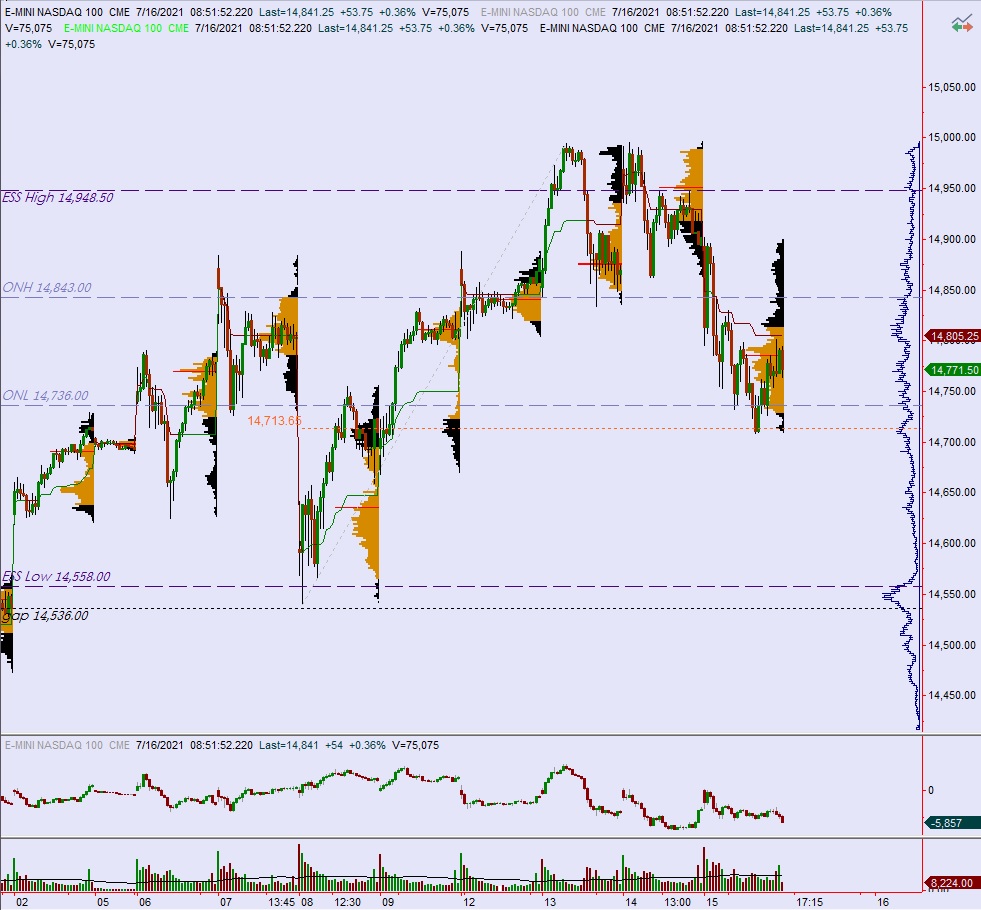

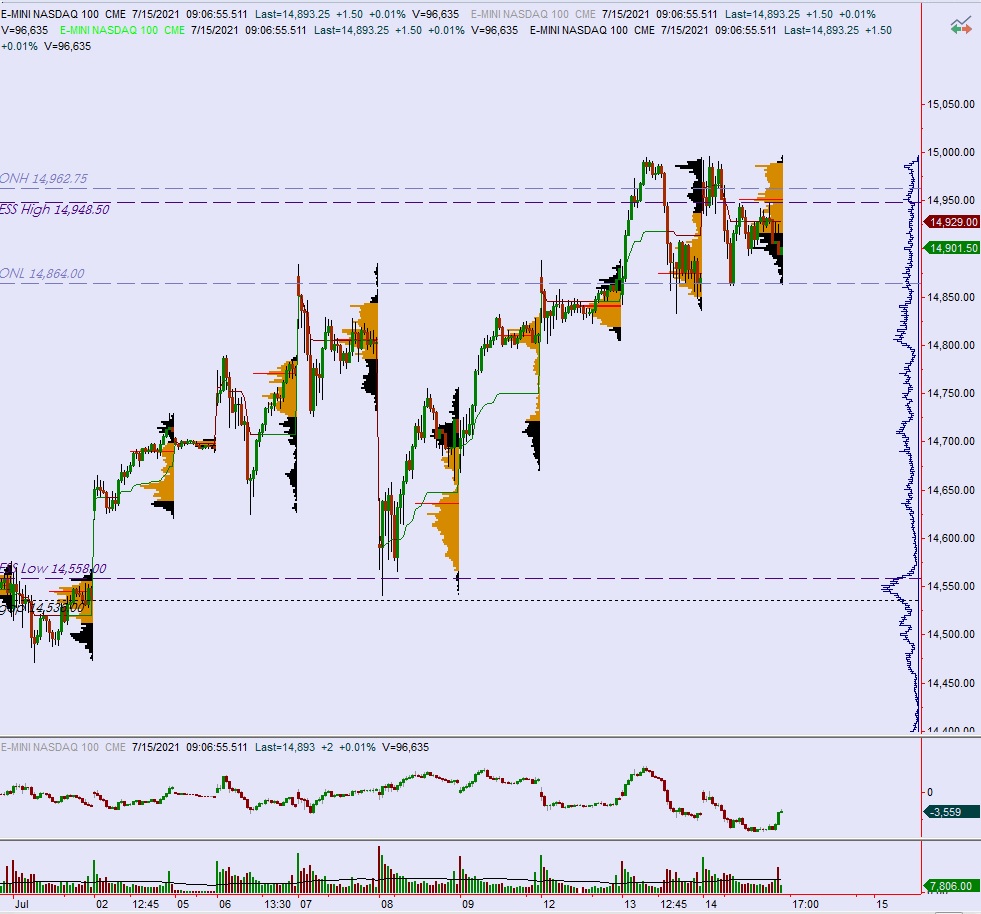

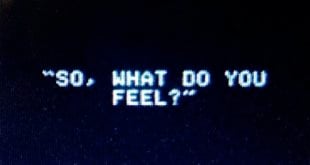

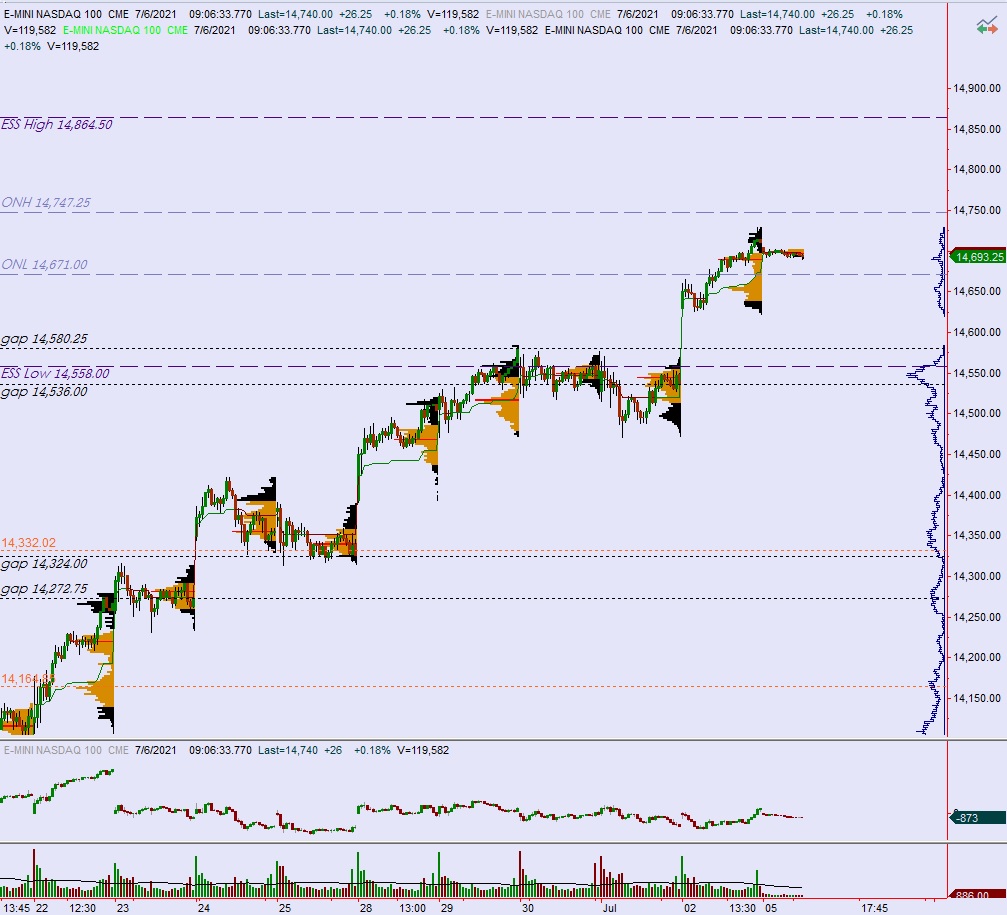

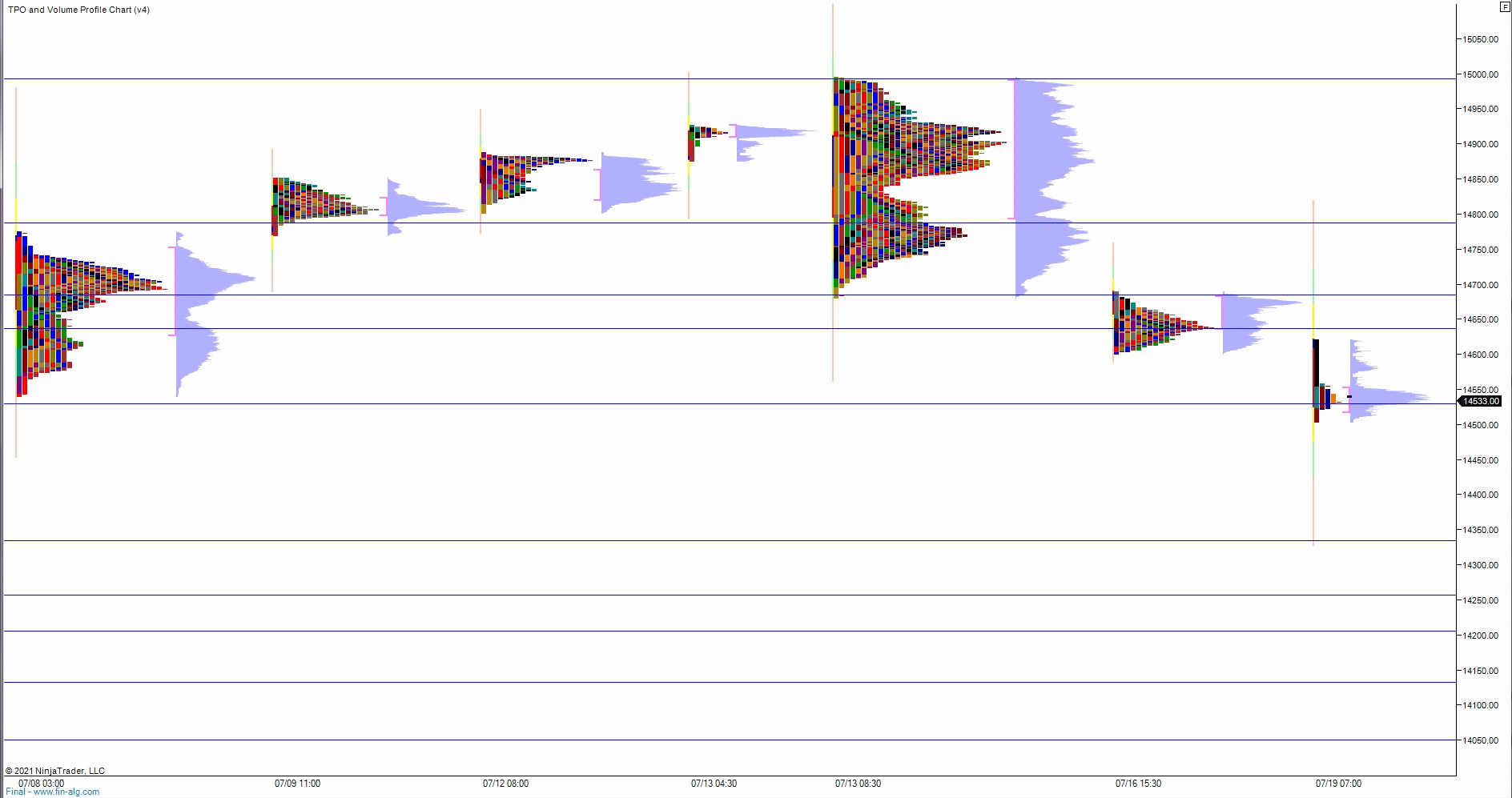

NASDAQ futures are coming into the second-to-last week of July down about -120 after an overnight session featuring extreme range and volume. price was balanced overnight, balancing below last Friday’s low until about 7:10am New York when sellers stepped in and drove price lower. As we approach cash open, price is hanging onto the lower quadrant of the 07/08 range.

On the economic calendar today we have housing market index at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

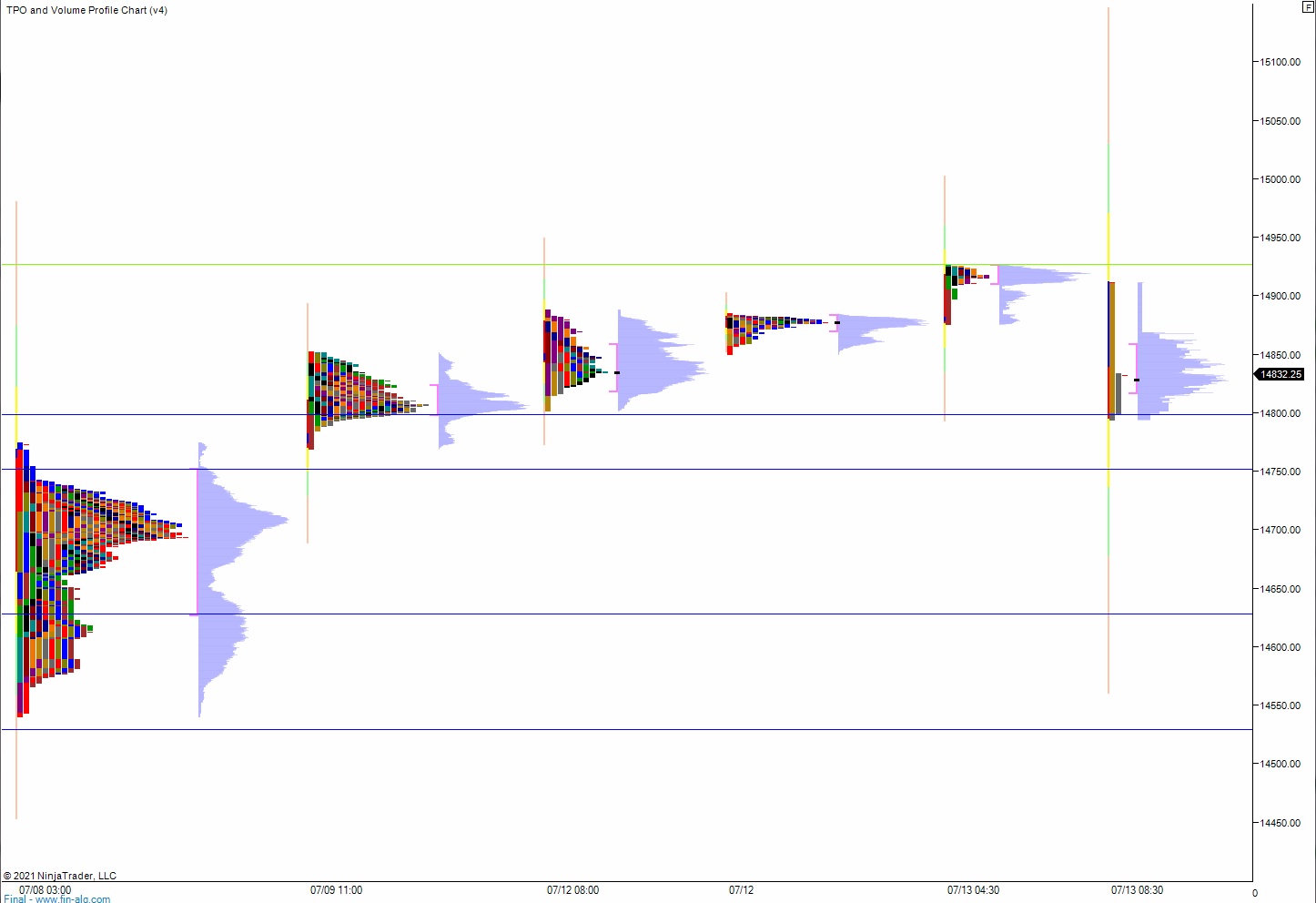

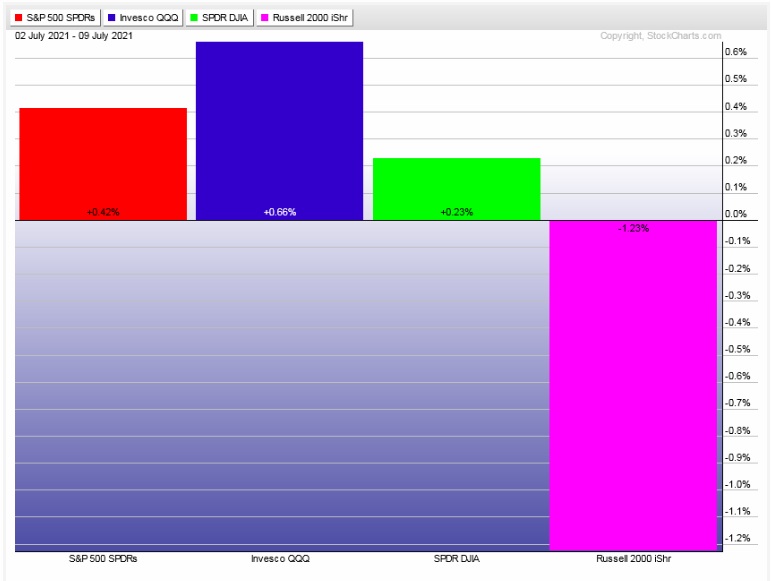

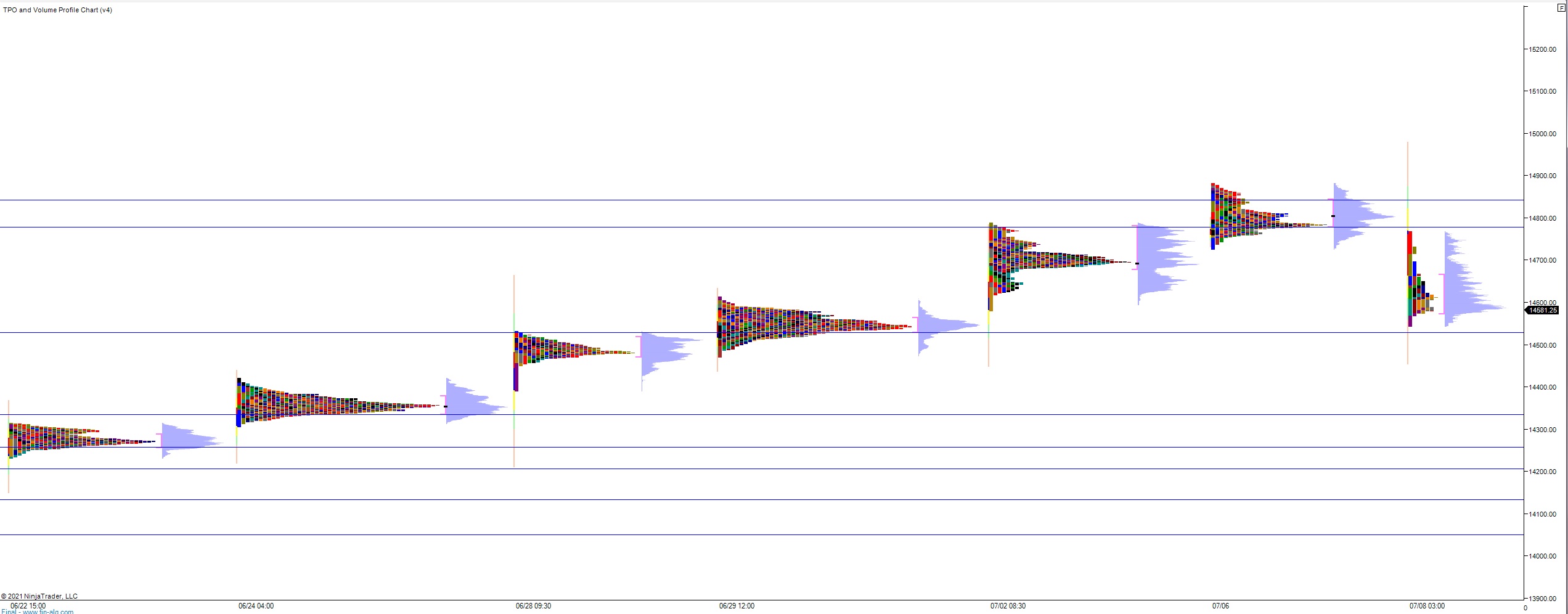

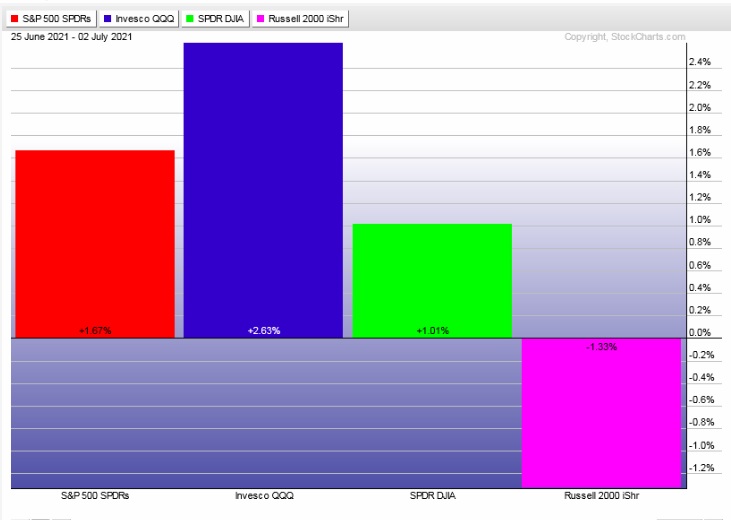

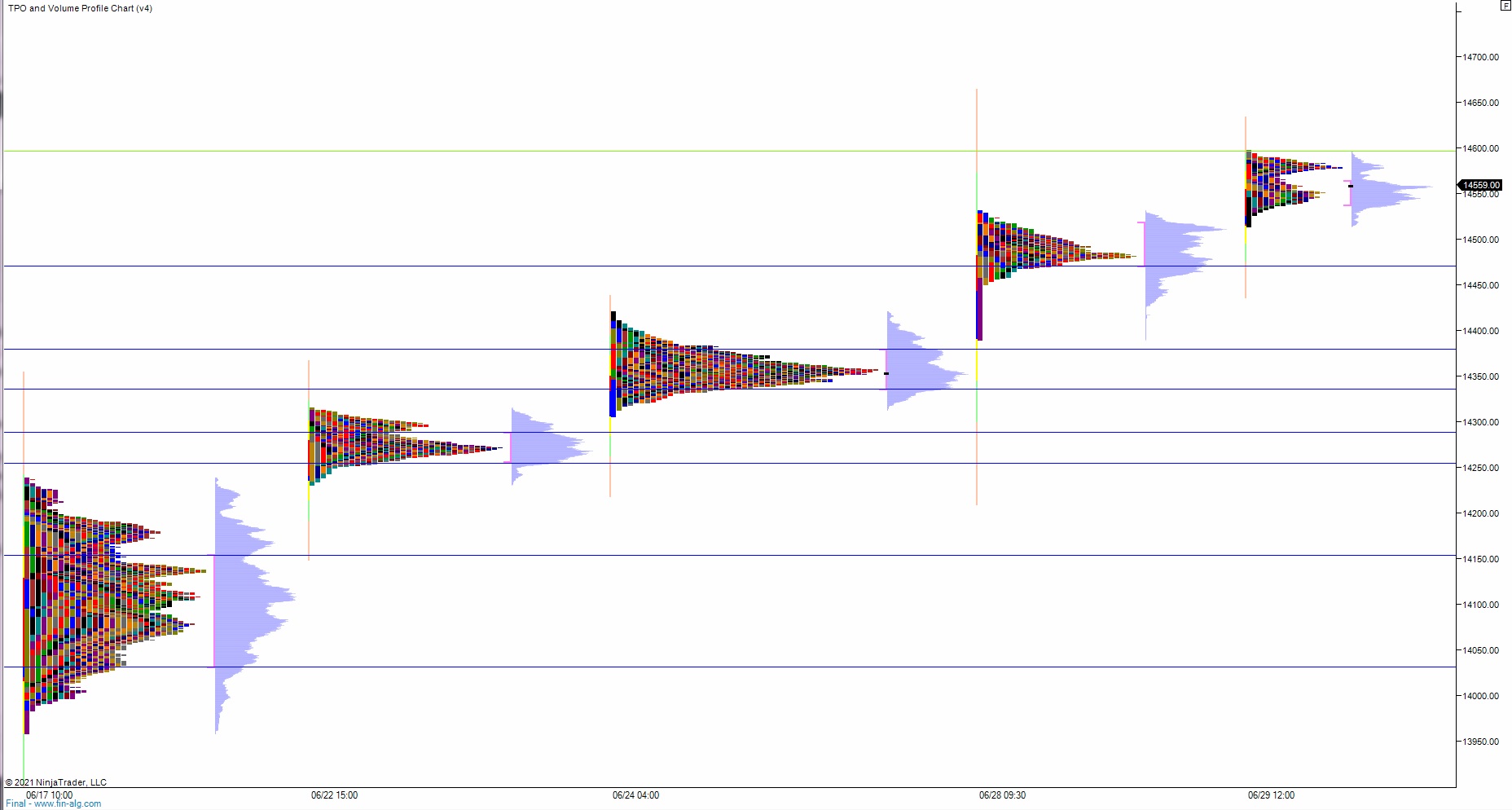

Last week equity markets rallied through Wednesday morning then featured selling pressure for the rest of the week. Russell 2000 was bearish divergent all week long. The last week performance of each major index is shown below:

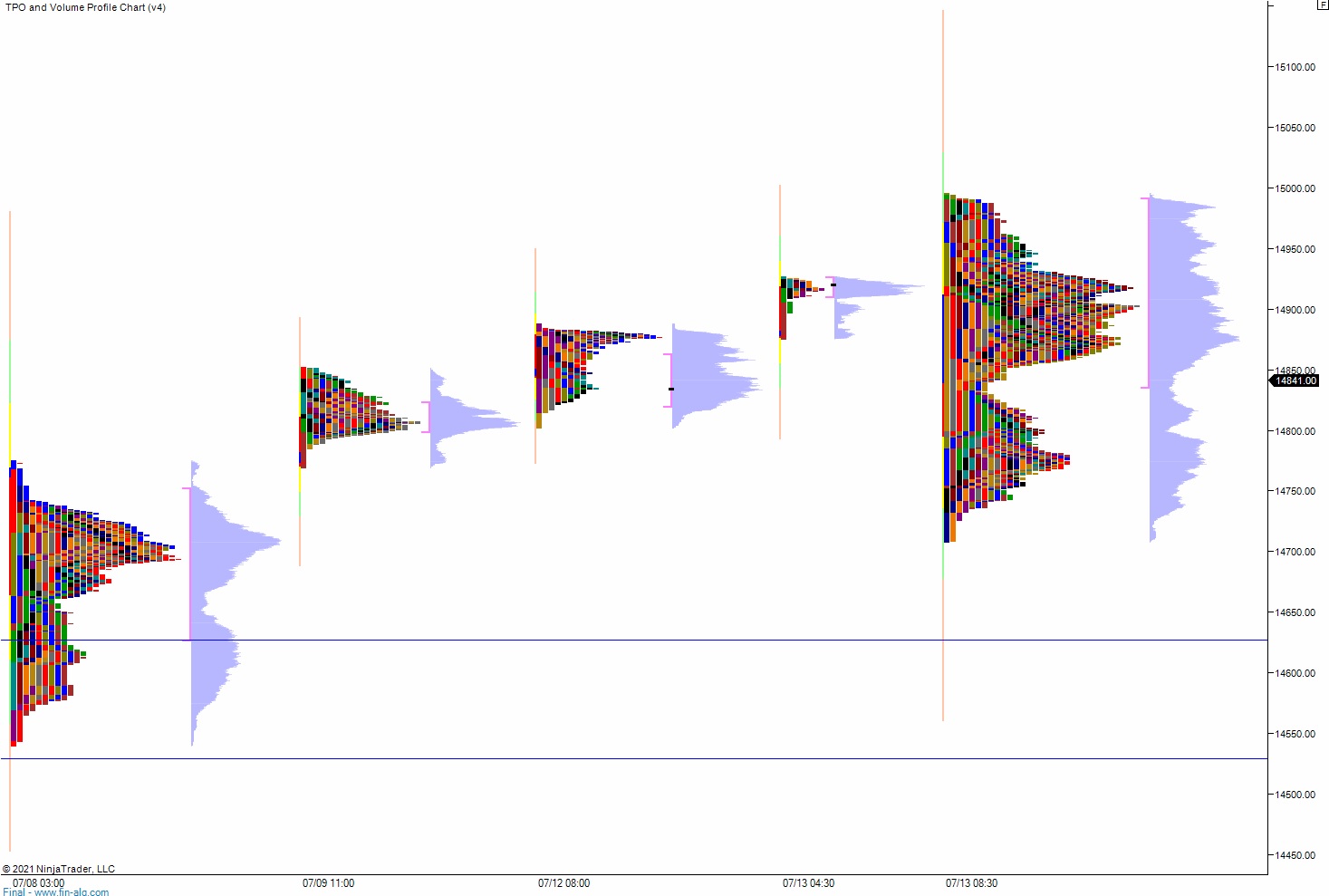

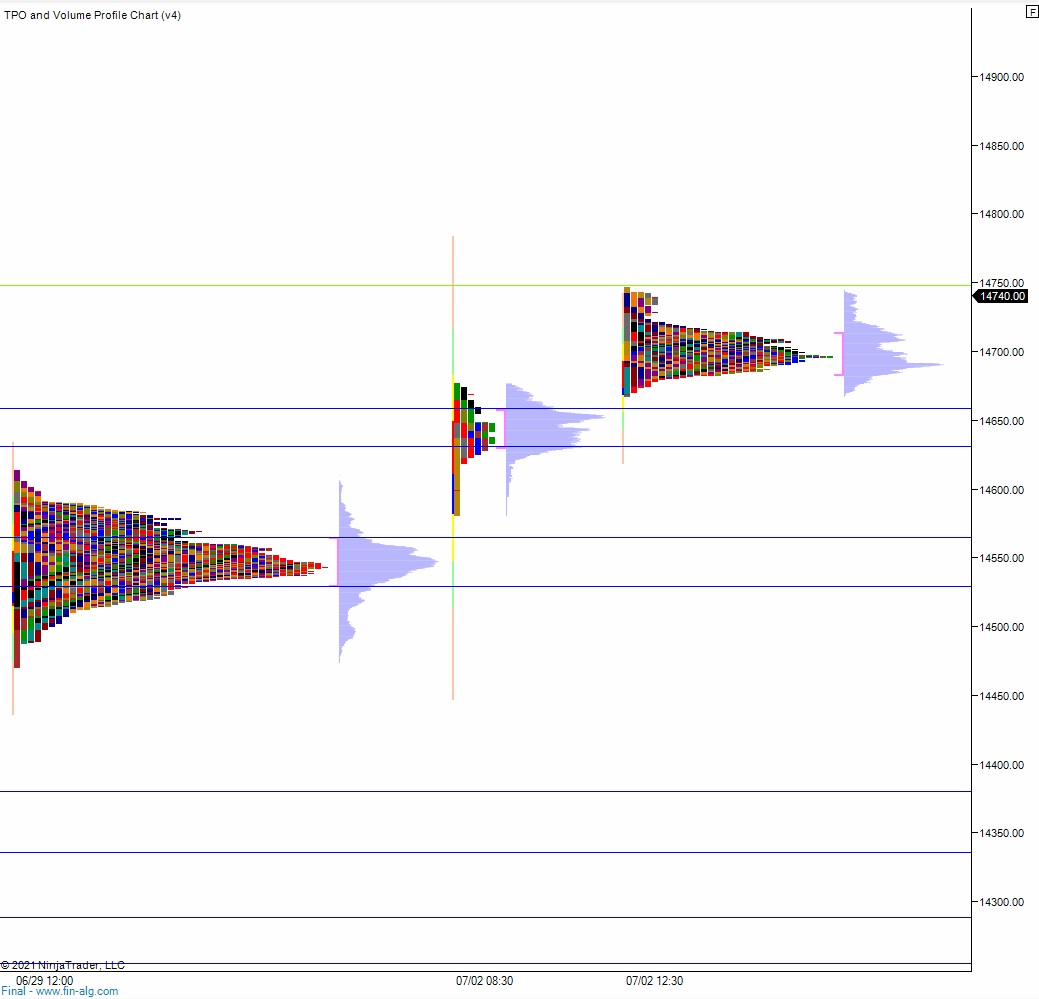

On Friday the NASDAQ printed a double distribution trend down. The day began with a gap up in range. After a brief open-test higher, sellers stepped in and filled the gap then continued their campaign lower, taking out the Thursday low around noon. Just below Thursday low was a strong responsive bid and price rallied back to the daily mid. Sellers were a wall here, defending a setting up a fresh rotation lower which lasted right up into the closing bell. We closed on the lows.

Heading into today my primary expectation is for buyers to work into the overnight inventory and tag 14,600 before choppy two-way trade ensues.

Hypo 2 sellers gap-and-go lower, tagging 14,400. Look for buyers down at 14,334.25.

Hypo 3 stronger buyers work a full gap fill up to 14,667 before two way trade ensues.

Levels:

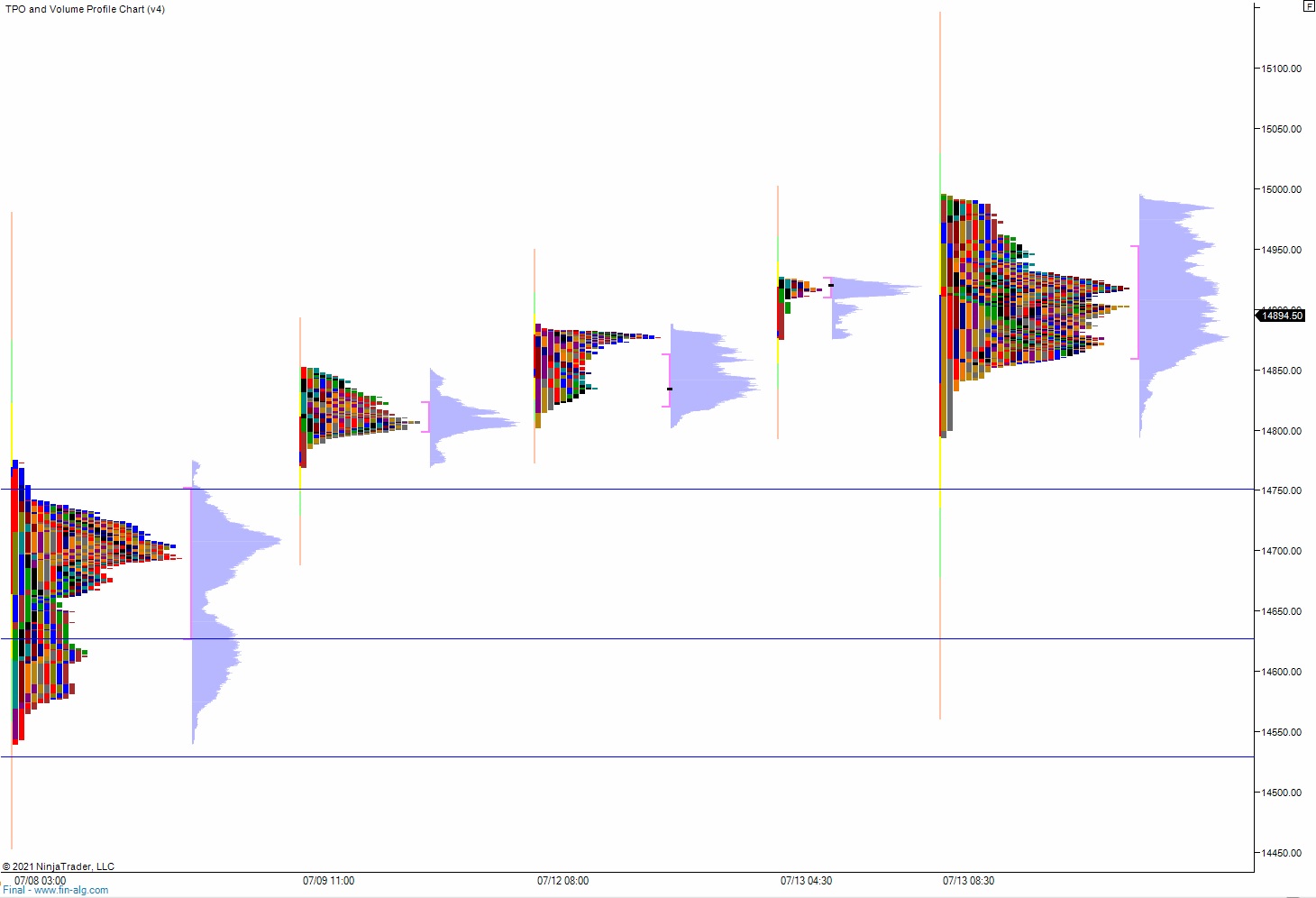

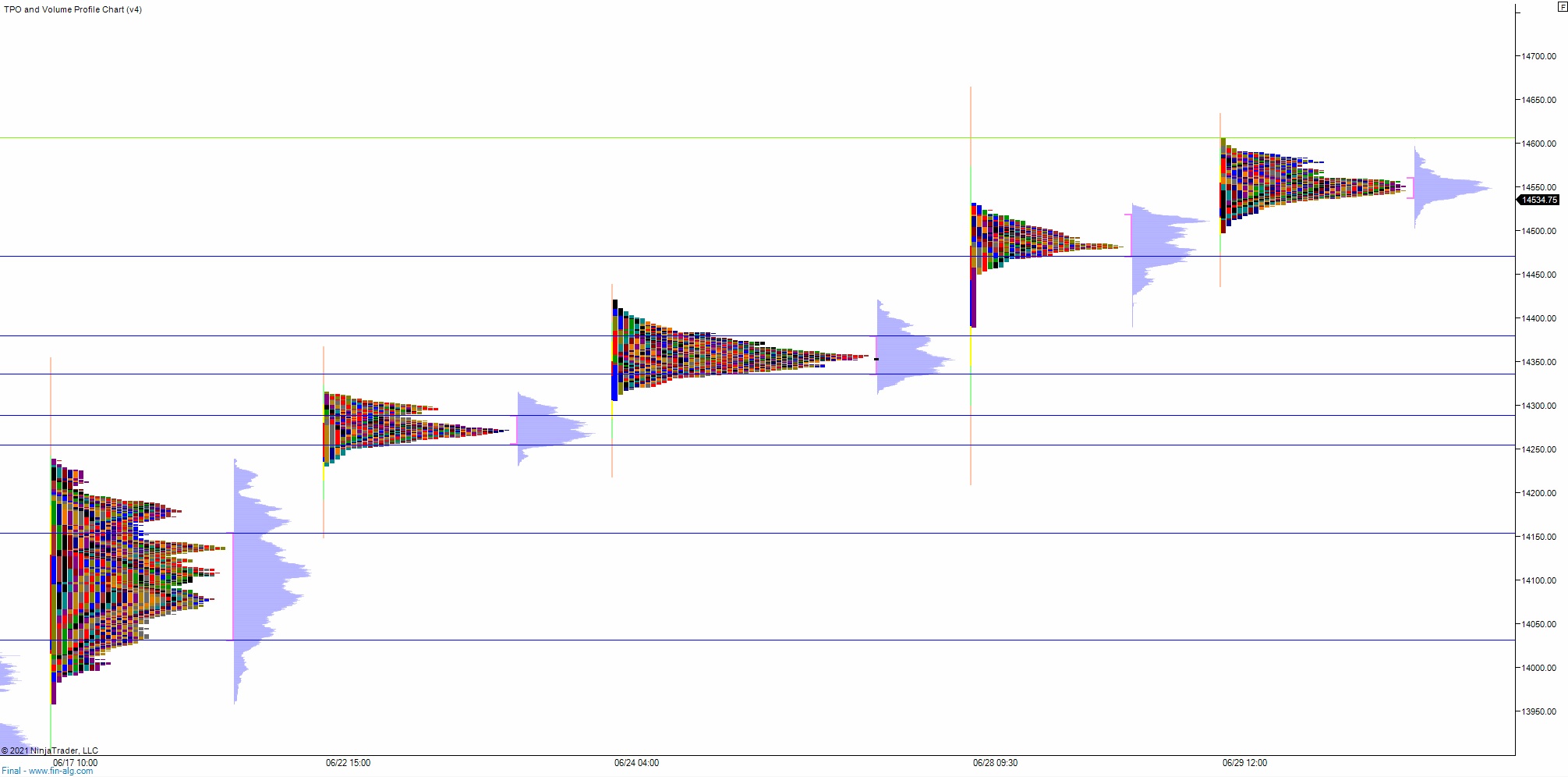

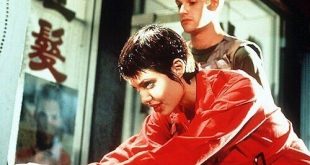

Volume profiles, gaps and measured moves: