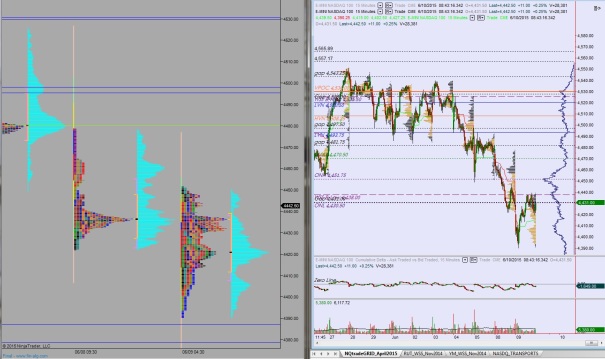

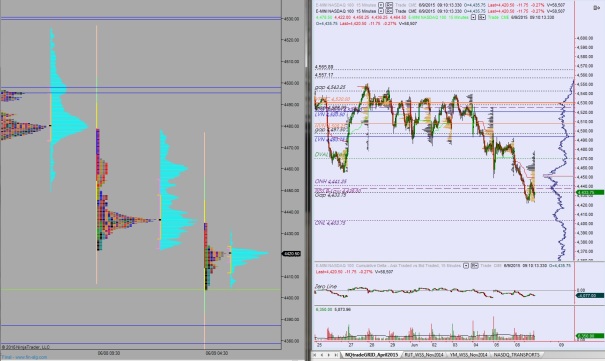

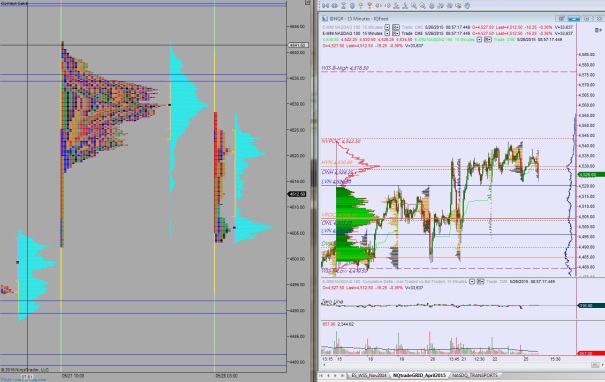

Nasdaq futures are up a touch as we head into US market open after a second globex session of normalized range and volume. The overnight session compressed in the upper quad of yesterday’s range before making a burst higher.

At 8:30am we heard Advance Retail Sales figures as well as Initial/Continuing Jobless claims. We also have natural gas storage data at 10:30am.

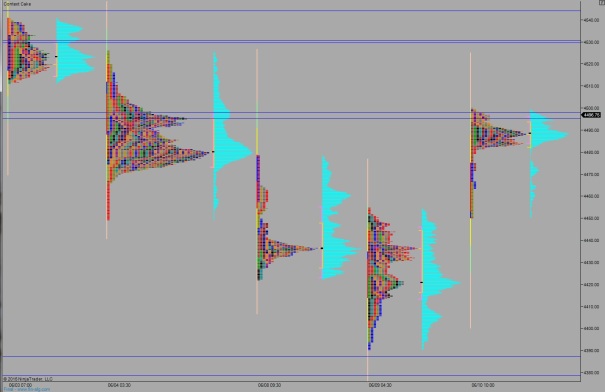

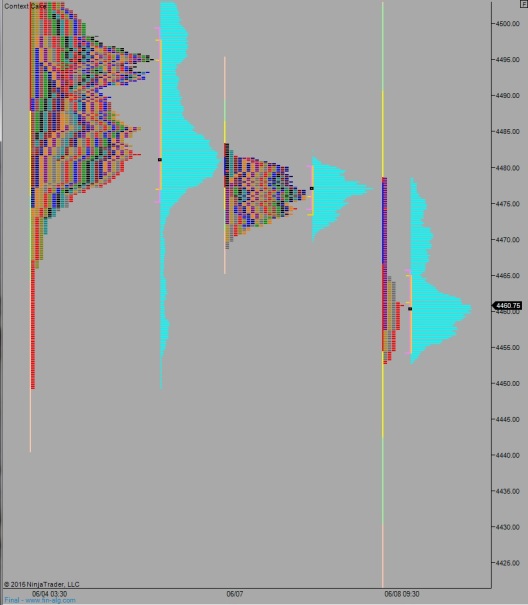

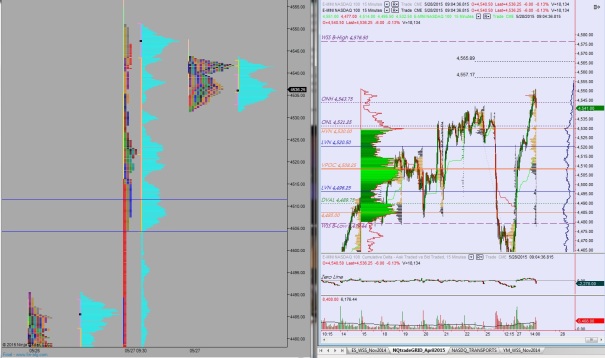

Yesterday we printed a trend day, for the most part, before settling out in the afternoon and forming balance/acceptance. The last three days have been an exercise in clearing up old open gaps. On Tuesday we went and closed the 5/13 gap and bounced. On Wednesday we continued lower before finding a sharp responsive buy. Then yesterday we pushed higher to close the 6/5 gap and the 6/4 gap.

Bulls will have to consider the fact we left an open gap behind yesterday morning down at 4431. If this market has consistently demonstrated anything this year, it has been a strong proclivity to go back and close gaps.

Nevertheless, this type of methodical trading suggests we’re in a healthy market with multiple time frames participating.

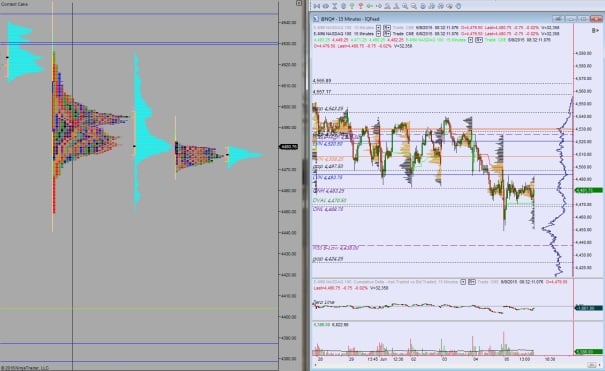

Heading into today my primary expectation is for sellers to push into the overnight inventory to close the overnight gap to 4488. Look for buyers to defend north of 4482 who continue pushing higher to take out overnight high 4500. Overhead targets are 4512.75 and 4515.50.

Hypo 2 buyers push early and take out overnight high 4500 and continue higher to explore the LVNs at 4515.50 & 4520.50. Look for responsive sellers at 4529.50.

Hypo 3 Churn inside the upper quad of yesterday’s range 4473.50 – 4500.

Levels:

Comments »