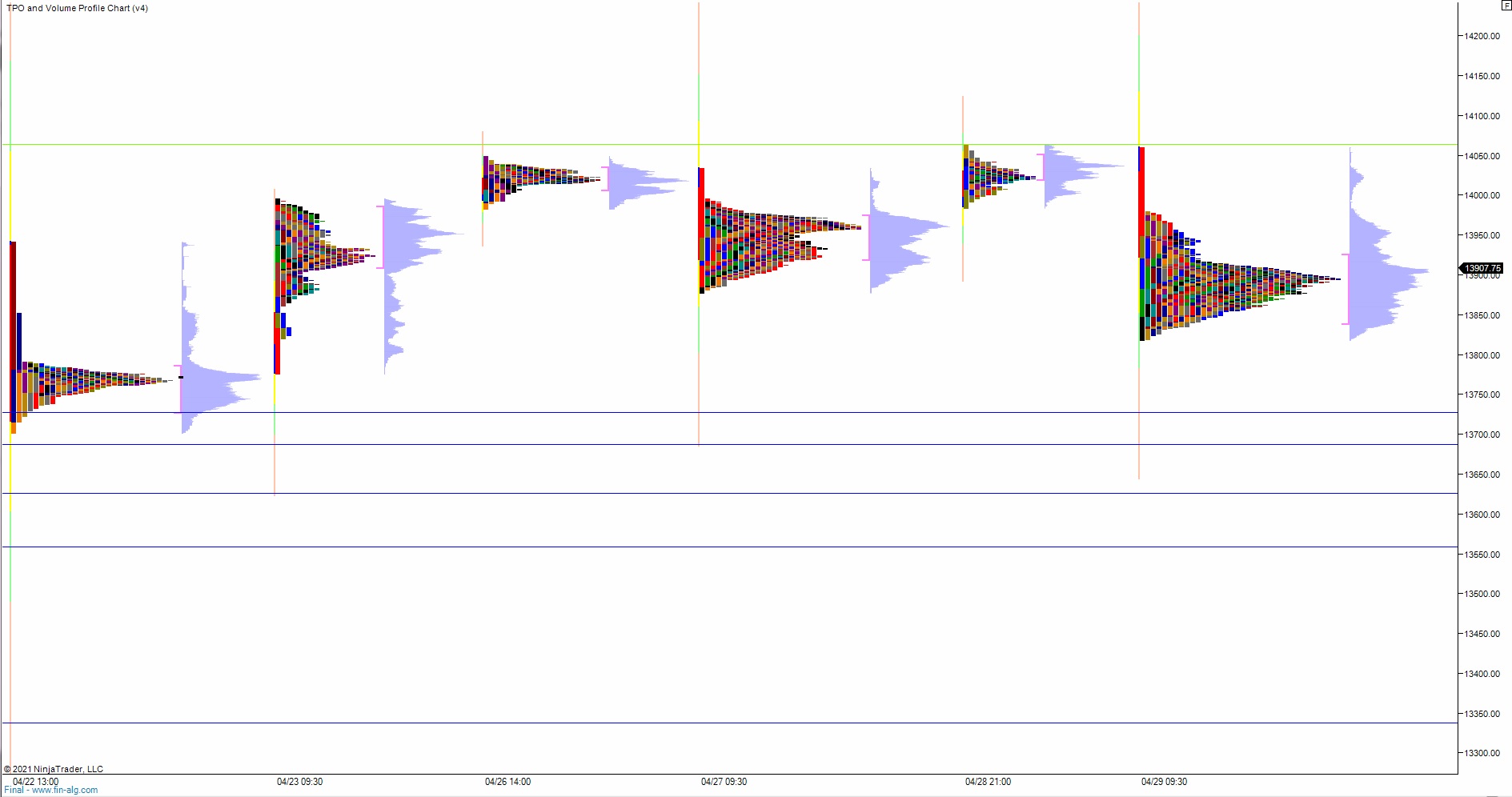

NASDAQ futures are a touch lower heading into option expiration week after an overnight session featuring extreme range and volume. Price was balanced for much of the overnight session, balancing along the upper quadrant of Friday’s range. Then around 7:25am New York price poked a bit lower, and as we approach cash open price is hovering just above last Friday’s midpoint.

On the economic calendar today we have housing market index at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

Also be aware the largest U.S. employer in 39 states (Walmart) is set to report earnings Tuesday before the bell.

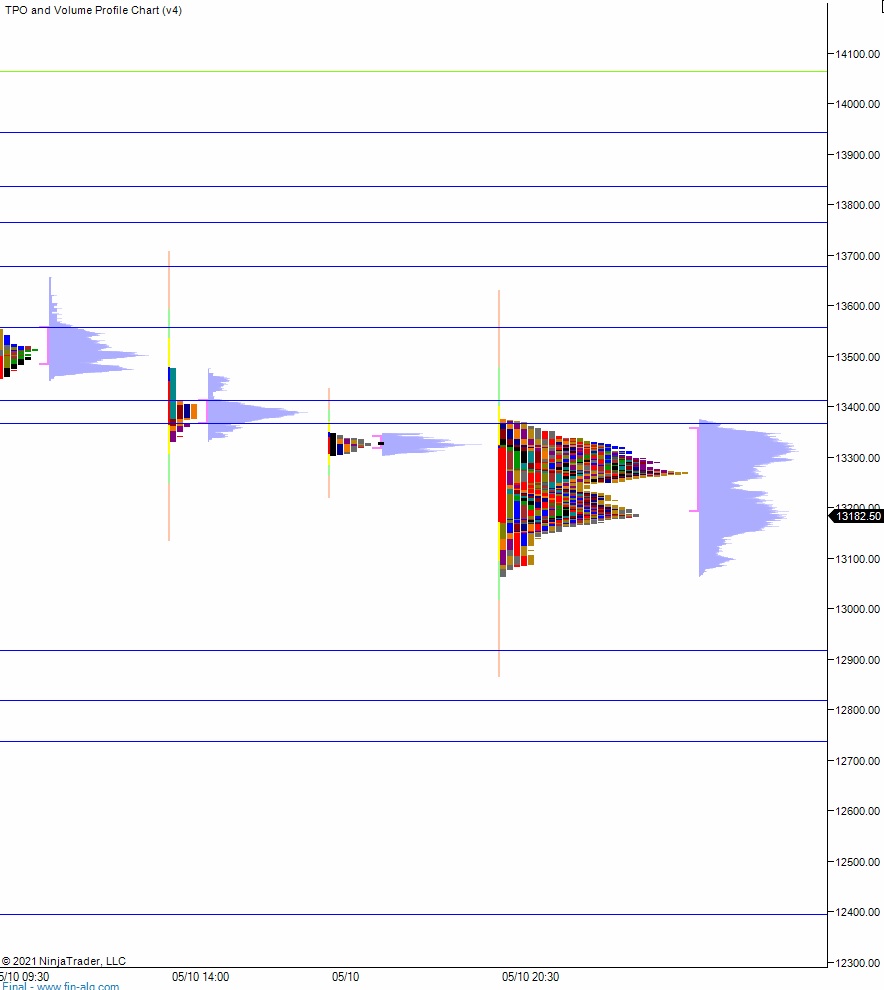

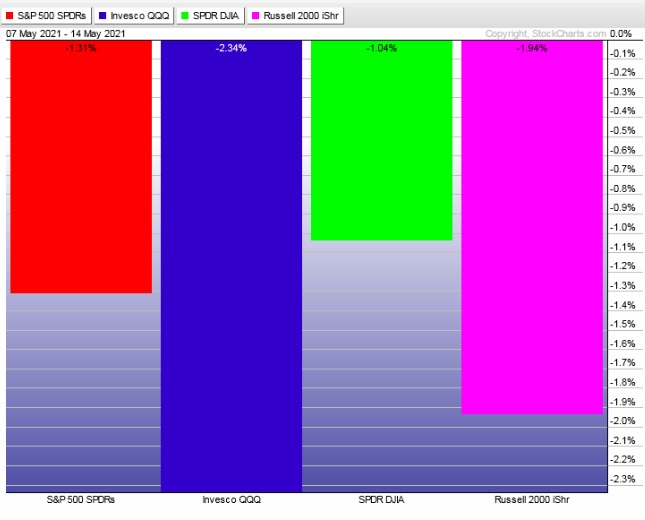

Last week had a trend down Monday across the board. Then continuation selling through Wednesday. Eventually a snap-back rally took hold Thursday and into the weekend, accentuated by a trend up Friday.

The last week performance of each major index is shown below:

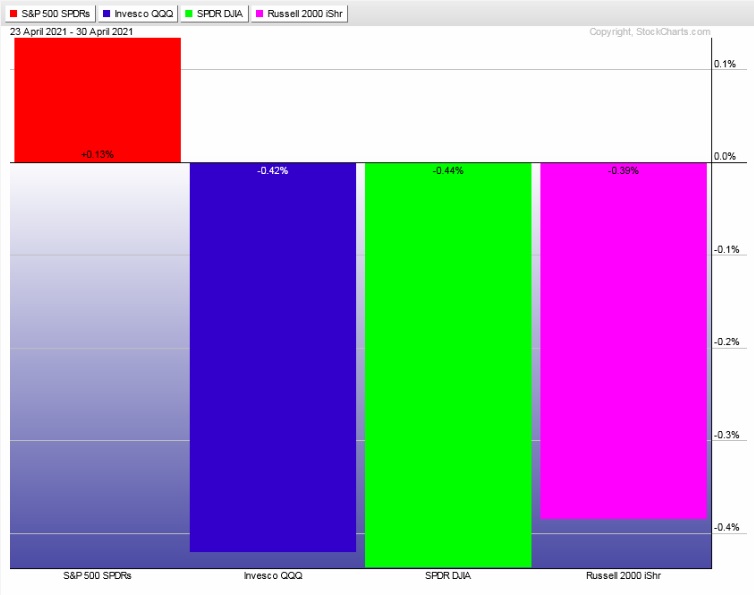

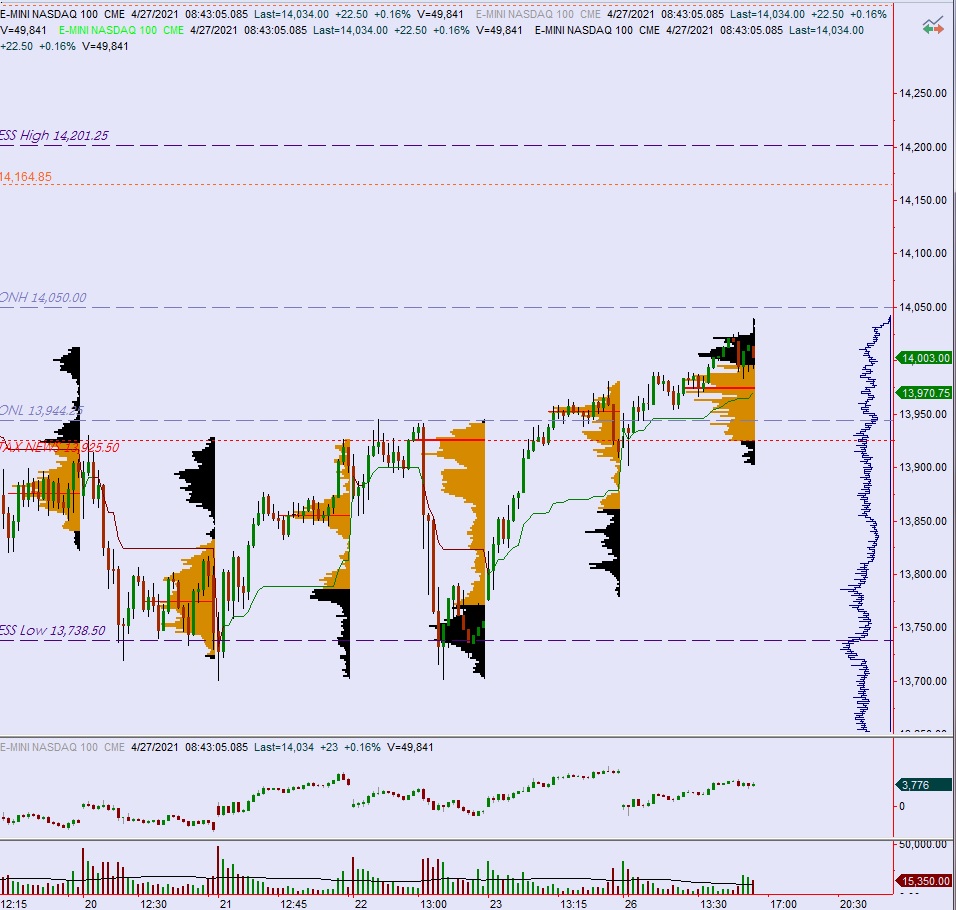

On Friday the NASDAQ printed a trend up. The day began with a gap up near the Wednesday/Thursday high. After a brief open-two-way auction buyers stepped in and drove higher, driving higher clean through to 3pm before sort of flagging into the weekend.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 13,393.25. From here buyers continue higher, tagging 13,400 before two way trade ensues.

Hypo 2 stronger buyers make a run up to last Monday’s naked VPOC 13,500.

Hypo 3 sellers take out overnight low 13,301 and sustain trade below it setting up a move down to 13,200.

Levels:

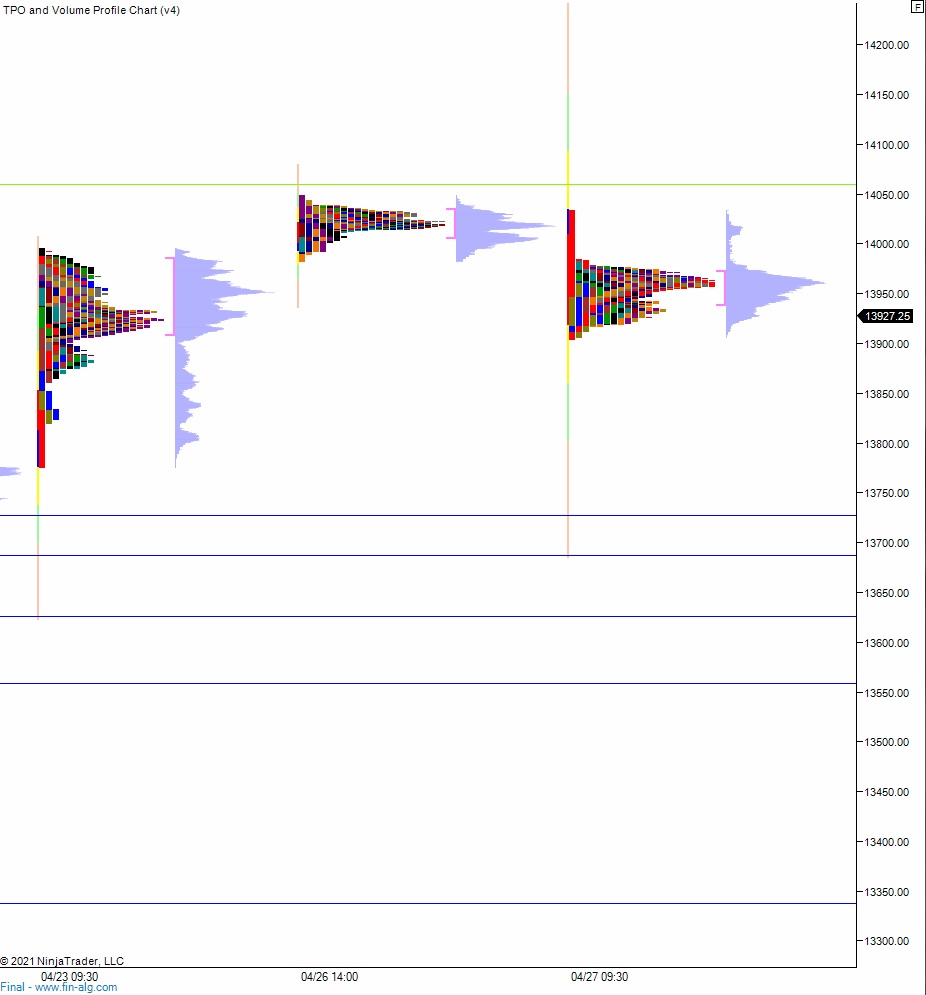

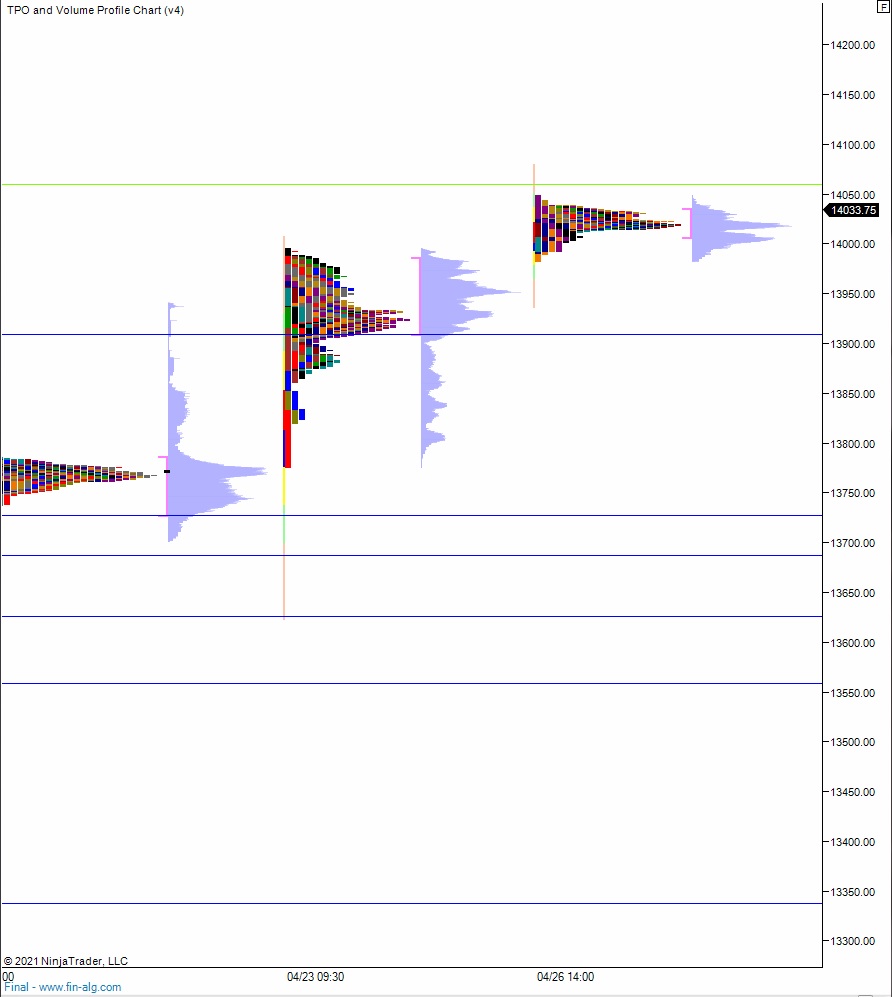

Volume profiles, gaps and measured moves: