NASDAQ futures are coming into Tuesday pro gap up after an overnight session featuring extreme range and volume. Price broke free from Monday’s range early in the Globex session, around 9pm New York, and sustainted trade above it for the remainder of the night. Price worked up into last Thursday’s range before finding responsive sellers who rotated price back down to Monday’s range. Buyers rejected a return to the range and as we approach cash open, price is hovering up inside of last Thursday’s range.

On the economic calendar today we have ISM non-manufacturing at 10am followed by 4- and 8-week T-bill announcements at 11am.

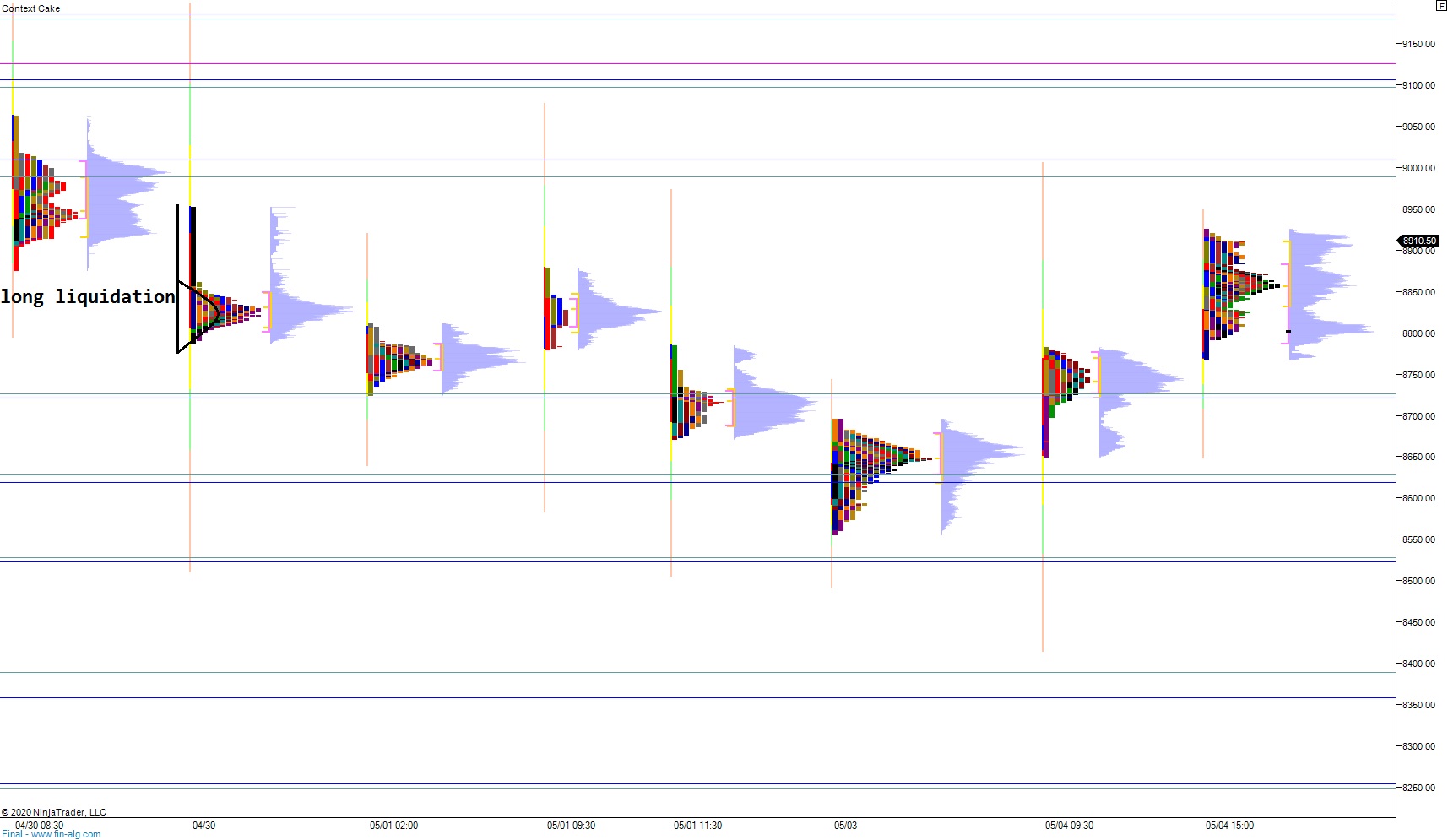

Yesterday we printed a double distribution trend up. The day began with a gap down and after a battle of an open two-way auction buyers stepped in and quickly resolved the overnight gap. BUyers then continued higher, tagging last Friday’s midpoint before falling back to the daily mid. Buyers then rotated higher for the rest of the session closing on high of day, up in the top quadrant of last Friday’s range.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up and closing last Thursday’s gap 8934.50. Look for sellers up at 8948.25 and two way trade to ensue.

Hypo 2 stronger buyers tag 8988.50 before two way trade ensues.

Hypo 3 sellers work into the overnight inventory and close the gap down to 8796.25 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves:

Feliz Cinco de Mayo, señor Santos

Enjoy your Day, I will drink some tequila and eat some enchiladas con mole negro in the afternoon.