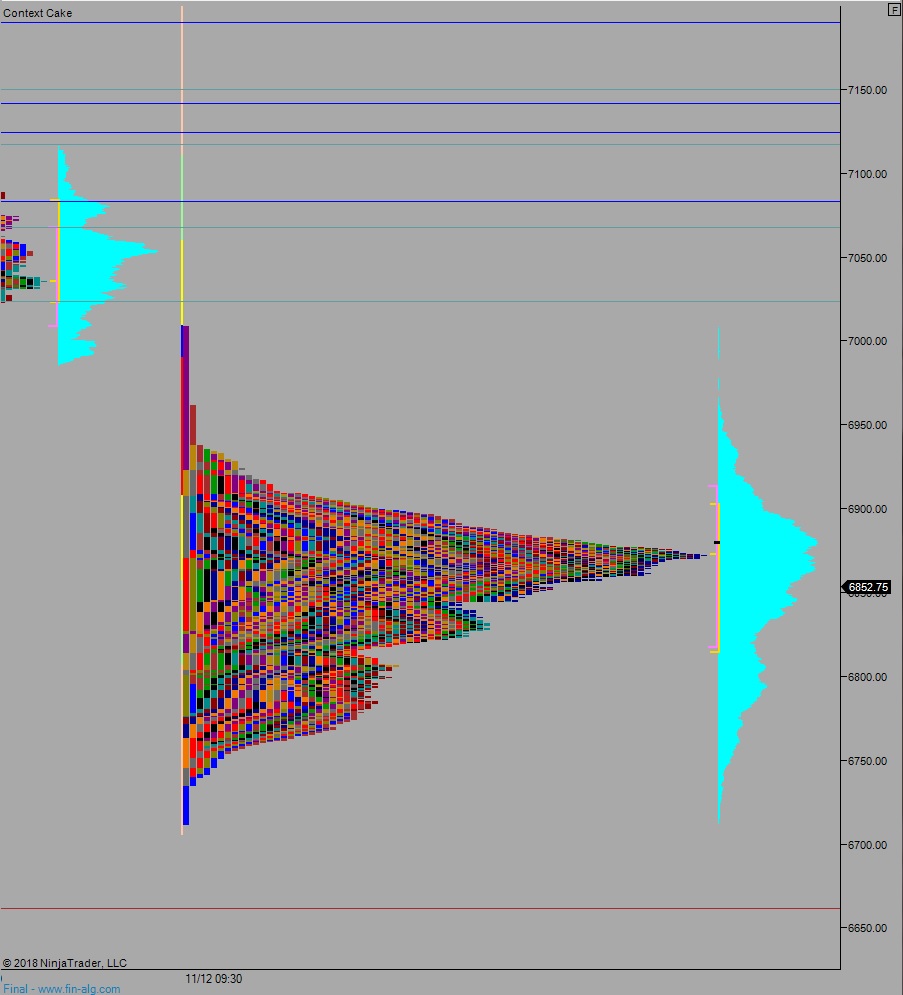

NASDAQ futures are coming into Monday gap down in-range after an overnight session featuring extreme range and volume. Price worked to a new three-day high overnight before falling back down to into Friday’s range. As we approach cash open price is hovering just below the Friday midpoint.

On the economic calendar today we have NAHB housing market index at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

Last week the NASDAQ began gap down and with a liquidation lower. Selling pressure saw prices lower through Wednesday despite some strong responsive bids stepping in along the way. Finally a strong enough responsive bid came in Wednesday morning that had enough force to turn the auction higher. We had conviction buying through Thursday and Friday was a balance day.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 6893.25. From here we continue higher, up through overnight high 6934.50 setting up a move to tag the 6950 CVPOC before two way trade ensues.

Hypo 2 sellers gap-and-go lower, driving a liquidation off the open that trades down to 6800 before two way trade ensues.

Hypo 3 stronger sellers liquidate down to the measured move ATR band at 6730.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

Interesting that you called out 6730 in your Hypo3, if that holds that would be a test of last week’s low.