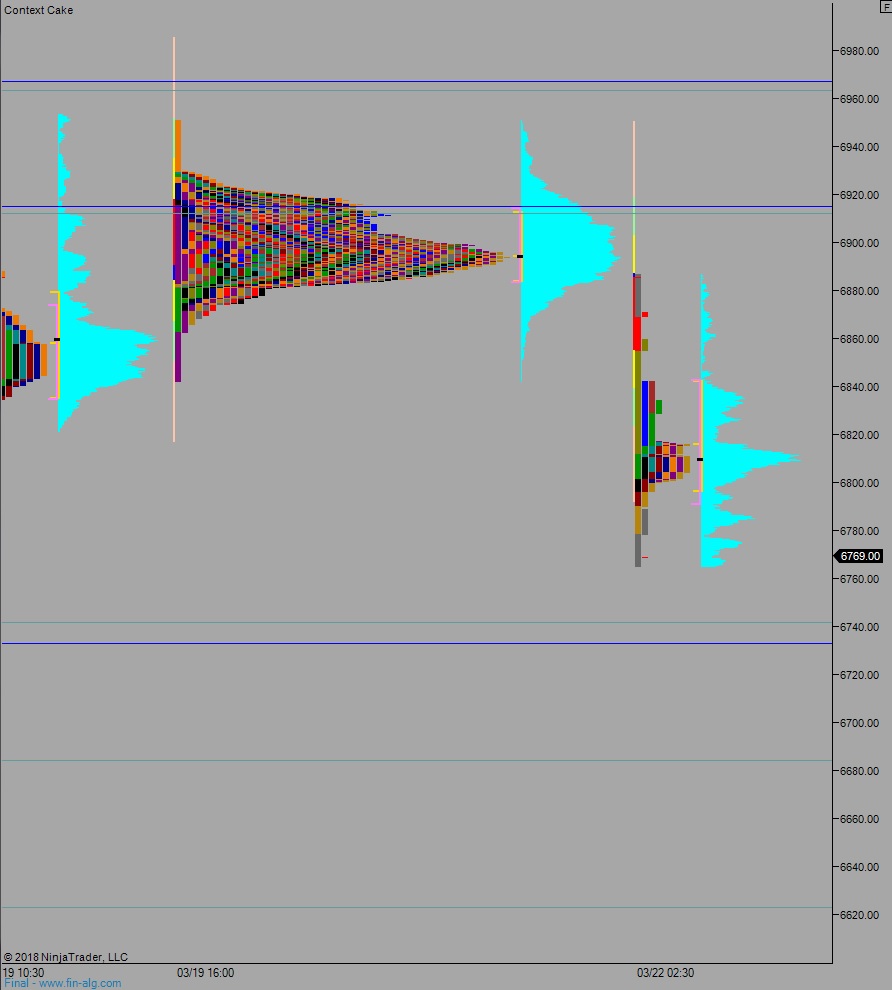

NASDAQ futures are coming into Thursday pro gap down after an overnight session featuring extreme range and volume. Price began working lower around 2am New York after spending most of the night in balance. At 8:30am Initial/Continuing jobless claims data came out better-than-expected.

Also on the economic docket today we have manufacturing PMI at 9:45am, leading indicators at 10am, service/composite PMI at 10:45am, and a 10-year TIPS auction at 1pm.

Yesterday we printed a neutral extreme down. The day began gap down in range. Buyers close gap, take out overnight high. Then Jerome Powell’s Fed lifted benchmark borrowing rate 25 basis points. During his presser the market went 3rd reaction down. There was a bit of a bounce late in the day that was sold into.

Heading into today my primary expectation is for sellers to gap-and-go lower, down to 6741 before two way trade ensues.

Hypo 2 buyers work into the overnight inventory and do a half gap up to 6800 before two way trade ensues.

Hypo 3 full on liquidation, next downside targets are 6683.50 then 6623.

Levels:

Volume profiles, gaps, and measured moves:

Want to learn how these reports and charts help me consistently trade the NASDAQ futures for profit? Come to my free event Tuesday, March 27th at Benzinga Headquarters in downtown Detroit. Link to RSVP: https://www.meetup.com/Detroit-Investors-Traders-StockTwits-Meetups/events/248652154/

If you enjoy the content at iBankCoin, please follow us on Twitter