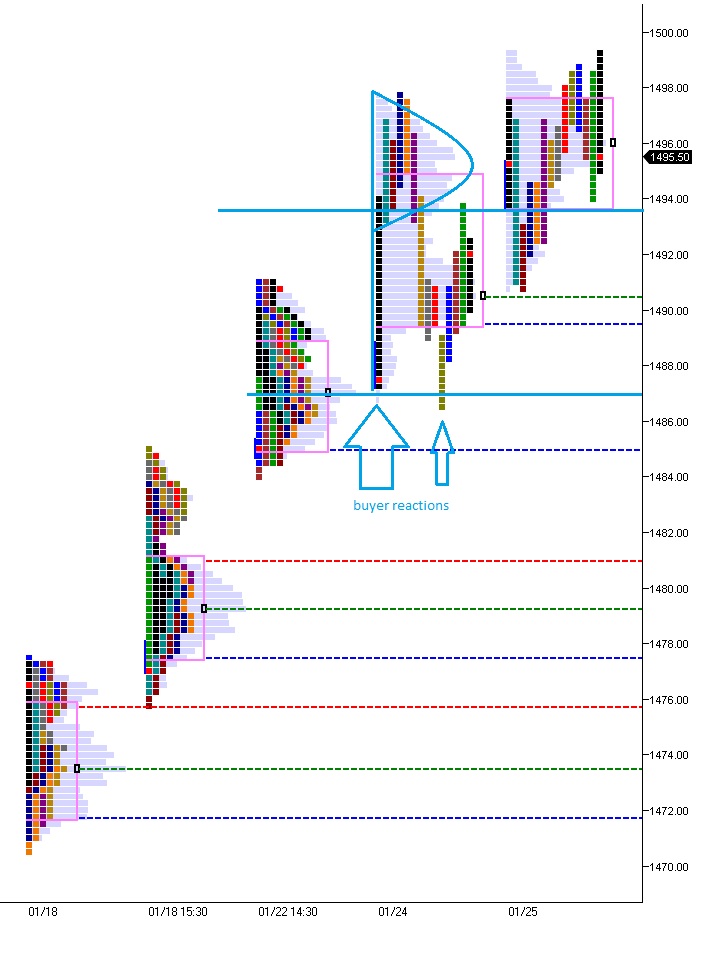

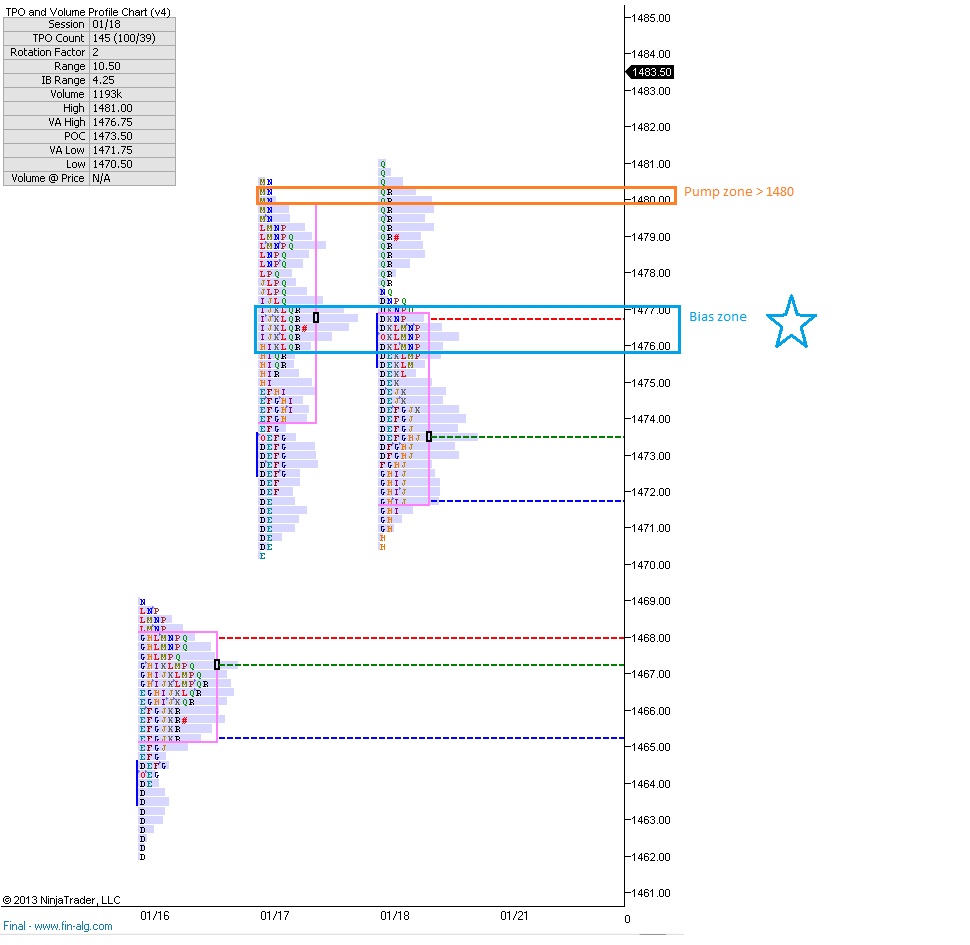

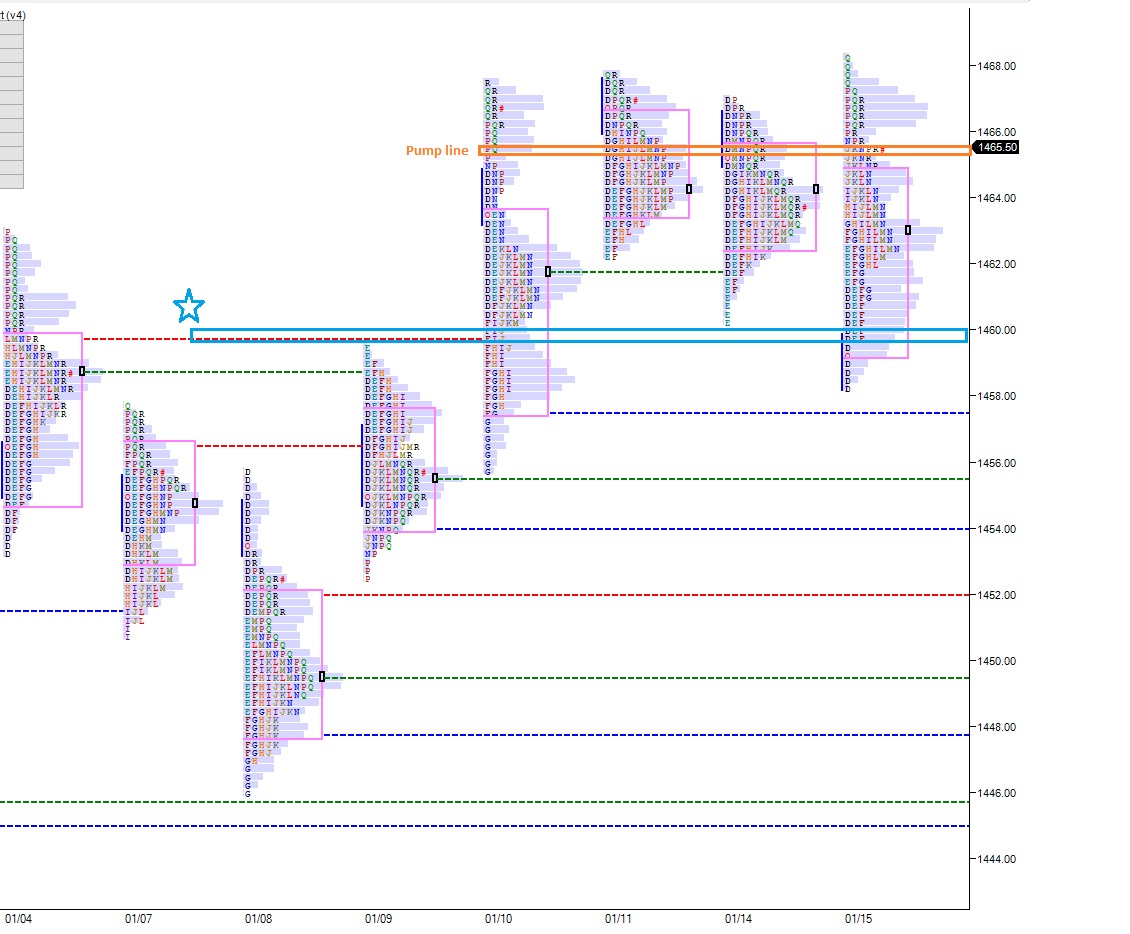

The ball is still firmly in the bull’s court. Seeing a day of liquidation with price discovery lower to find buyers would be constructive and welcomed by many participants who are sidelined or underexposed. The question becomes at what level do the eager buyers step back in? Buyers have spent the last six sessions buying value area lows and VPOCs from prior days. They haven’t allowed price to trade below the prior day’s high. If that trend changes, we can consider it an opportunity to test the true mettle of this year’s bulls.

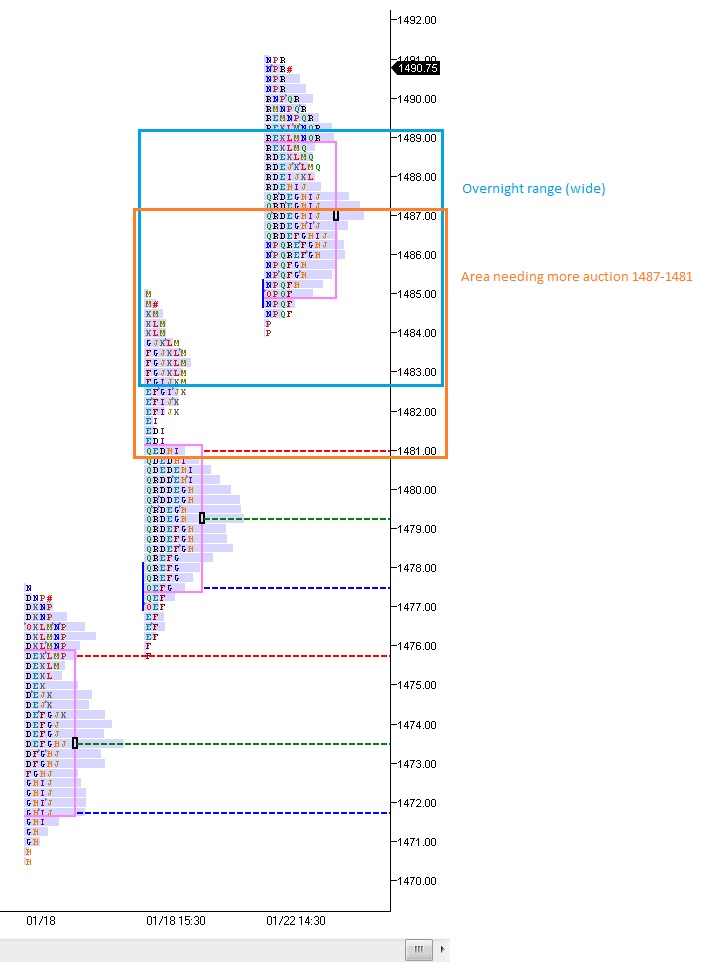

Yesterday the developed profile overlapped Friday’s which signals a form of balance. Buyers managed to push the VPOC only two ticks higher verses Friday and value high crept one tick higher also. It appears the market is still trying to go higher but was contained by sellers. The opening’s push lower by the sellers set the range for the day. That was a minor victory for the sellers.

Clearly 1491 will be a key level today. There are multiple levels in confluence here as of 8:30am the globex low was set here. Should that break look for signs of buyers at 1487 where the low was set on 01/24 and is in confluence with the VPOC from last week Tuesday.

Chartpin link to market profile: https://chartpin.com/#chart/1151

Comments »