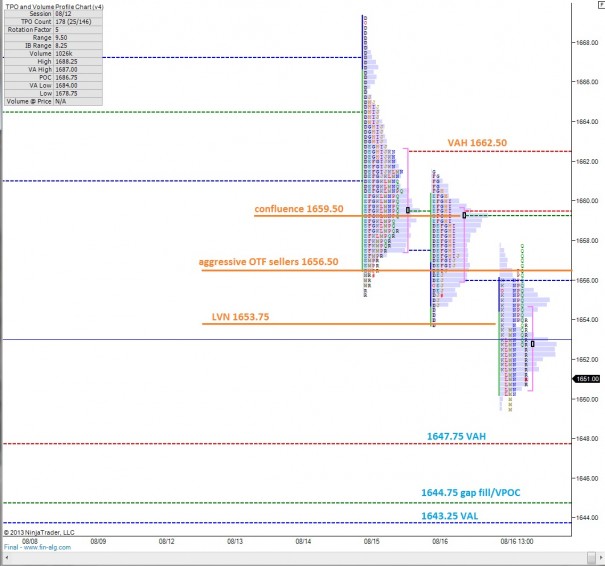

After gapping higher in July and pressing to all time highs, the S&P grinded out a sideways consolidation before experiencing the corrective trading we experienced late last week. The downward action is accomplishing the ever important task of filling a gap in the price action. When we gapped higher on 07/10, the market left a large gap in its wake, spanning from 1661 to 1653. The closing price on 07/10 was even lower, at 1644.75 which is where we need to trade to fulfill the gap.

It will be pertinent to monitor the profile levels from 07/10 early this week as we come into its range. 1647.75 marks the value area high. Spending an hour or more trading below this level swings the door wide open for trade down to the gap-fill/VPOC at 1644.75 and the value area low at 1643.25.

The S&P is currently priced three handles below the Friday closing print and this gap is another (smaller) piece of context to be mindful of. Trade back up to 1651 or perhaps to the overnight VPOC at 1651.50 seems a distinct possibility if the revision trade kicks in early.

Up above we have plenty of tradable opportunities at resistance which I’ve highlighted on the following profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter