http://youtu.be/zQDaGLe2qk4

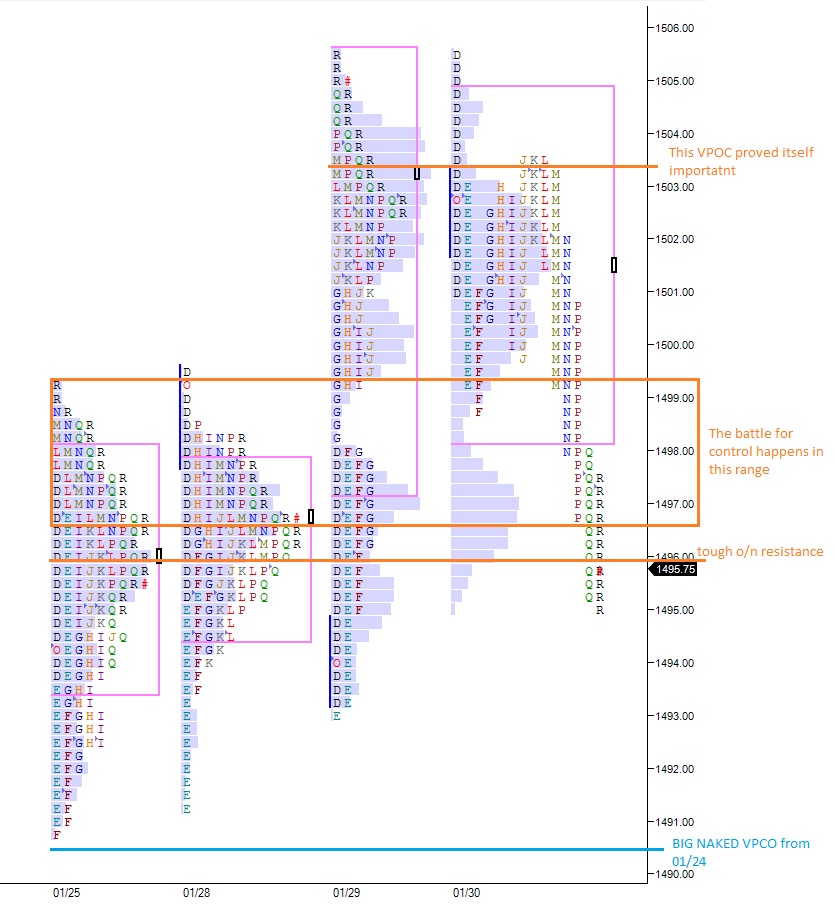

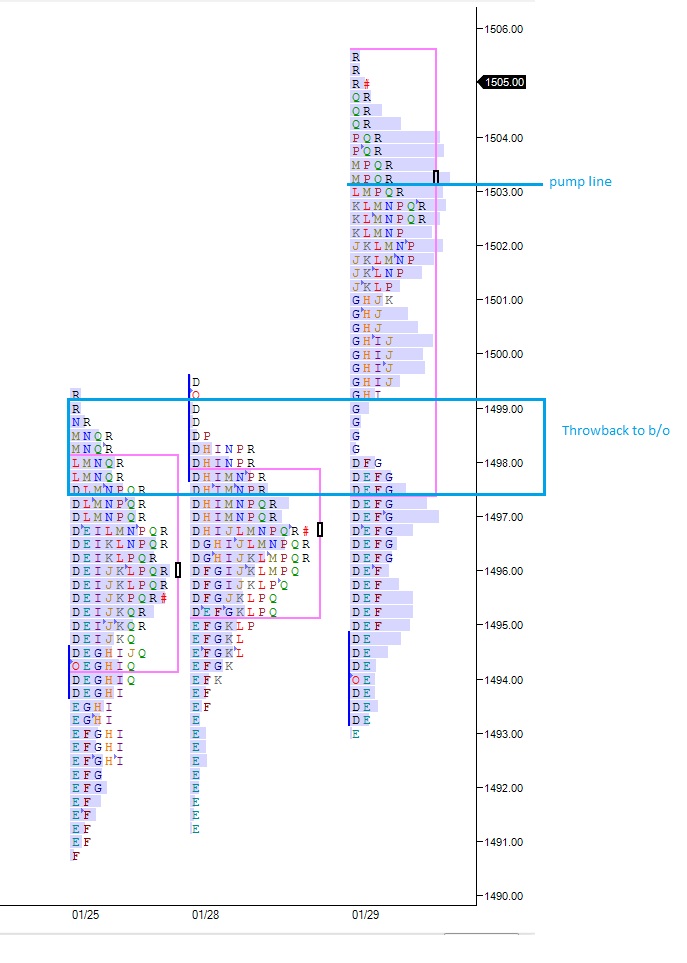

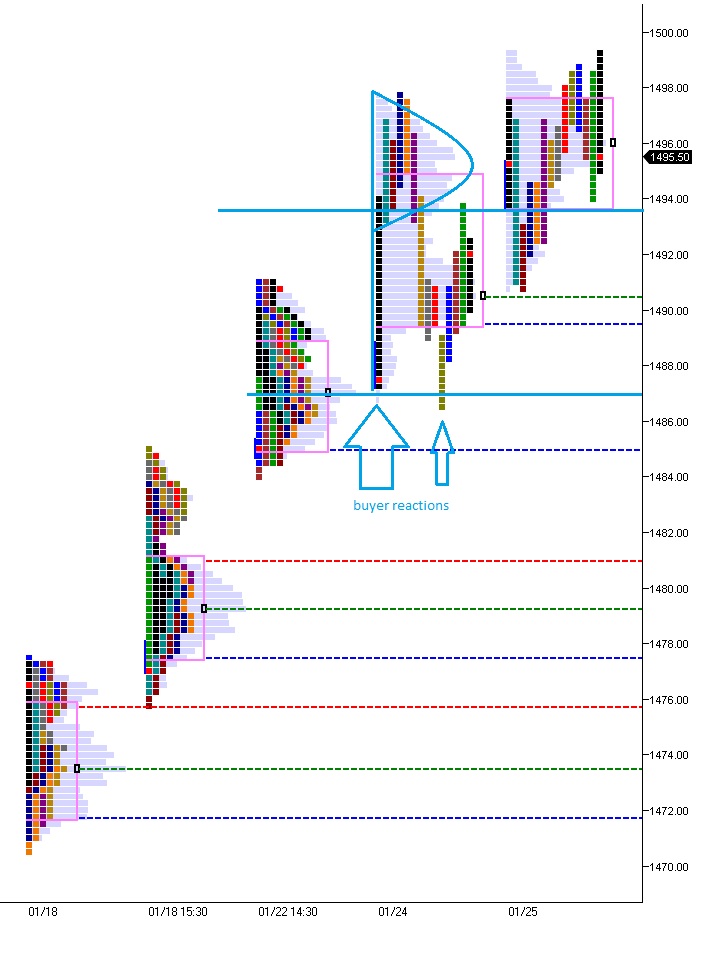

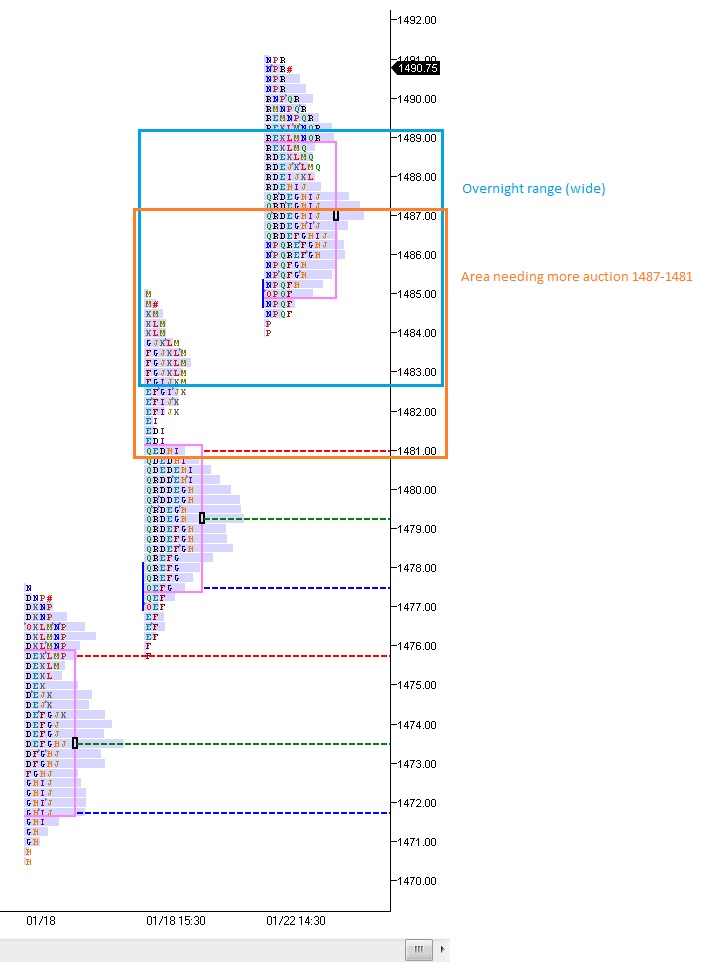

Yesterday’s auction was successful in cleaning up the toothy lower ends of the prior two day’s profiles. The price range from 1500-1495 has been very balanced and building pressure. We’ve seen aggressive entry into the tape by both buyers and sellers at the extremes of this range which is healthy behavior for a balanced auction.

The sellers did manage to push value to its lowest level since entering this new range, down to 1494.75. There were three shifts in the VPOC yesterday which is another sign of a balanced auction. The VPOC was resting higher most of the session but as we entered the last fifteen minutes of trading a massive block of orders came through and lifted price higher. Before the price was lifted the activity shifted value lower.

Honing in on yesterday’s value area, notice the entire value area is below the prior days. This is a victory for the sellers as they have been able to slow value at best for most of this year.

Being the first of the month and a Friday, I’m expecting lots of trickery and traps. I will again be placing most of my attention on the afternoon activity and the value placement.

Comments »