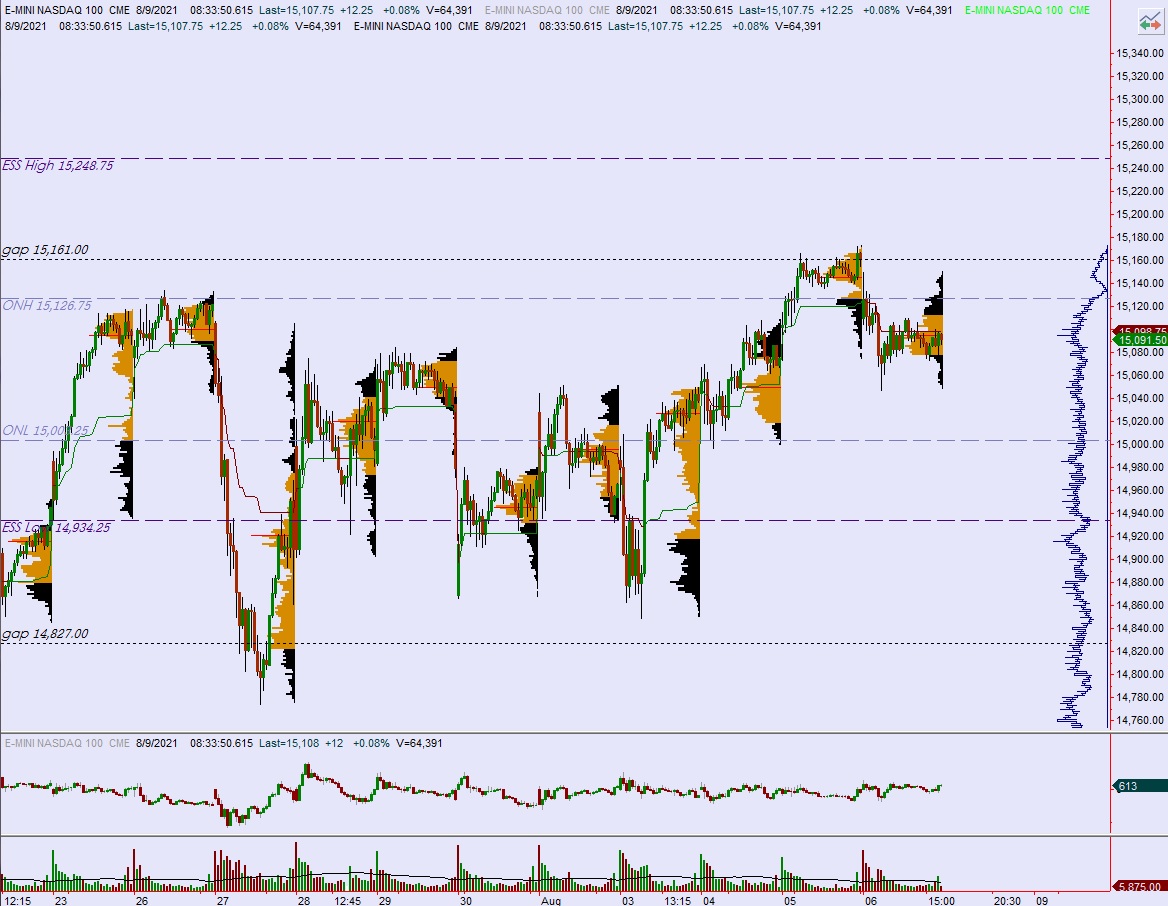

NASDAQ futures are coming into the second week of August with a slight gap up after an overnight session featuring extreme range on elevated volume. price was balanced overnight, first falling down down through the Friday low and then working back up through it. As we approach cash open price is hovering up above the Friday midpoint.

On the economic calendar today we have JOLTS jobs openings at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

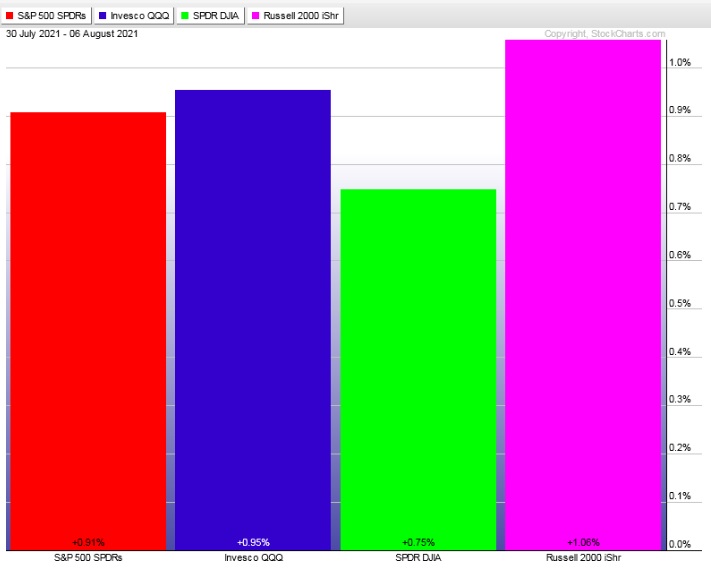

Last week saw index prices Gap up into the week before slowly fading lower Monday. Hard selling early Tuesday discovered a strong responsive bid by late morning then we rallied into the weekend with the NASDAQ lagging a bit behind. The last week performance of each major index is shown below:

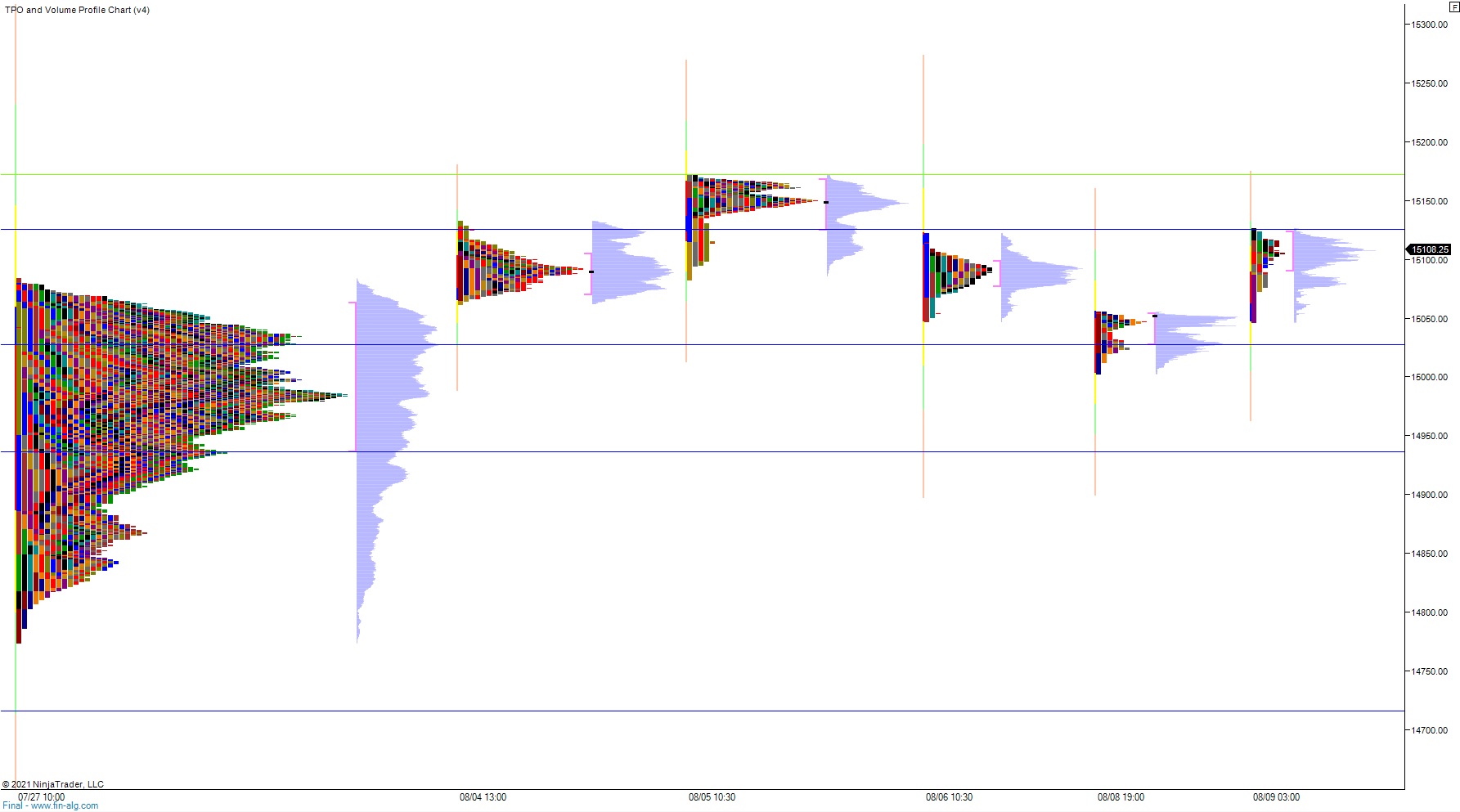

On Friday the NASDAQ printed a normal variation down. The day began with a gap down in range. After a brief open two way auction buyers stepped in and began driving higher. Their campaign came to an end before buyers could close the gap. Instead sellers were active at the VPOC and the auction reversed lower. Sellers reclaimed the mid and then defended it to set up a move down through the Thursday low. By around 11:15am low-of-day was in. Price worked back up to the daily mid and we spent the rest of the session chopping along the bottom-side of the mid.

Heading into today my primary expectation is for sellers to push into the overnight inventory and close the gap down to 15,091.50. Look for buyers down at 15,089.50 and for two way trade to ensue.

Hypo 2 stronger sellers press down to 15,000 before two way trade ensues.

Hypo 3 buyers work up through overnight high 15,126.75 setting up a run on last Thursday’s gap 15,161 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: