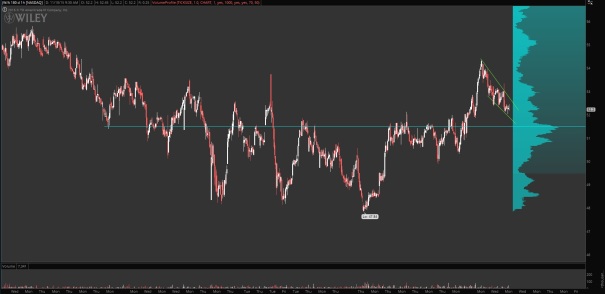

NASDAQ futures are priced to gap down into Thursday—the third gap down on the week. The overnight session featured elevated range and volume. It started out balanced then sellers pushed in and worked price down to a new low of the week. At 8:30am Initial/Continuing Jobless claims data came out worst than expected. The initial reaction is selling.

After a rough week for oil we will hear the crude/distillate report today—a day later than usual due to Veterans Day. We also have a Monthly Budget Statement at 2pm.

Yesterday we printed a neutral extreme down. I examined it closely yesterday evening.

Heading into today my primary expectation is for sellers to work a gap-and-go down. Look for a liquidation run down to test the 4600 century mark then look for responsive buyers. Buyers attempt to work price back up into value above but struggle to regain 4624.75 which sets up a roll and continued move lower. Extended target is 4580.

Hypo 2 buyers work into the overnight inventory and work up through 4624.75. Trade is sustained above 4620.75 setting up a gap fill up to 4631.75. From there look for a rotation back up to the high volume point of control at 4638.50 before two way trade ensues.

Hypo 3 strong buyers close the gap up to 4631.75 early and work up to the top end of value around 4650. They set their sights on overnight high 4653.25 for a test above before two way trade ensues.

Levels:

Comments »