NASDAQ futures are coming into Wednesday gap up after an overnight session featuring elevated range on extreme volume. Price worked higher overnight, and as we approach cash open prices are hovering above the midpoint of last Monday’s (Monday before Thanksgiving) liquidation day. At 8:30am GDP came out in-line with expectations.

Also on the economic calendar today we have oil inventories at 8:30am, a 2-year note auction at 11:30am, Fed Chairman Jerome Powell speaking at 11:30am in New York, and a 7-year note auction at 1pm.

Yesterday we printed a normal variation up. The day began with a gap down and open two-way auction. Responsive buyers stepped in just below overnight low and then began a campaign to take close the overnight gap. We then returned to the daily midpoint, which buyers defended early in the afternoon, setting up a move back towards session high near end-of-day.

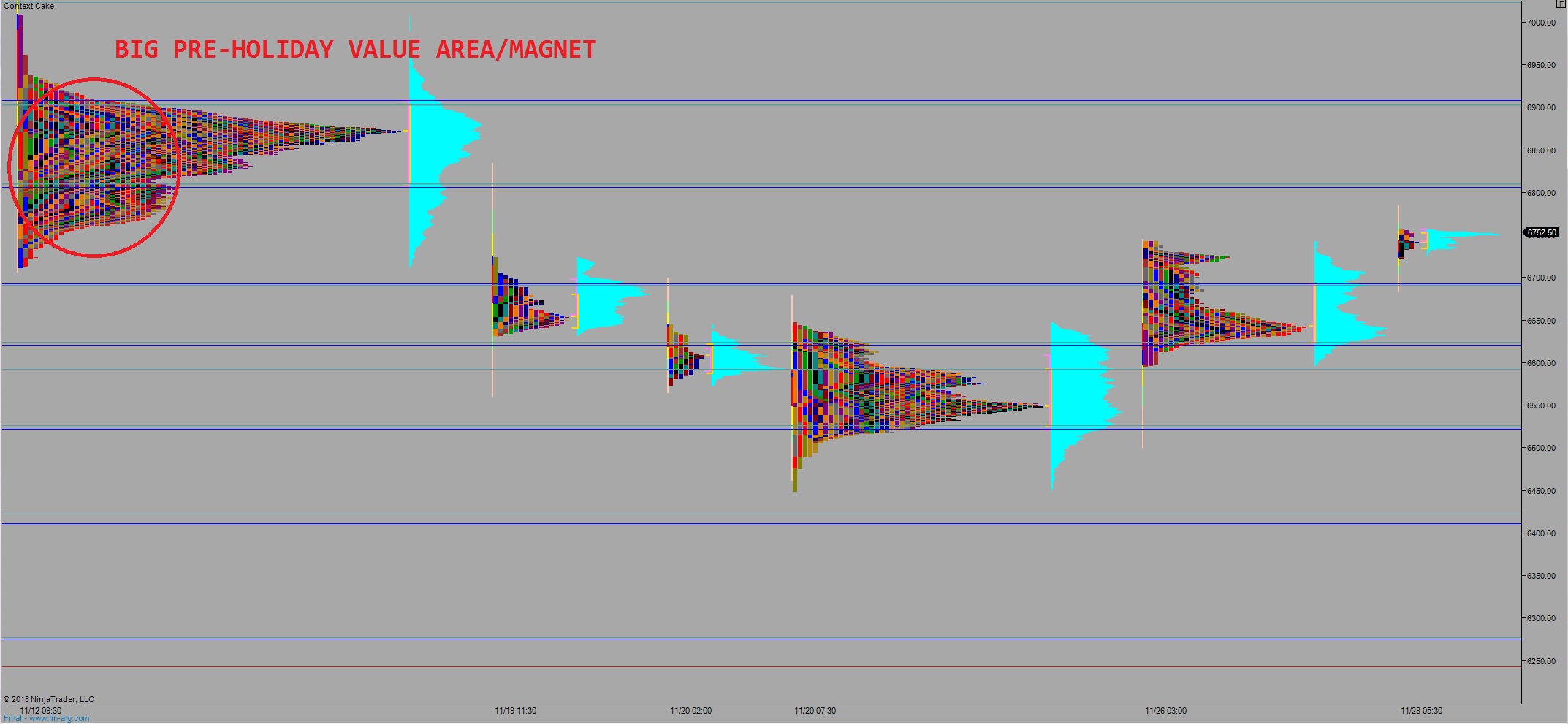

Heading into today my primary expectation is for buyers to gap-and-go higher. Up above, 6800 aligns nicely with the value area low of a major zone that formed in the weeks leading up to the holiday. Look for sellers to defend here. Then look for the third reaction after Jerome Powell to provide direction into end-of-day.

Hypo 2 stronger buyers sustain trade above 6811 setting up a move to tag the VPOC of that big value area at 6873 before two way trade ensues. Then look for the third reaction after Jerome Powell to provide direction into end-of-day.

Hypo 3 sellers work into the overnight inventory and close the gap down to 6712.25. Look for buyers down at 6693.50 and two way trade to ensue. Then look for the third reaction after Jerome Powell to provide direction into end-of-day.

Levels:

Volume profiles, gaps, and measured moves: