As we enter another day of trading this market, we find ourselves hanging around near the highs but not pressing higher, it can be rather unnerving to have a large directional portfolio. Yet we continue to see a resilient market unwilling to give back much ground. S&P futures were higher overnight, peaking out at 1511, the high water mark set on Monday.

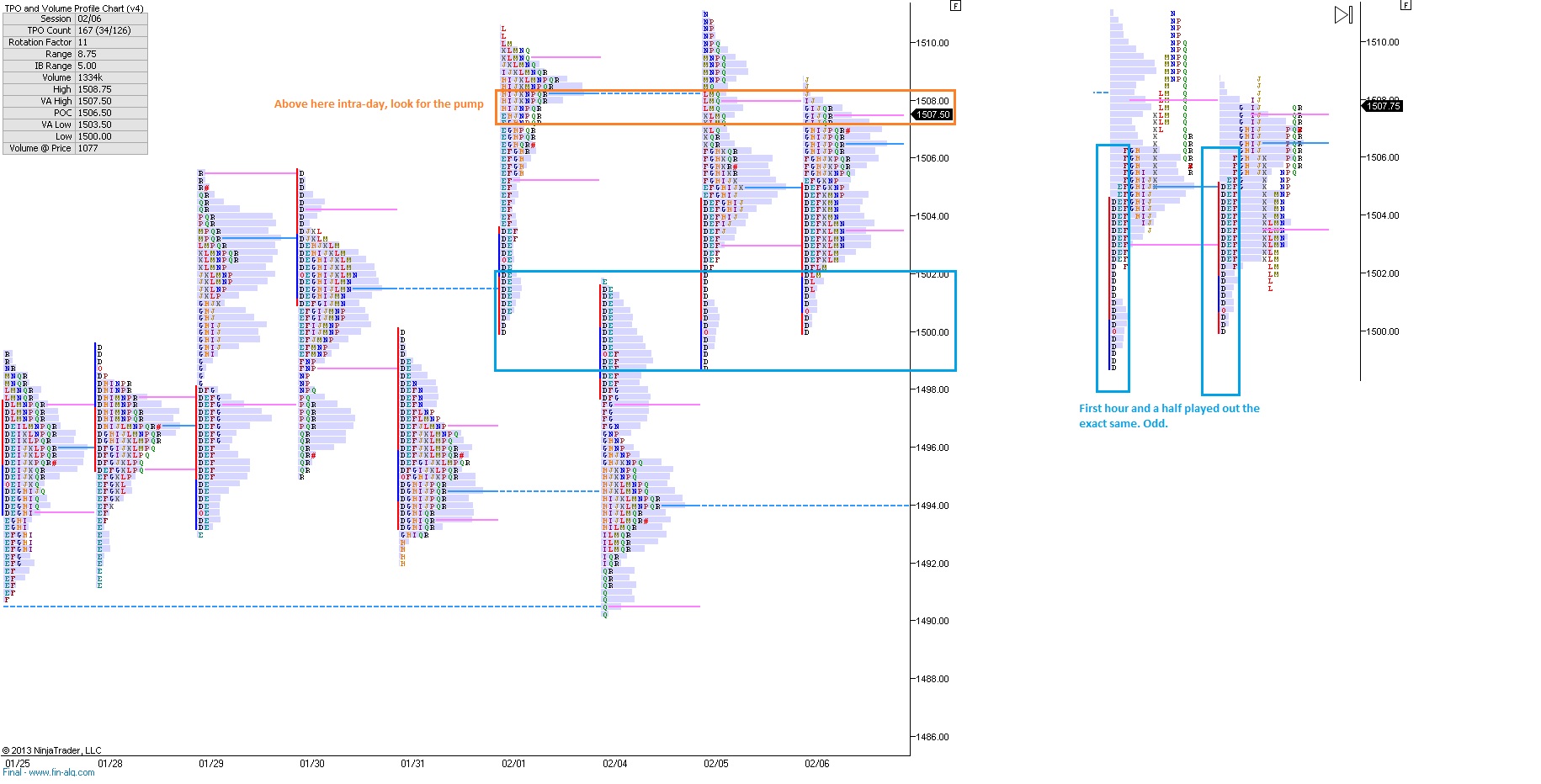

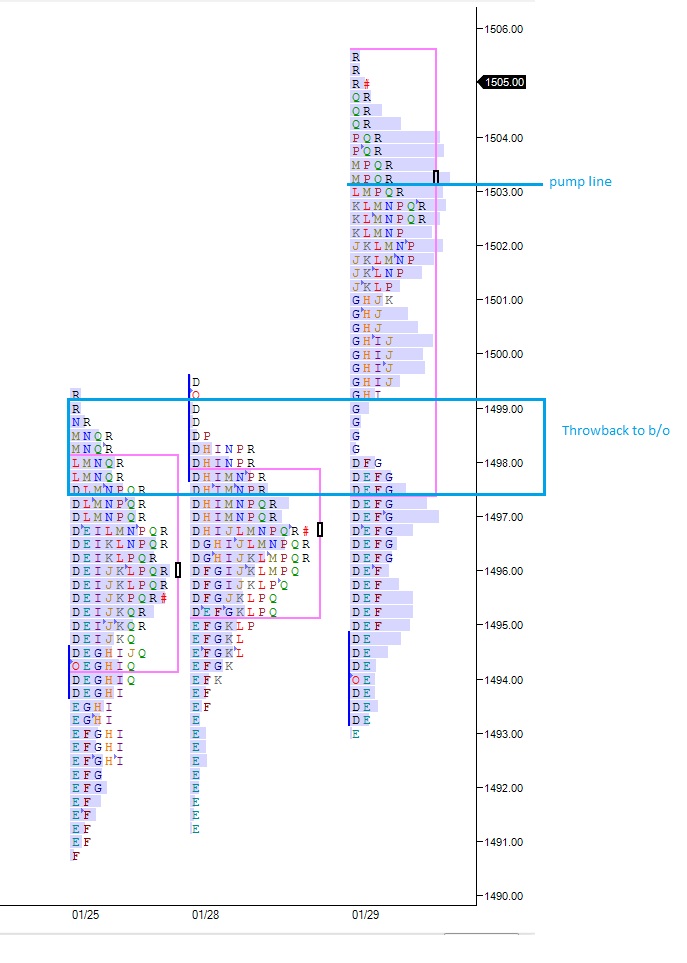

We’re off the highs a bit as we approach the 8:30 hour, and I want to point out a few odd characteristics about yesterday’s profile. I’ve separated Tuesday and Wednesday’s profiles to the right to highlight the odd mirrored auctions that occurred:

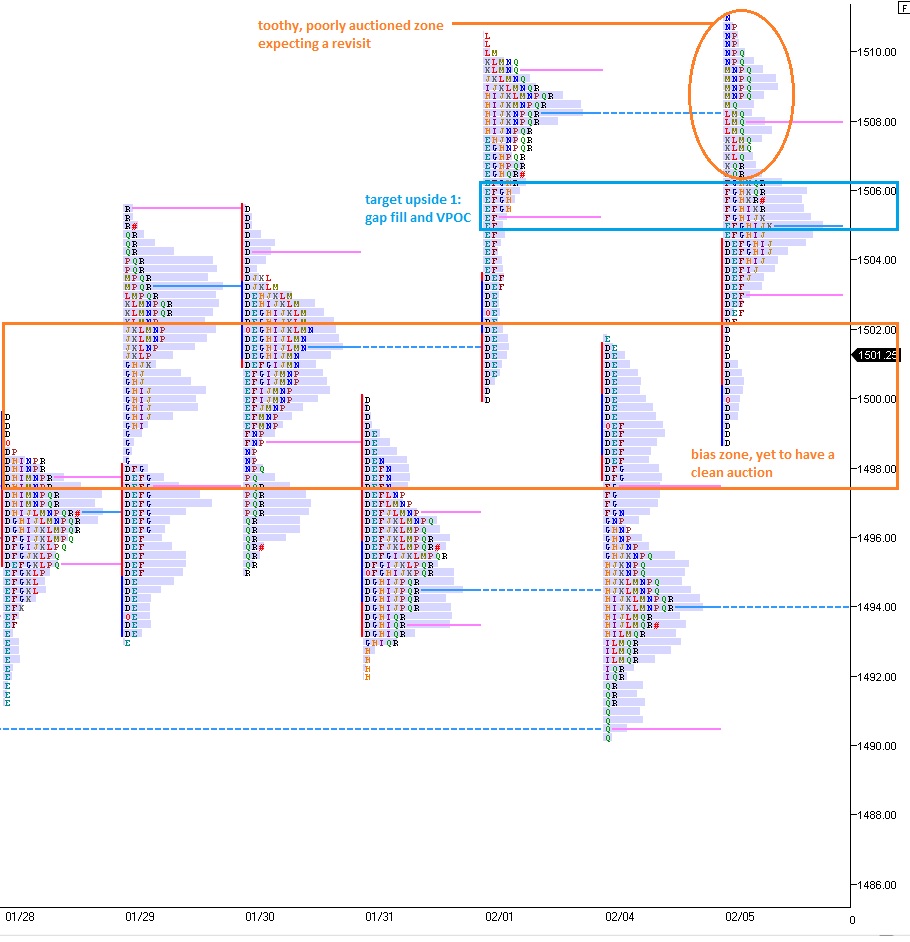

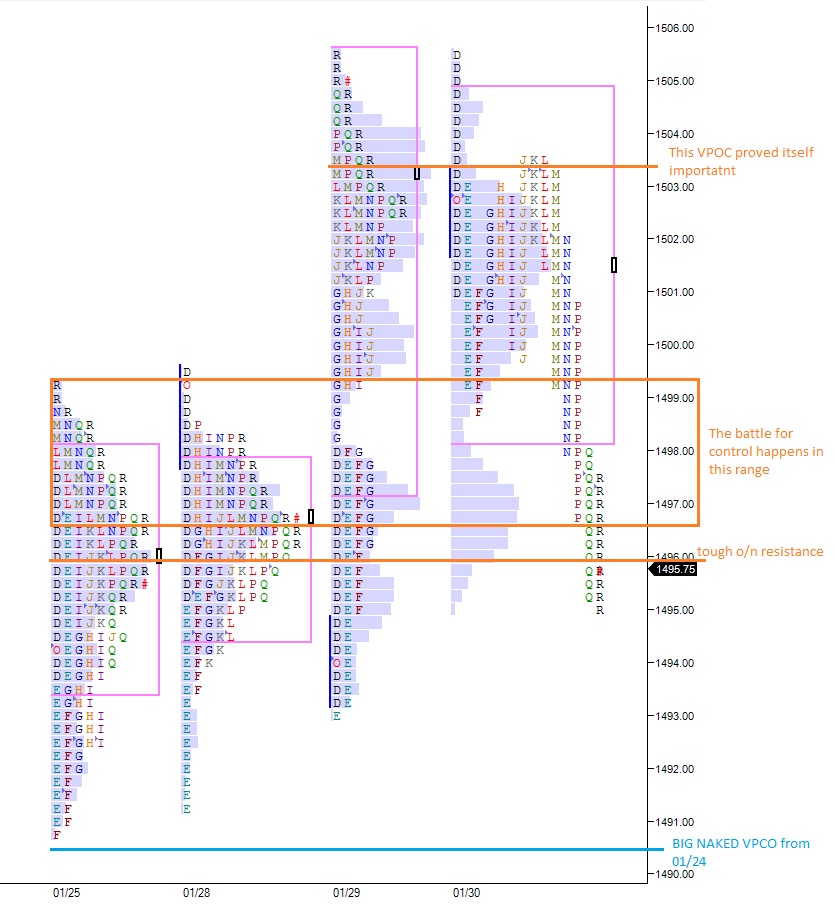

Odd, yes? Also, you can see we booked an inside day with both the range compressing and the value compressing into the prior day’s respective range and value. This signals balance. It also tells up the market is building potential energy, and the next move could have some major velocity. We still have the poorly auctioned range surrounding the 1500 century mark. Should we blast higher, I will stop keeping this observation in mind. But until we leave this area with authority, which starts with sustaining trade above the orange box I highlighted above, I have to keep my aggression in check and keep some cash on hand.

Cash level currently 20% with a 5% TZA hedge (clown college)

Here’s a throwback surf jam for Kai and people like him:

http://youtu.be/1gdG7TZUqY0

Comments »