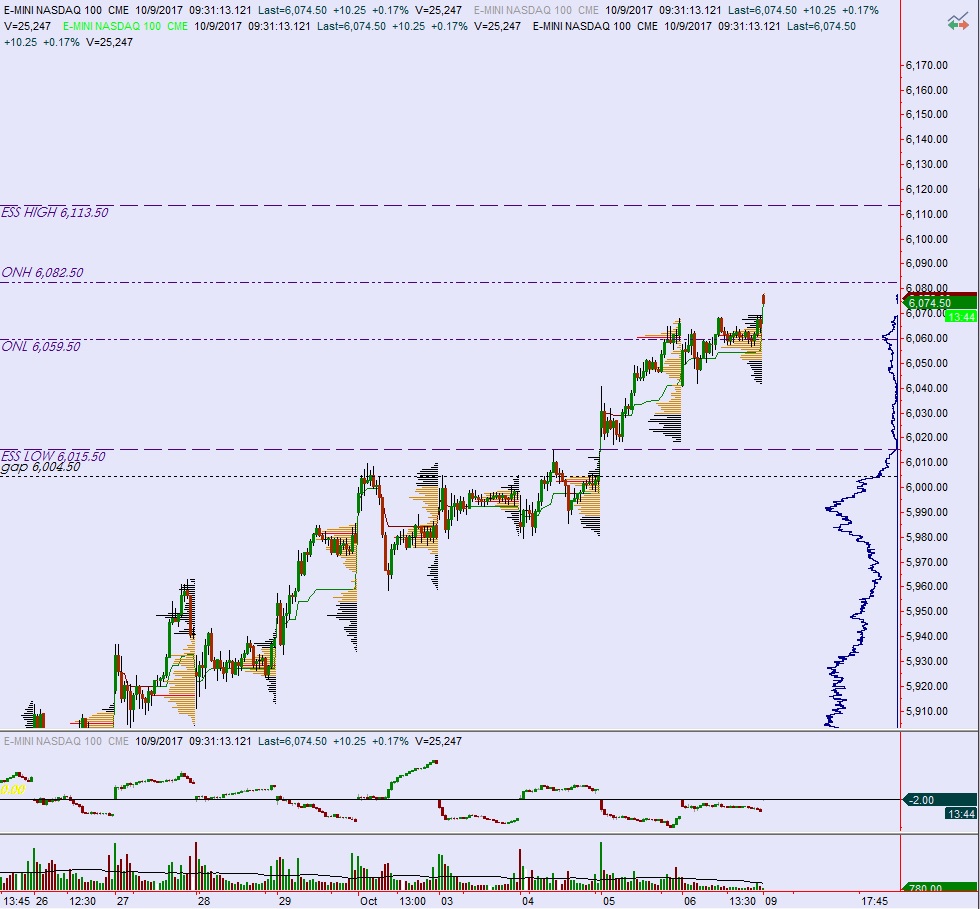

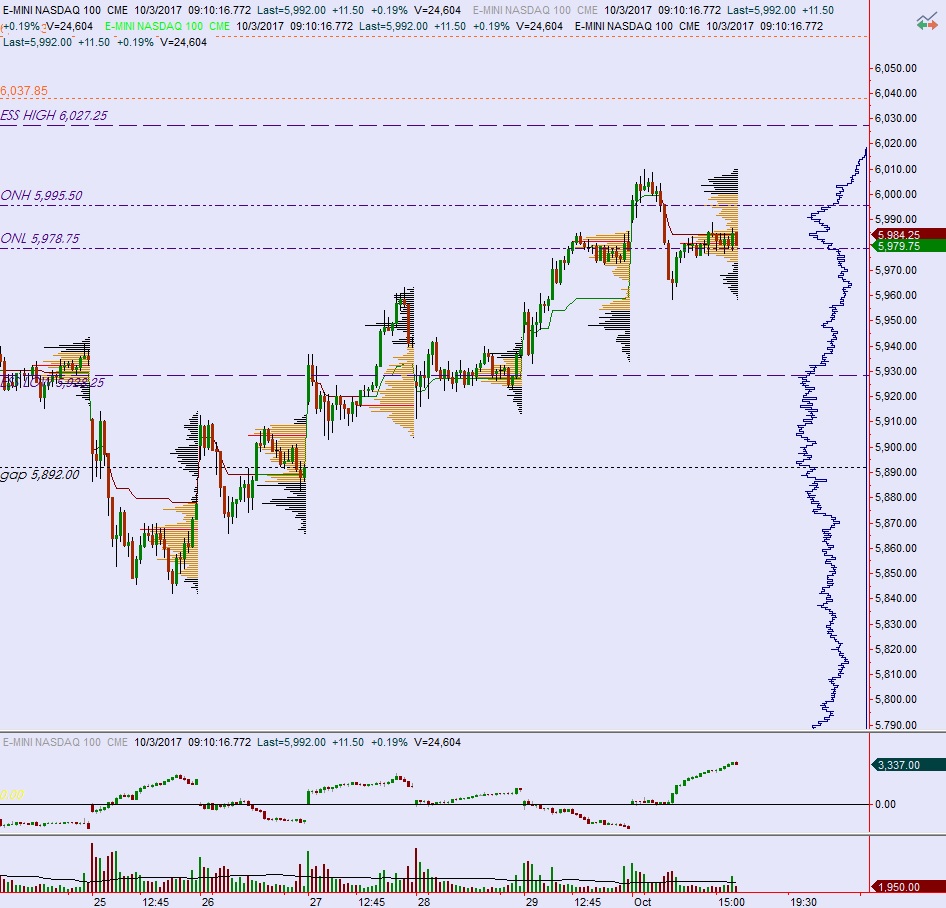

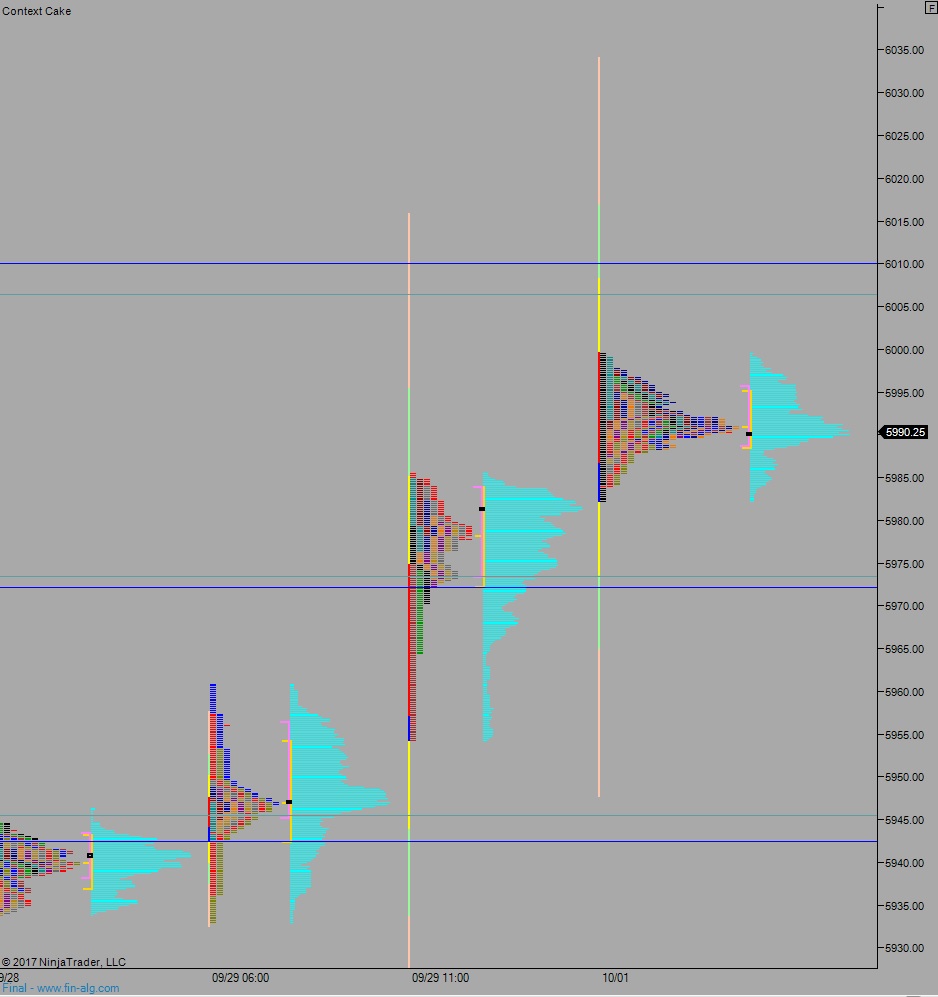

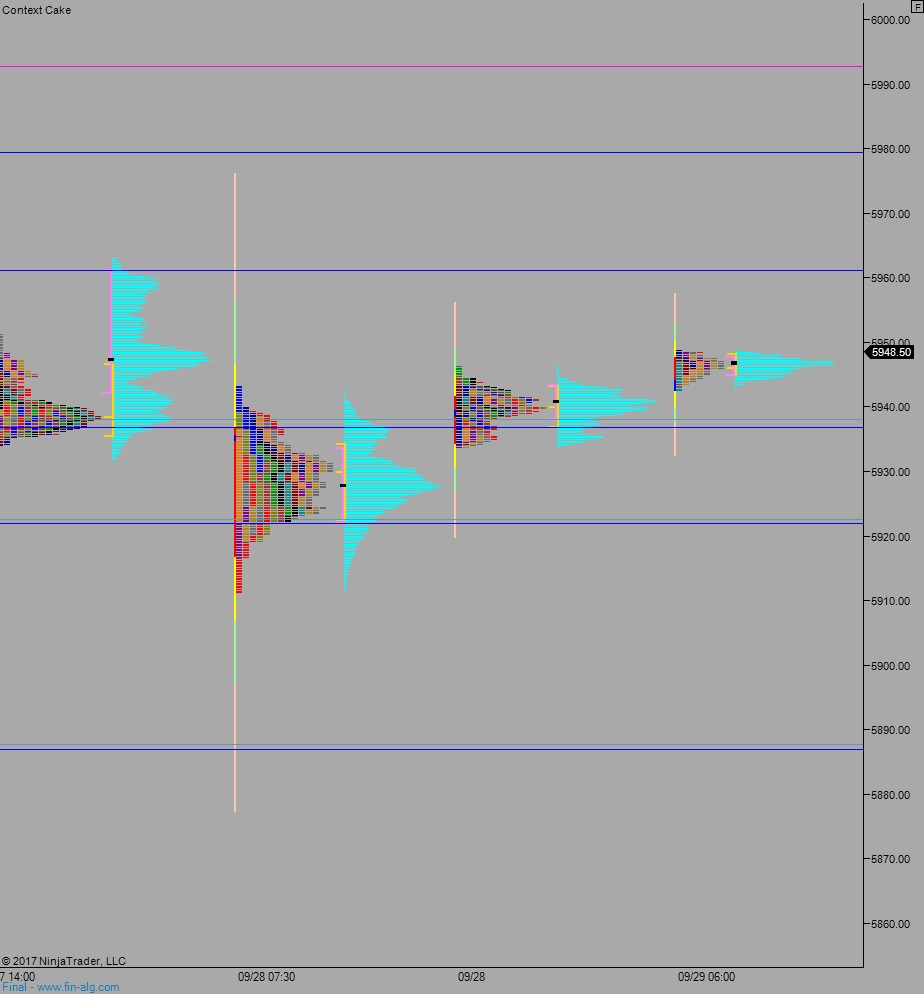

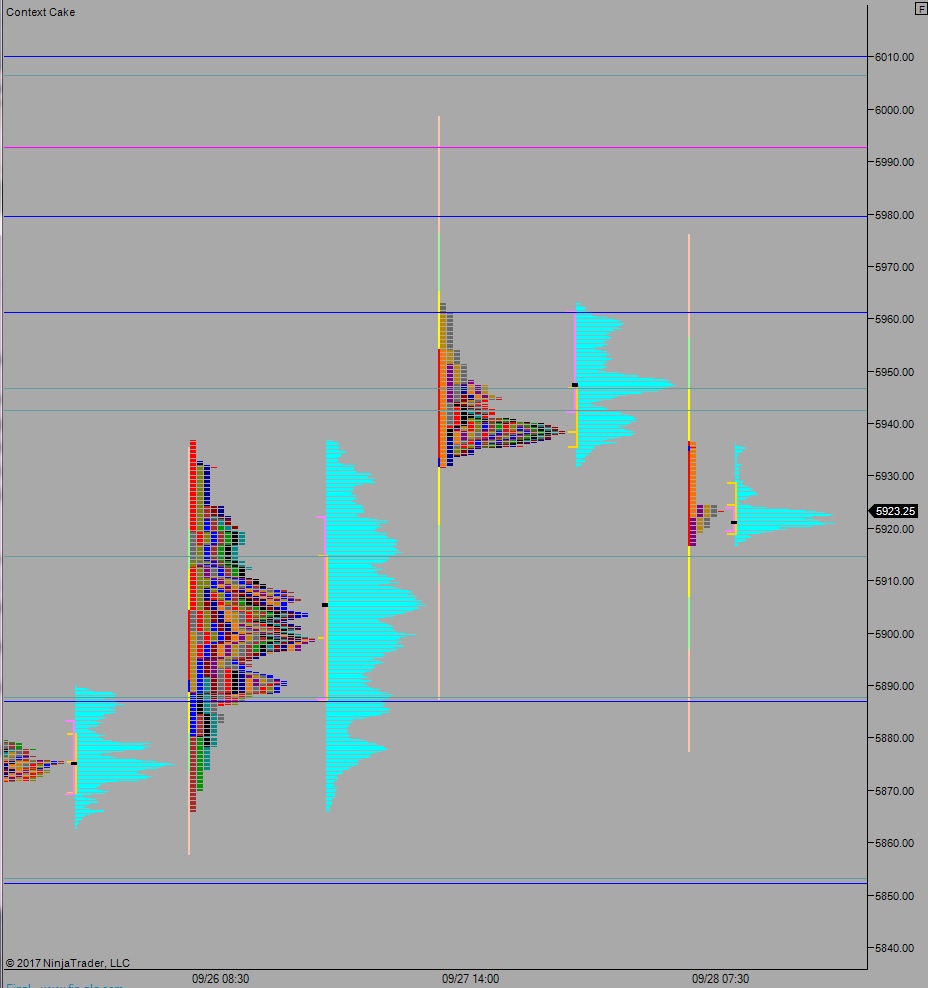

NASDAQ futures are coming into Thursday with a gap down after an overnight session featuring normal range and volume. Price worked lower overnight, trading down to to midpoint of Wednesday as we head into cash open. At 8:30am Initial/Continuing jobless claims came out better than expected.

Also on the economic docket today we have crude oil inventory at 10:30am and a 30-year bond auction at 1pm.

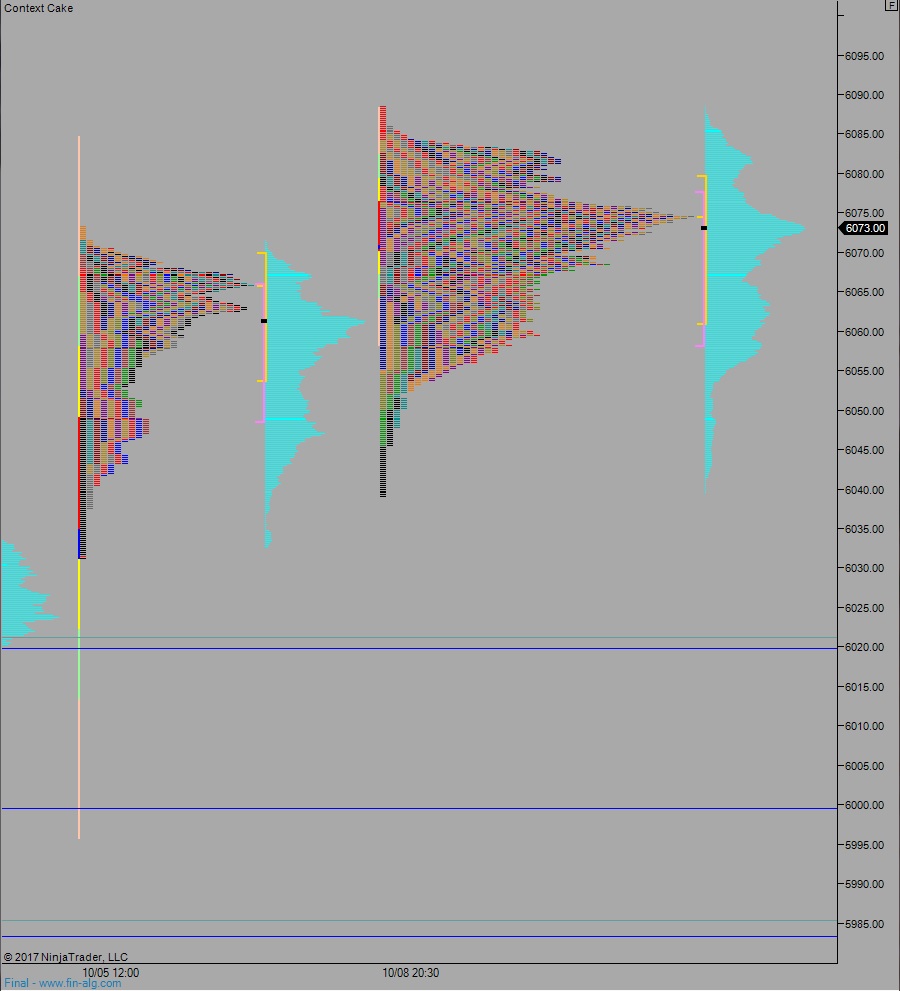

Yesterday we printed a normal variation up. The day began flat and after a slow opening auction we broke higher and worked back up near record highs. We did not, however, take out record highs.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 6082.25. From there we continue higher, up through overnight high 6084.25. Look for sellers up at the measured move target of 6133.50 and two way trade to ensue.

Hypo 2 sellers press down through overnight low 6071.50. Look for buyers ahead of 6057.75 and two way trade to ensue.

Hypo 3 some kind of liquidation triggers, pressing price down to 6021.50 before two way trade ensues.

Levels:

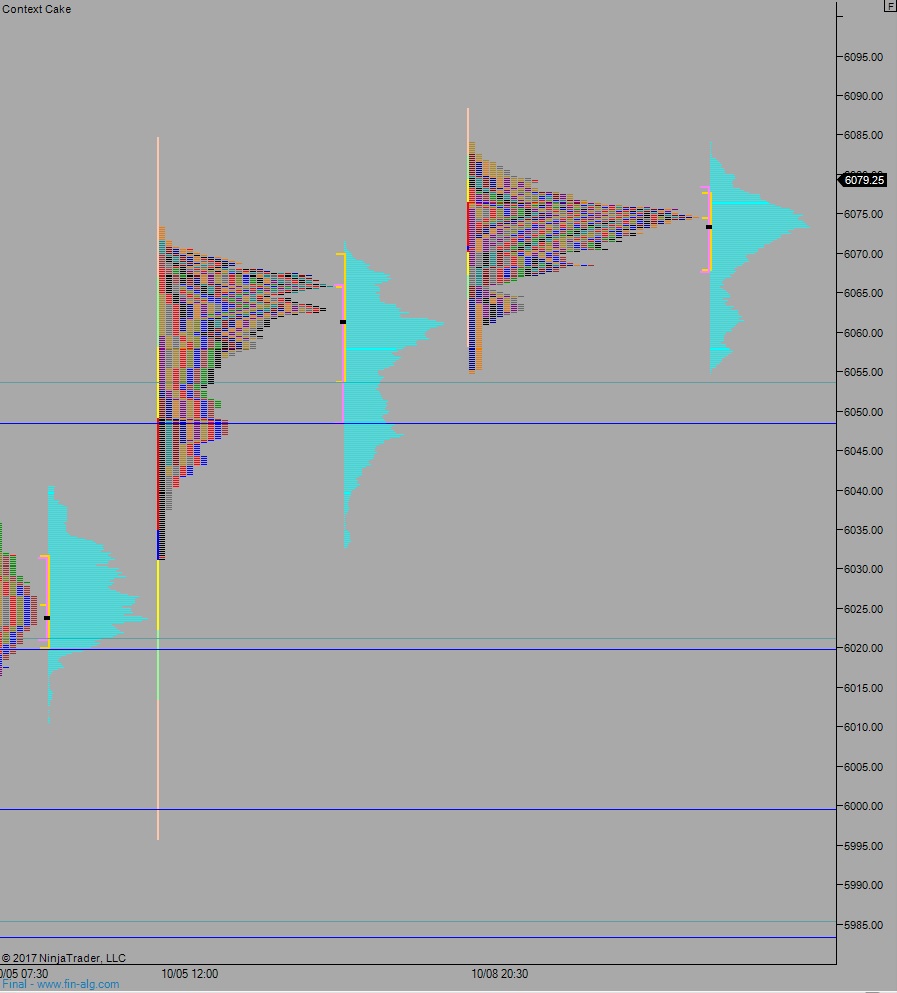

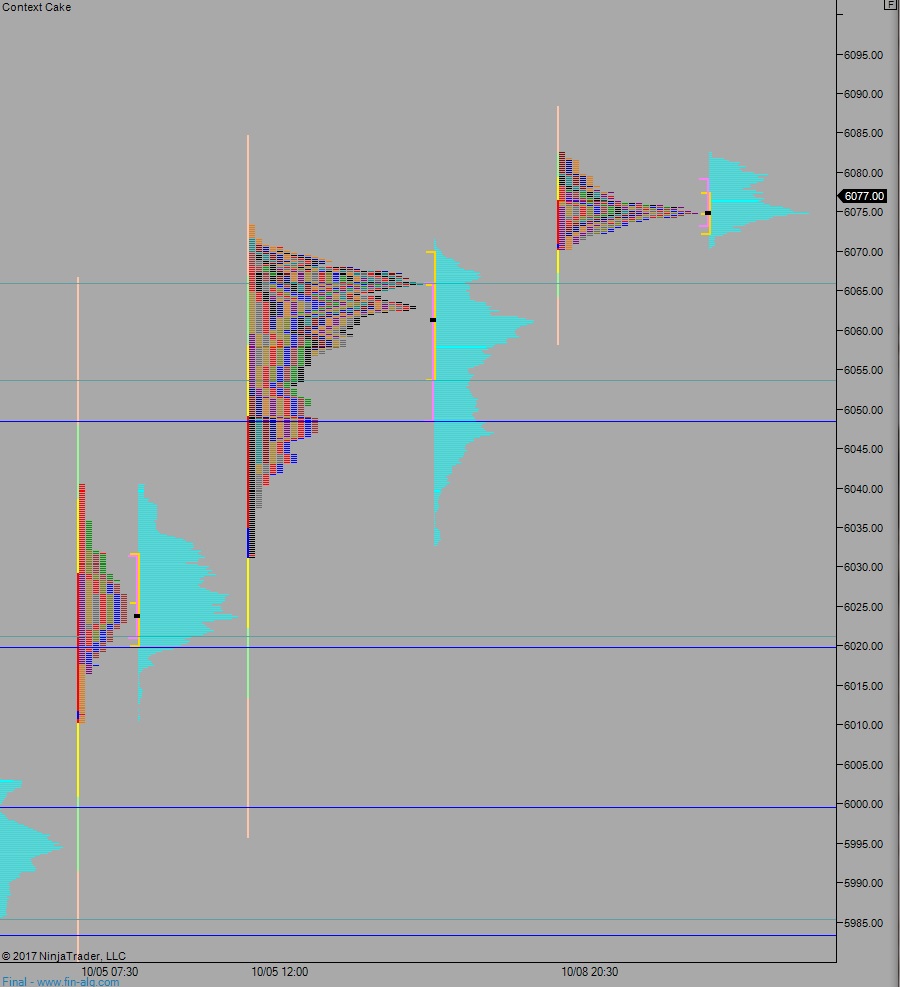

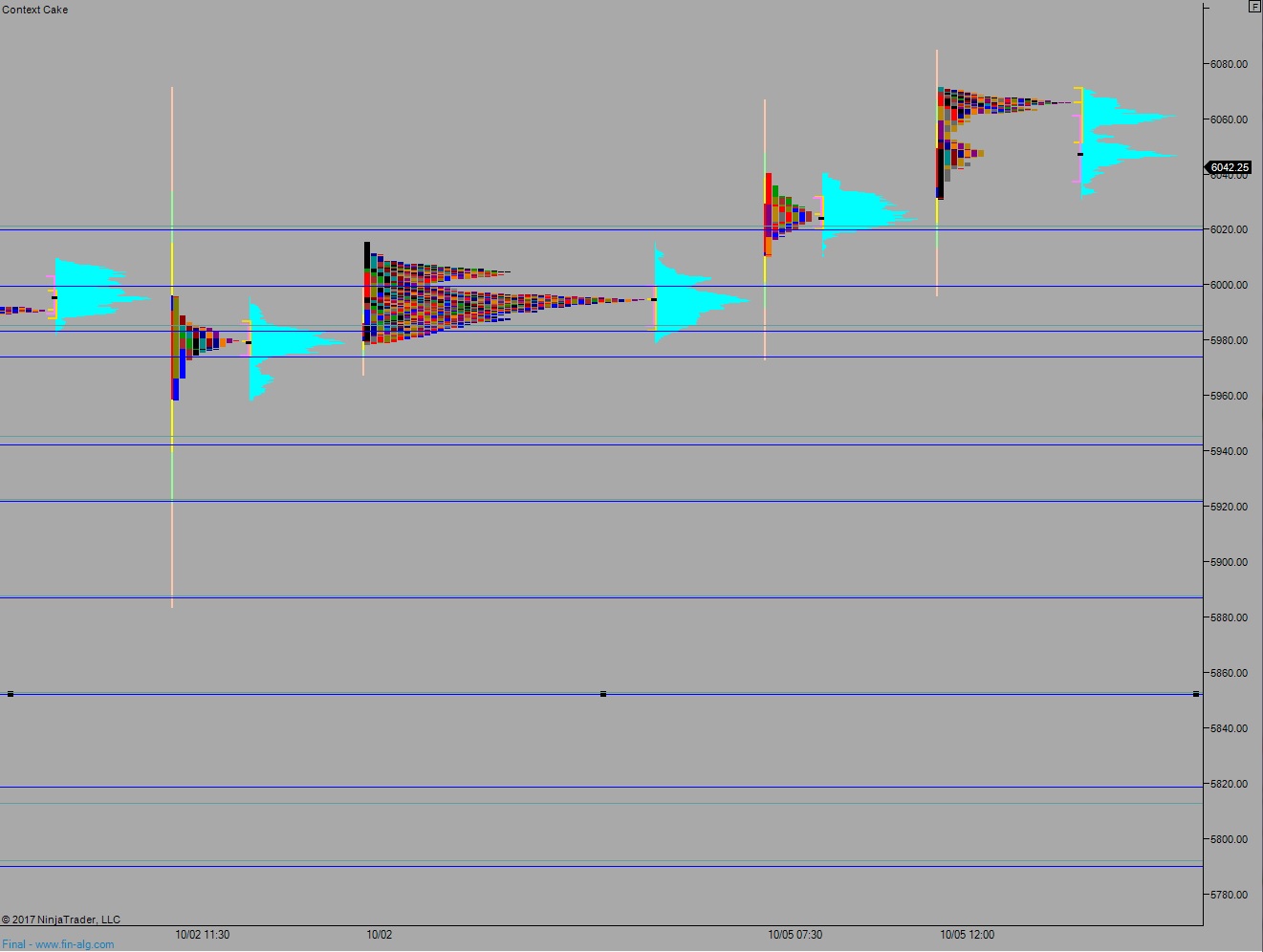

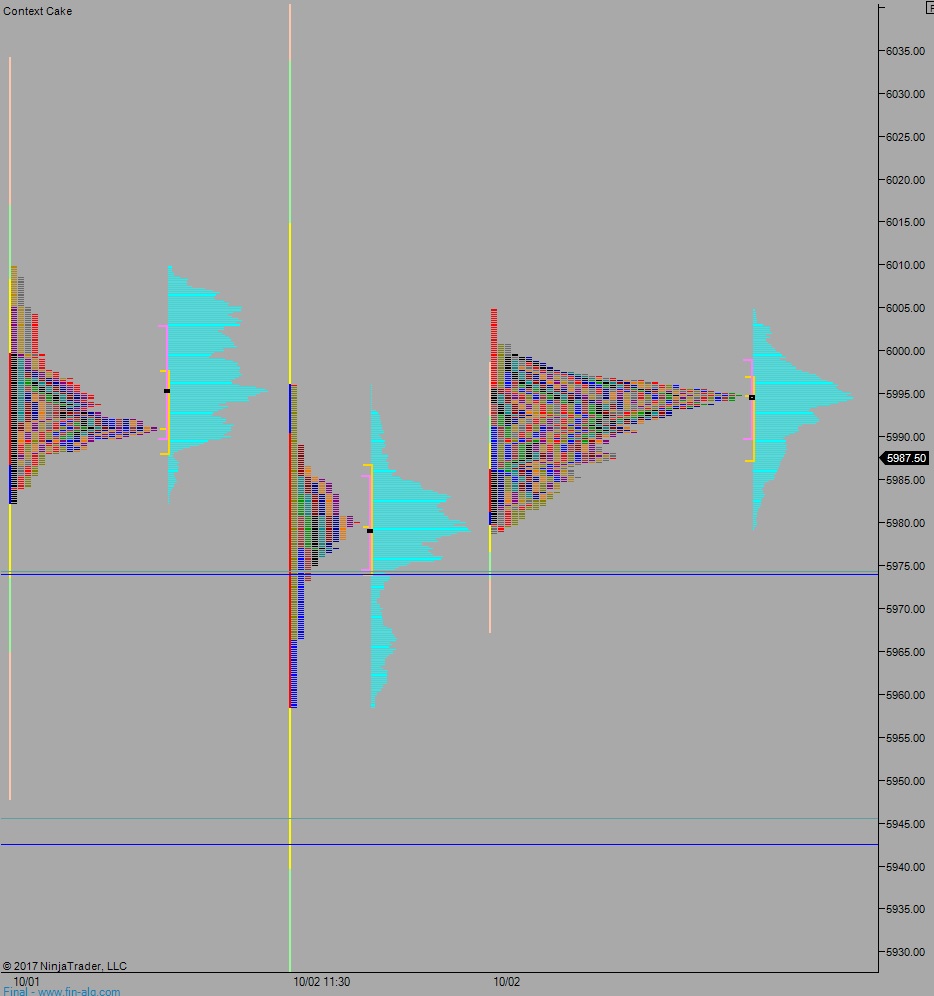

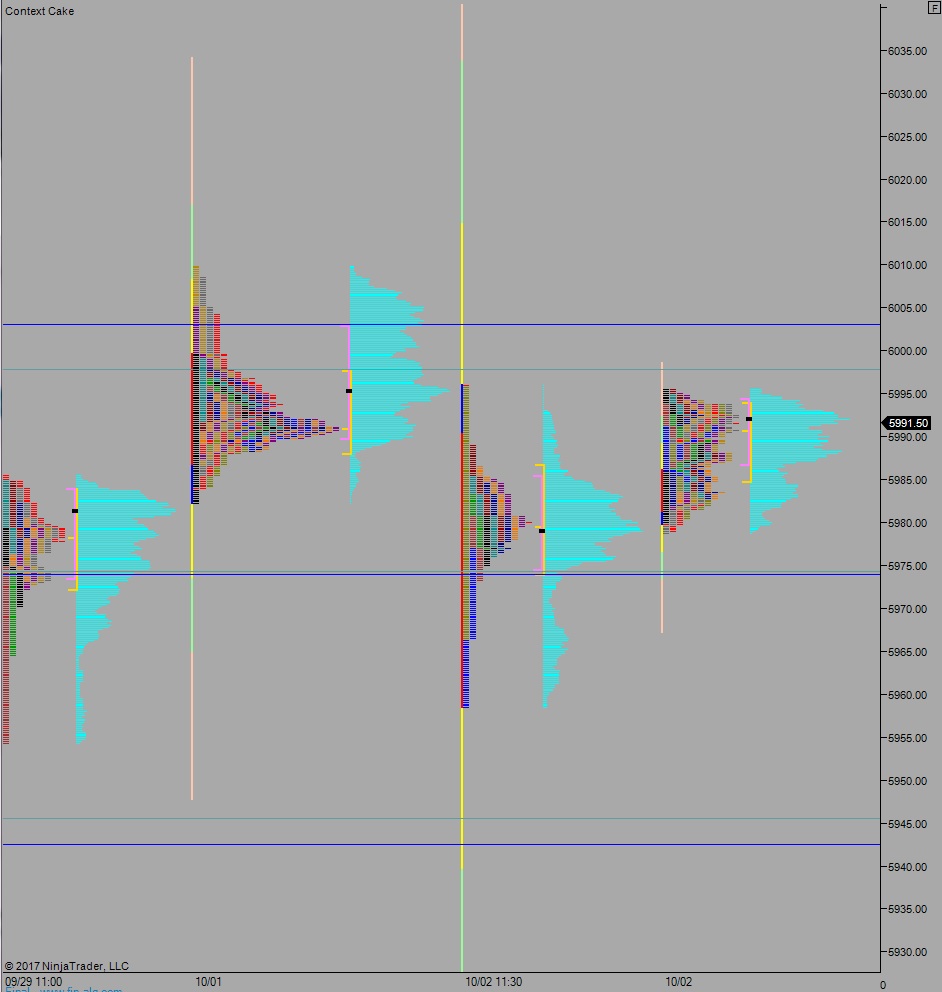

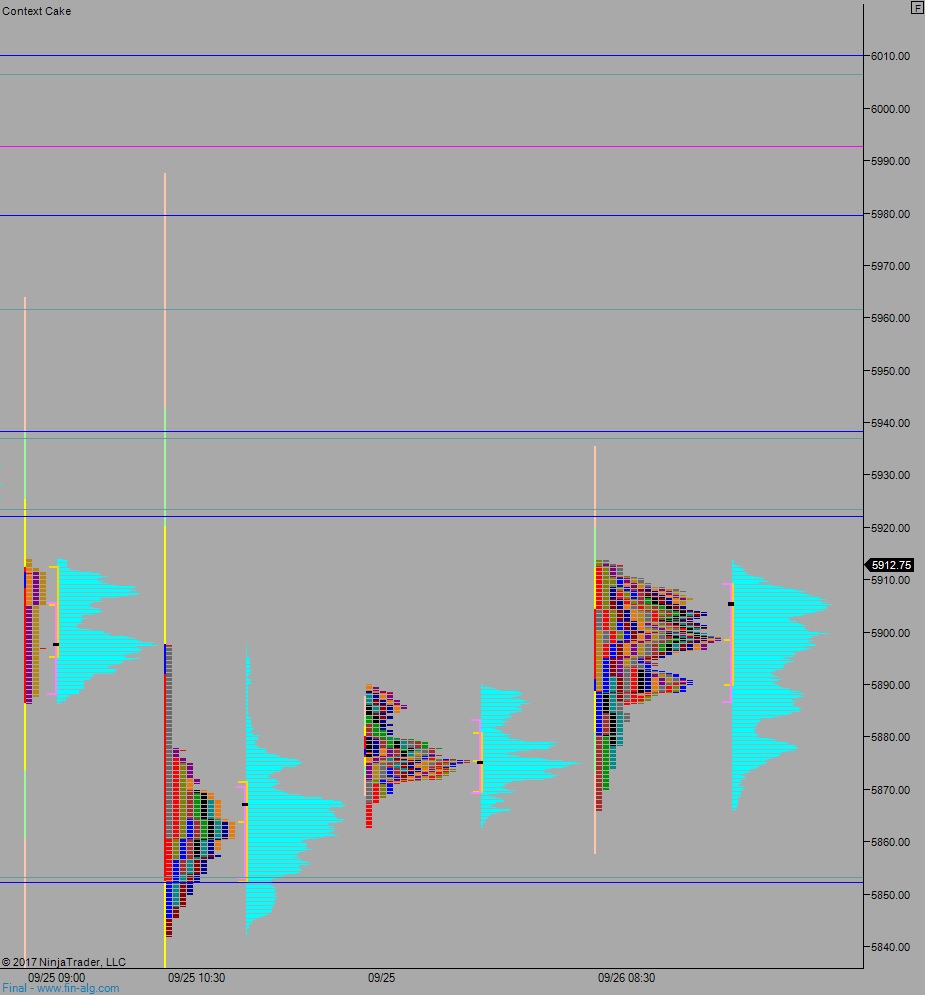

Volume profiles, gaps, and measured moves: