NASDAQ futures are coming into the week pro gap down after an overnight session featuring extreme range and volume. Price methodically worked lower overnight, trading down to prices not seen since March 7th before coming into balance.

The economic calendar is light to start the week. We have a 3- and 6-month T-bill auction at 11:30am.

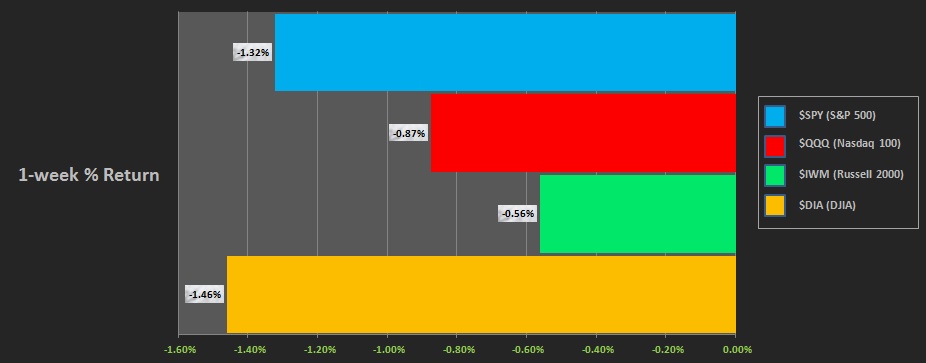

Last week markets started strong and by late Tuesday morning sellers were making themselves known. We then spent the rest of the week chopping along the weekly lows. The performance of each major index last week is shown below:

On Friday the NASDAQ printed a normal variation down. The day began with a slight gap up and after a morning 2-way auction sellers stepped in. They were not able to take out the Thursday low, instead bouncing along it as we headed into the weekend.

Heading into today my primary expectation is for buyers to work into the overnight inventory and work a half gap up to 7000 before two way trade ensues.

Hypo 2 sellers gap-and-go lower, taking out overnight low 6928 and continuing lower, down to 6907.25 before two way trade ensues.

Hypo 3 stronger buyers work a full gap fill up to 7043.75 then continue higher, up through overnight high 7045.75 before two way trade ensues.

Levels:

Want to learn how these reports and charts help me consistently trade the NASDAQ futures for profit? Come to my free event Tuesday, March 27th at Benzinga Headquarters in downtown Detroit. Link to RSVP: https://www.meetup.com/Detroit-Investors-Traders-StockTwits-Meetups/events/248652154/

If you enjoy the content at iBankCoin, please follow us on Twitter