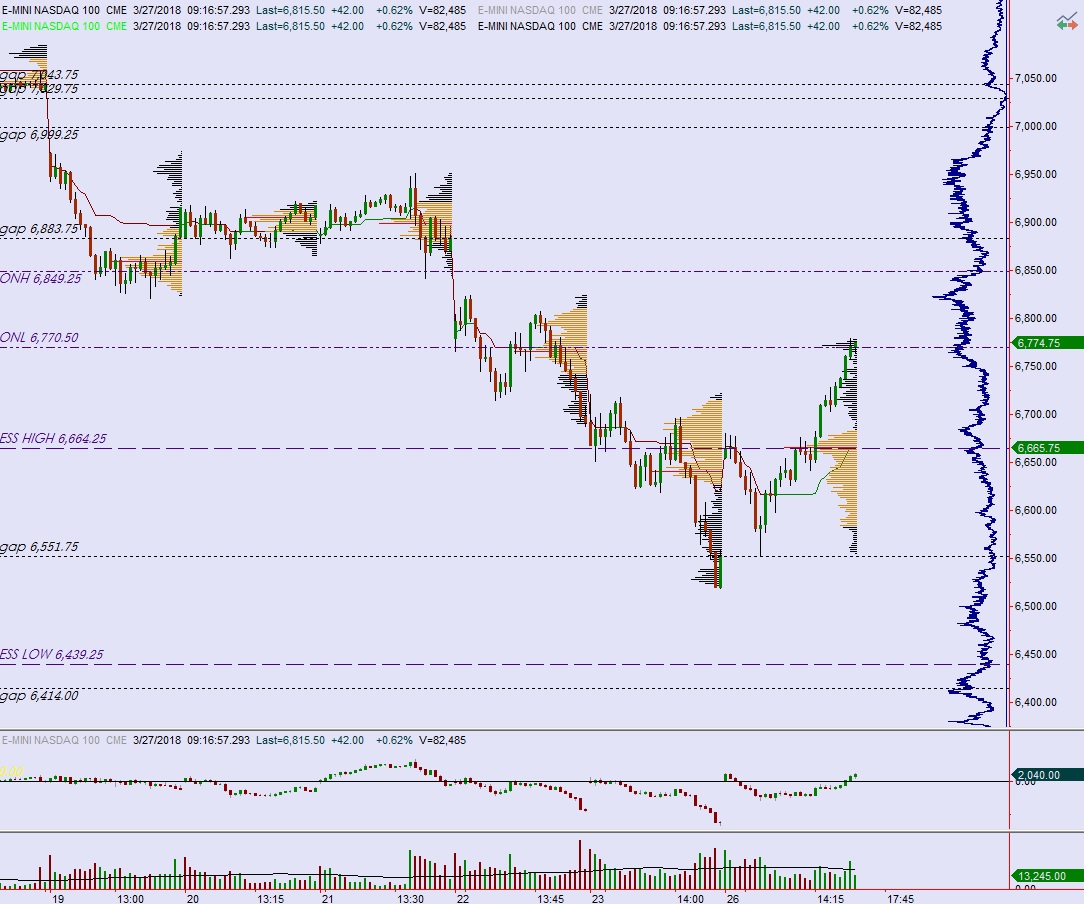

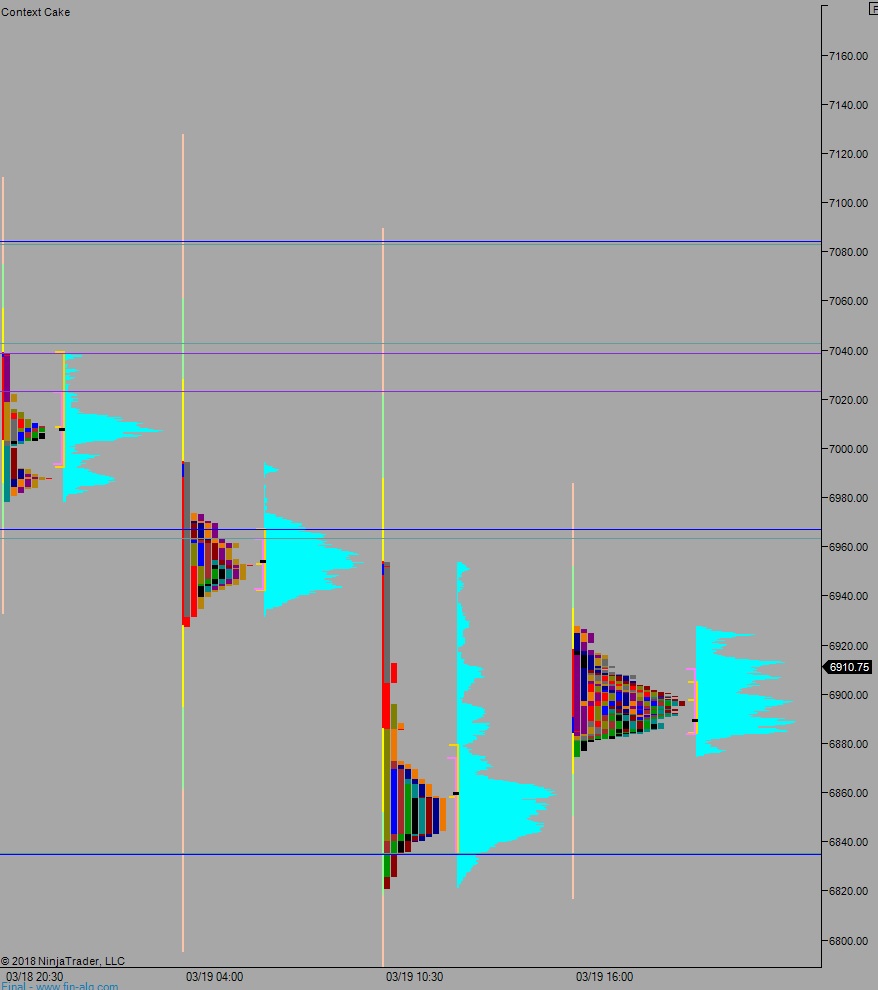

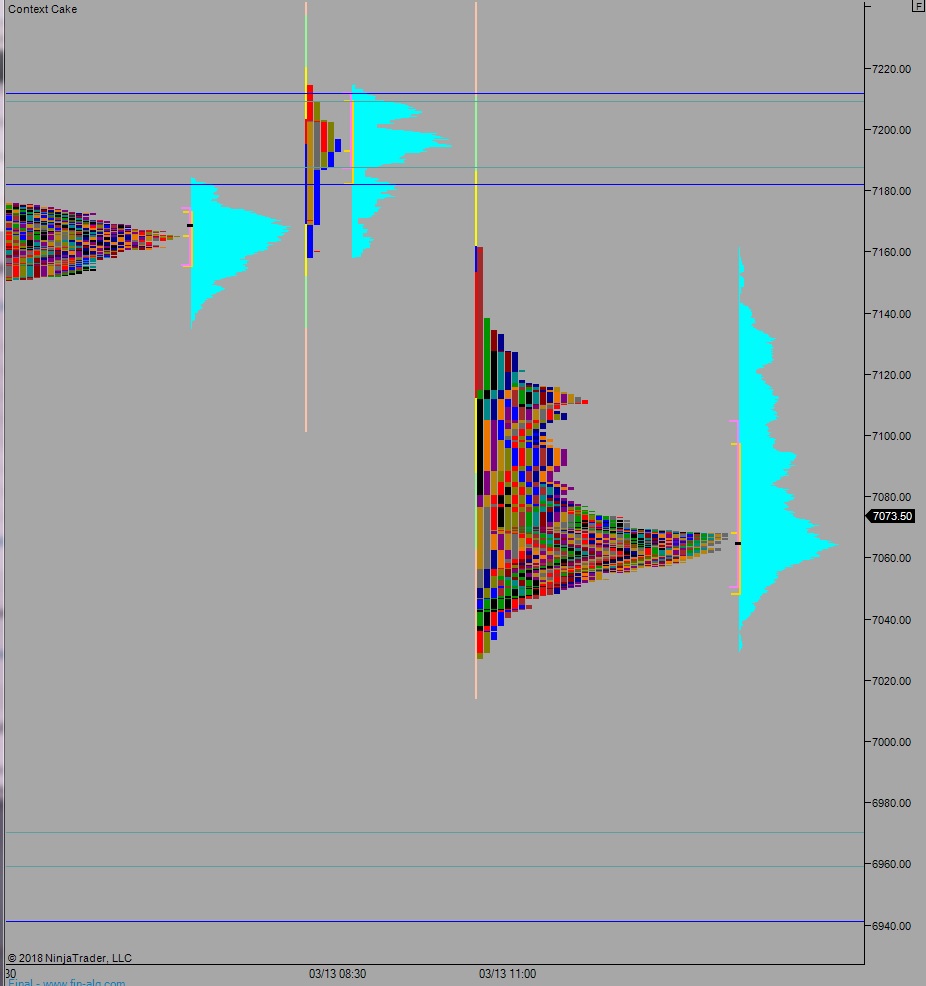

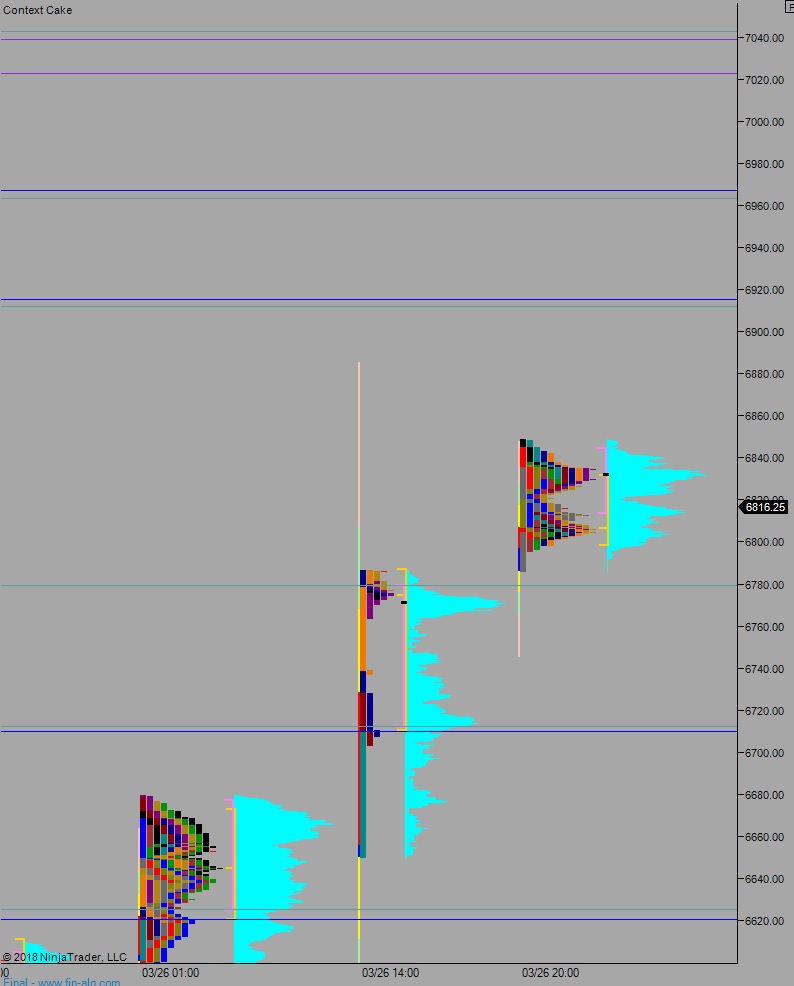

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring extreme range and volume. Price worked higher late Monday afternoon and continued higher into the evening before responsive sellers rejected a move back into the 3/21 range, stepping in just above last Wednesday’s low 6842.25.

The economic calendar is light today—we have consumer confidence at 10am, 4- and 52-week T-bill auctions at 11:30am, and a 5-year Note auction at 1pm.

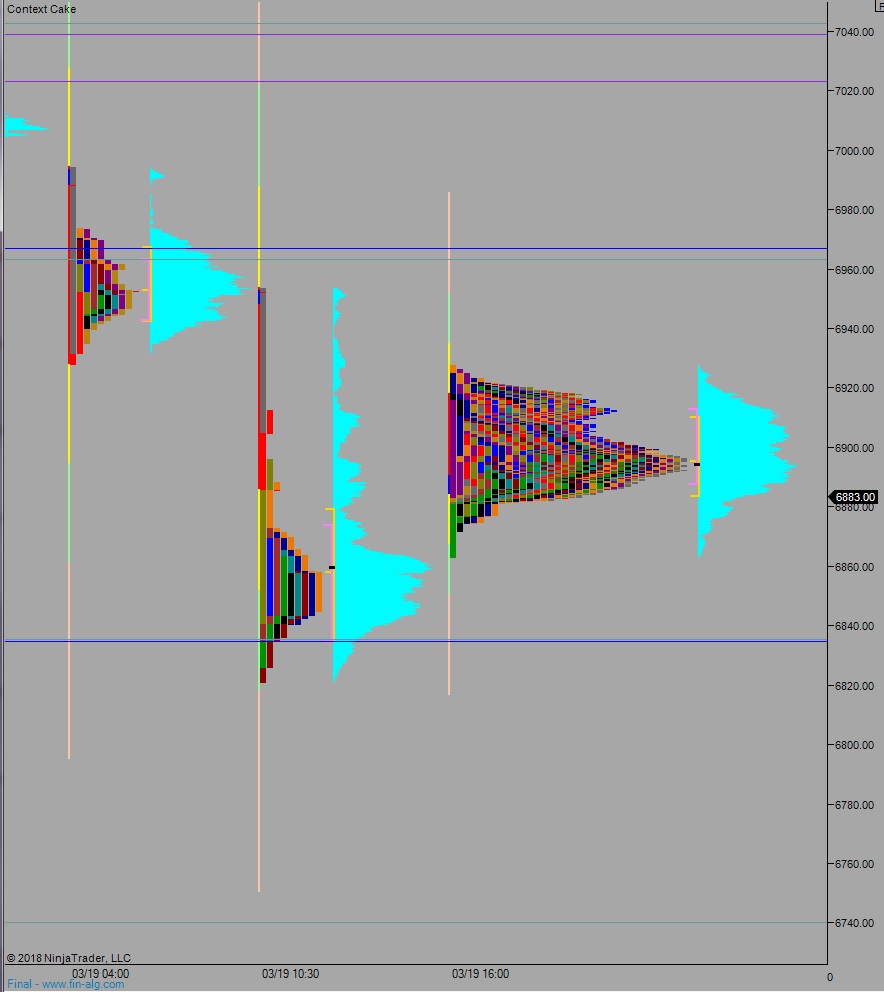

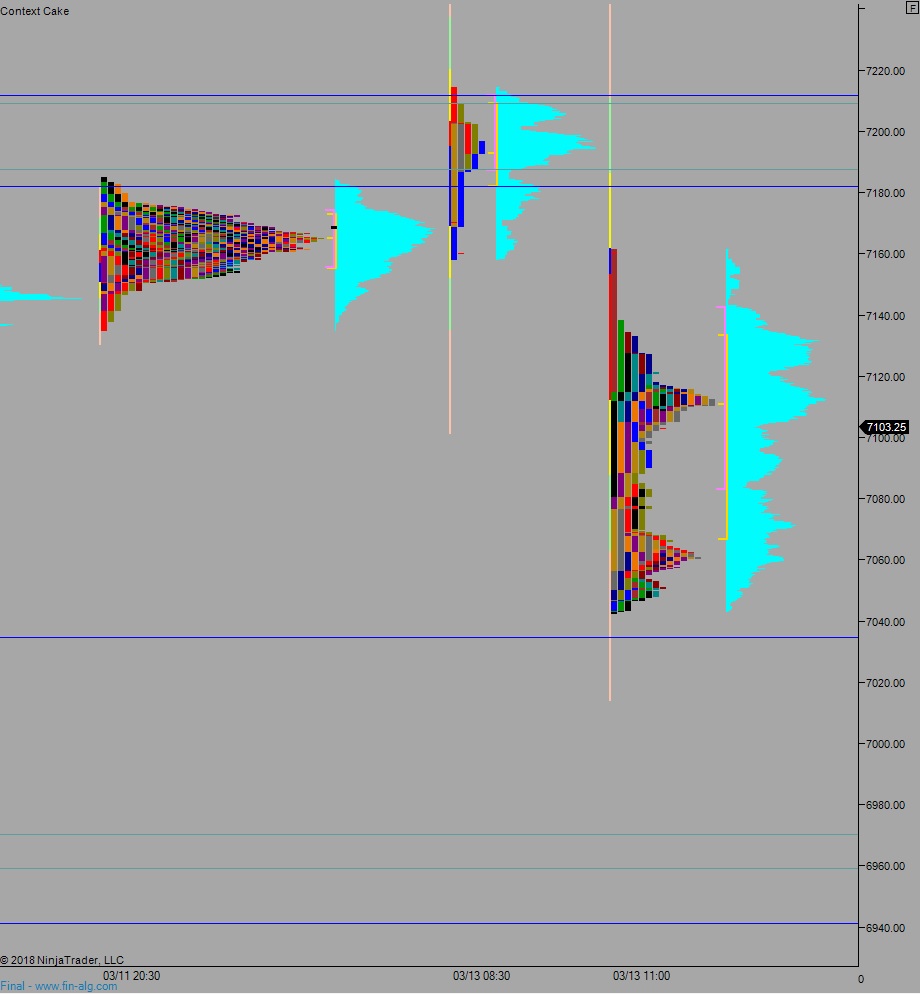

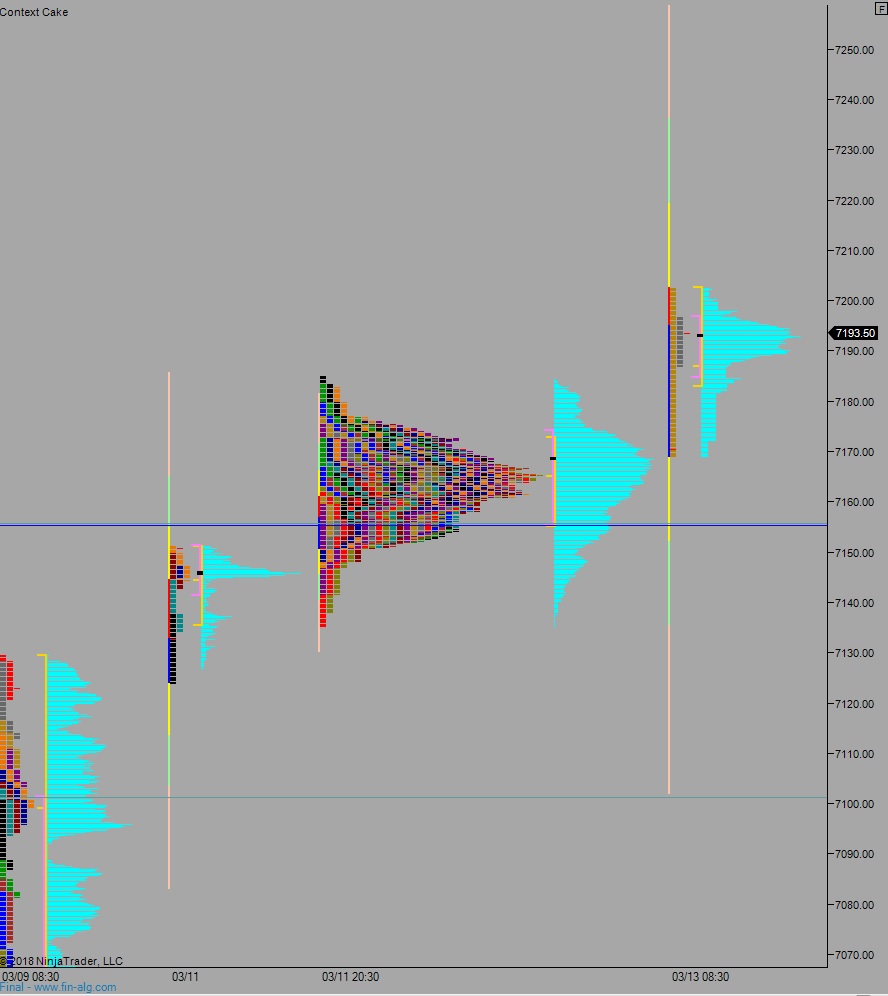

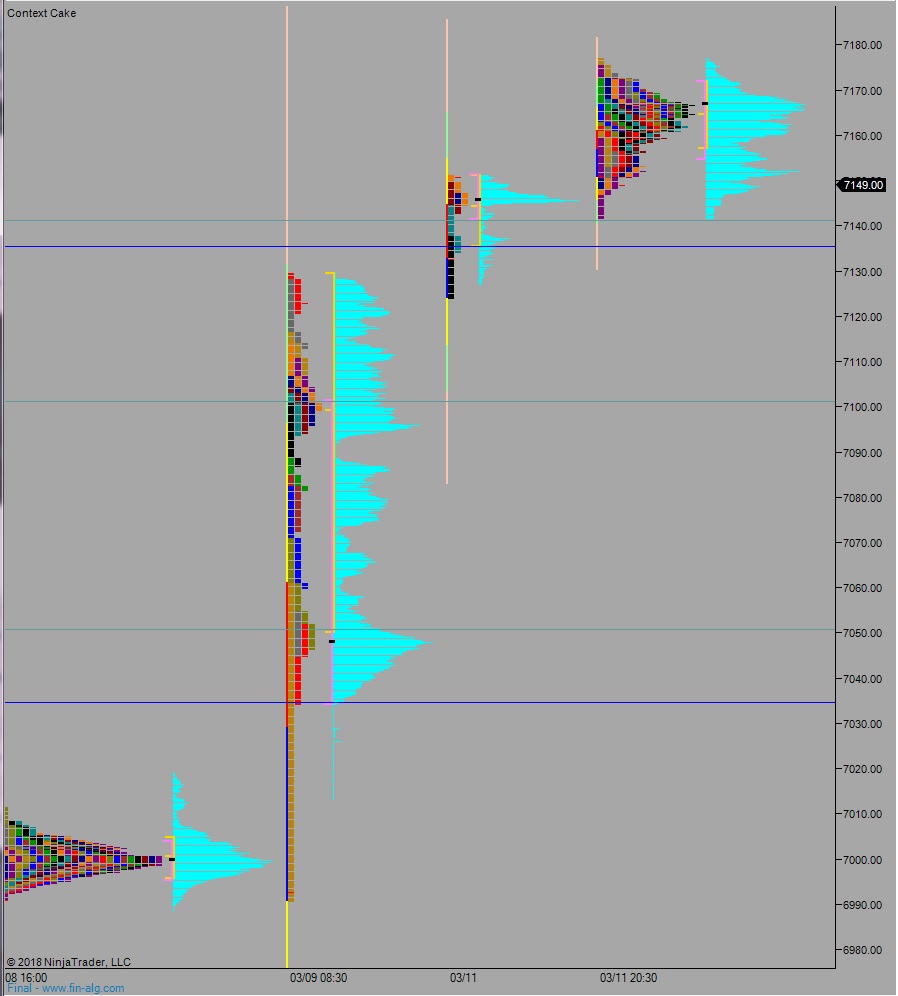

Yesterday we printed a neutral extreme up. The day began with a 100 point gap up, in-range. A brief open auction gave way to buyers who were able to barely poke above the overnight high before a strong wave of selling rolled in. Sellers nearly filled the overnight gap but did not. Instead strong responsive buyers stepped in, forming a sharp excess low. A brief battle at the daily midpoint saw buyers more agressive than sellers. Ultimately the buyers became initiative, pushing us neutral, then pressing the rally for the rest of the session, closing the day at the highs earning the neutral extreme designation.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 6774.75. Selling continues just through overnight low 6770.50 before buyers step in and two-way trade ensues.

Hypo 2 buyers gap-and-go higher, up through overnight high 6849.25 setting up a move to target the open gap at 6883.75 before two way trade ensues.

Hypo 3 stronger sellers press down into the Monday afternoon rally, down to 6666 before two way trade ensues.

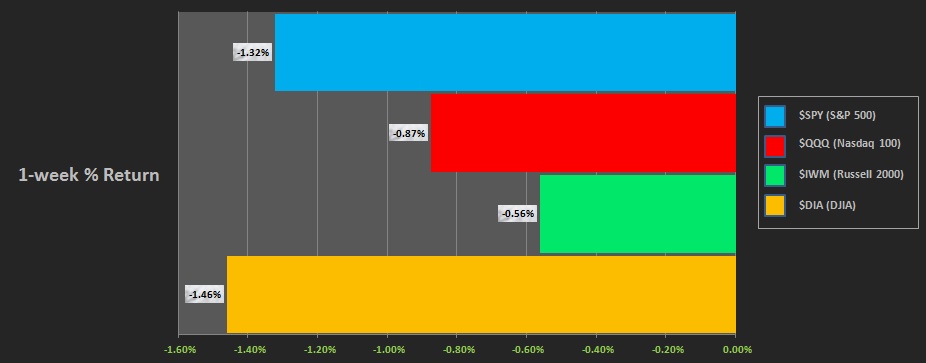

Levels:

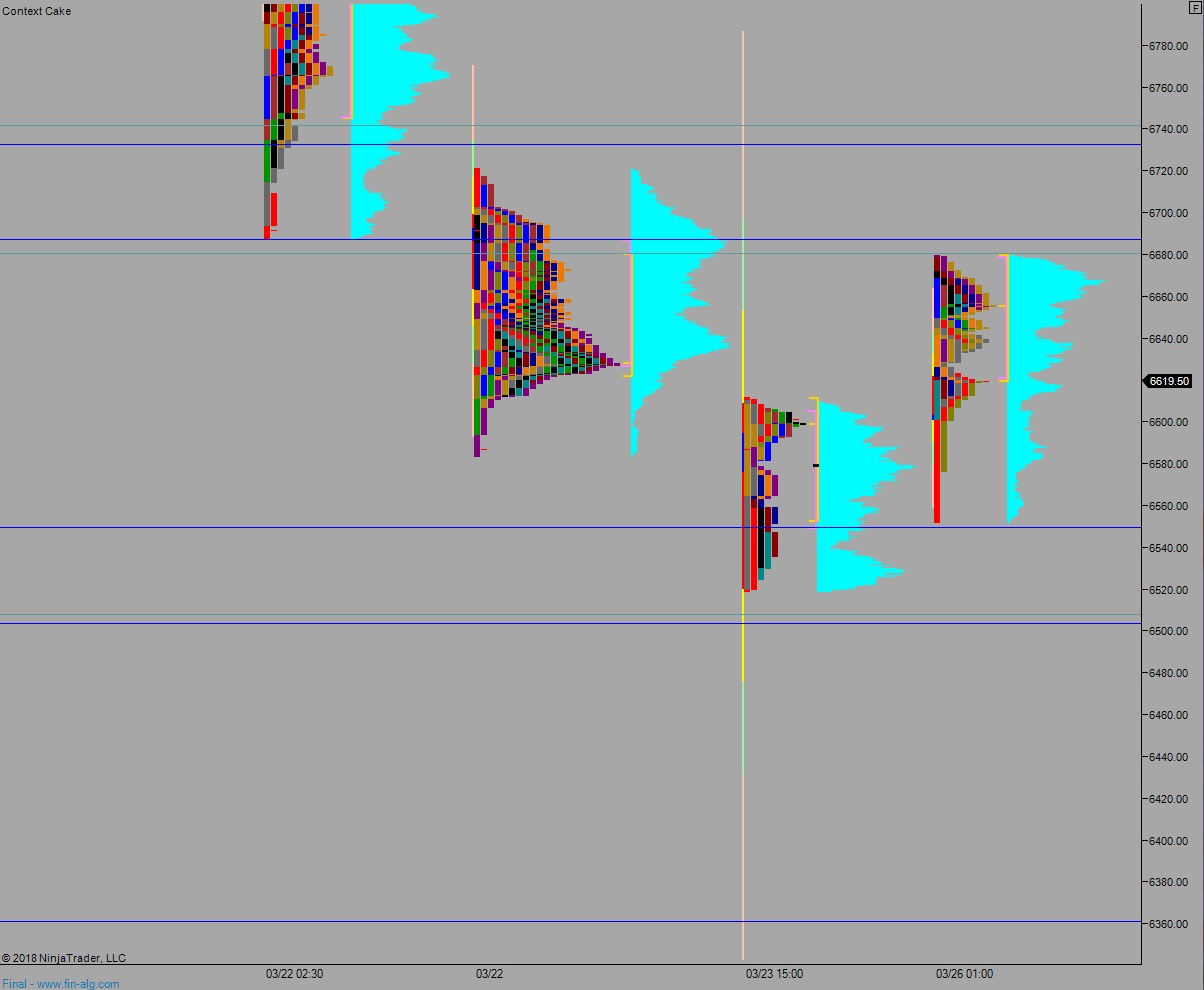

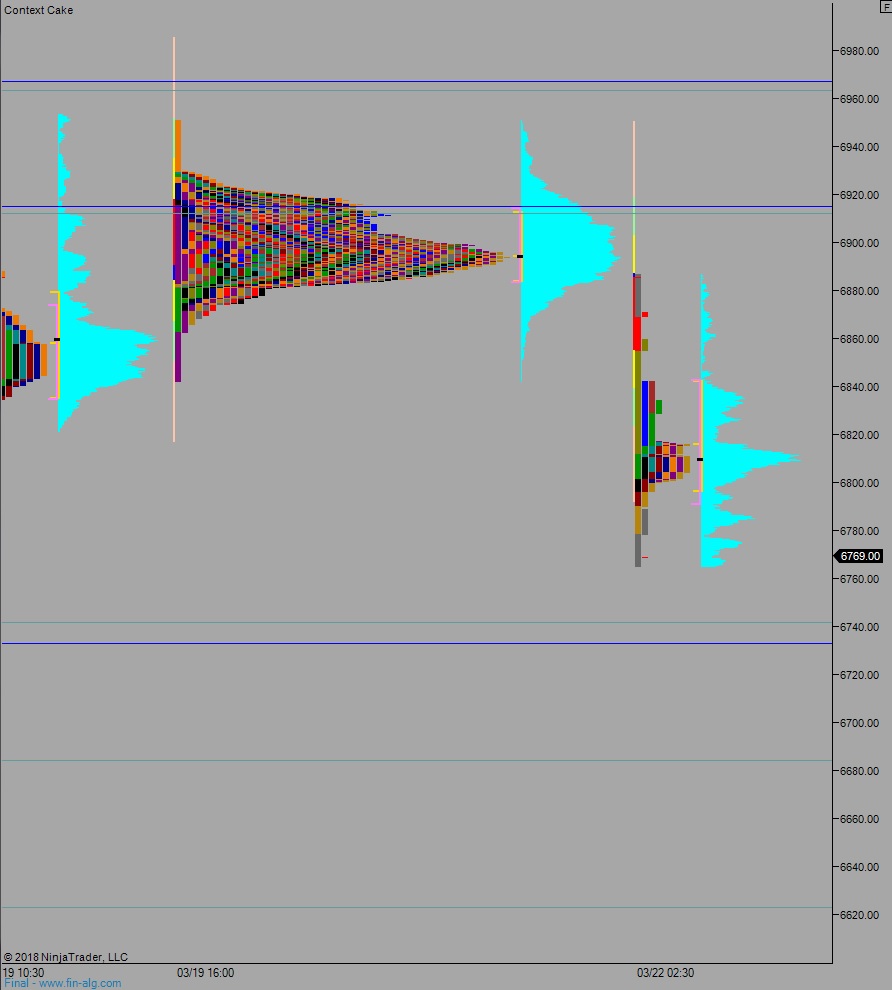

Volume profiles, gaps, and measured moves: