jackson Hole, my main focus has been to trade less. It took me an entire quarter of random churn to realize my edge only exits a few finite moments a year. Digging a bit deeper, and using tactical entries and exits, I have 3, maybe 5 times tops intraday where I have an edge.

The rest is all work for the sake of work, random back and forth that my broker must L-O-V-E.

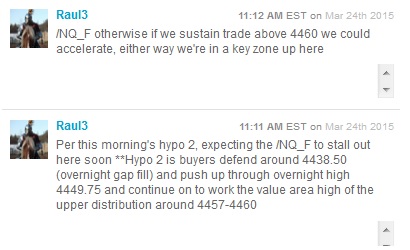

Today I had a strong trade coming out of lunch. I caught nearly the entire rotation up and by 1:45 I turned my attention to industry. Part of me knew this afternoon was destined to be hairy. It would have served no purpose to wring my hat and stress about the closing behavior because I had zero intention of altering my book.

I am long lads, the longest I have been all year. My positions are concentrated like the tanks of a blitzkrieg. Starting tomorrow, said spear will aim to penetrate the belly of the bear and separate its ranks, causing their camp confusion and chaos.

Like any blitzkrieg attack, its effectiveness is entirely dependent upon striking fear in the heart of the opposition.

I am like a wolf clad in skinned sheep and you are a merely baby cub. Cometh with great fury, all yee market inflows. Q2 starts at the stroke of midnight. Watch your futes.

Comments »