Nasdaq futures are lower ahead of the start to a holiday shortened week. The session featured big rotations both up and down, and volume is running just a touch above first sigma while range remained compressed into normal territory.

The economic calendar is chock-full of events to wade through today. At 8:30am Durable Goods Orders came in-line with expectations with orders for Capital Equipment climbing for a second month. The initial reaction to the data is selling. Also on the docket today we have House Price Index at 9am, Markit Composite PMI at 9:45am, and New Home Sales and Consumer Confidence at 10am. Also this evening the minutes from the Bank of Japan’s April 30th meeting will be released.

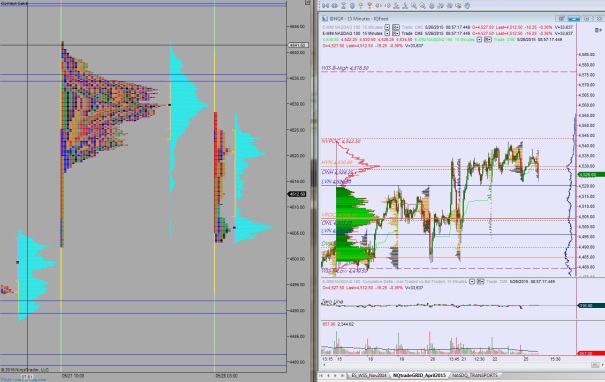

If I had the software capabilities to do it, I would completely remove Monday’s trading action from my charts. I am skeptical to give any weight to trade data that occurred while the underlying components were closed. Conversely, on my Market Profile chart (the letters and turquoise shaded volume distribution) I prefer to see all activity on the Nasdaq futures.

We formed a large distribution last week (and during the holiday) just below our contract-high session back on April 27th. Instead of making new highs, the distribution formed and then we headed lower. Meanwhile, on a slightly higher time frame, we are coming into balance. This can be seen as several sessions of overlapping price action. Overall it seems the market is accepting higher prices and forming value.

Heading into today, my primary expectation is for choppy action. With the busy economic schedule and the holiday rebalancing needed, fits and starts with little accomplished seems likely. I will look for buyers to push into the overnight inventory and take out the overnight high 4528.25. I will look for signs of sellers up around 4530 who work us back lower. The I will look for the remainder of the session to back-and-fill around 4520.50.

Hypo 2 sellers push the lower early on, taking out 4503.25. Look for buyers around 4496.25 then two way trade to set in around the MCVPOC at 4504.

Hypo 3 sellers push down through the volume pocket at 4496.25 to test down to 4489.50 where buyers come in and we back-and-fill around 4496.25.

Hypo 4 buyers push up through 4536 and sustain trade above it, setting up a run to new highs.

If you enjoy the content at iBankCoin, please follow us on Twitter