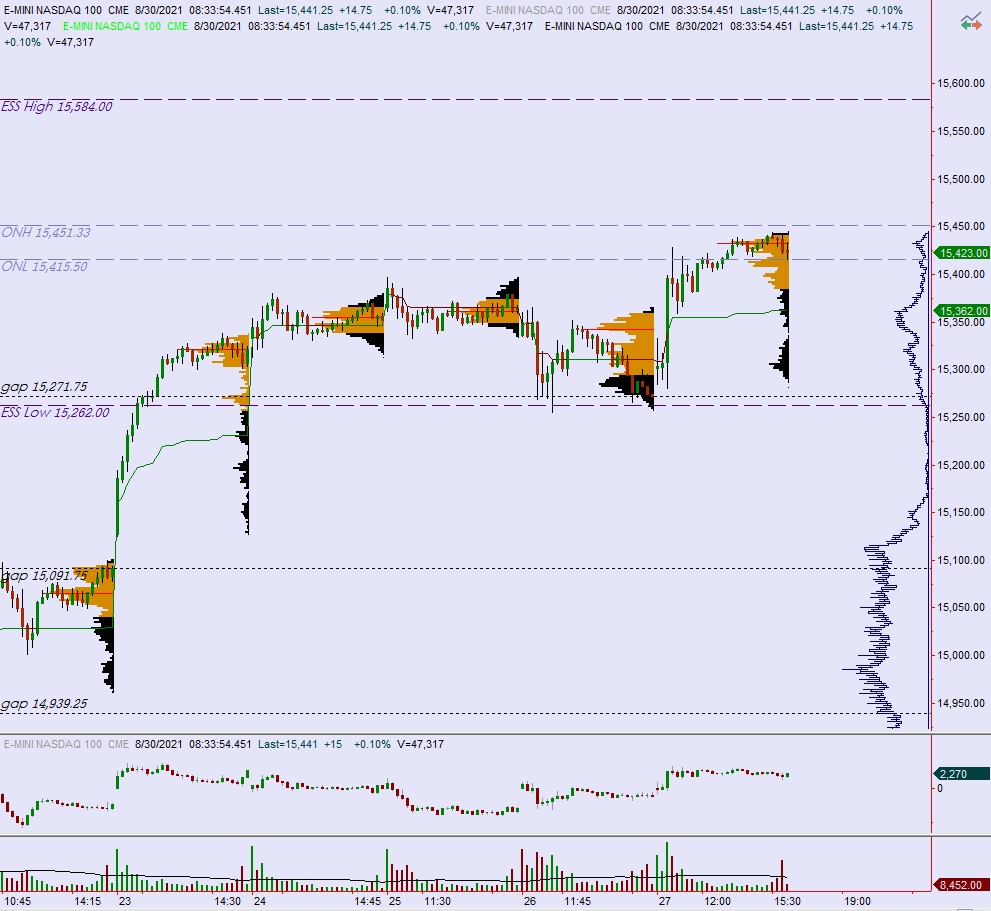

NASDAQ futures are coming into the final Monday in August gap up after an overnight session featuring normal range and volume. Price worked slightly higher overnight, making a new record high and then drifting along it. As we approach cash open price is up above the Friday high.

On the economic calendar today we have pending home sales at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

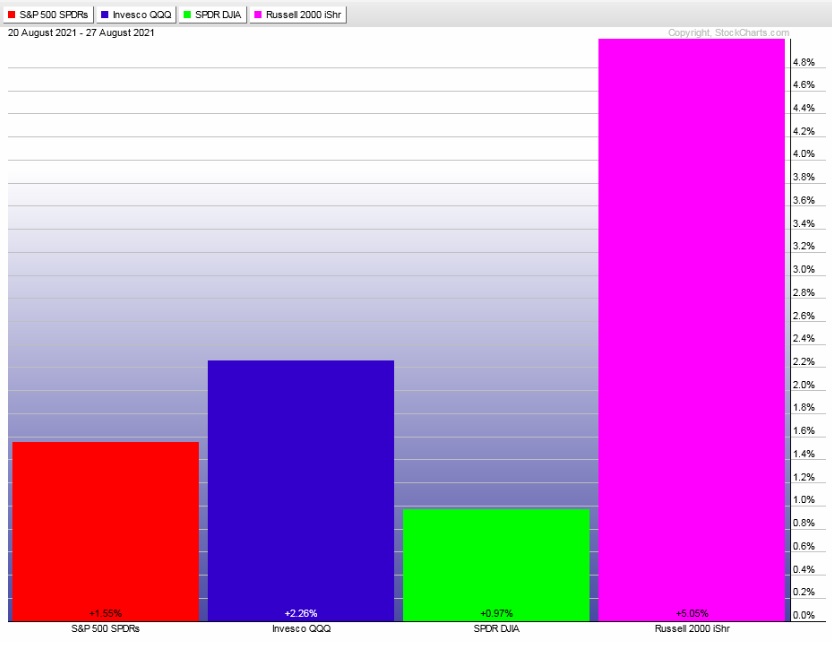

Last week featured a big gap up across the board to start things off followed by a conviction buy trend Monday. Steady gains through Wednesday. Selling pressure Thursday immediately negated Friday morning by another day of conviction buying. The Russell 2000 lead the way.

The last week performance of each major index is shown below:

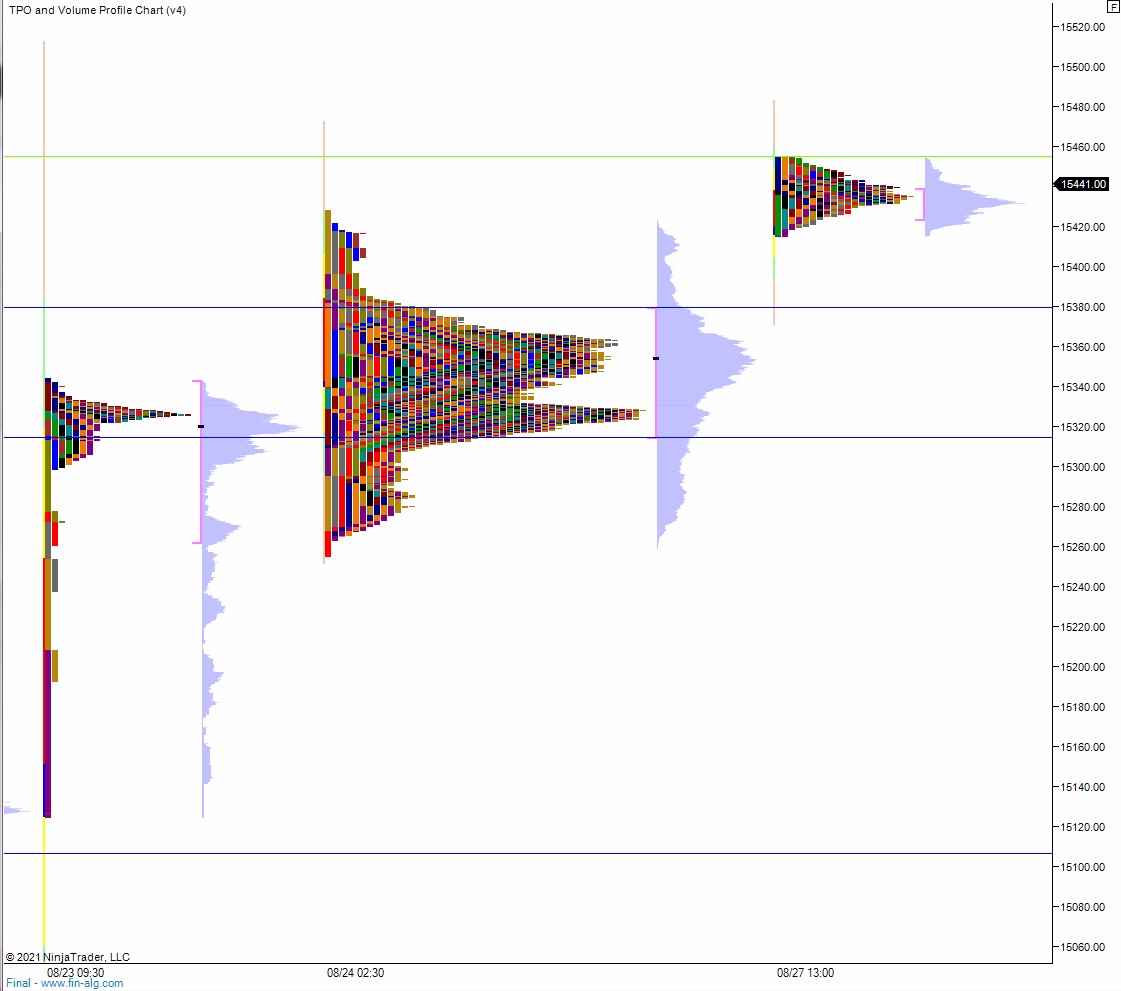

On Friday the NASDAQ printed a normal variation up. It nearly resembled a double distribution trend up and these labels are only generalities but given the auction behavior I am classifying it as a normal variation up.

The session began with a slight gap up in range. After a brief two-way auction sellers made a try at closing the overnight gap. They could not and this was followed by a initiative buyers spiking price higher, to new all-time highs. Price nearly checked back to the midpoint before buyers came in and began a slow grind higher, a slow grind that migrated value up to the highs and made new highs. We ended near the highs.

Heading into today my primary expectation is for a tight drift along the highs, ranging between 15,450 and 15,420.

Hypo 2 stronger buyers campaign price up to 15,500.

Hypo 3 sellers close the gap down to 15,423 then take out overnight low 15,415.50. Look for buyers down at 15,400 and for two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: