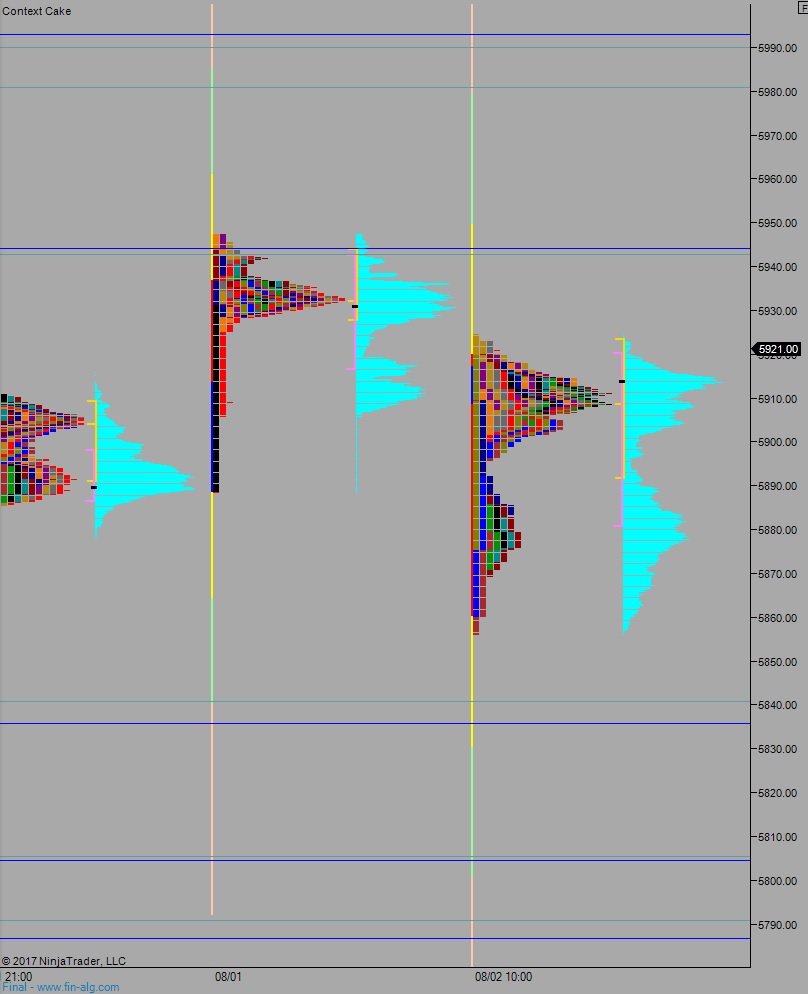

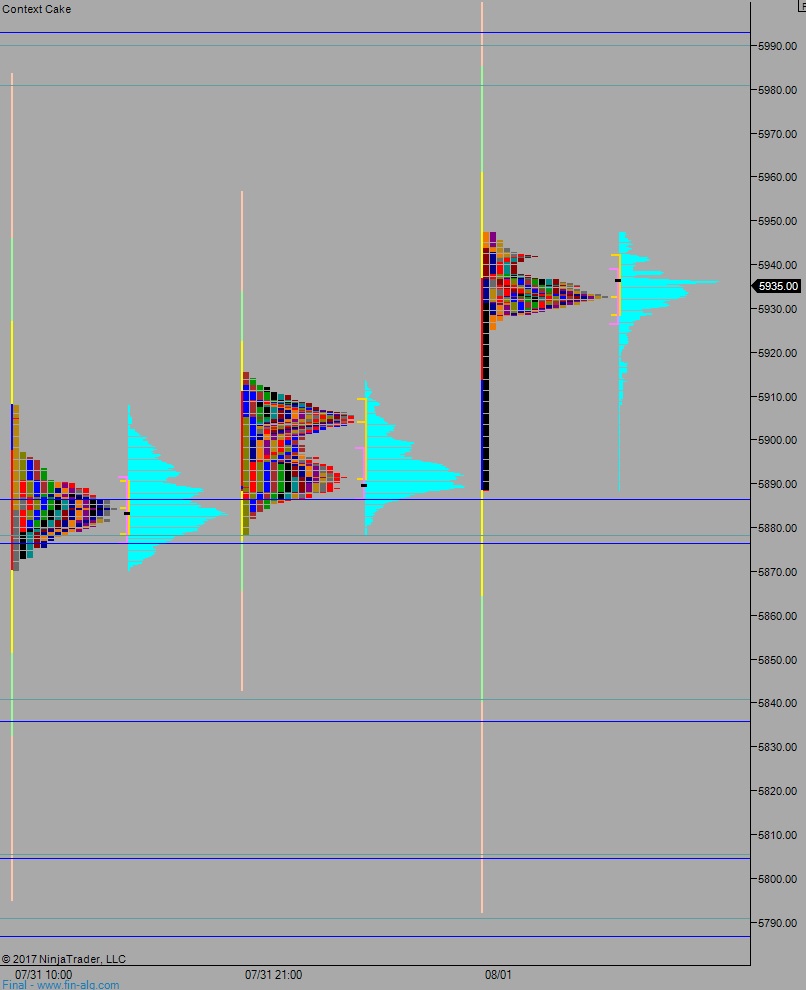

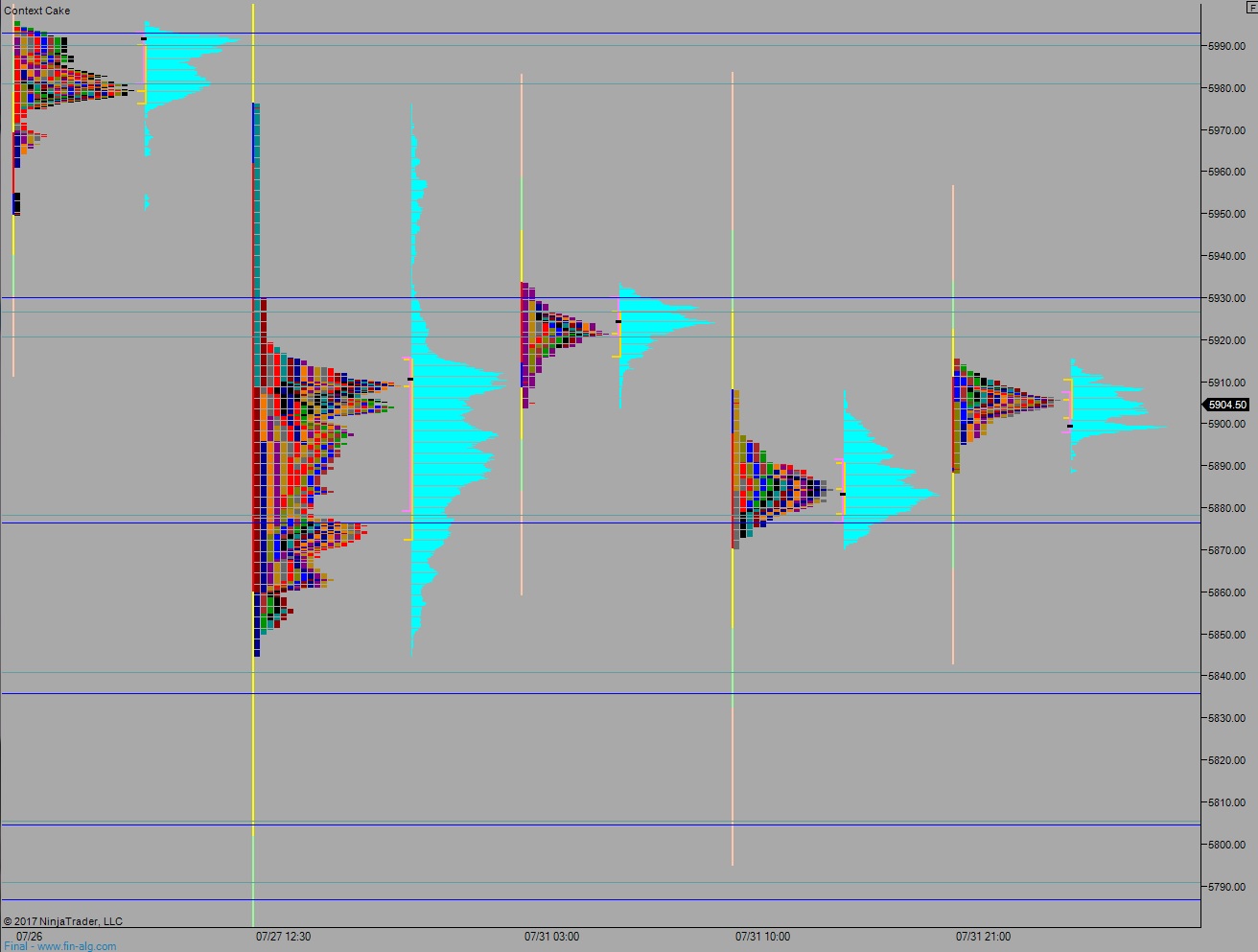

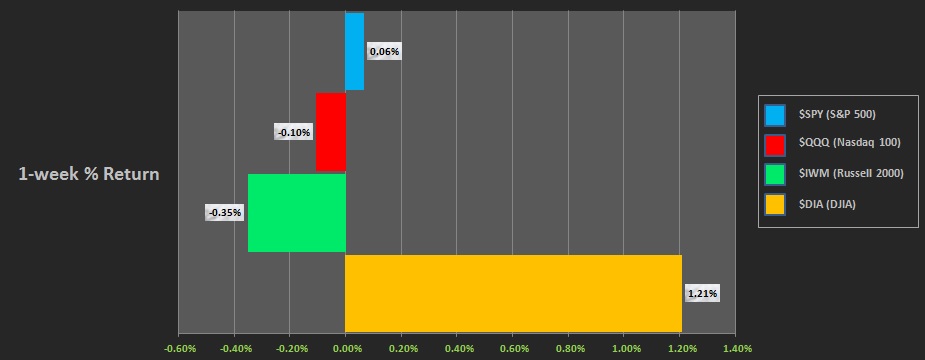

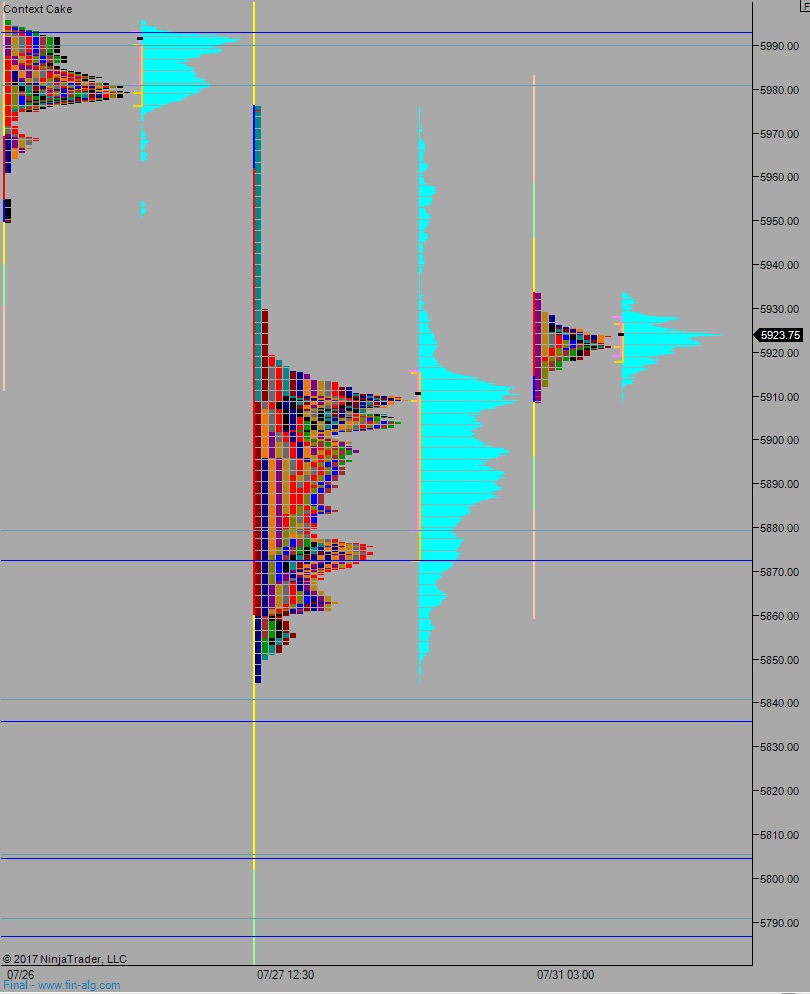

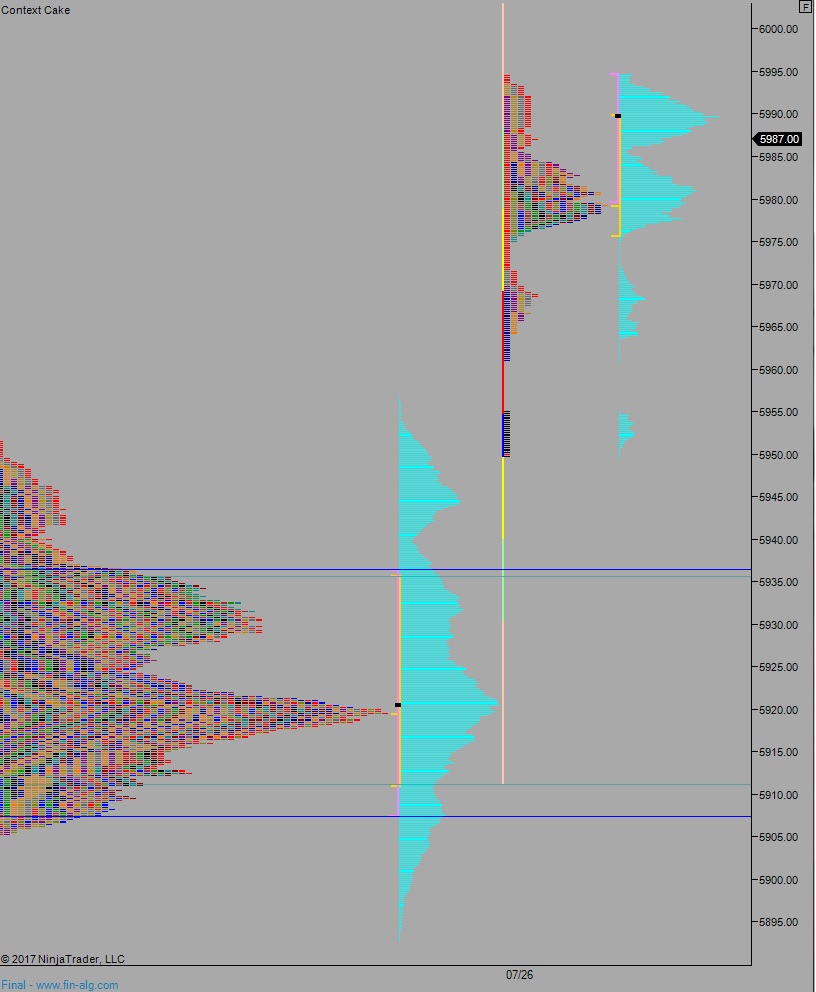

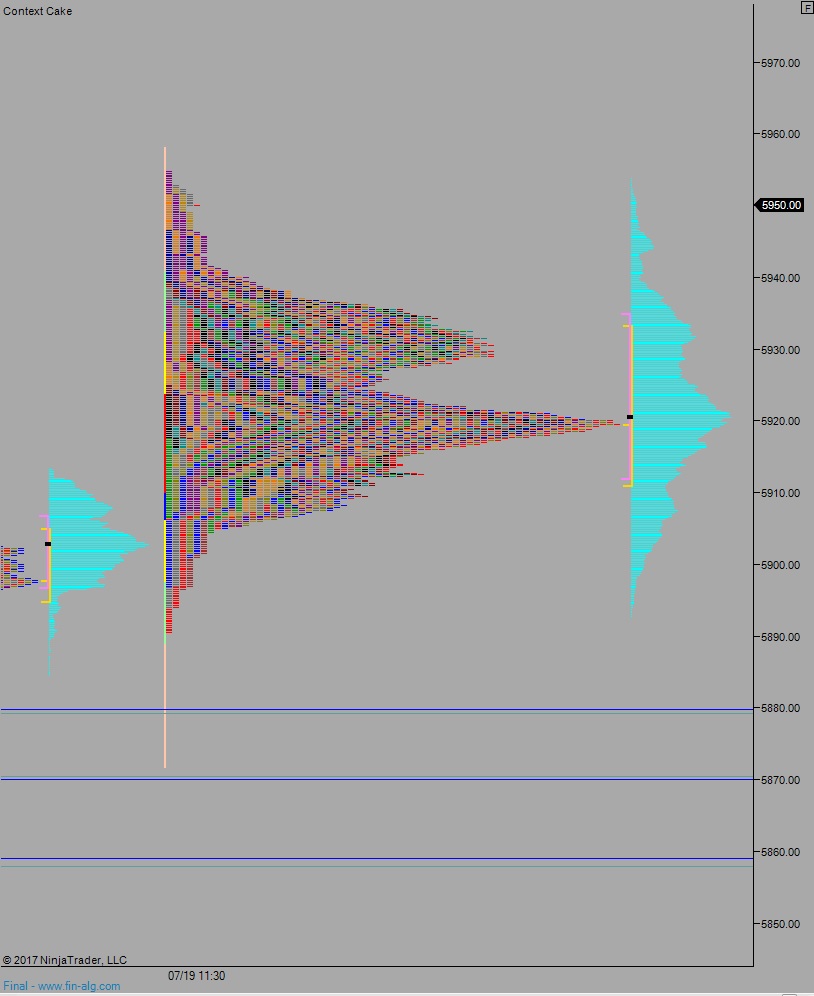

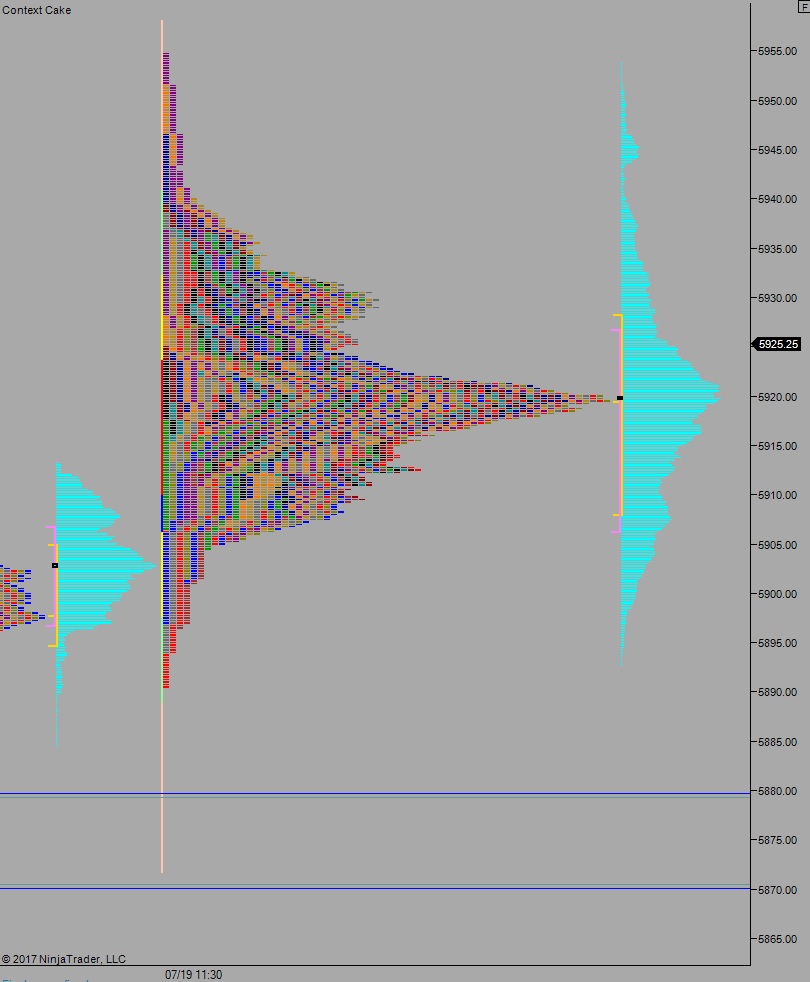

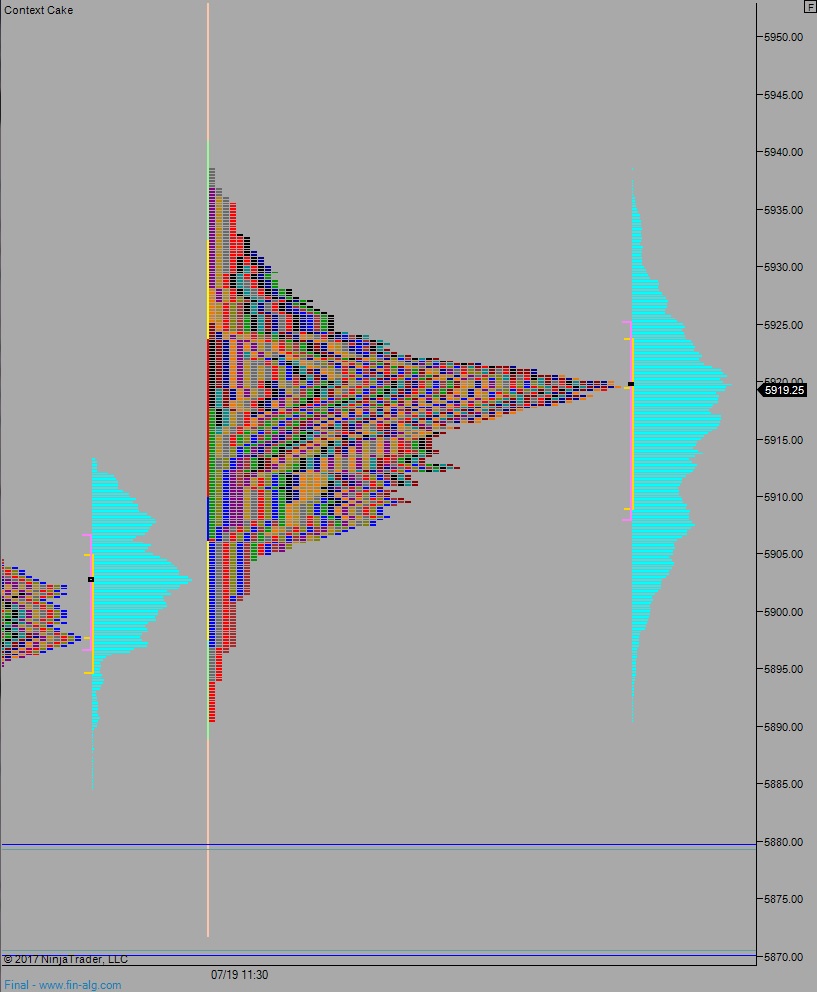

NASDAQ futures are coming into Friday gap up after an overnight session featuring normal range and volume. Price worked slightly higher overnight before balancing out. This is the fifth gap up we have seen this week. At 8:30am Non-farm Payroll data was slightly better than expected. So the the reaction is mute.

There are no other economic events today.

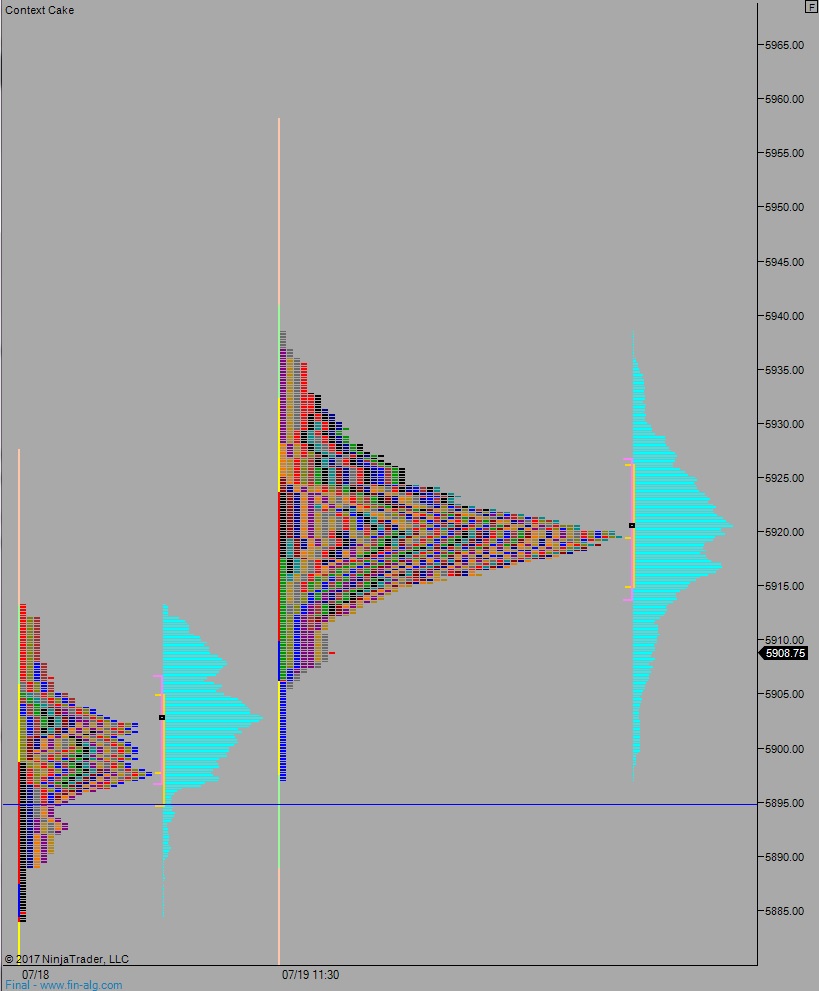

Yesterday we printed a normal day, which is anything but. They only occur about 5% of the time. The day began with a gap up and sellers pushed hard off the open. Then, the rest of the day was spent trading inside the range established during the first hour of trade. Balanced.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close teh gap down to 5889.50. From here, we continue lower, down through overnight low 5881. Buyers show up just below and two way trade ensues.

Hypo 2 stronger sellers push down to 5840.50 before two way trade ensues.

Hypo 3 buyers work up through overnight high 5906.50 and continue higher, up to 5942 before two way trade ensues.

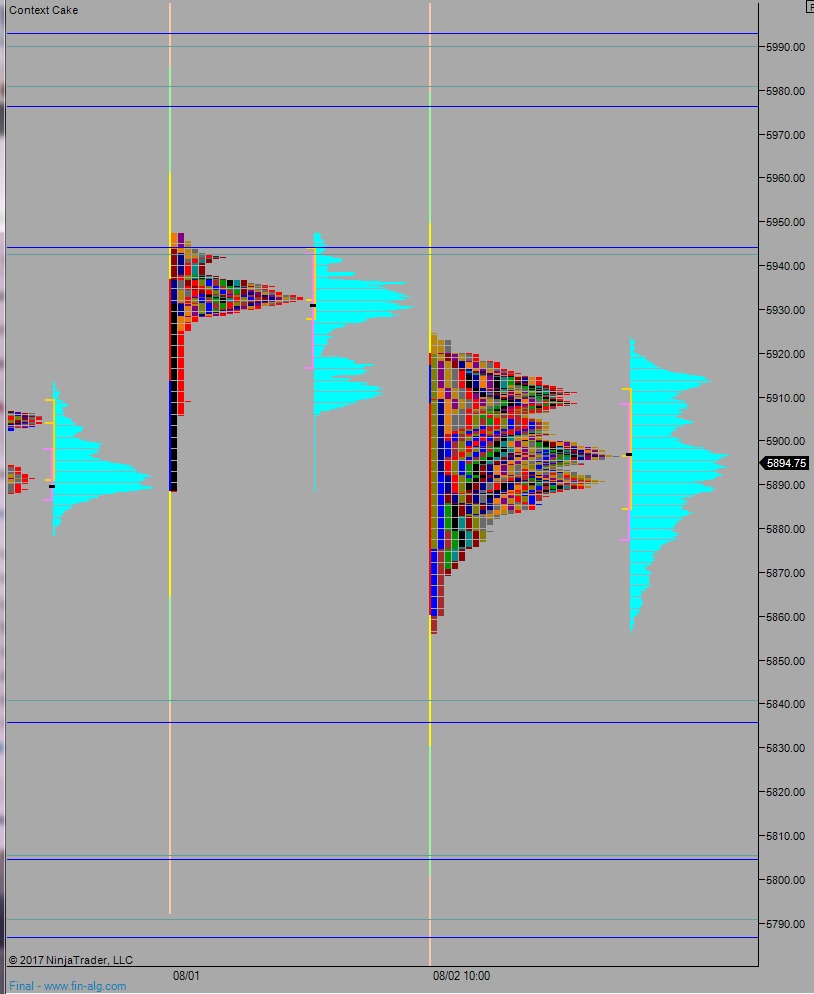

Levels:

Volume profiles, gaps, and measured moves: