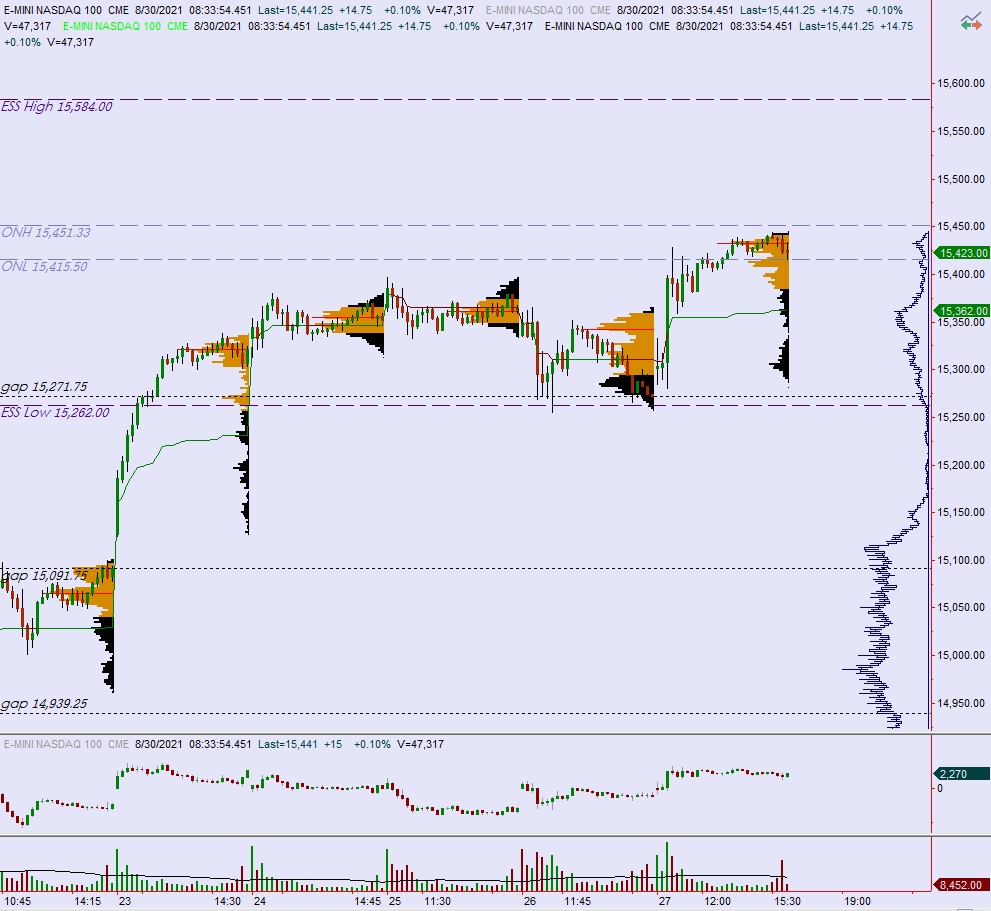

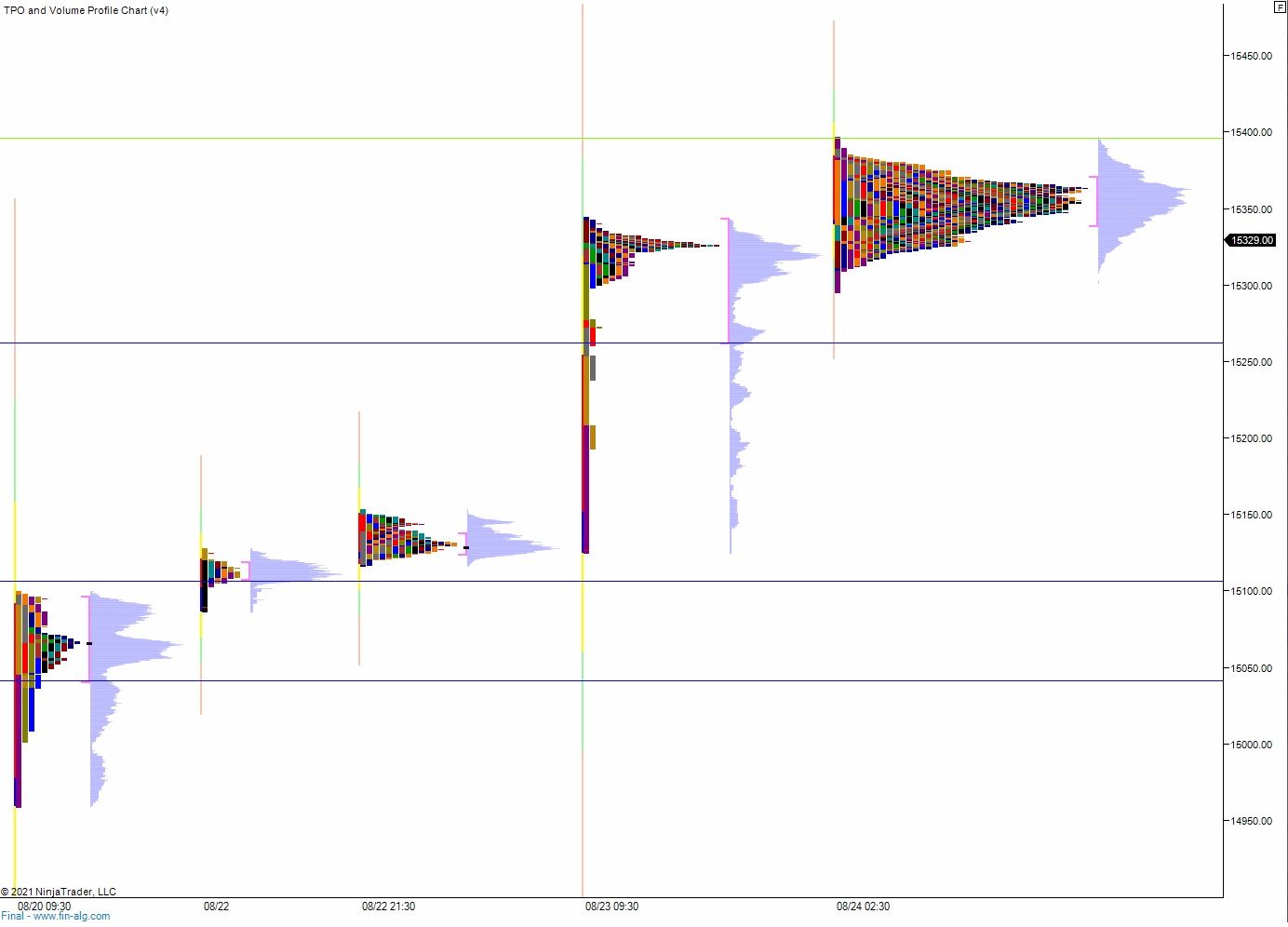

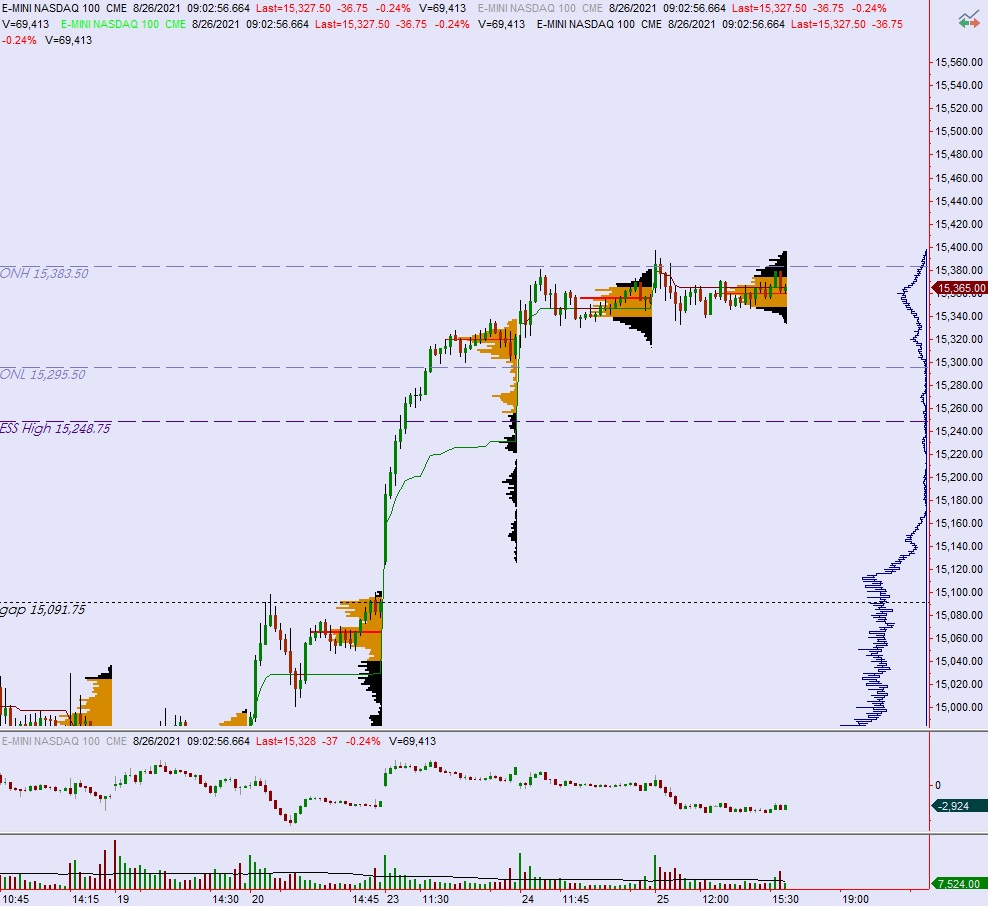

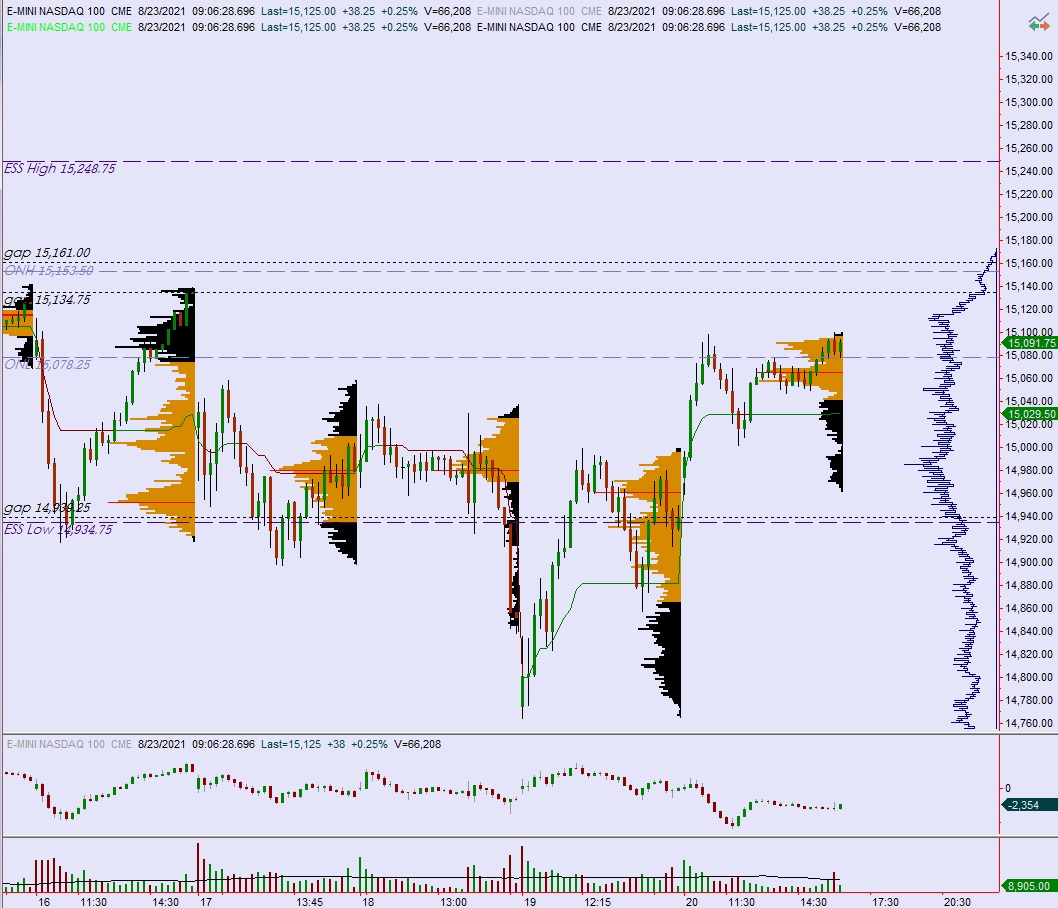

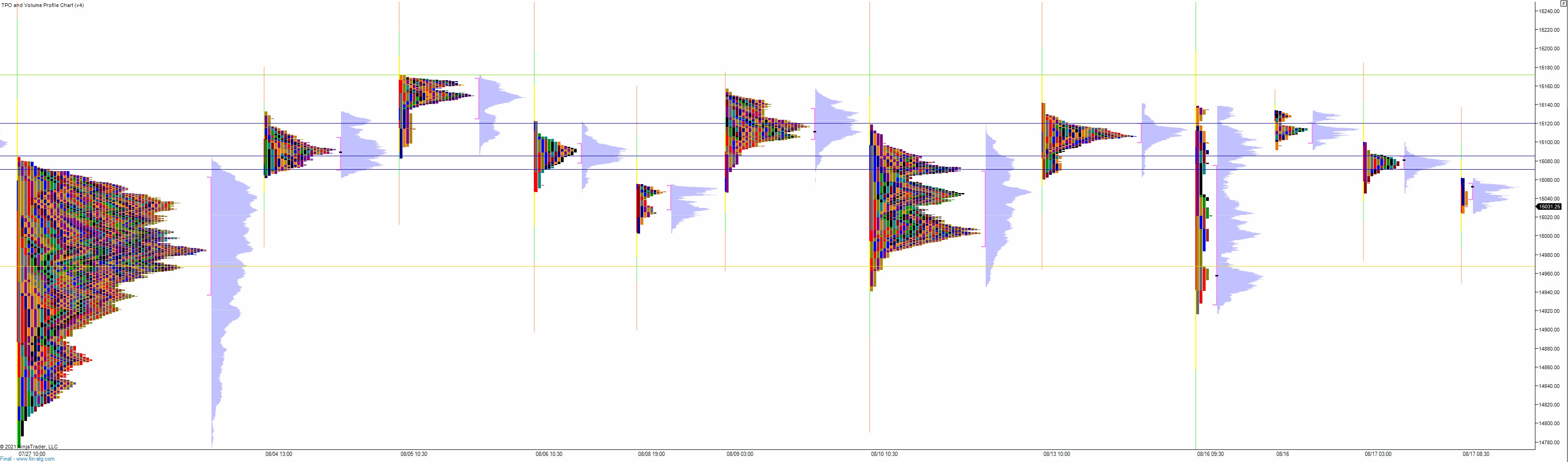

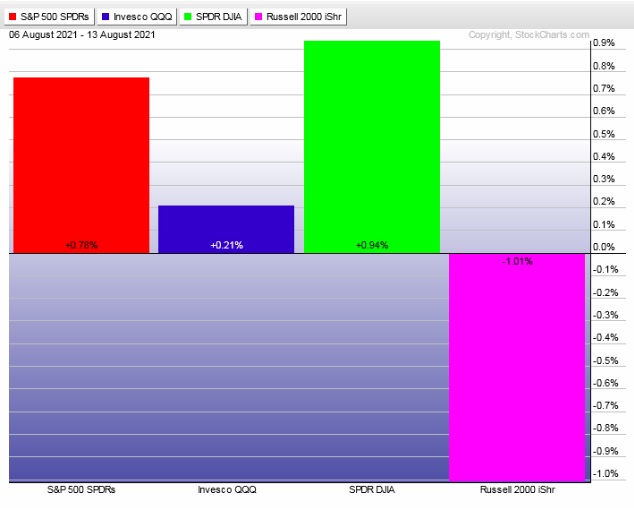

NASDAQ futures are coming into the final day of August with a slight gap down after an overnight session featuring extreme range and volume. Price drove higher overnight until about 5:30am New York, marking a new record high. Since then price has retraced the overnight move, effectively returning inside the Monday range and dipping a bit below the Monday close. As we approach cash open price is hovering in the upper quadrant of Monday’s range.

On the economic calendar today we have consumer confidence at 10am.

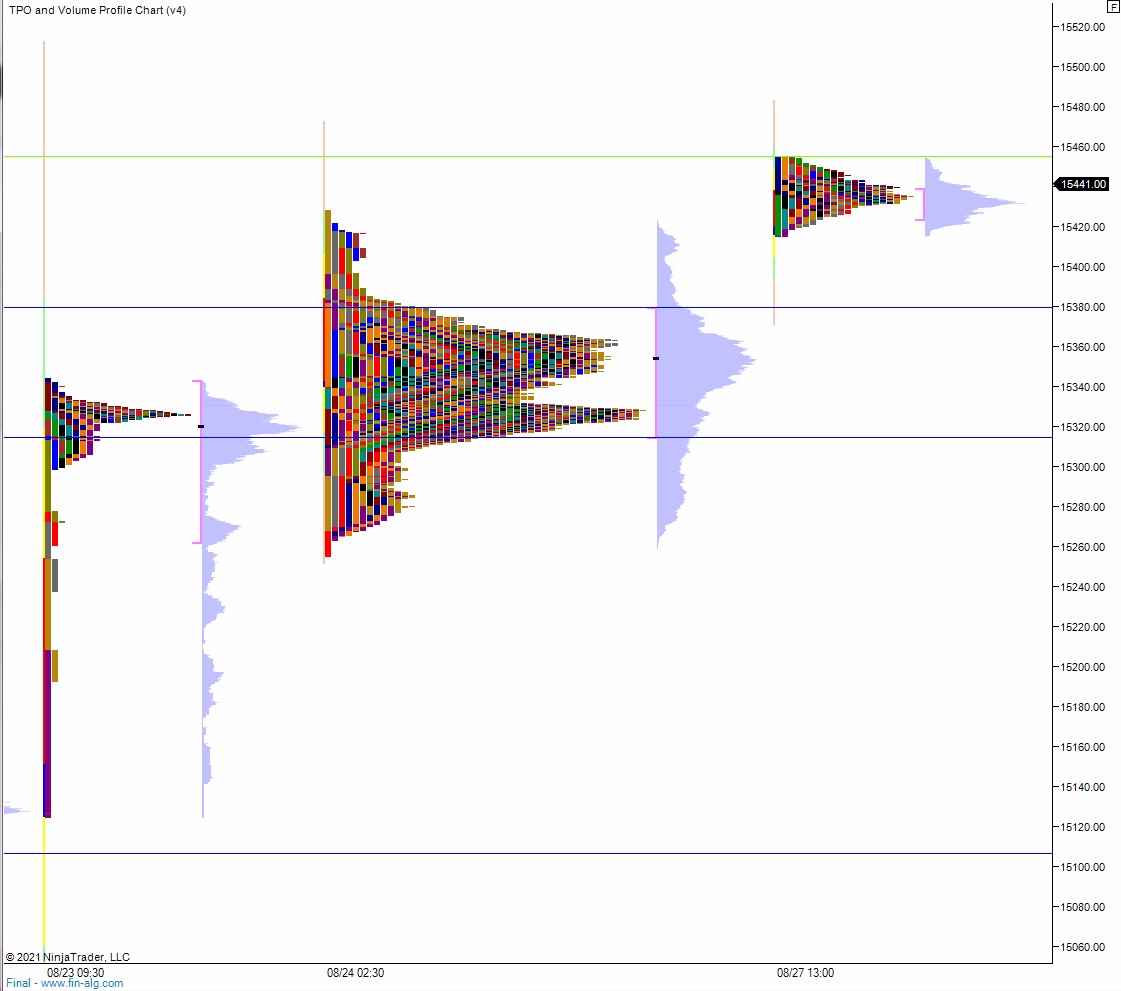

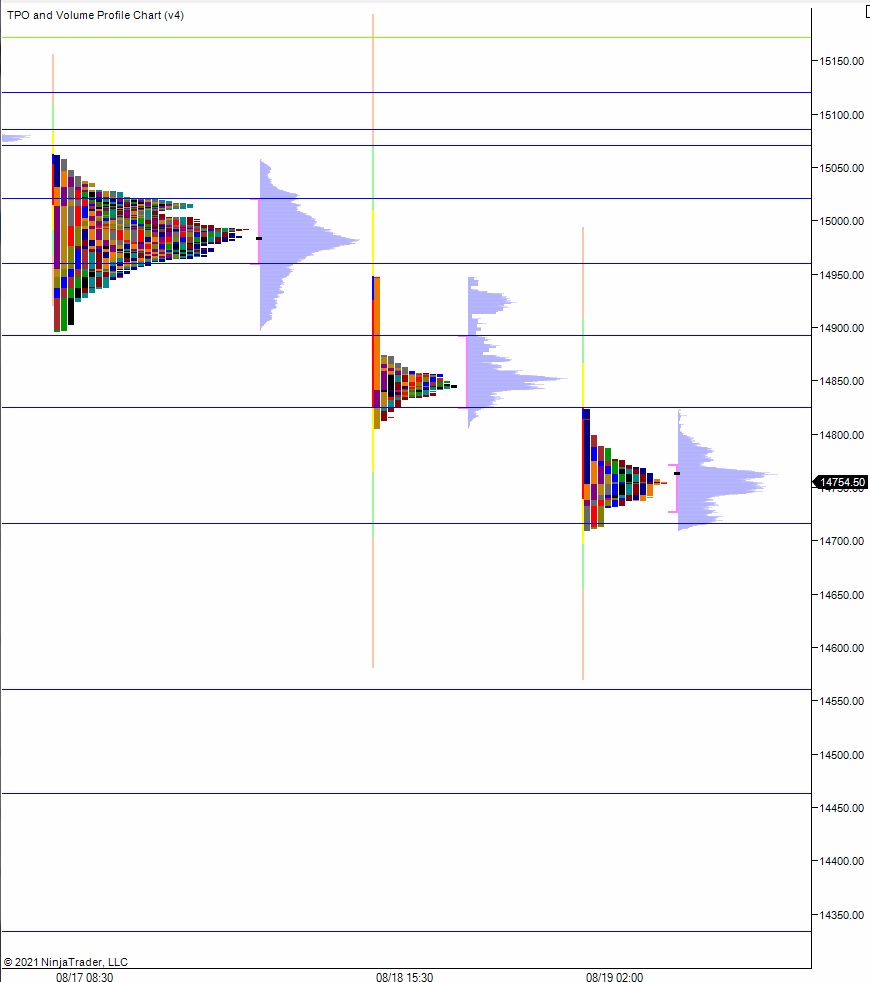

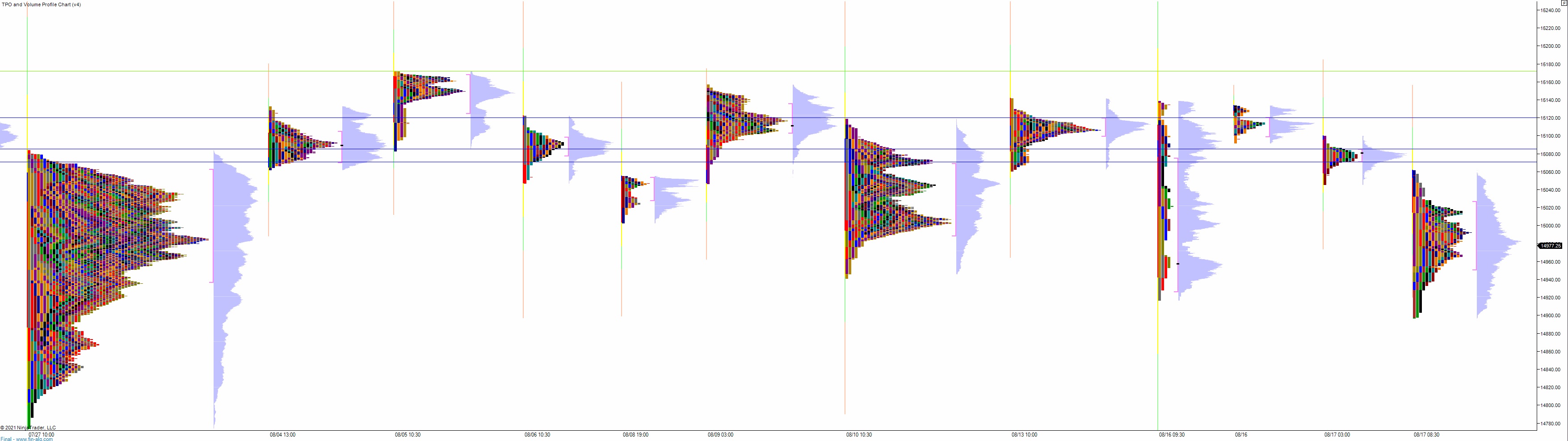

Yesterday we printed a double distribution trend up. The day began with a gap up beyond the Friday range. Buyers drove into the open, campaigning price right up to 15,500. A bit of back-and-forth at the century mark occurred before the campaign continued making new highs, eventually tagging 15,600 and sustaining trade up at this next century mark into the close. This effectively migrated value up to the highs.

Heading into today my primary expectation is for buyers to work up through overnight high 15.677.25 before two way trade ensues.

Hypo 2 sellers hold buyers around 15,605 setting up a move down through overnight low 15,563. Look for buyers just below at 15,550.

Hypo 3 stronger sellers effectively erase much of the Monday rally, trading down to 15,500.

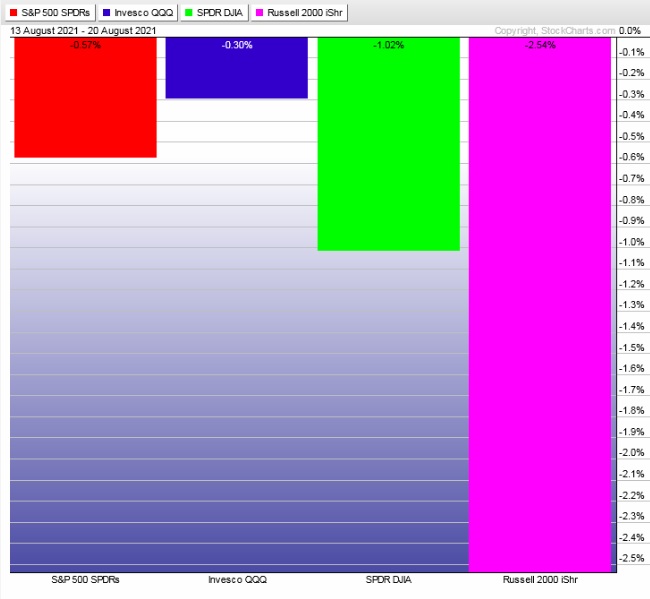

Levels:

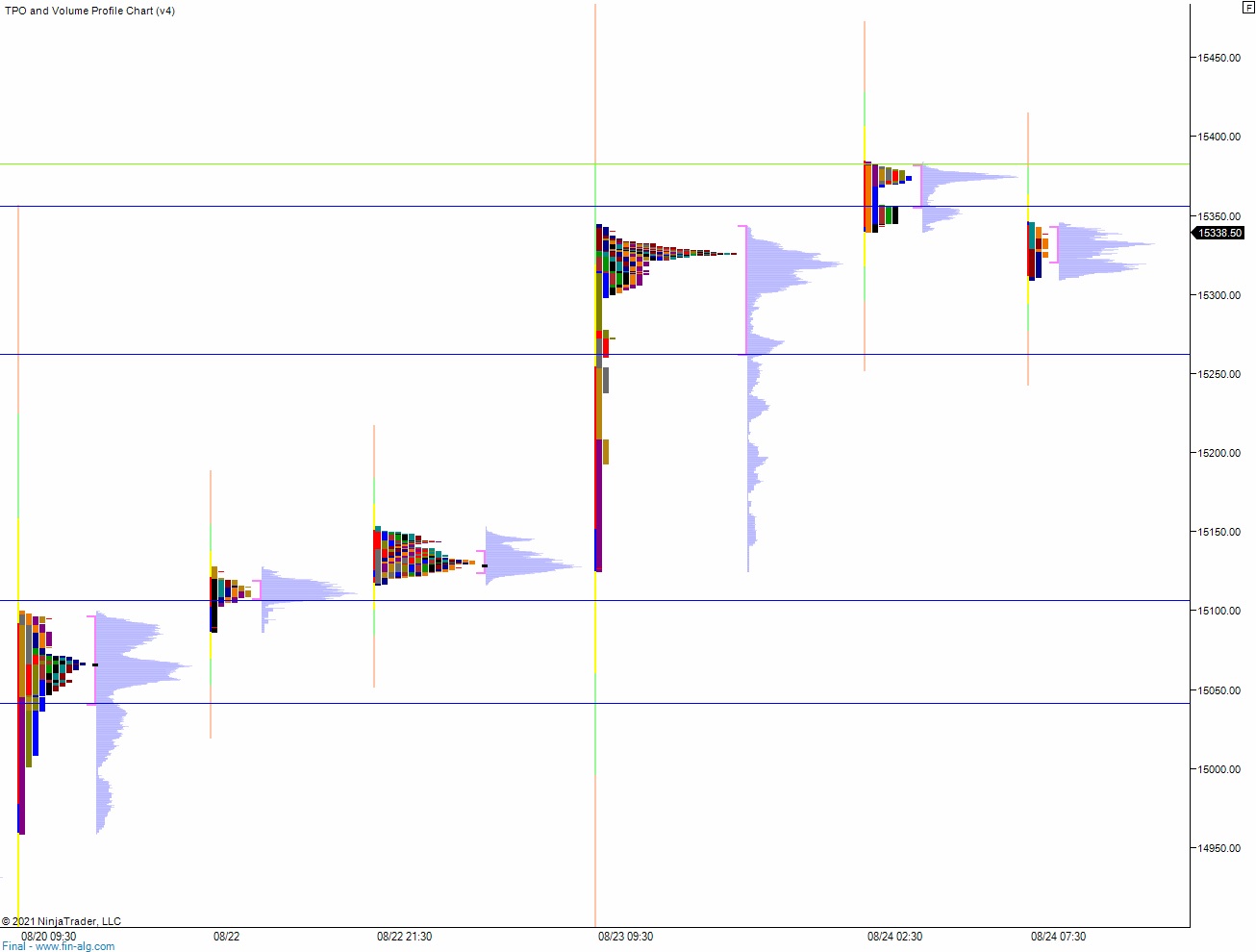

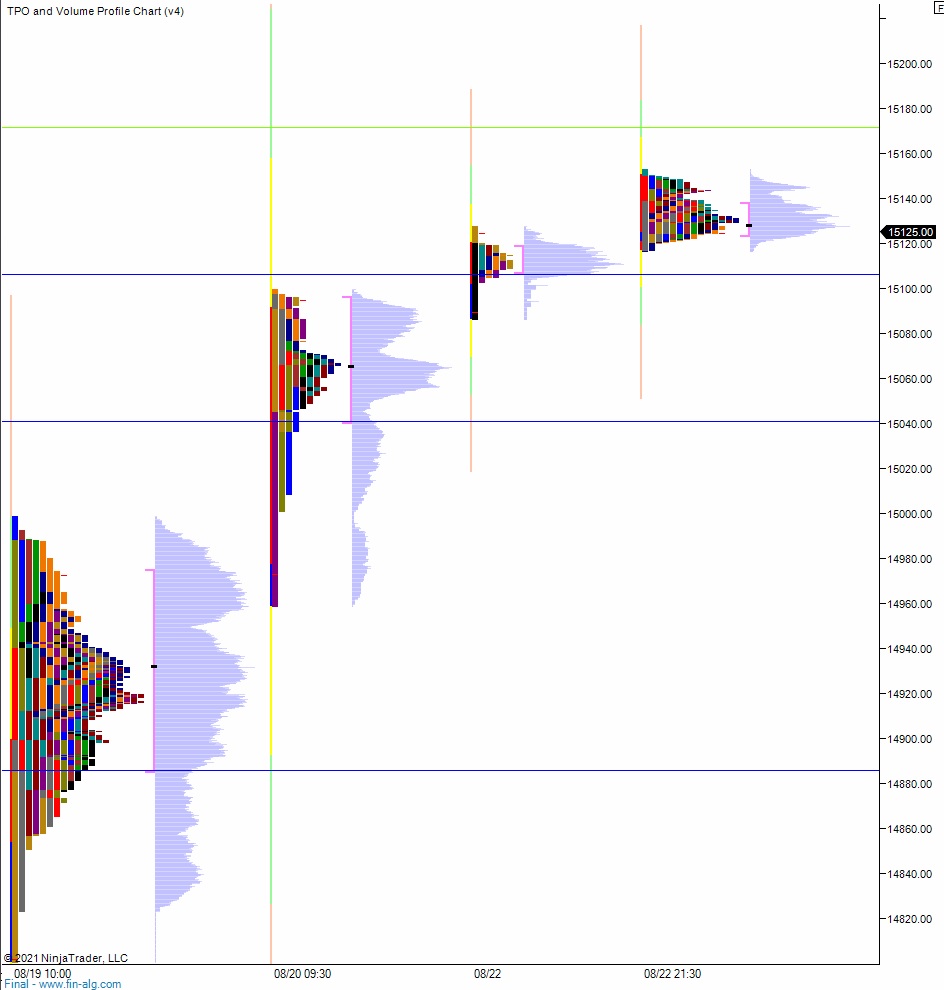

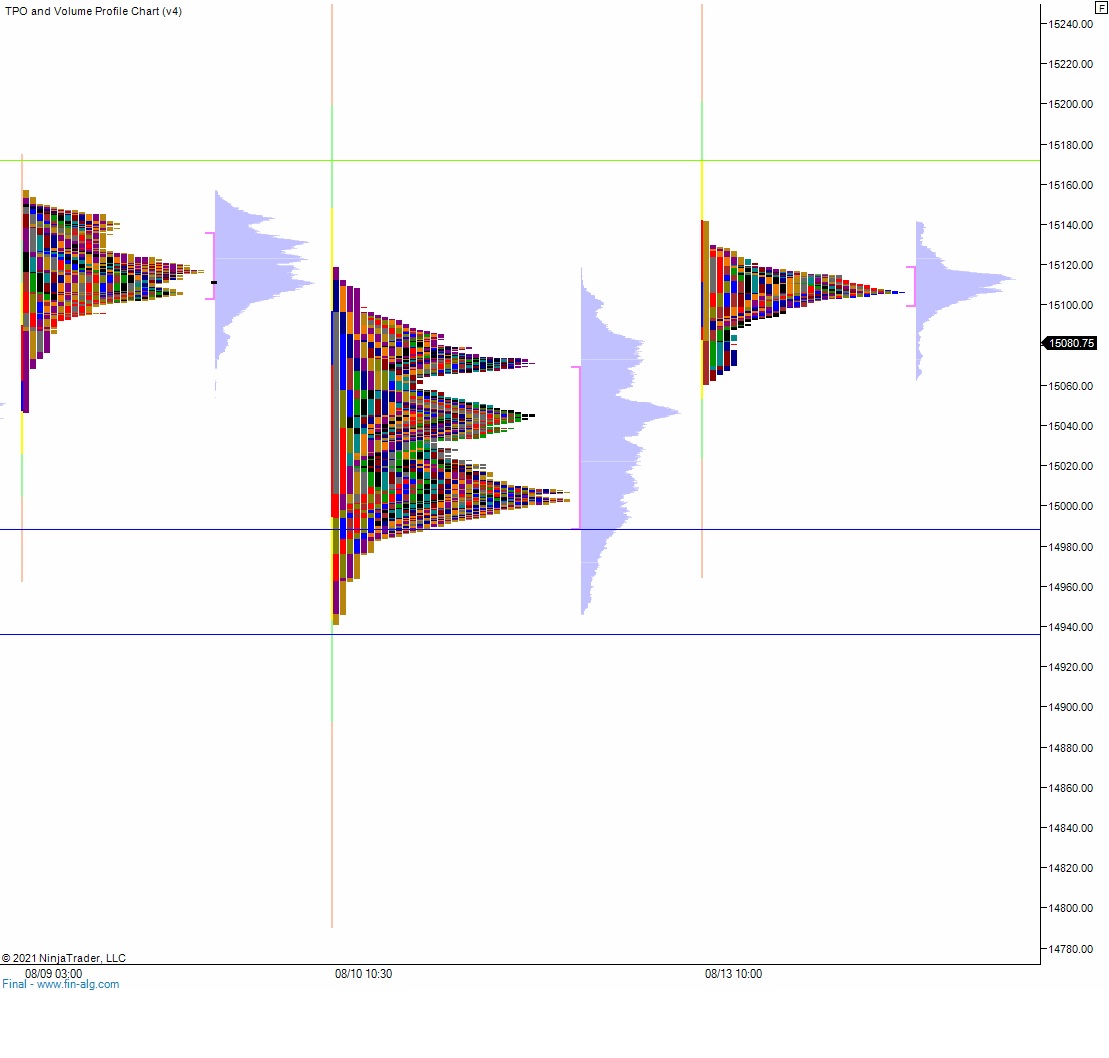

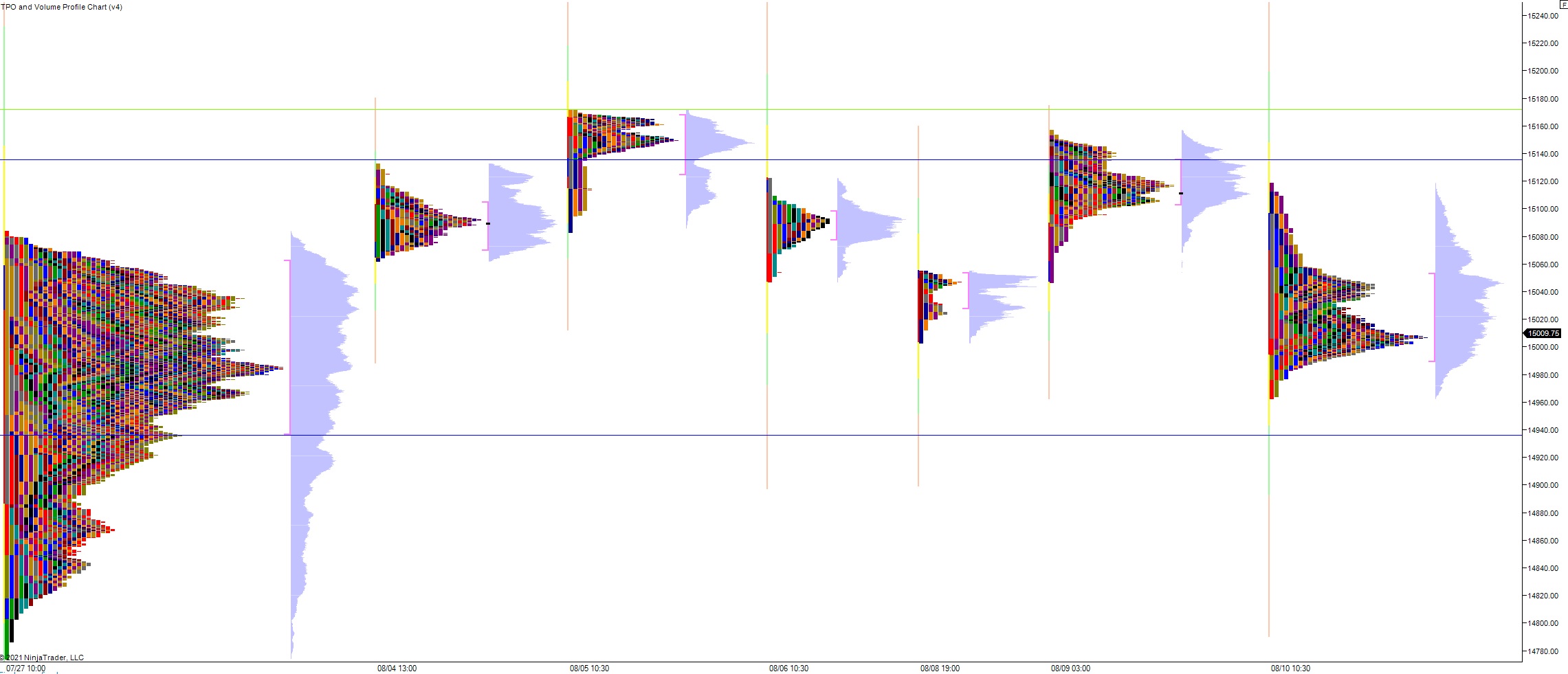

Volume profiles, gaps and measured moves: