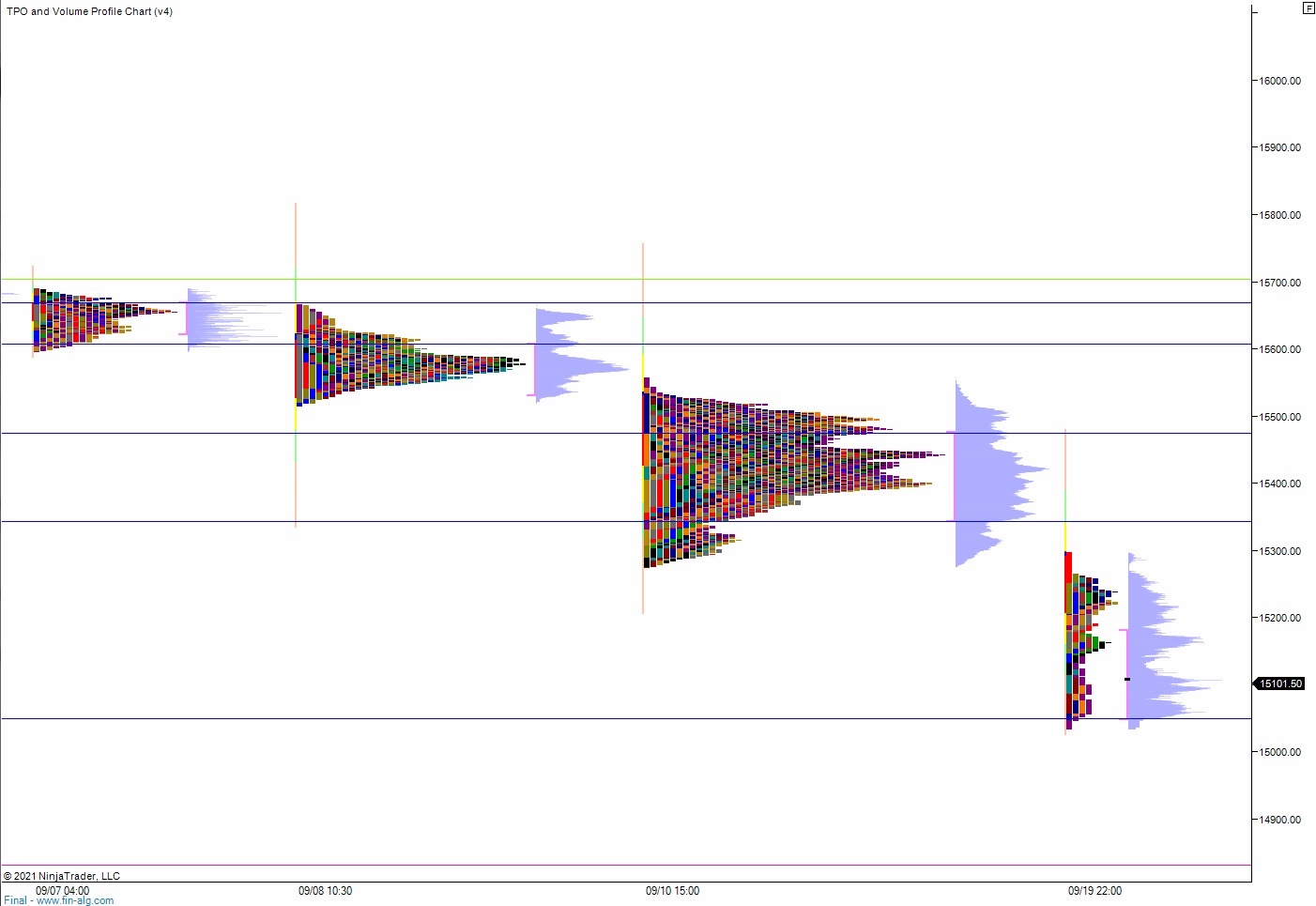

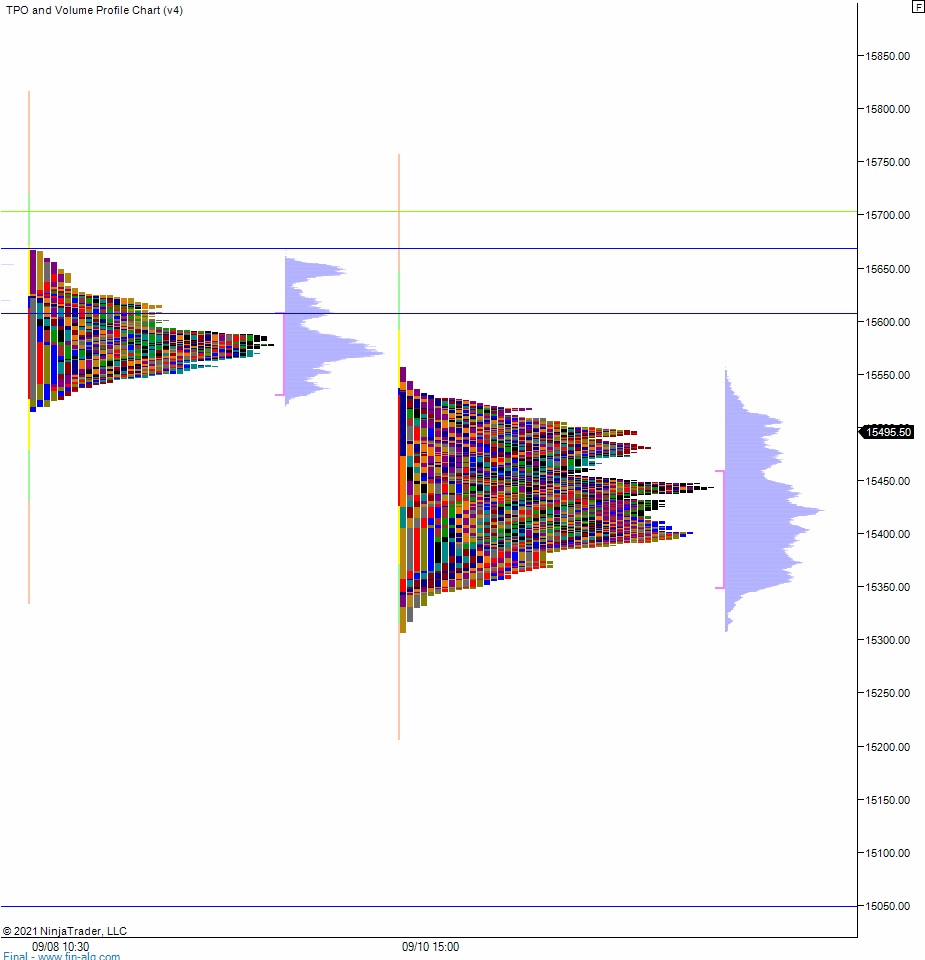

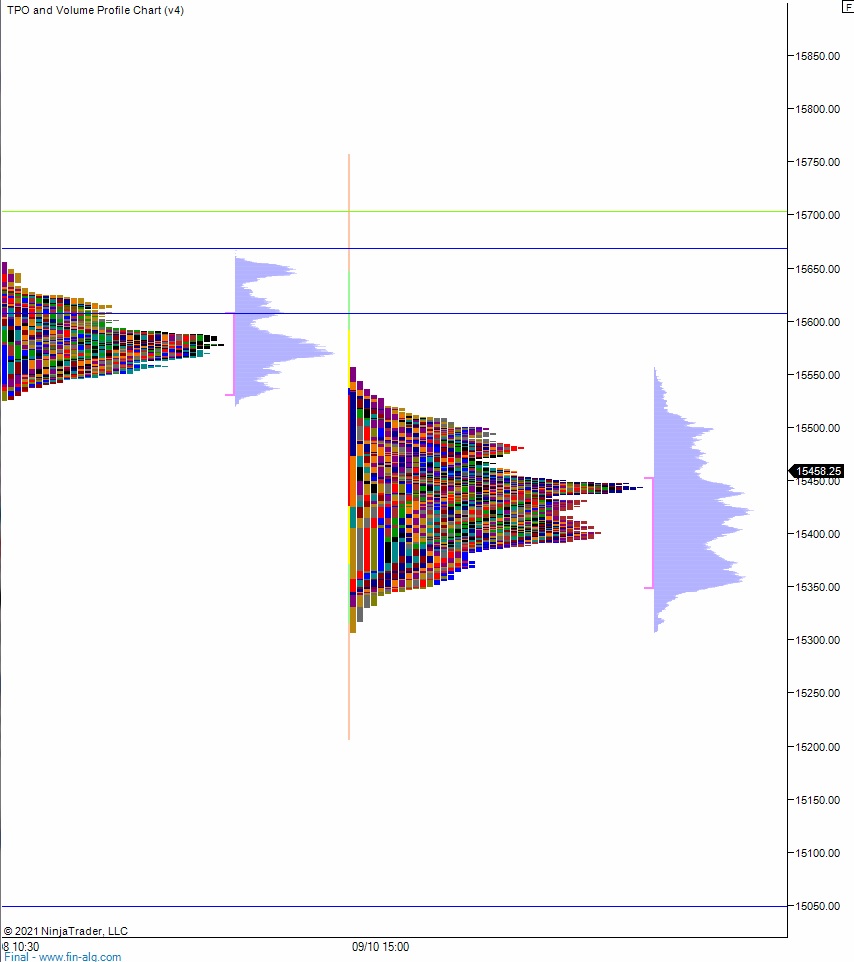

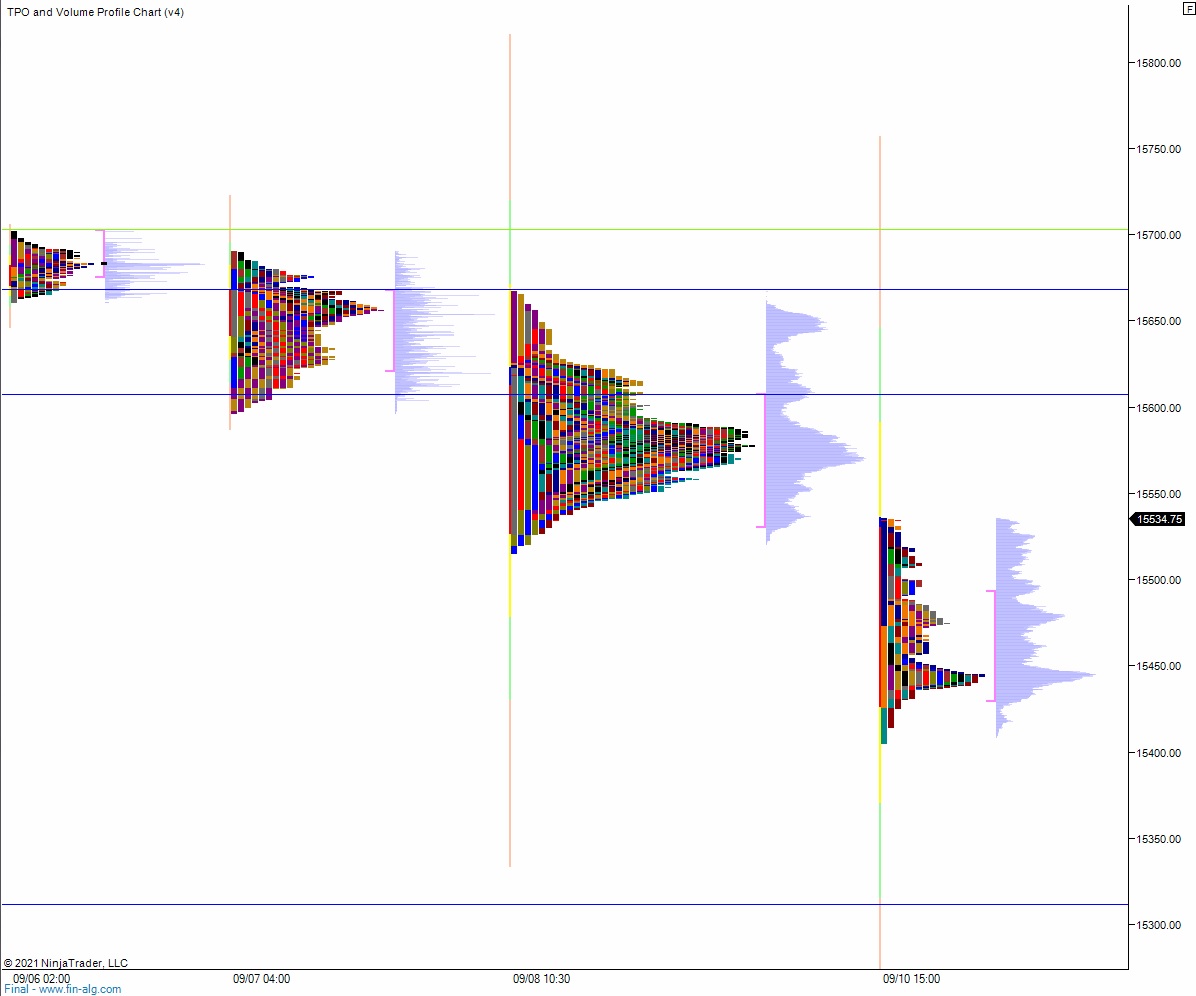

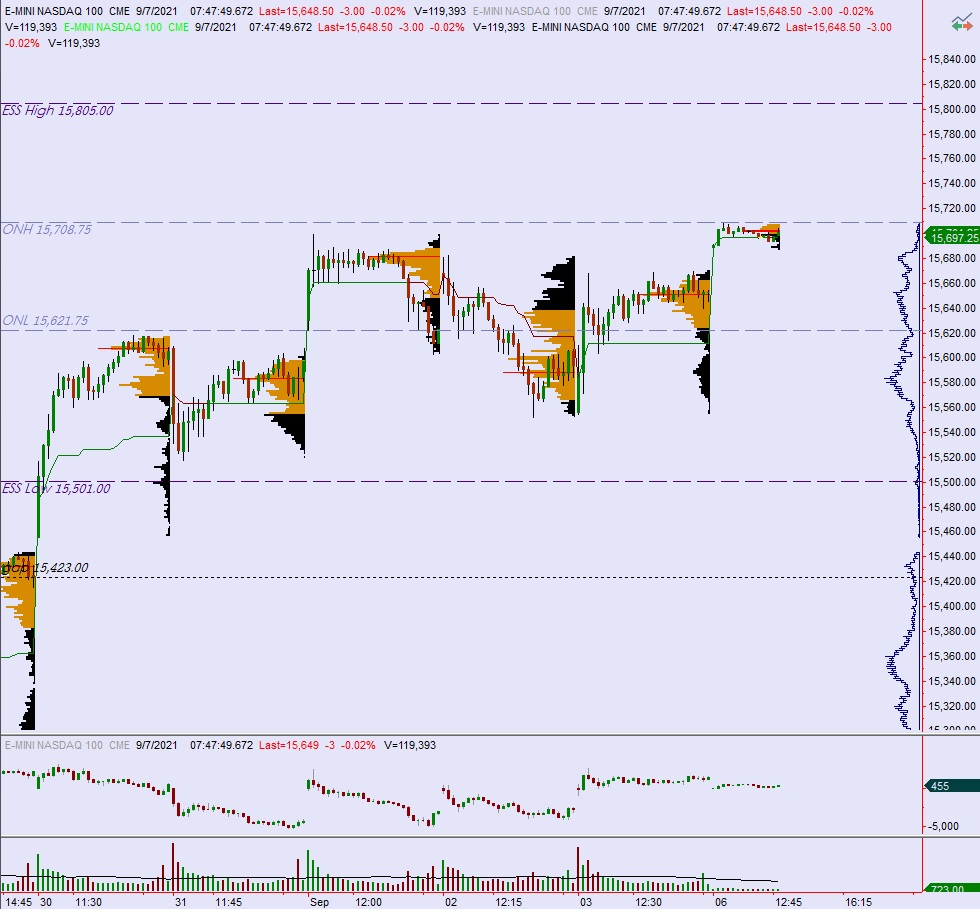

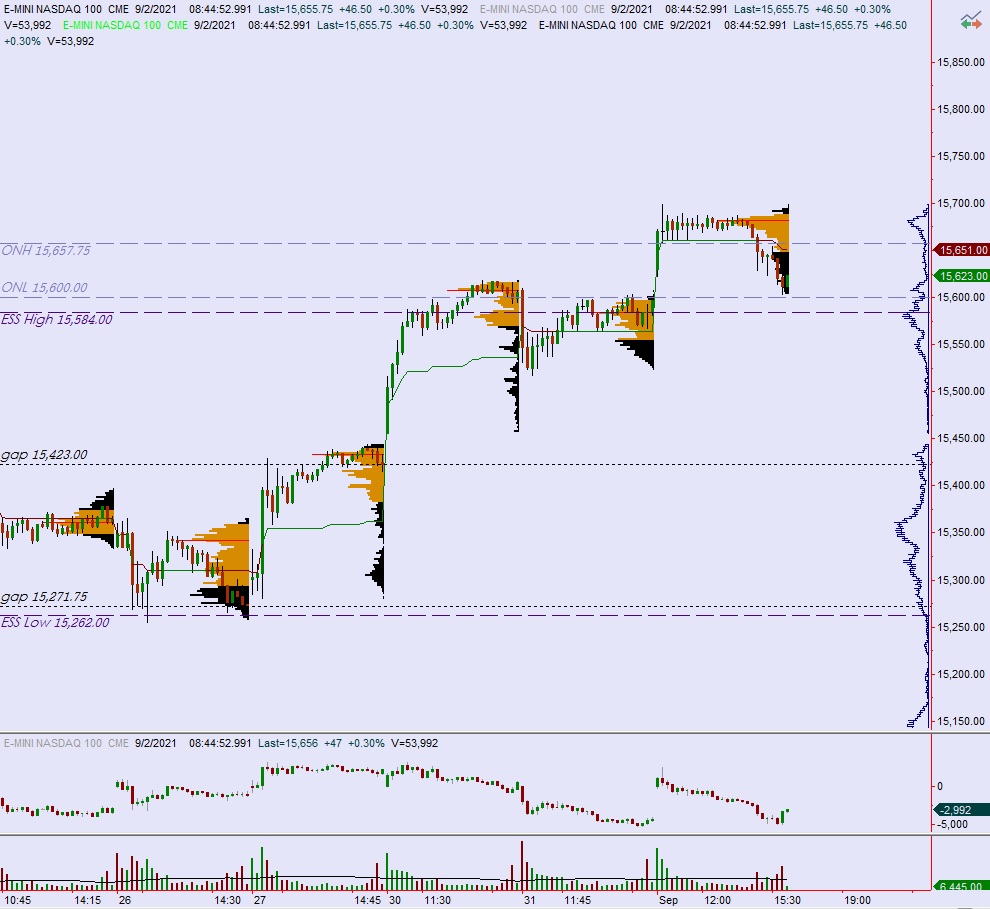

NASDAQ futures are coming into Wednesday with a slight gap up after an overnight session featuring extreme range and volume. Price was balanced overnight, balancing along the Tuesday midpoint after briefly exceeding the Tuesday low early in the Globex session. As we approach cash open price is hovering above the Tuesday midpoint.

On the economic calendar today we have existing home sales at 10am, crude oil inventories at 10:30am, a 2-year frn note auction at 11:30am, then at 2pm we have the FOMC announcement followed by a 2:30pm press conference.

The CME fed fund futures are currently pricing a 100% probability rates the benchmark Fed borrowing rate will remain unchanged.

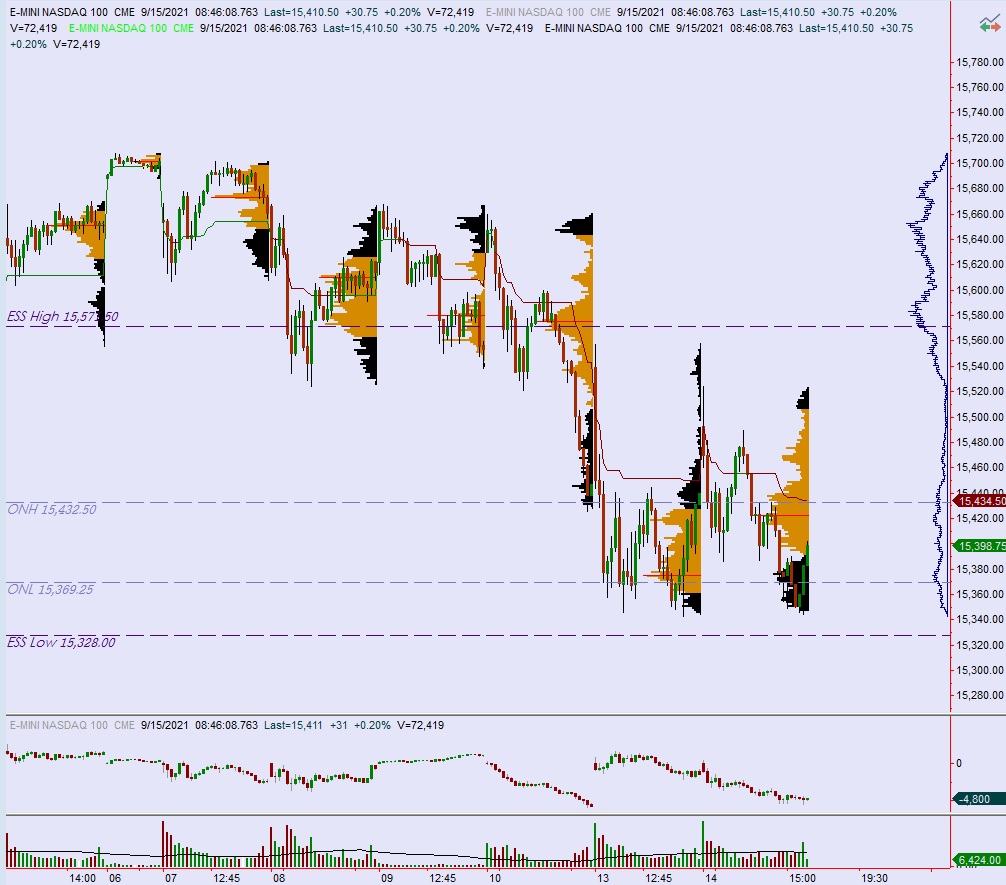

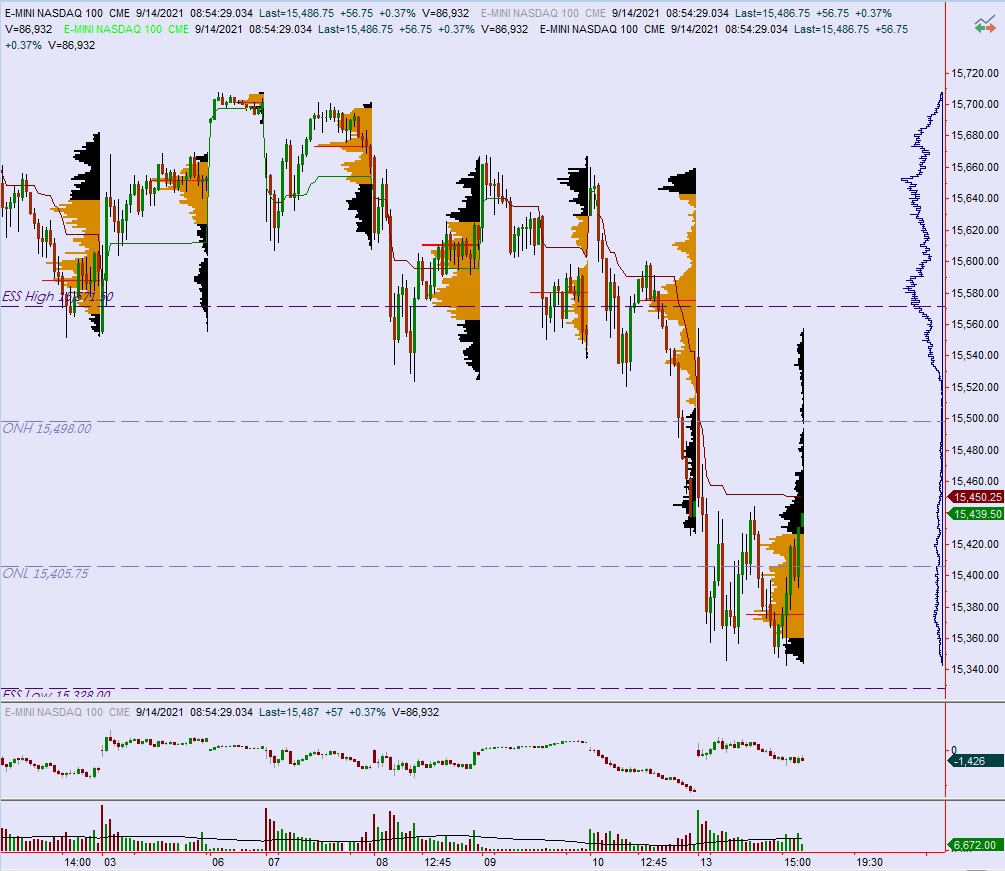

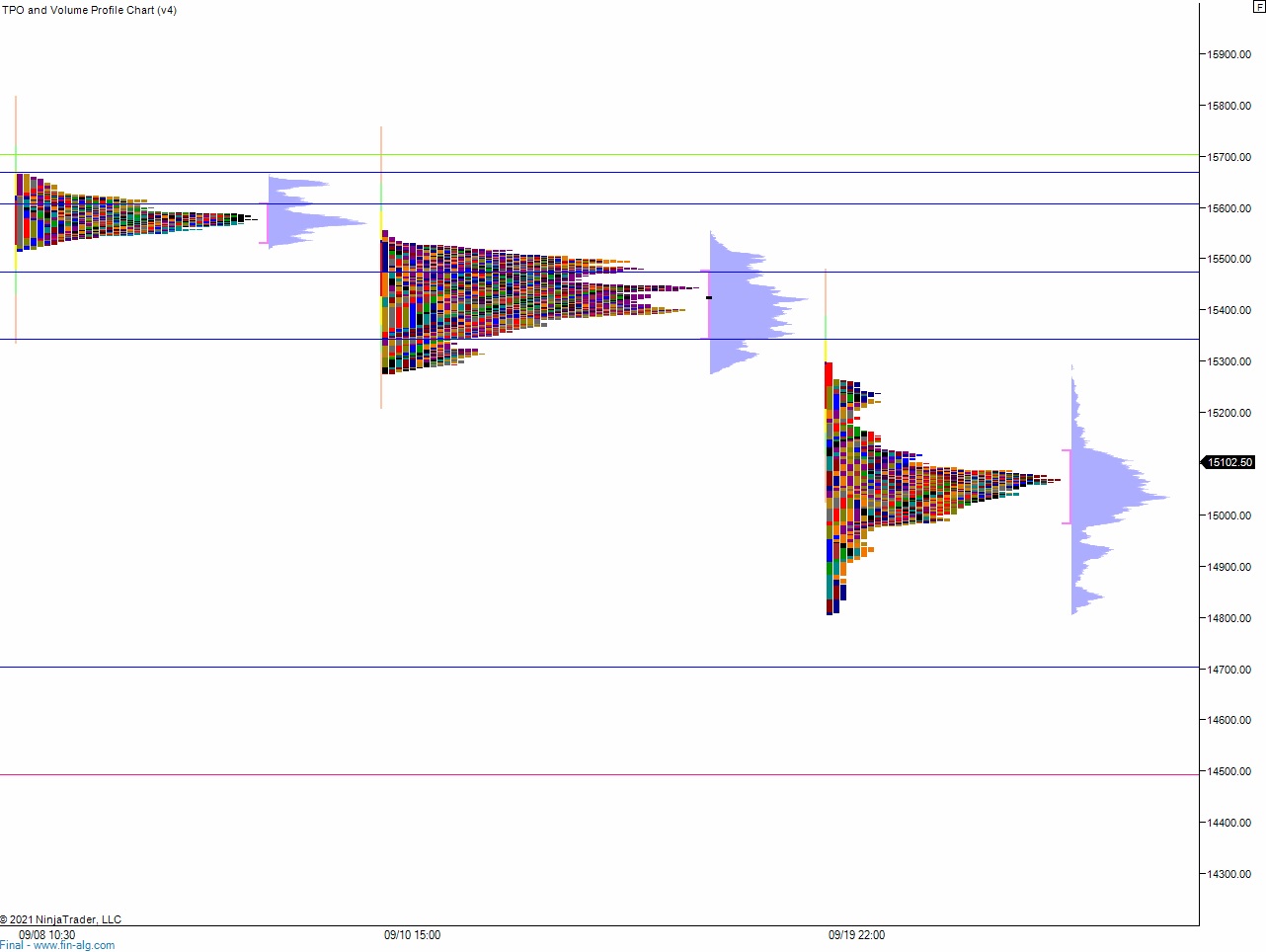

Yesterday we printed a normal variation down. The day began with a gap up in range. After a brief open-two-way auction buyers made a push higher. Said buyers failed to take out the Monday high. Sellers stepped in and closed the overnight gap and into an early range extension down. Responsive buyers were active at the Monday close and worked price back up through the daily mid but could not sustain price above the mid after New York lunch. Buyers made an afternoon attempt at pressing into a neutral print but stalled out before taking out the daily high. Sellers were active during the settlement pushing price back down to the daily low but never exceeding it.

On the whole we printed an inside day.

Heading into today my primary expectation is for buyers to gap and go up through 15,100 on their way to tagging 15,200. Then look for third reaction to the FOMC announcement to dictate direction into the close.

Hypo 2 sellers work into overnight inventory and close the gap down to 14,982 then continue lower taking out overnight low 14,930.50. Look for buyers down at 14,900. Then look for third reaction to the FOMC announcement to dictate direction into the close.

Hypo 3 stronger buyers trade up to 15,302 resolving the weekend gap. Then look for third reaction to the FOMC announcement to dictate direction into the close.

Levels:

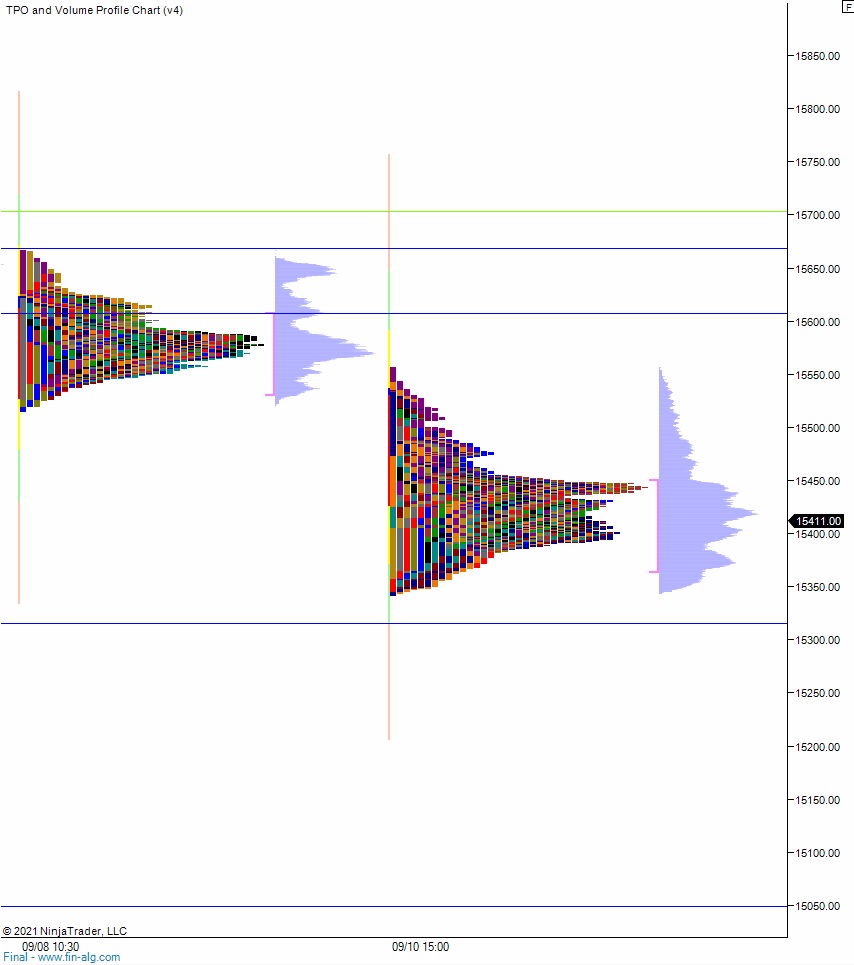

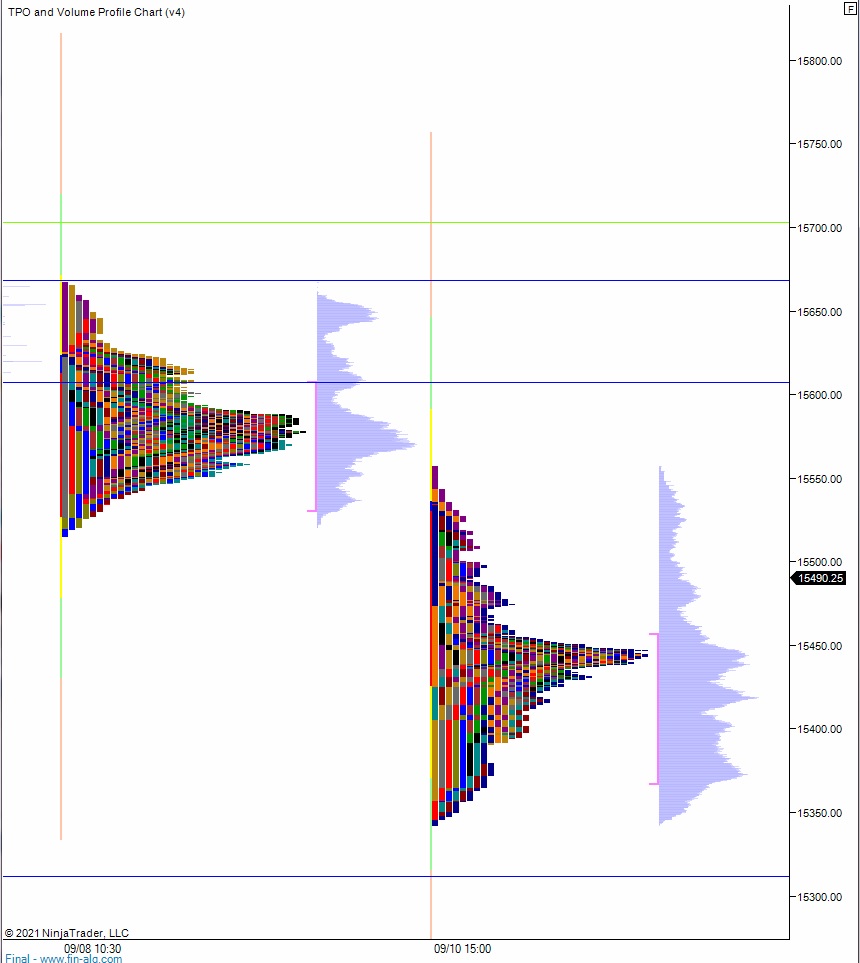

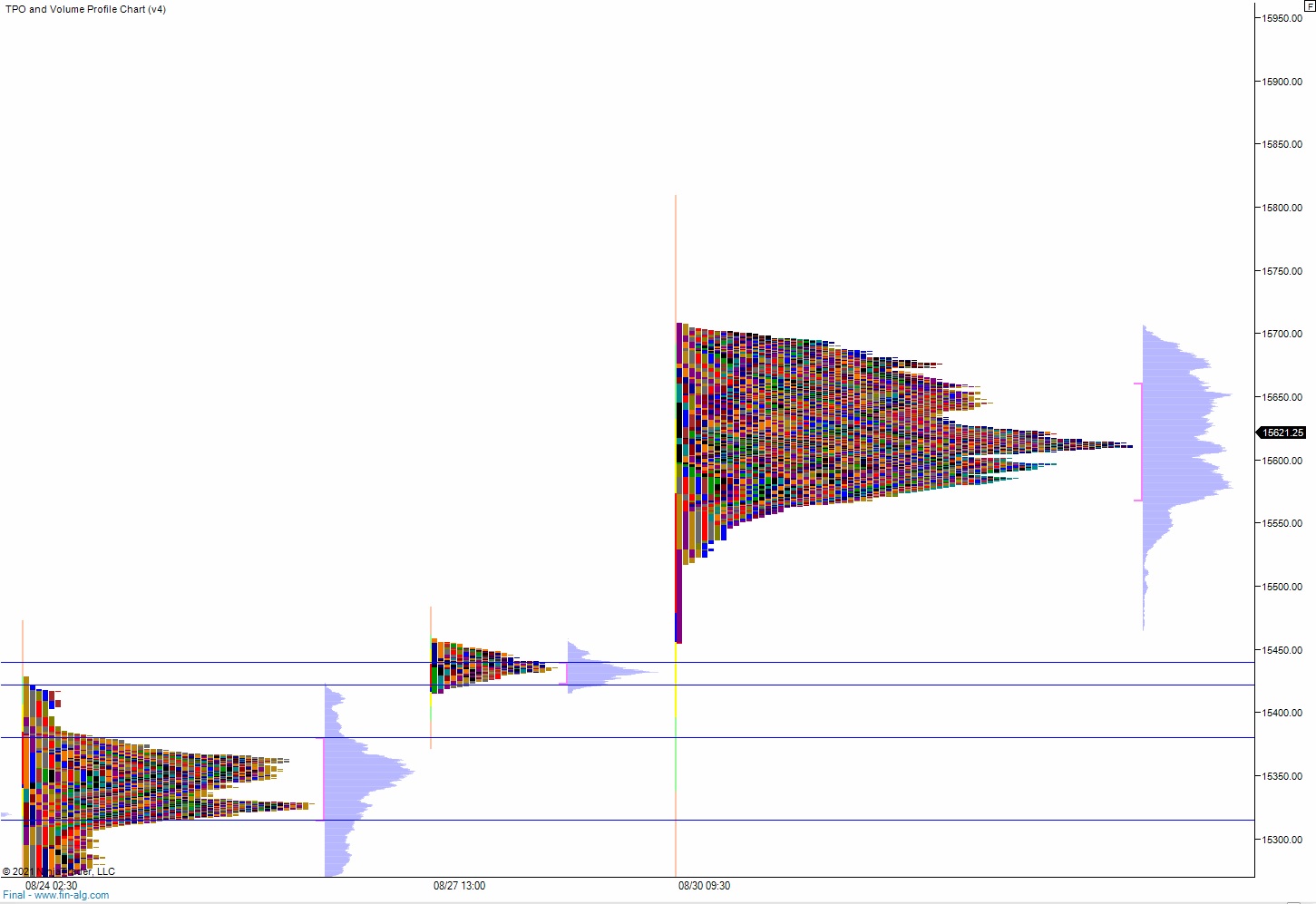

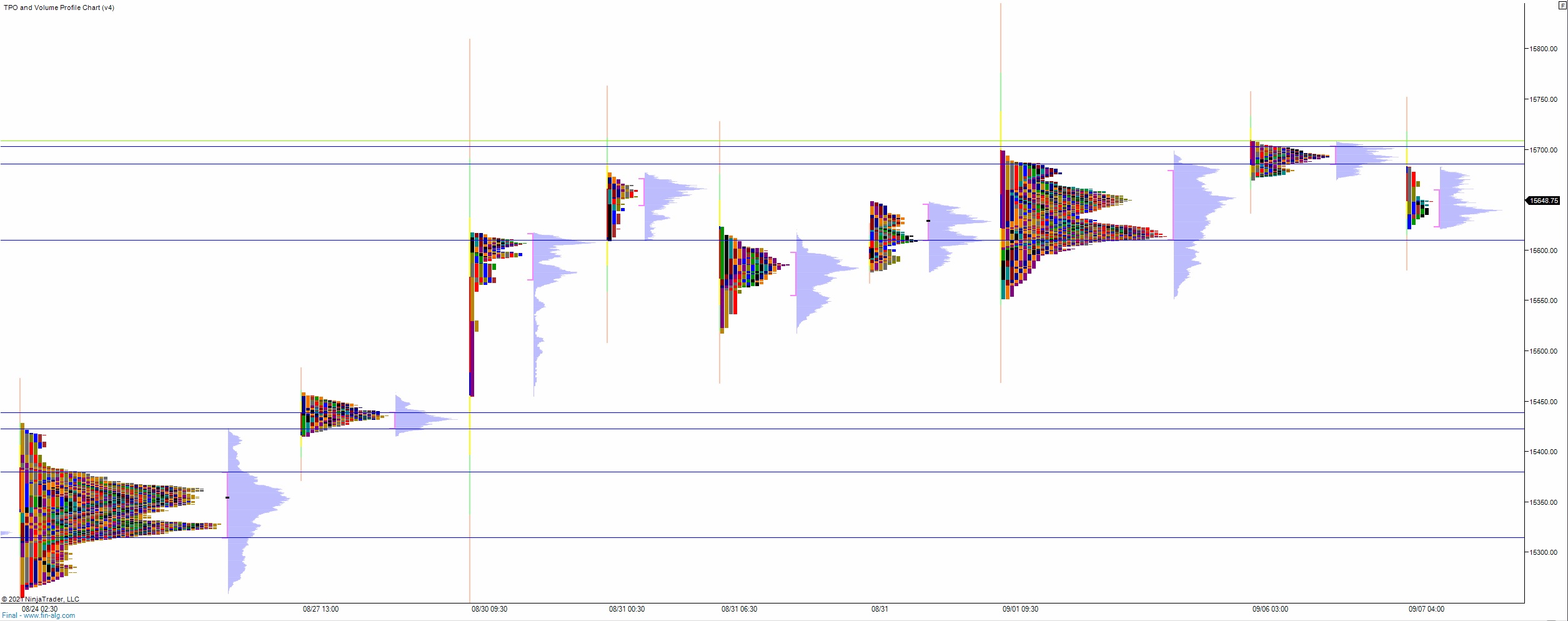

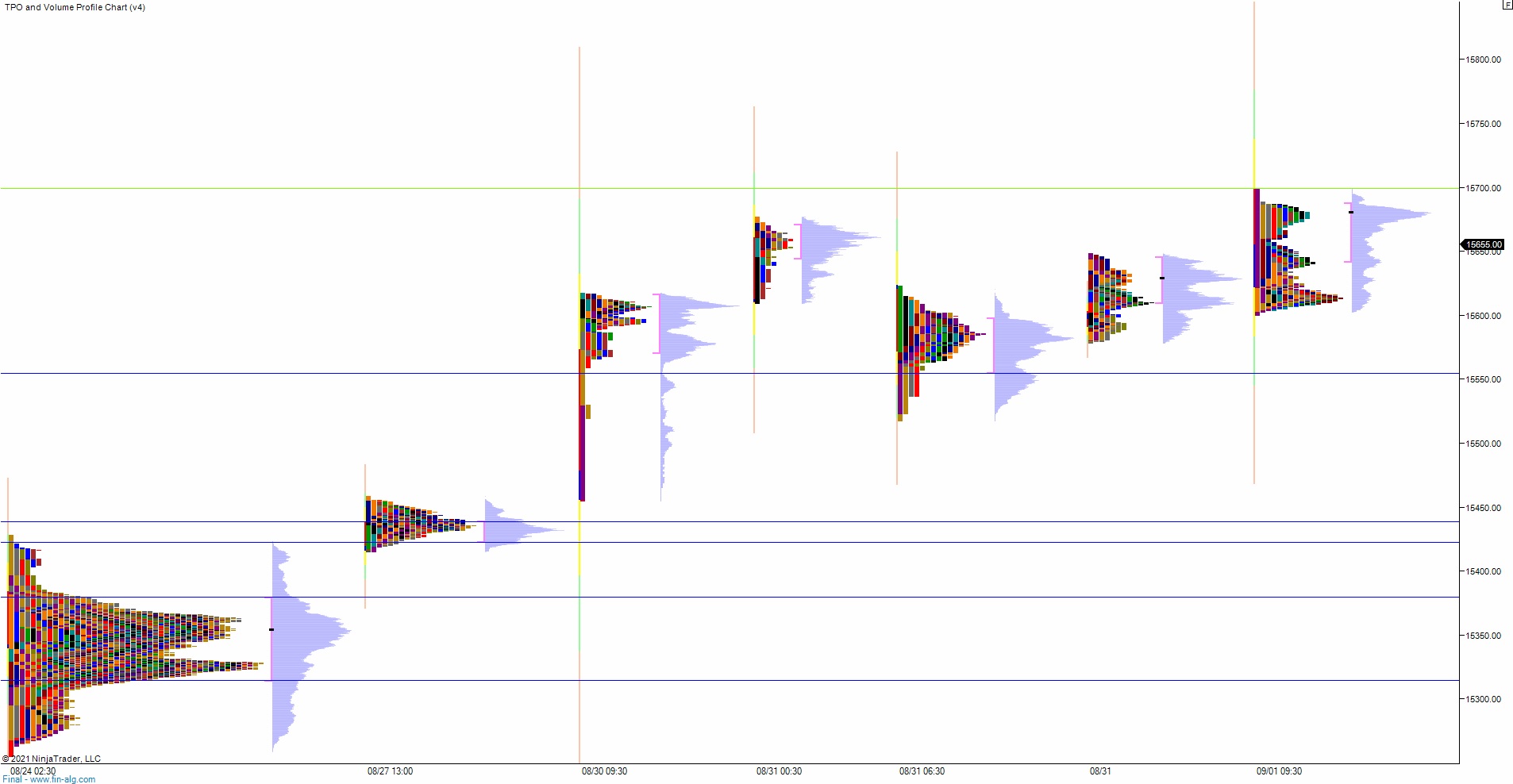

Volume profiles, gaps and measured moves: