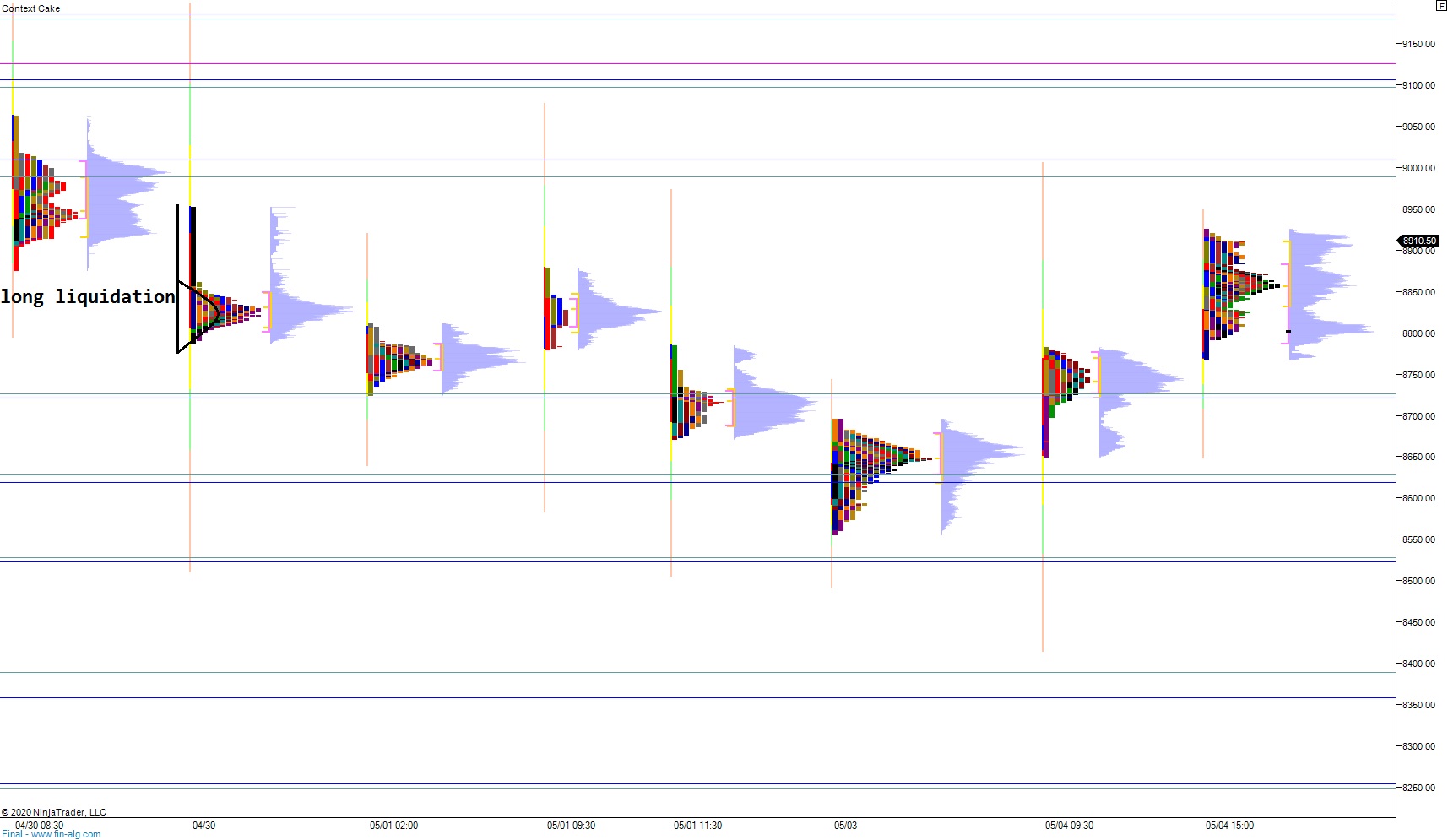

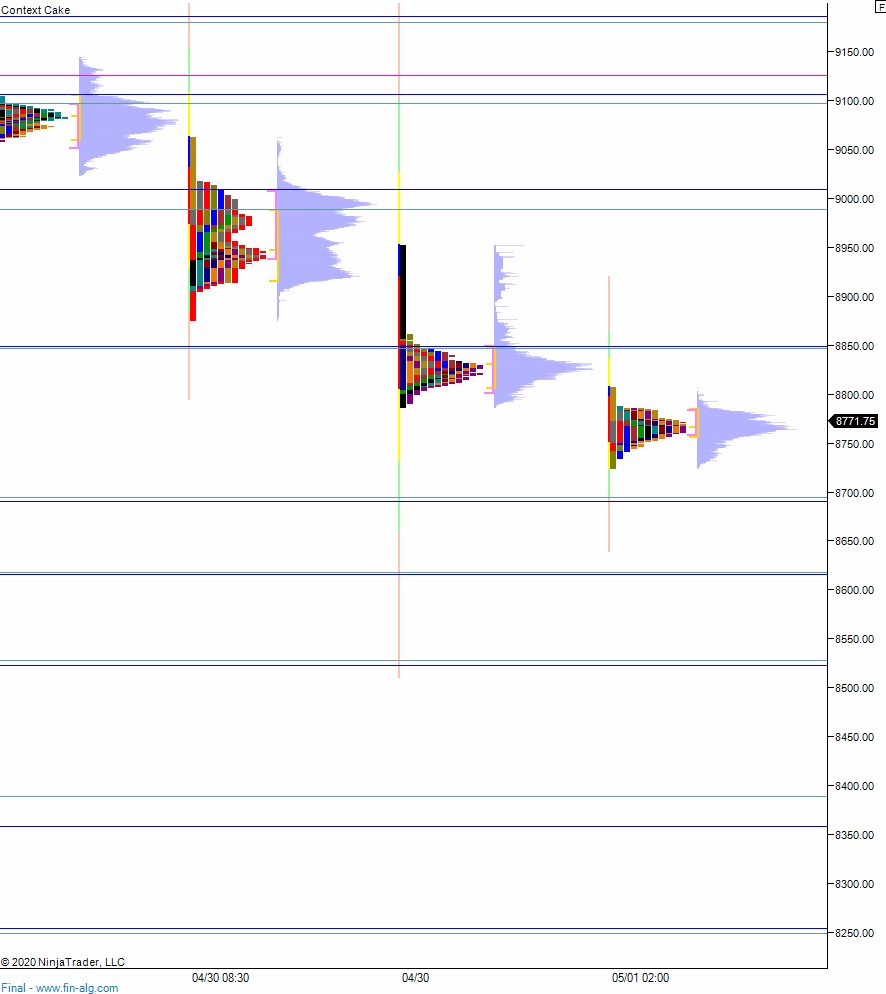

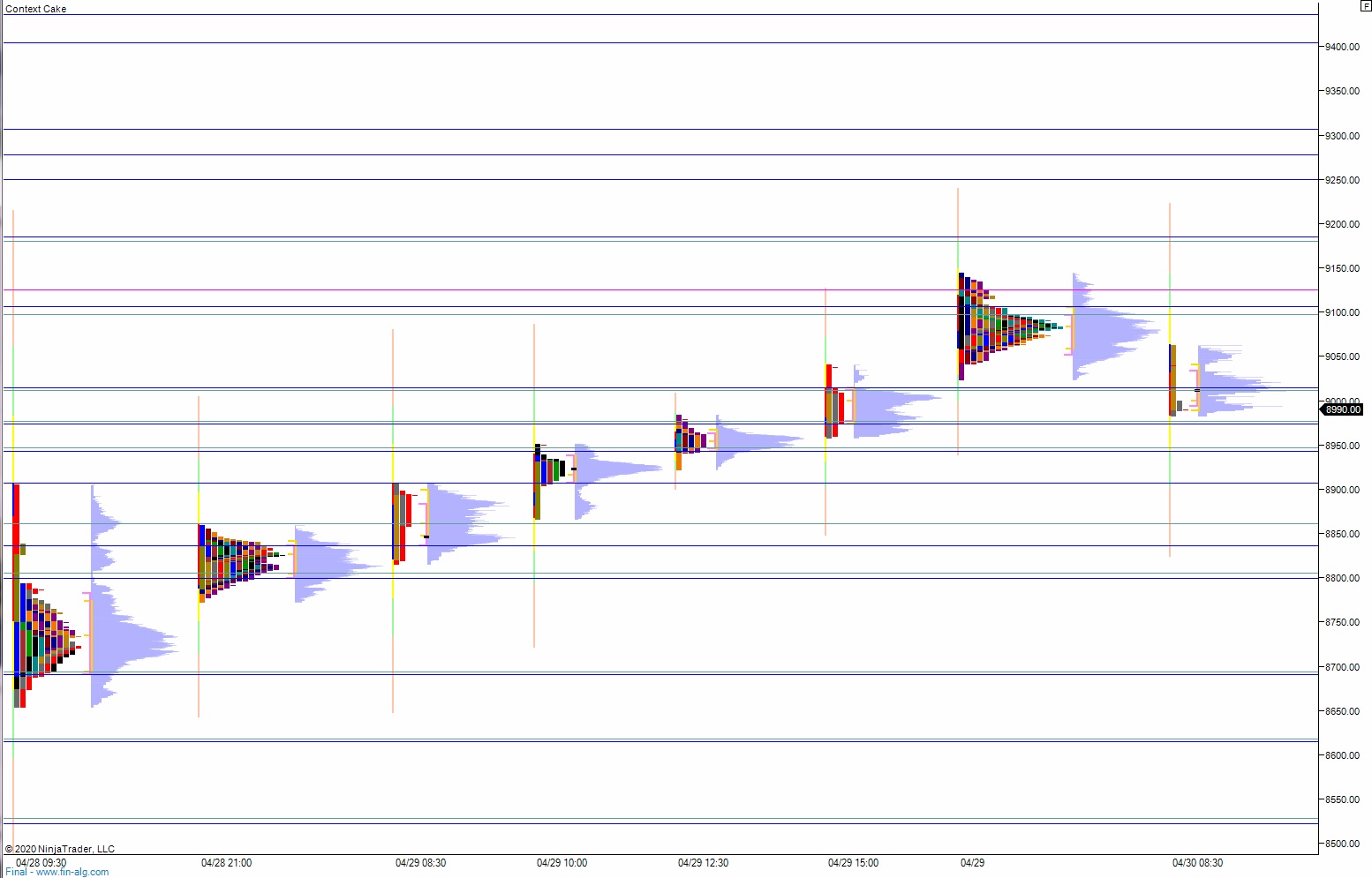

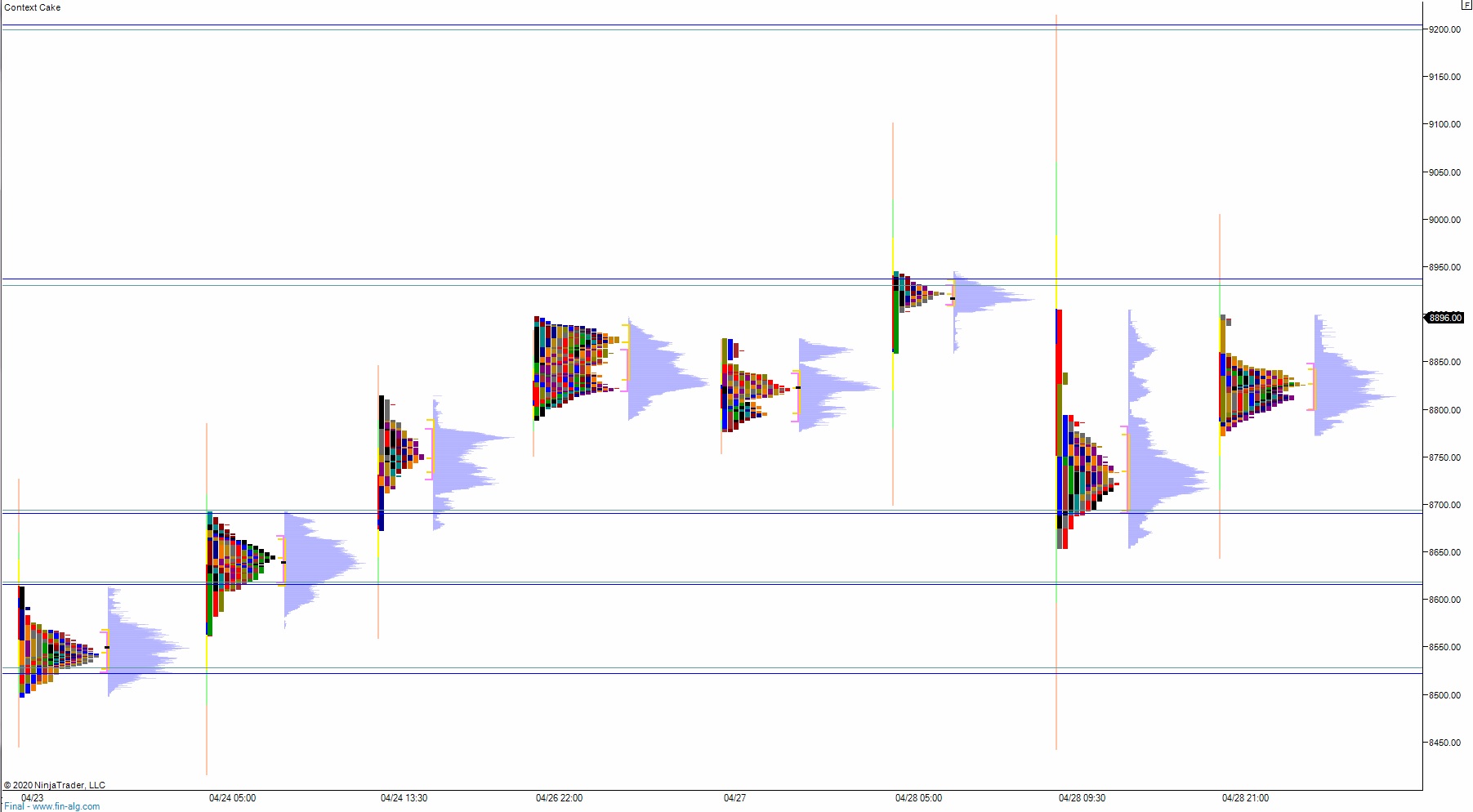

NASDAQ futures are coming into Thursday pro gap up after an overnight session featuring extreme range and volume. Price drove higher last night, unidirectional, steadily rotating higher during the entire globex session. As we approach cash open, price is hovering up near the high print set back on 04/29 during globex hours. At 8:30am initial/continuing jobless claims data came out worse than expected.

Also on the economic calendar today we have 4- and 8-week T-bill auctions at 11:30am followed by consumer credit at 3pm.

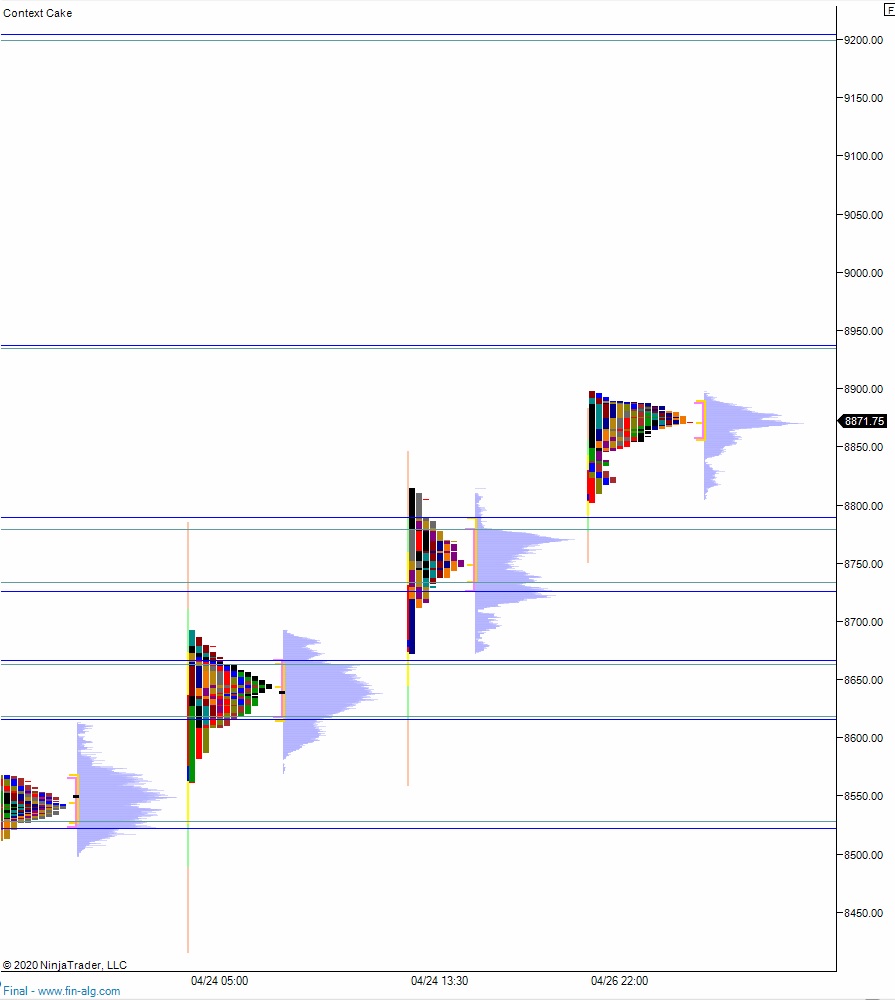

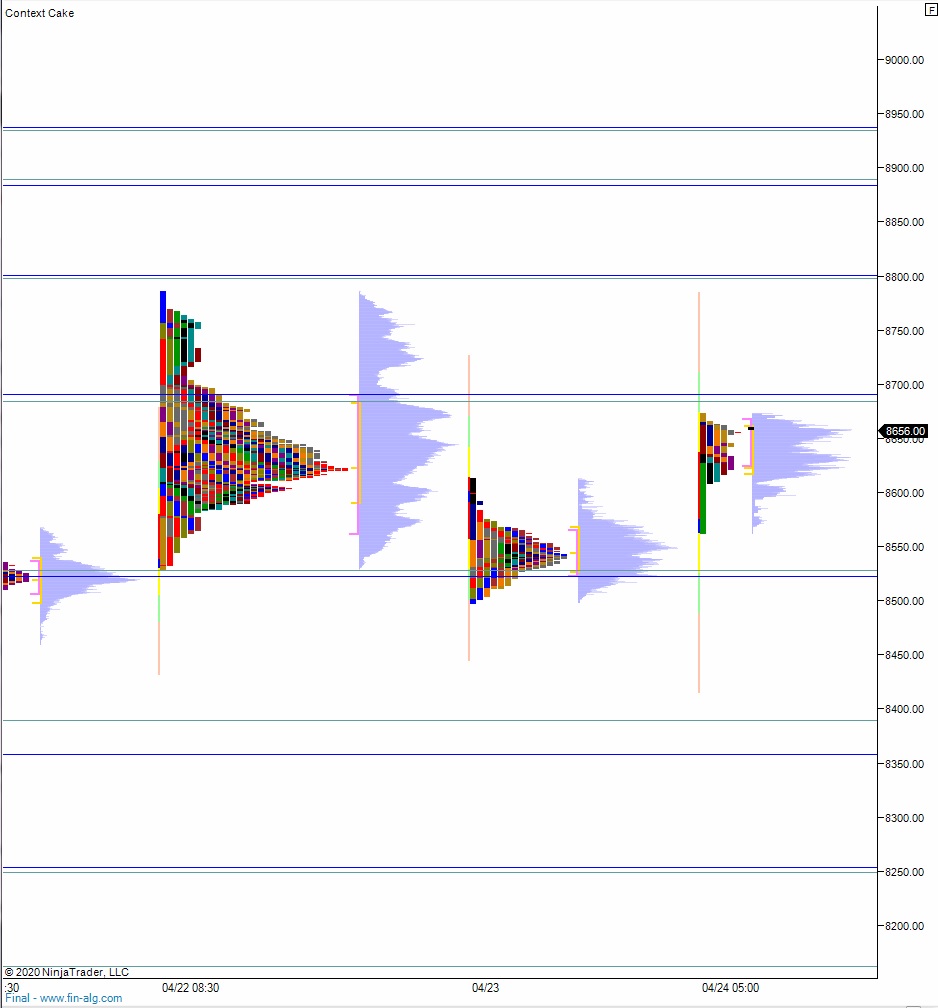

Yesterday we printed a normal variation up. The day began with a gap up and after a brief two-way open auction buyers stepped in, leaving that overnight gap unfilled. Buyers took out Tuesday high and closed the 04/29 open gap. After exceeding it by a few ticks and sustaining the gains thru most of the session, sellers pressed in late day and returned us back down to the session low.

Heading into today my primary expectation is for buyers to probe above swing high 9144.75. Look for sellers up at 9179.50 and two way trade to ensue.

Hypo 2 full-on bull run, get up into the open gap zone and trend up to 9459.25.

Hypo 3 sellers press into the overnight inventory and close the gap down to 8952. Look for buyers at 8950 and two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: