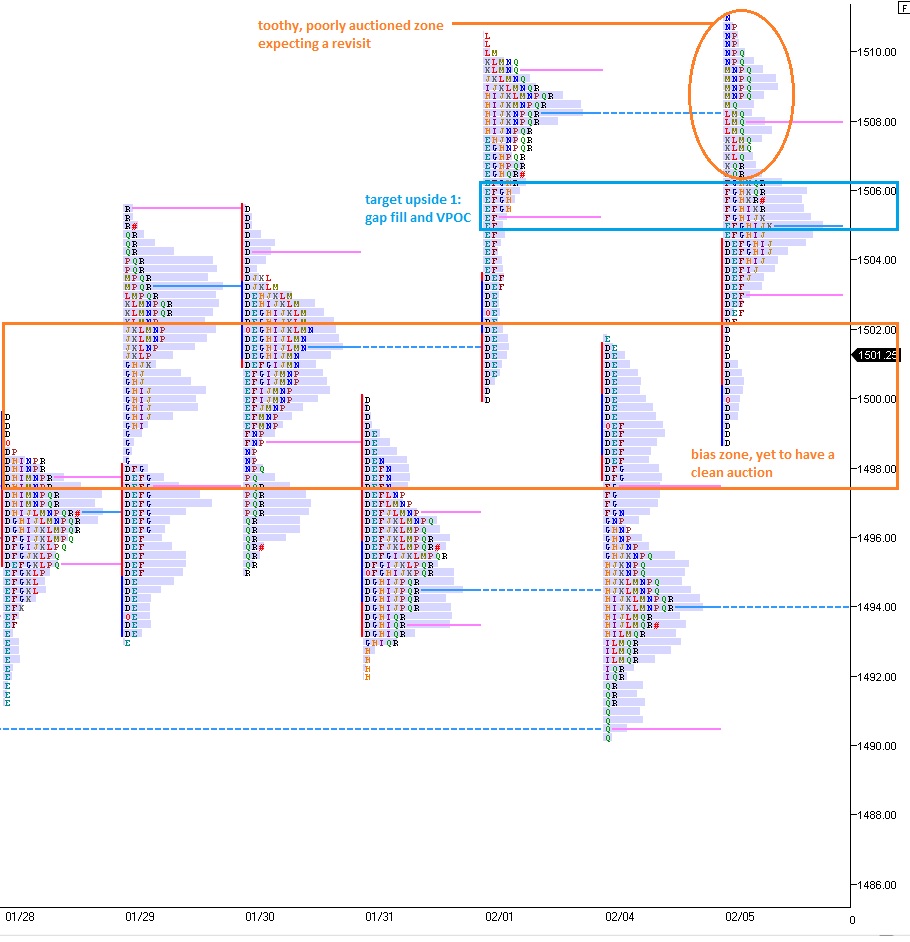

Yesterday the action in the S&P did little to change to overall outlook of the direction of the market. We’re still trading within the confines of brackets and there’s still cock fight action surrounding the 1500 century mark.

Bears can claim a small victory over the bulls yesterday in not allowing the value to be moved higher than last Friday. Notice the value areas overlap, but the Tuesday value area has a lower VAH, VAL, and VPOC. Bulls need to contain the downside for the remainder of the week, else the likelihood of an exploration lower increases.

What I want to see most is a healthy auction, represented by a smooth bell-shaped distribution, occurring within the area of 1502-1498. Once these levels are thoroughly traded, our next move is a high probability hand tip for the direction of the next swing.

The NVPOC from Monday is the major target for sellers today. If they’re able to reach it, I would consider their ability to dictate the direction of this tape to be increasing. However, I will monitor the area for signs of buying activity. You likely want to cut losses out of your portfolio if we begin rotating down to 1496 with behavior that suggests we’re closing the NVPOC because you losers will participate 1.5x or more with the broad market selloff. Unless they don’t…this could be telling of buyer interest.

Remember to be water.

If you enjoy the content at iBankCoin, please follow us on Twitter