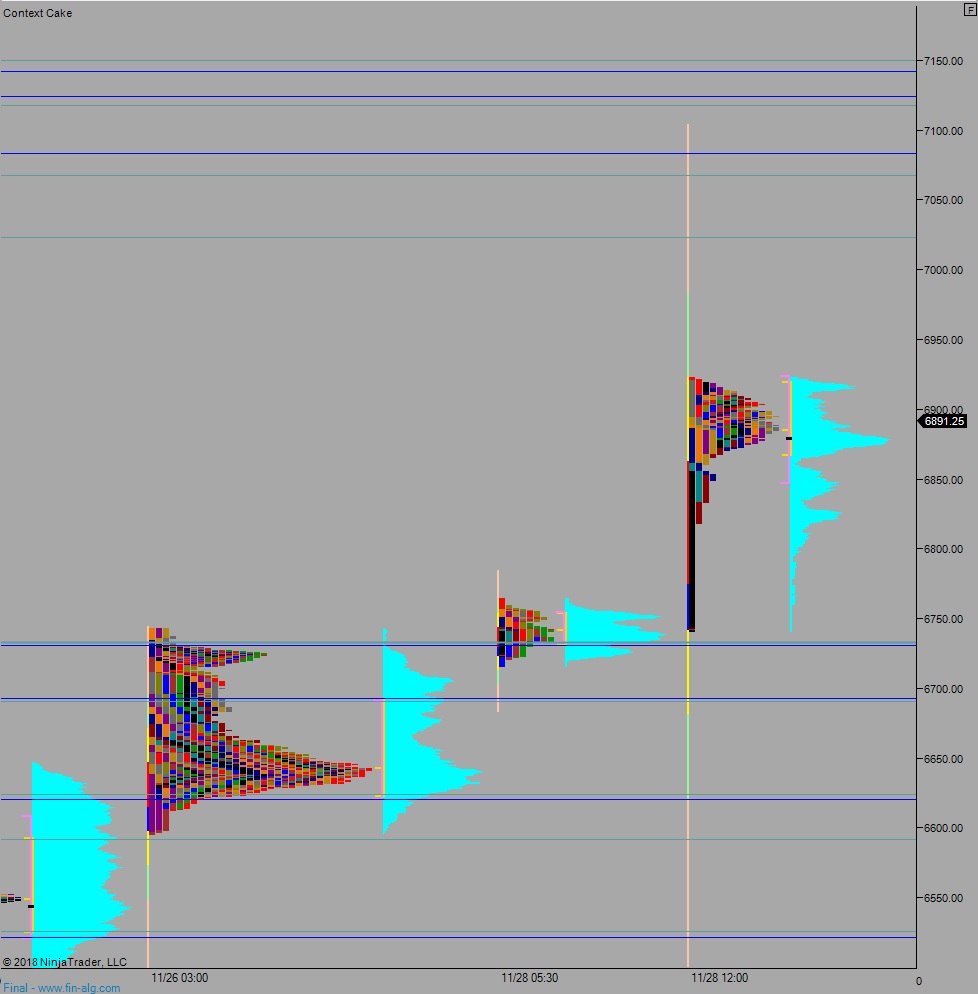

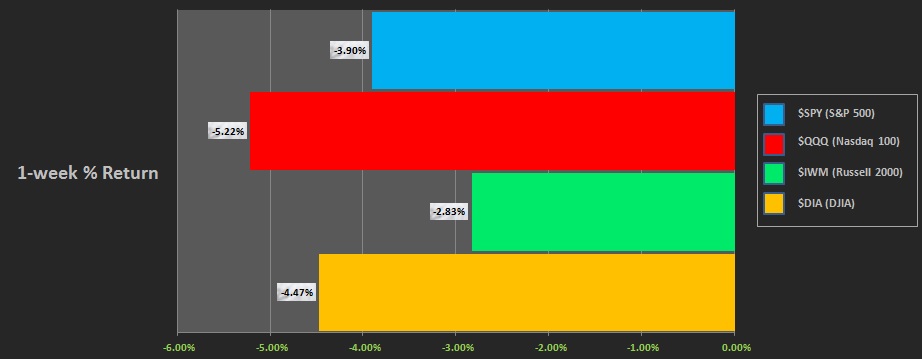

NASDAQ futures are coming into Friday flat after an overnight session featuring elevated range on extreme volume. Price was balanced overnight, trading inside of the Thursday range. As we approach cash open price is hovering above the Thursday mid.

On the economic calendar today we have Chicago purchasing manager at 9:45am.

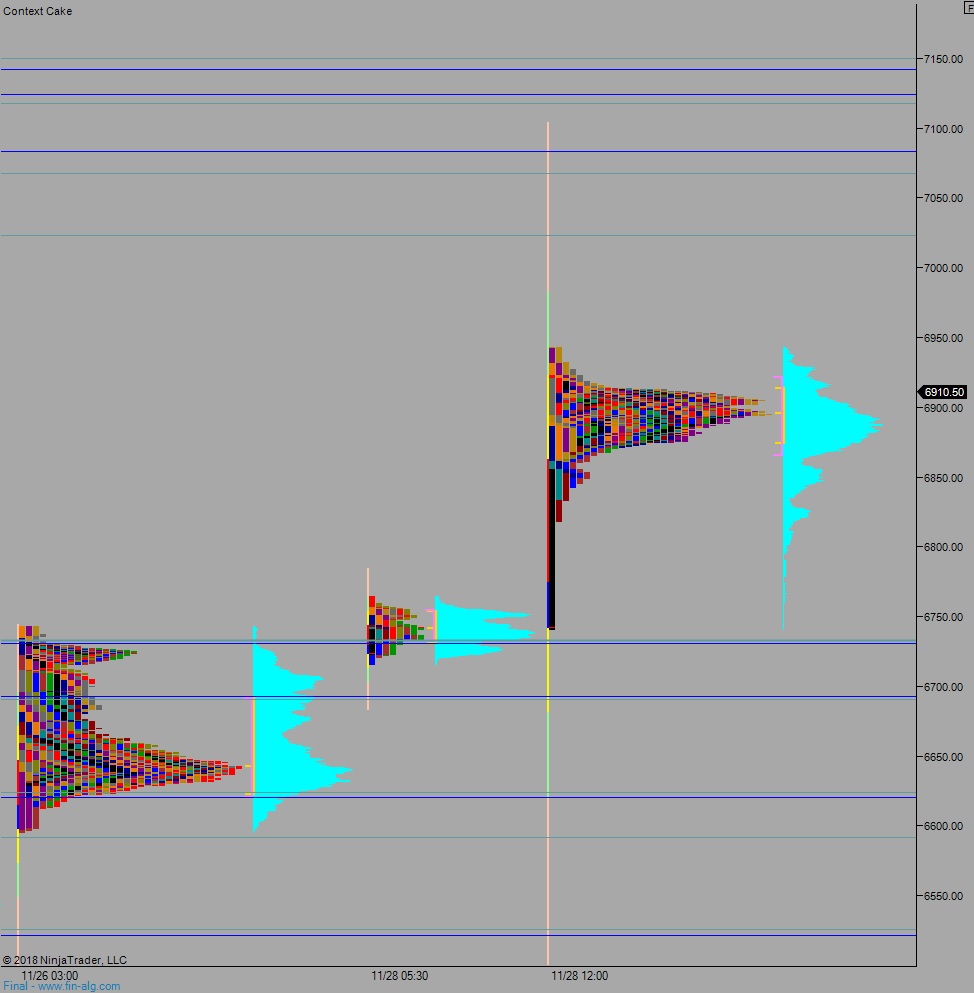

Yesterday we printed a neutral day. The day began with a gap down and two-way auction. Sellers pressed us range extension down, however the LVN observed as part of yesterday’s hypo 2 was defended by responsive buyers. Said buyers eventually worked a full gap fill and briefly pressed us RE up, into a neutral print, before we drifted back to the mid by end-of-day.

Heading into today my primary expectation is for buyers to work higher, taking out overnight high 6917.50 setting up a move to test beyond the Thursday high 6943.75. Look for sellers at the composite VPOC 6950 and two way trade to ensue.

Hypo 2 stronger buyers trade us up to 7000. Look for sellers up at 7022.25 and two way trade to ensue.

Hypo 2 sellers press down through overnight low 6871.50 and continue lower, down through Thursday low 6843 setting up a move to target 6800 before two way trade ensues.

Levels:

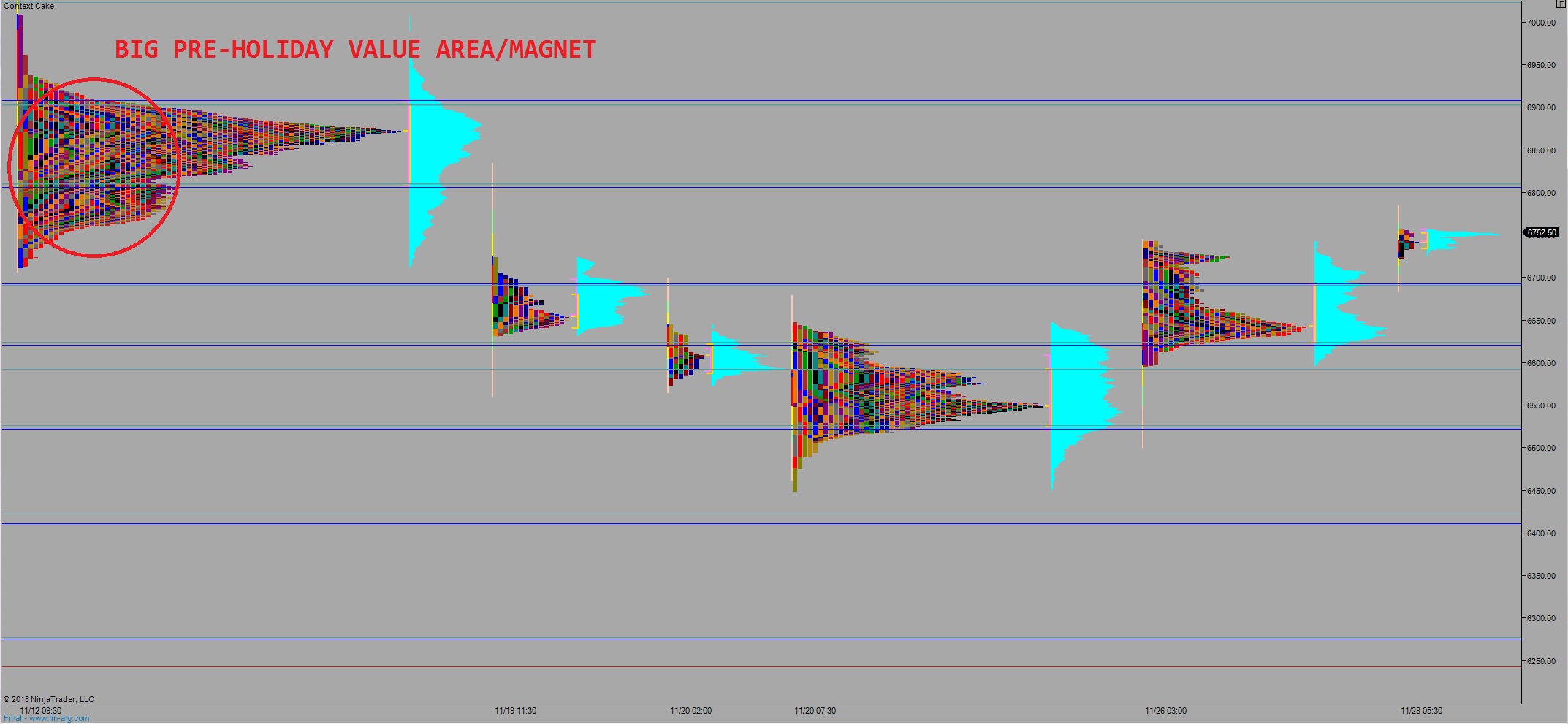

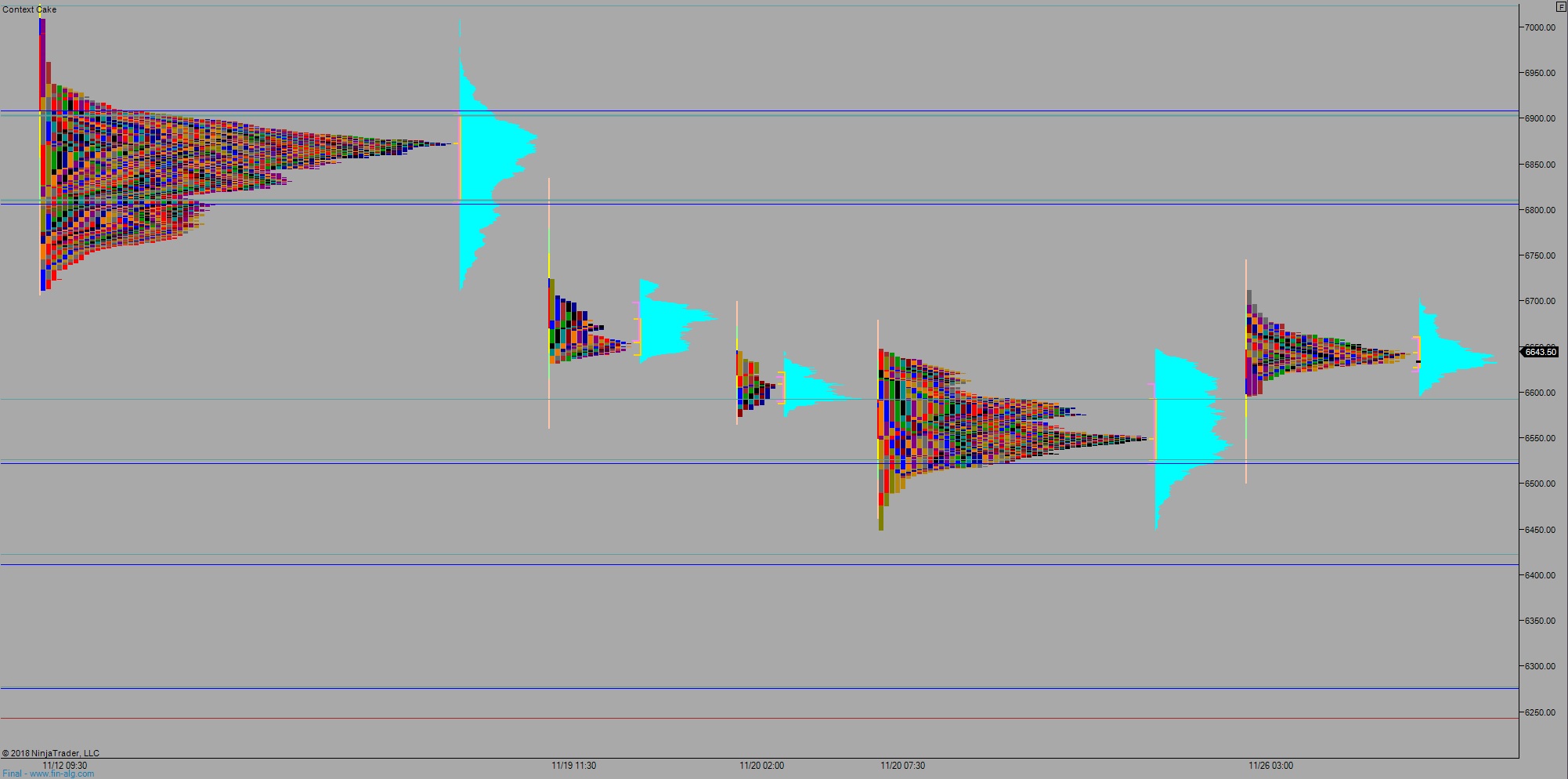

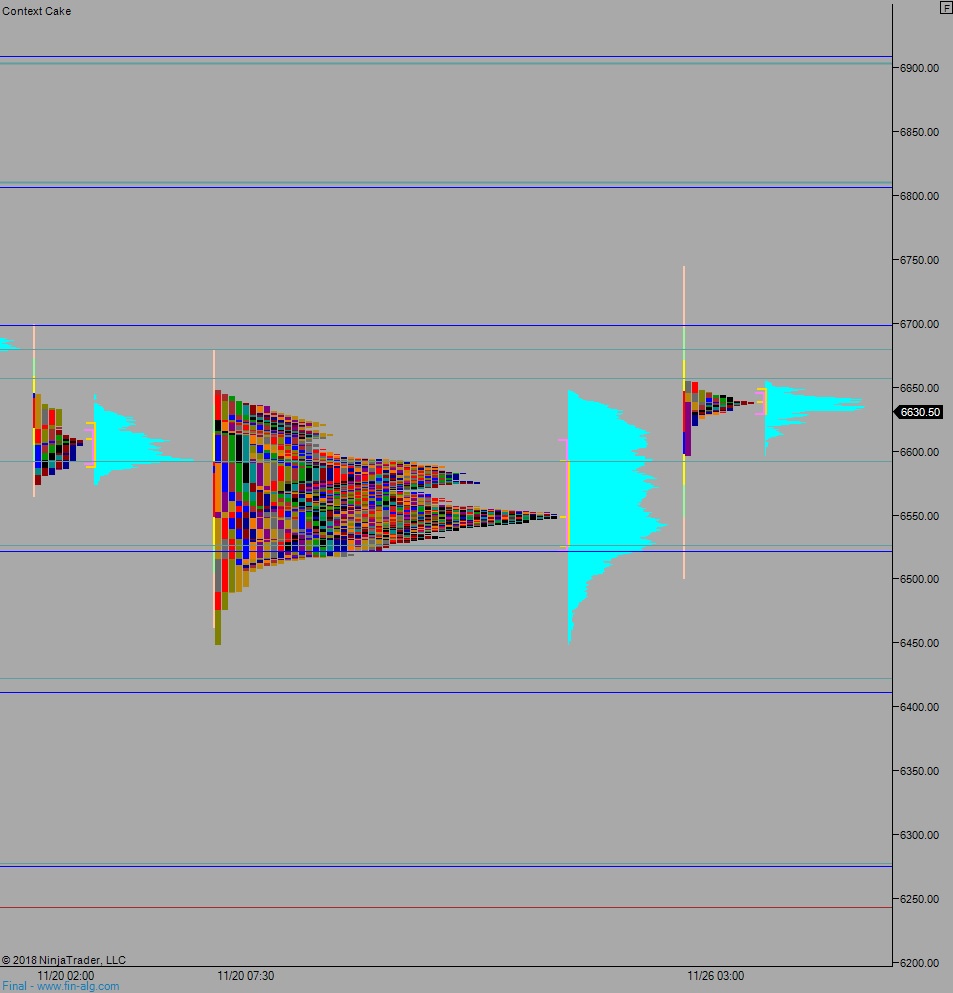

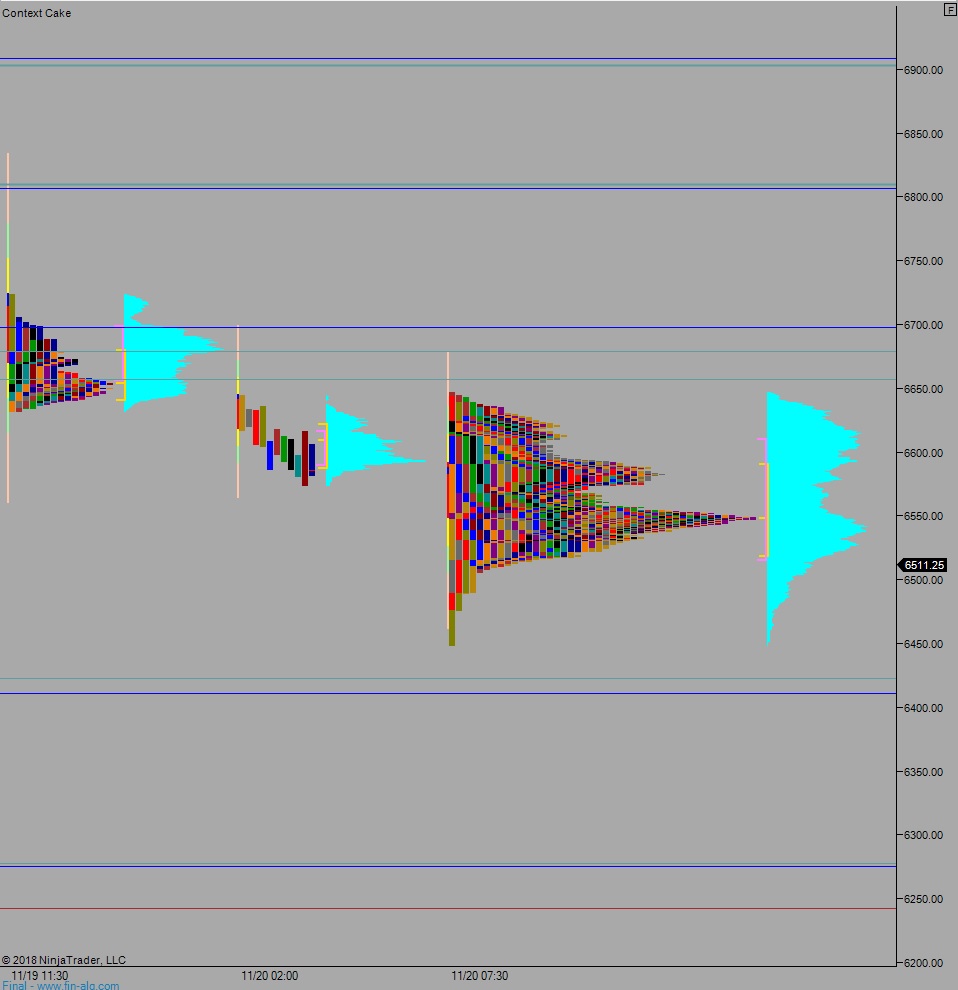

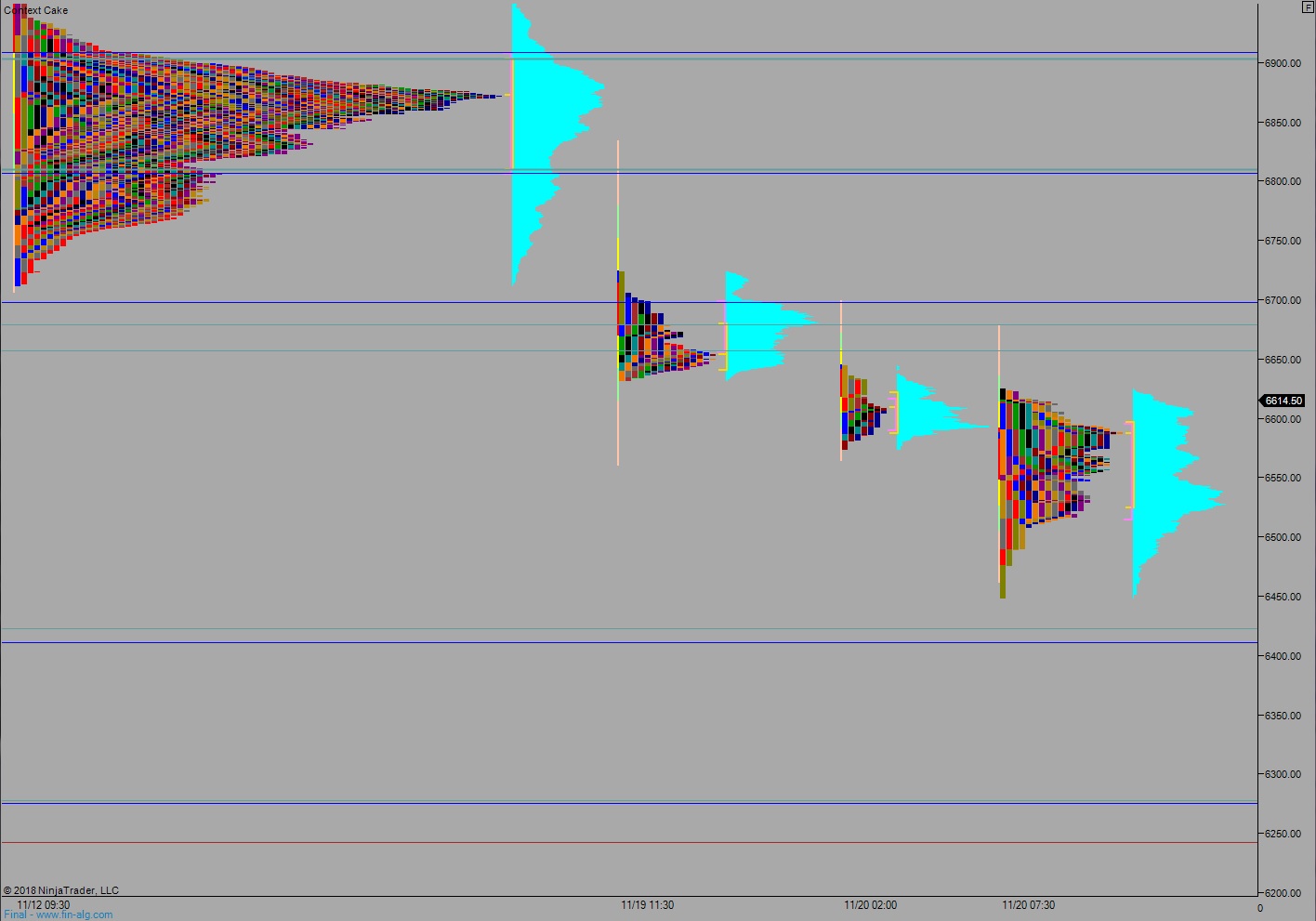

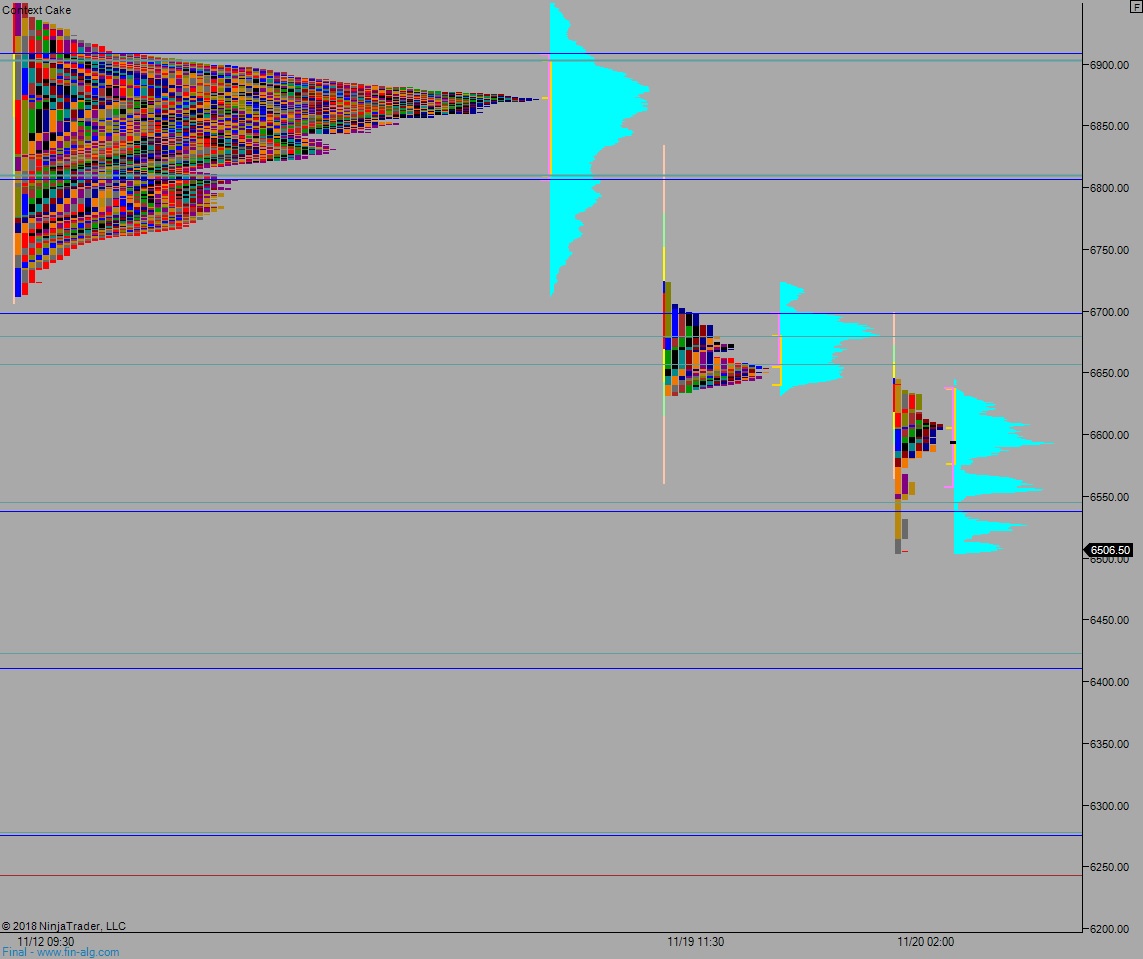

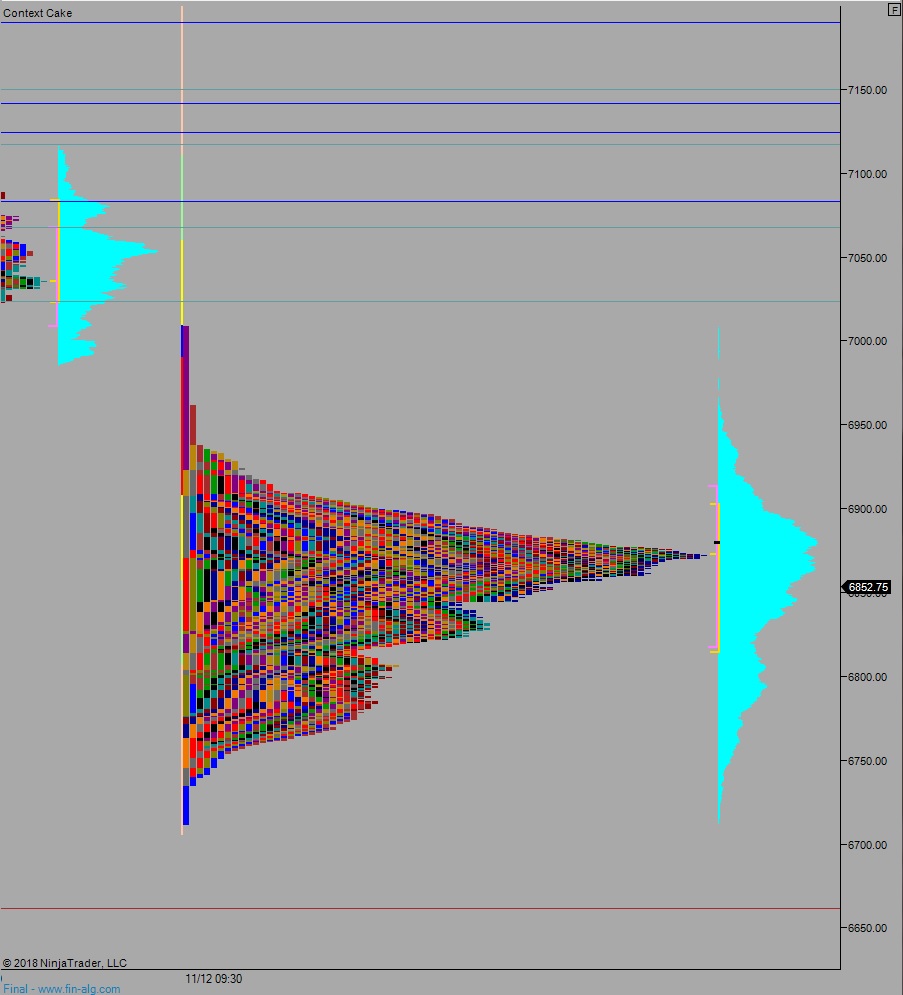

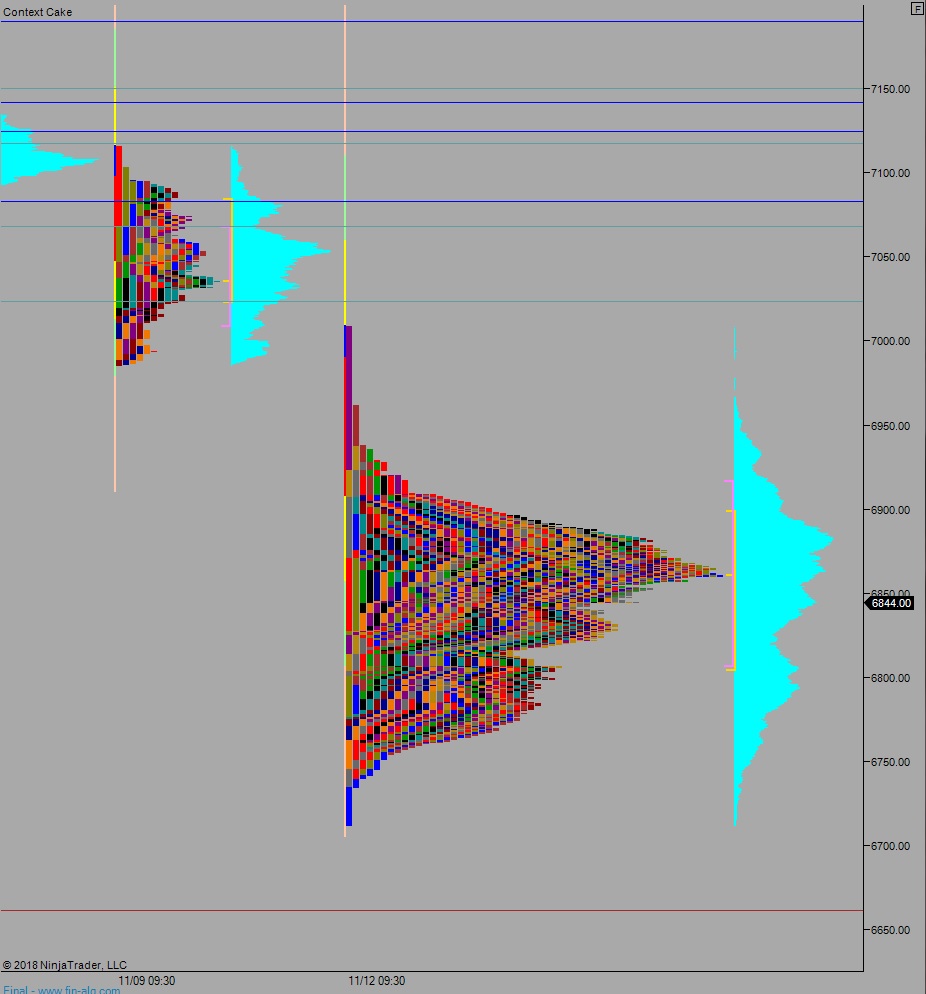

Volume profiles, gaps, and measured moves: