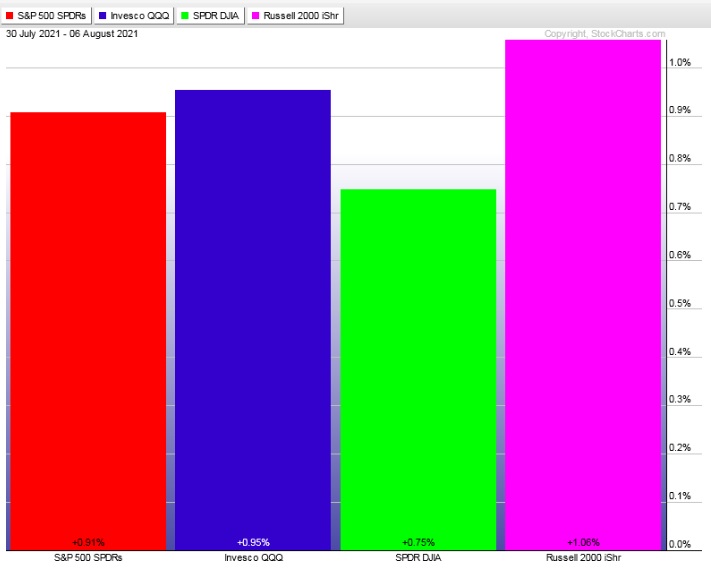

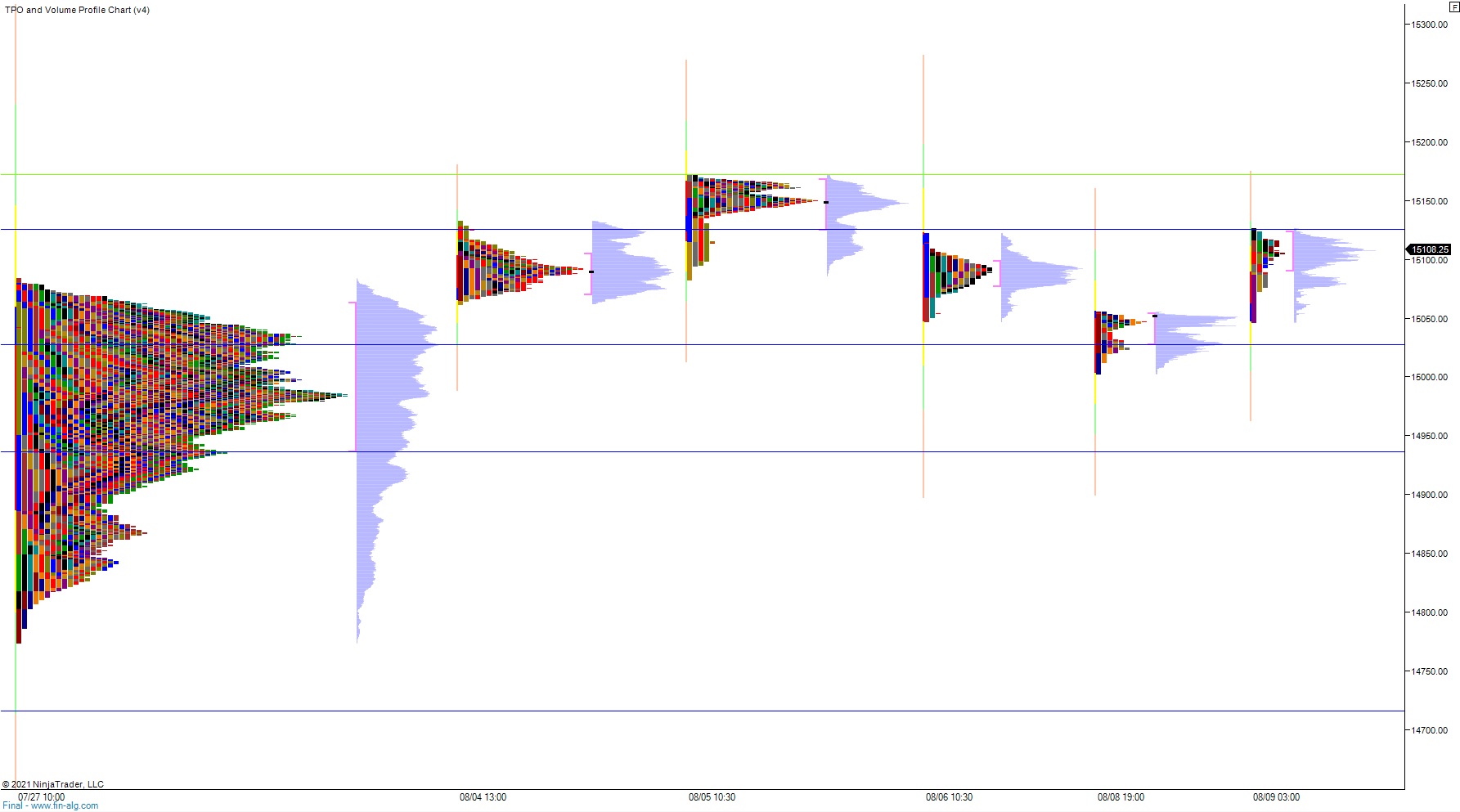

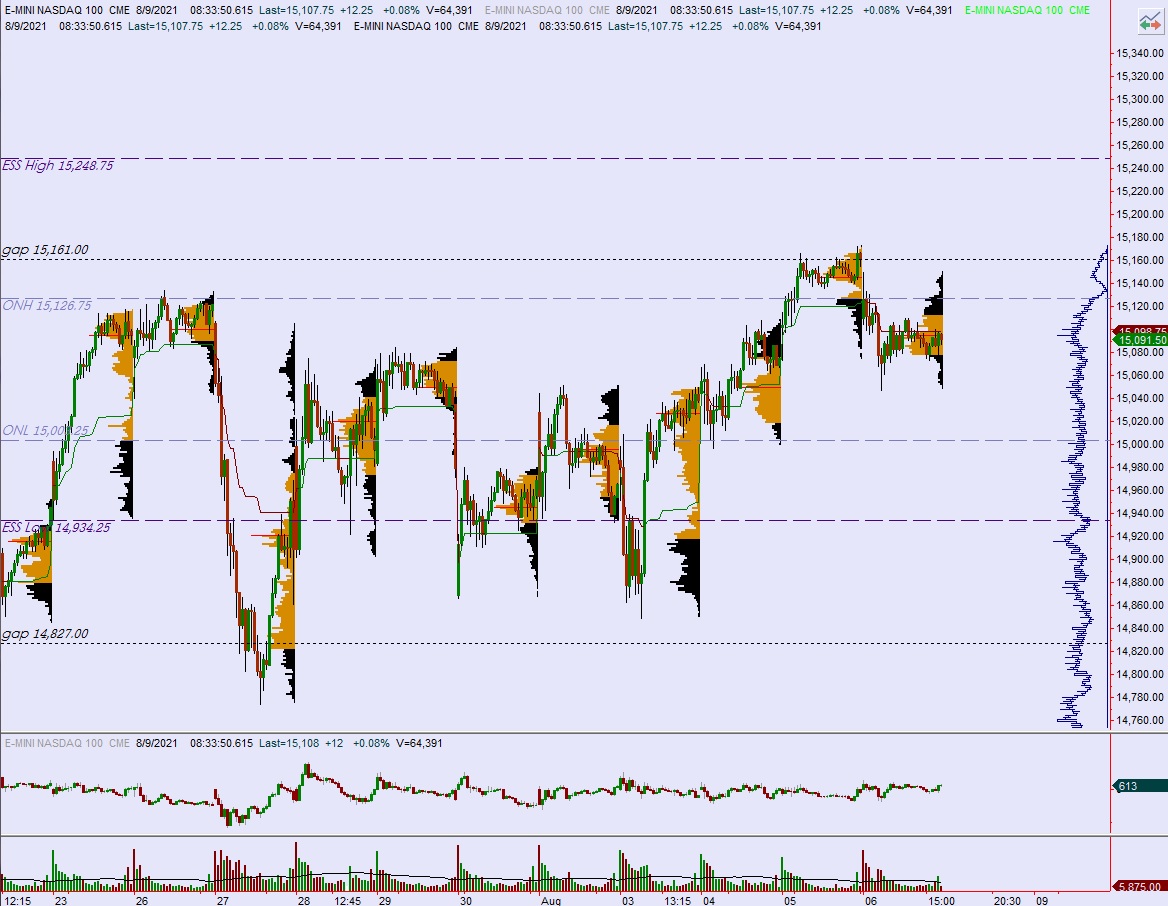

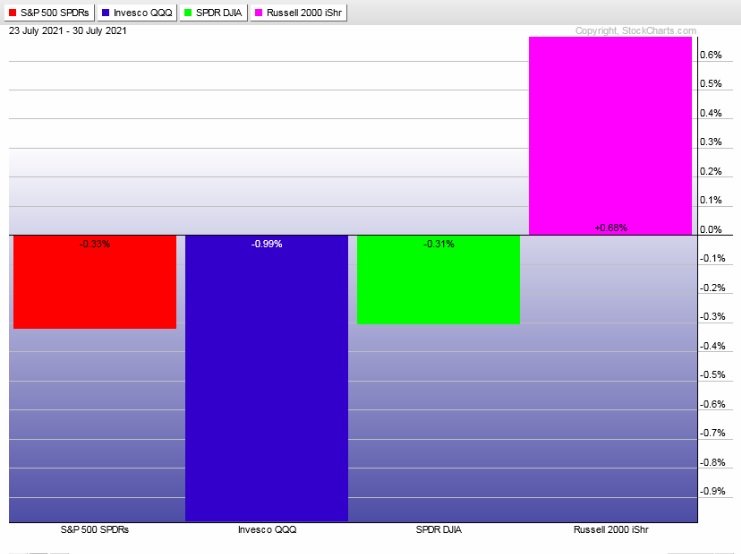

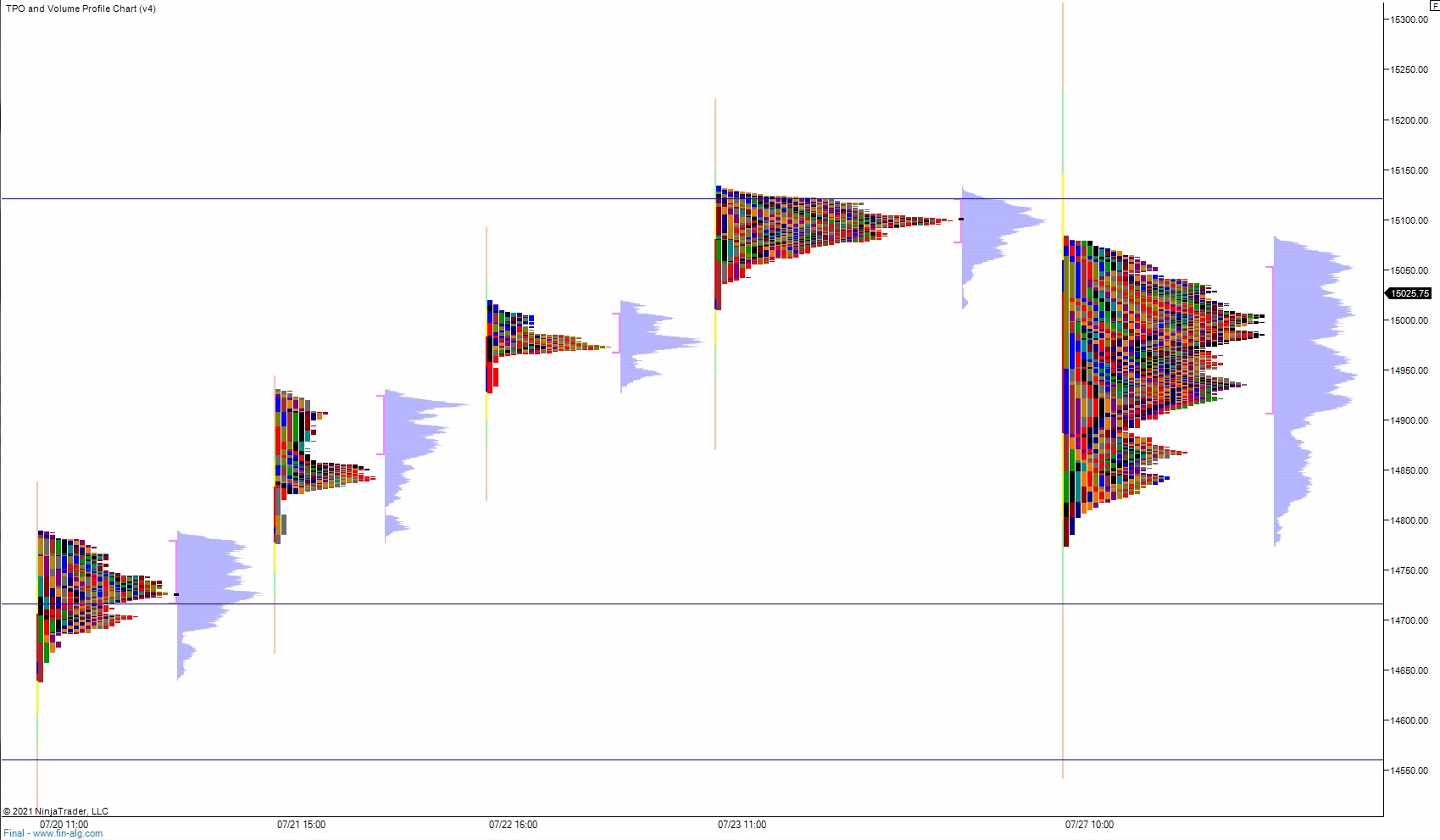

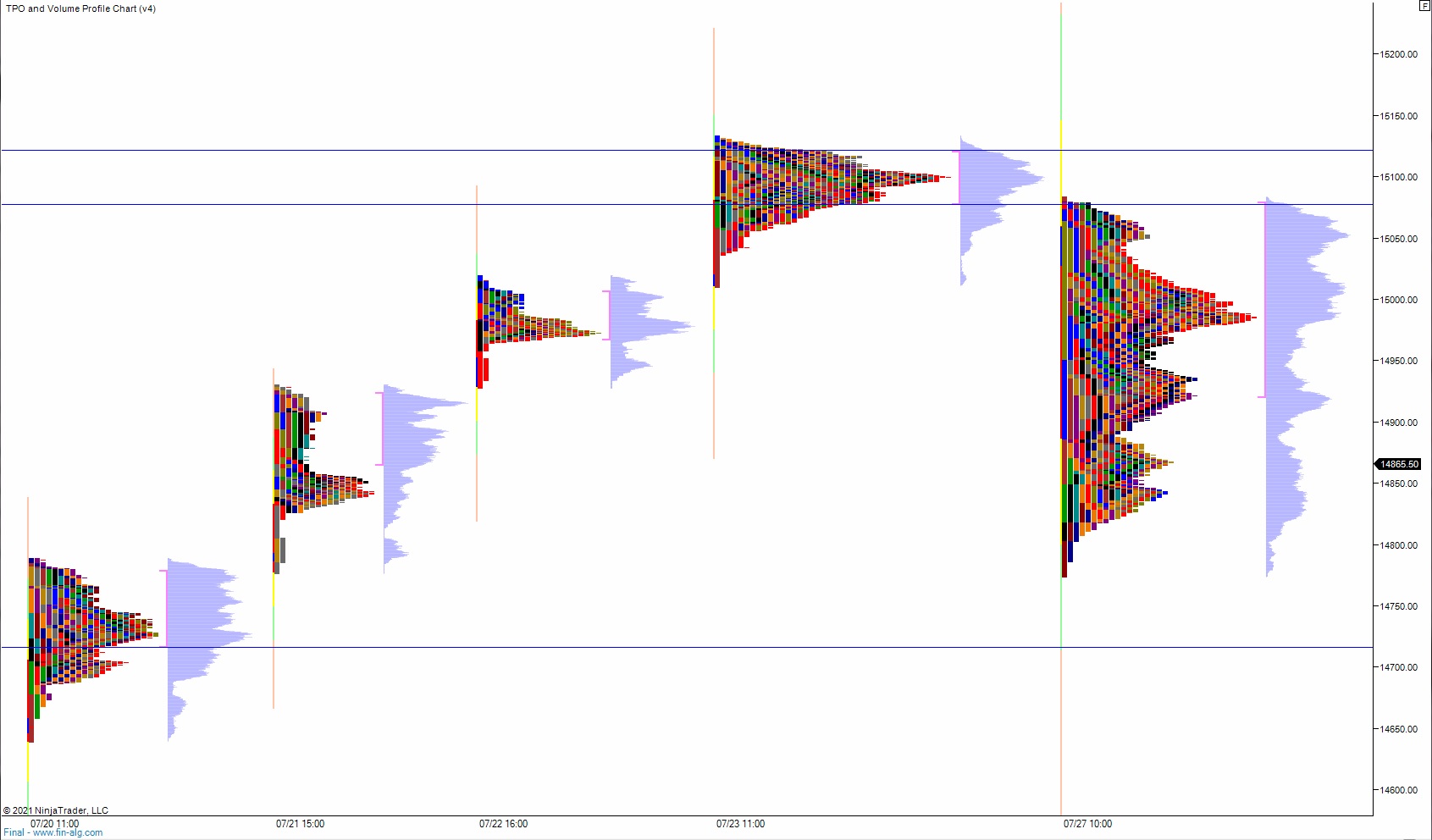

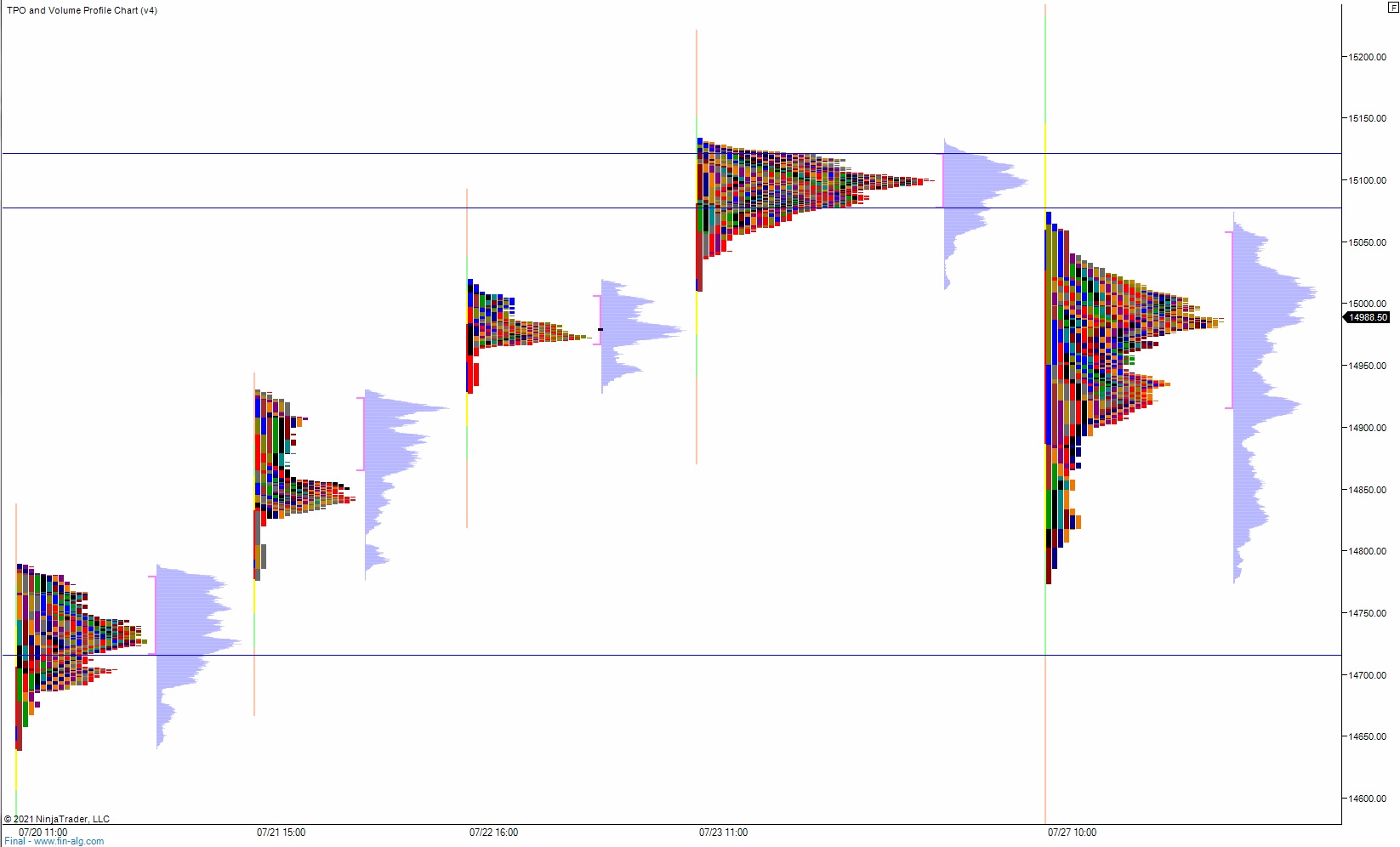

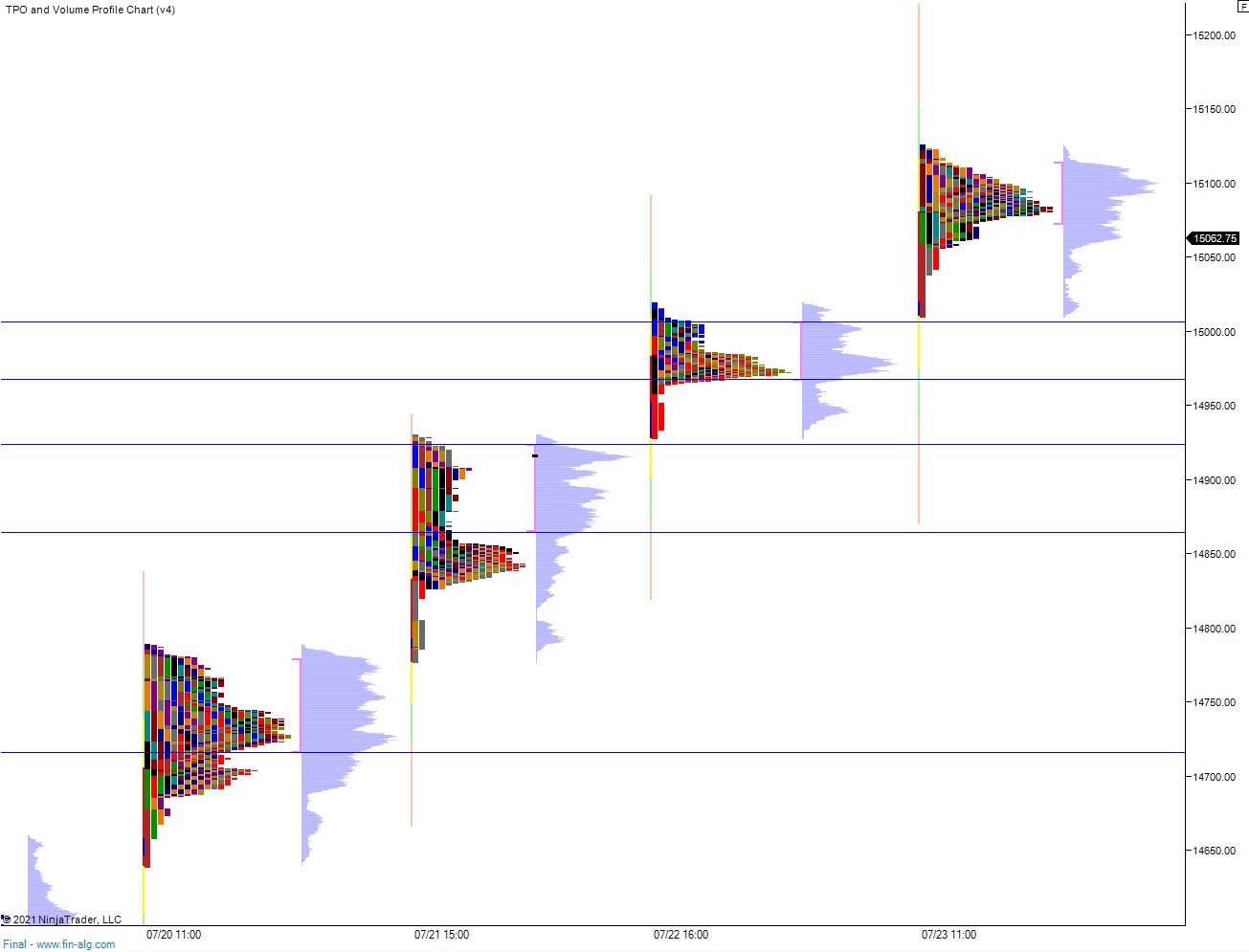

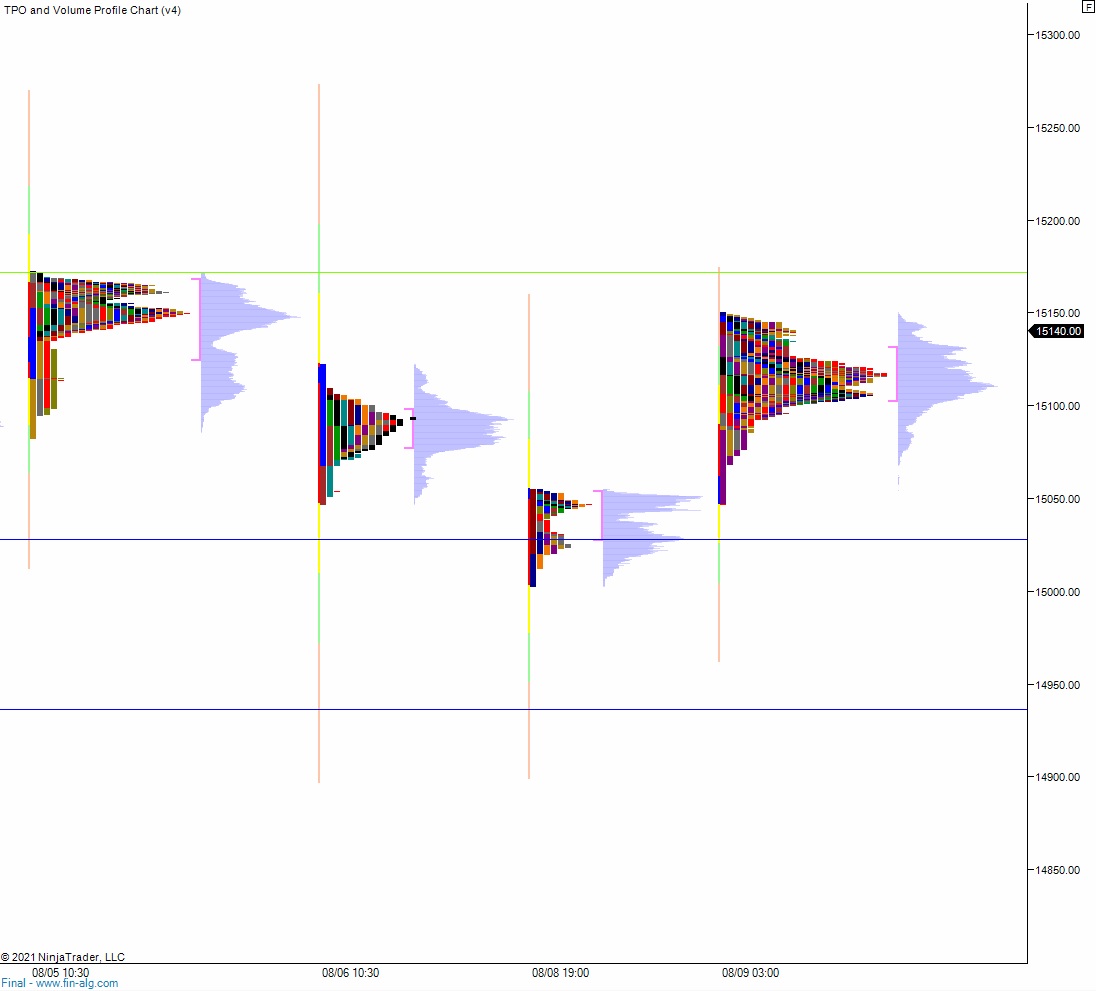

NASDAQ futures are coming into Tuesday with a slight gap up (~+20) after an overnight session featuring normal range and volume. Price was balanced overnight, balancing along the upper half of Monday’s range. As we approach cash open price is hovering right up near the Monday high.

On the economic calendar today we have 52-week T-bill auction at 11:30am followed by 3-year note auction at 1pm.

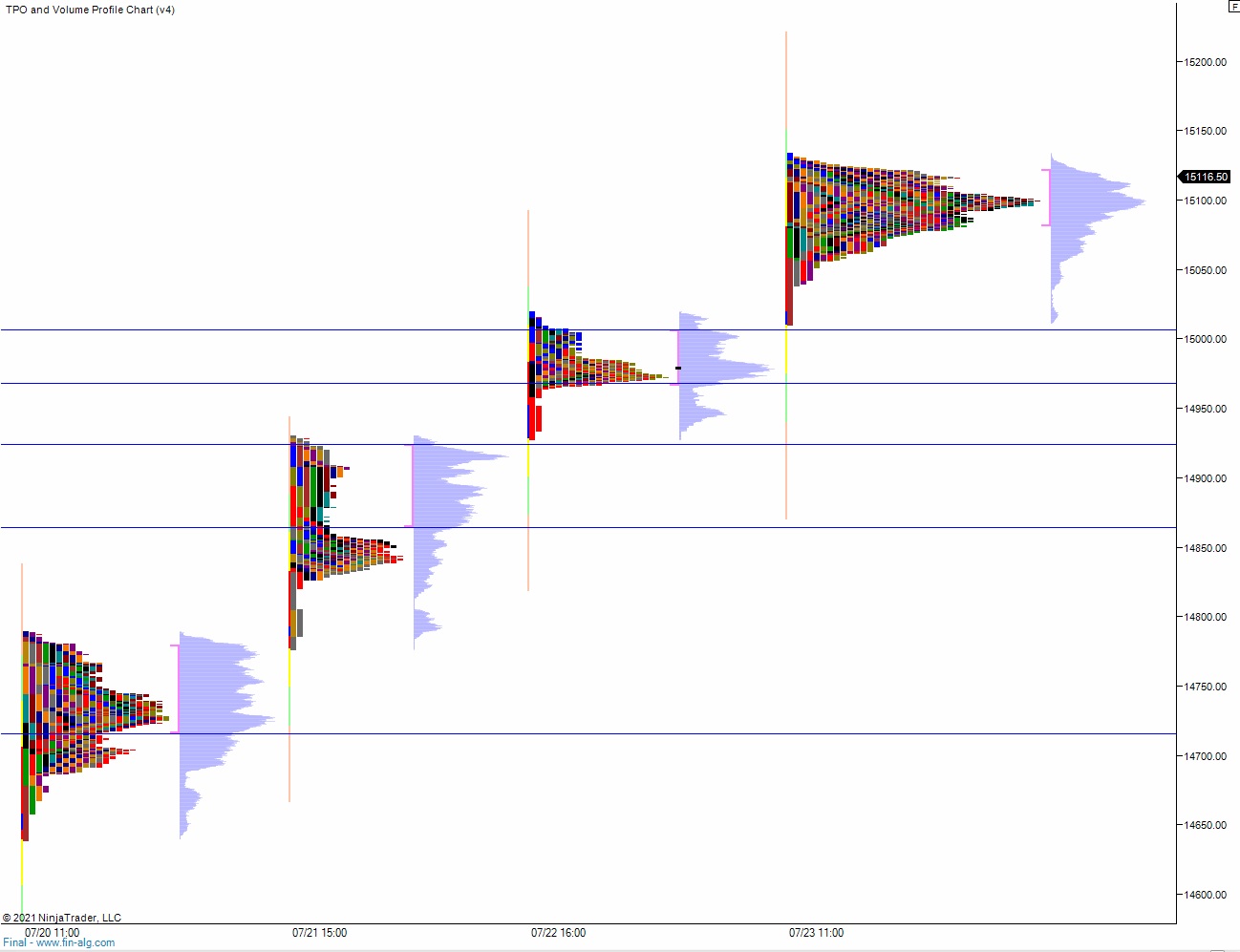

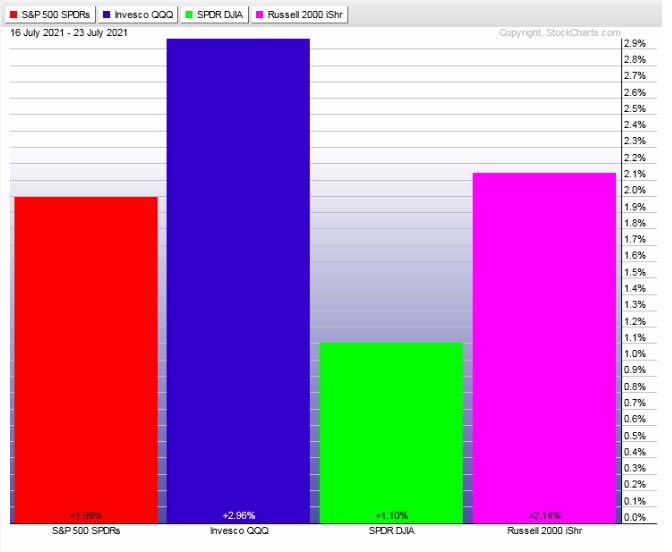

Yesterday we printed a normal variation up. The day began with a slight gap up in range and after a brief open auction in range sellers stepped in and closed the overnight gap. They pushed a bit beyond the gap fill before responsive buyers came in and formed an excess low that would mark low-of-day. We spent much of the session chopping along the topside of the daily mid before a late session rally pushed us into a range extension up. We ended the day flagging down off the highs a bit, but well above the mid.

Heading into today my primary expectation is for buyers to gap-and-go higher, closing the Thursday gap 15,161 on the way to making to probing above all-time high 15,172.25.

Hypo 2 stronger buyers rally to 15,200.

Hypo 3 sellers press down through overnight low 15,092.75 before two way trade ensues.

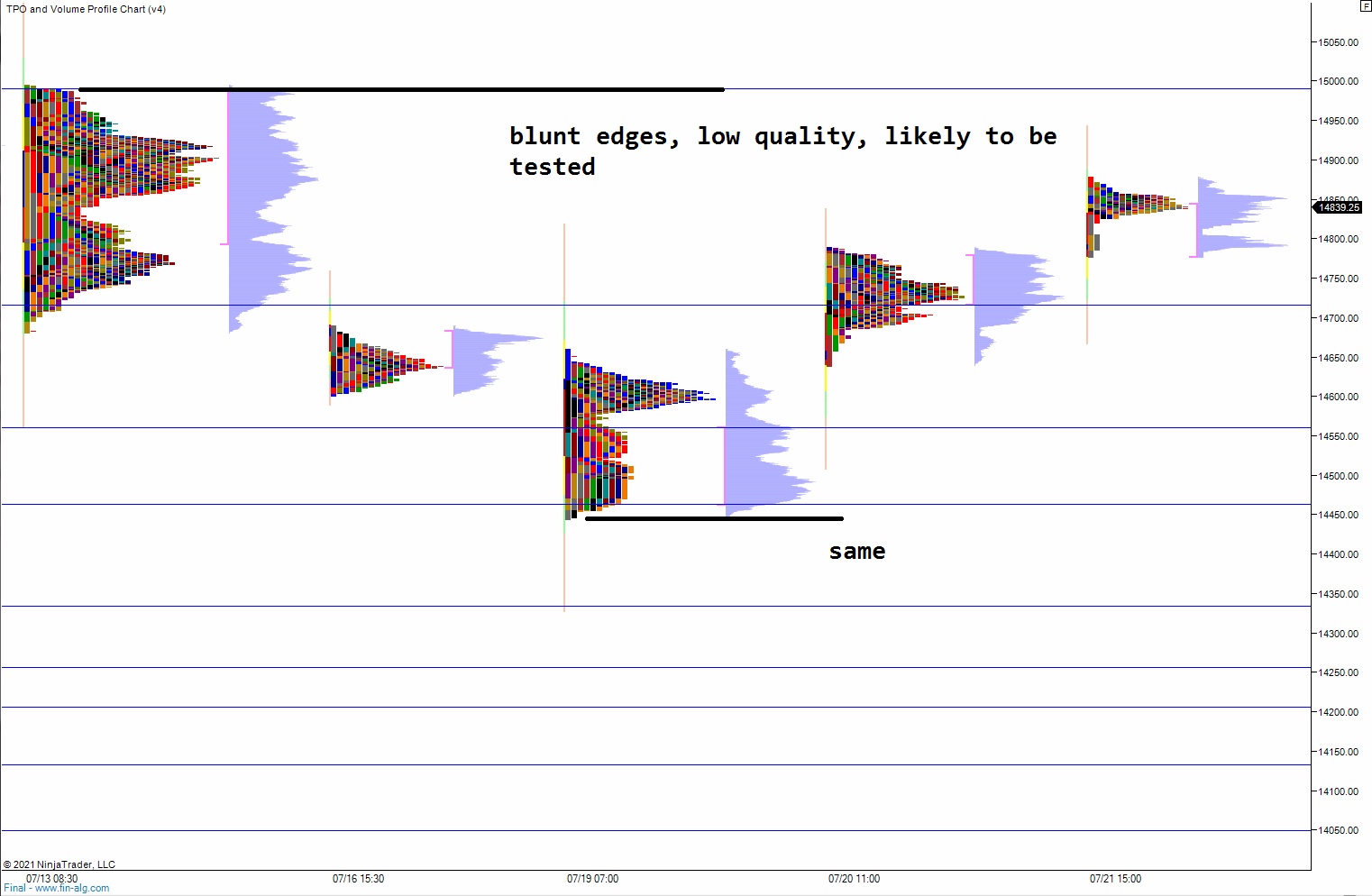

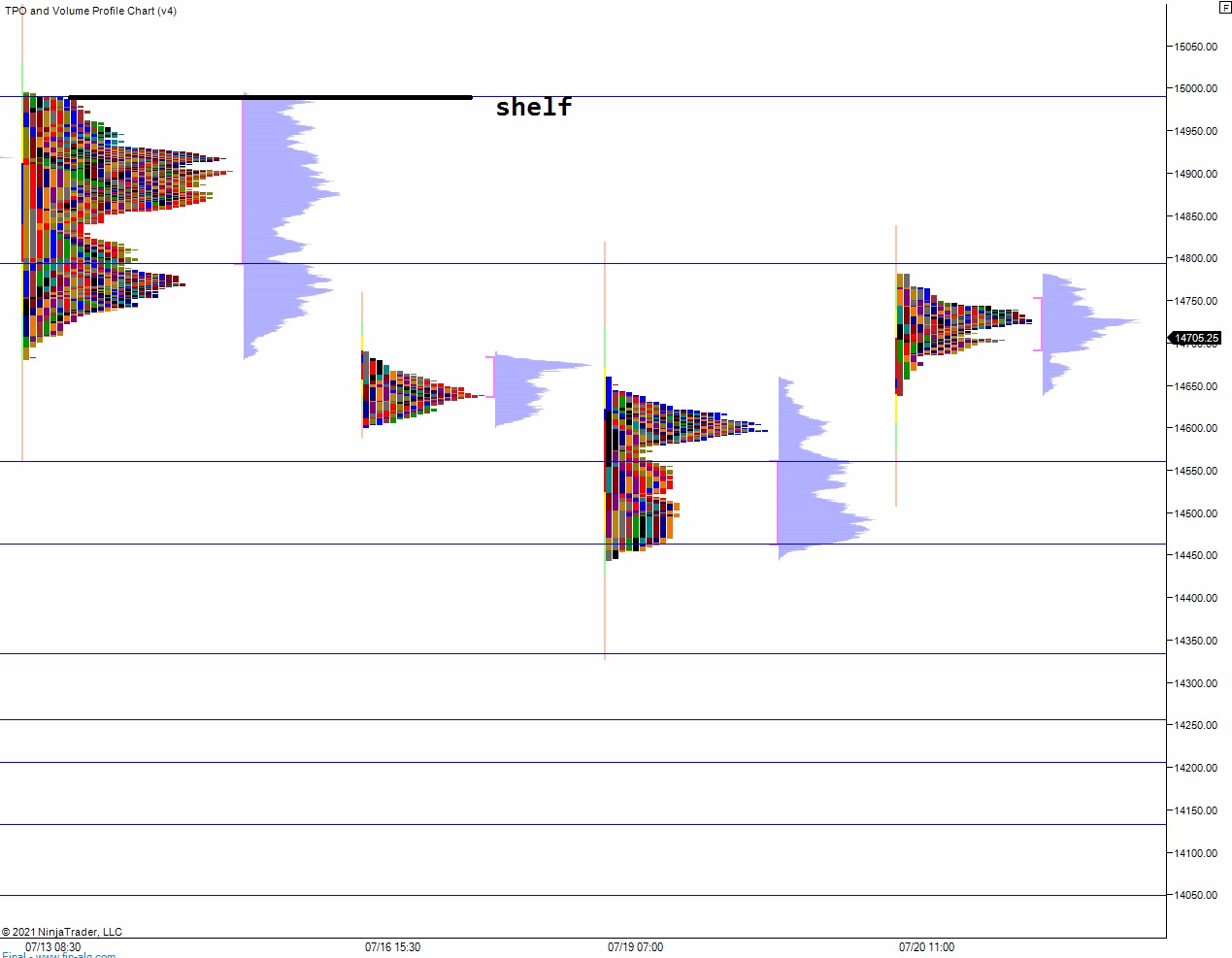

Levels:

Volume profiles, gaps and measured moves: