I’m impressed with the roster of musicians I saw at last night’s Grammy awards. I often get stuck in the mentality that the best music has already been made, and for many listeners’ ears that’s true. But there’s always more in store in this short life.

Well here we are, mid-February, making new highs in the S&P. As I’ve continually expressed during this up move, and perhaps the advice I’m trying to hammer into my own mind, is to not over think the trend. Keep your picks simple, you want stocks that participate in the strength of the market. I sashayed out of Goldman last week, why? No reason. Look at its chart, side-by-side with S&P, they’ve been mirror images this year, except GS is like the levered version, check it out:

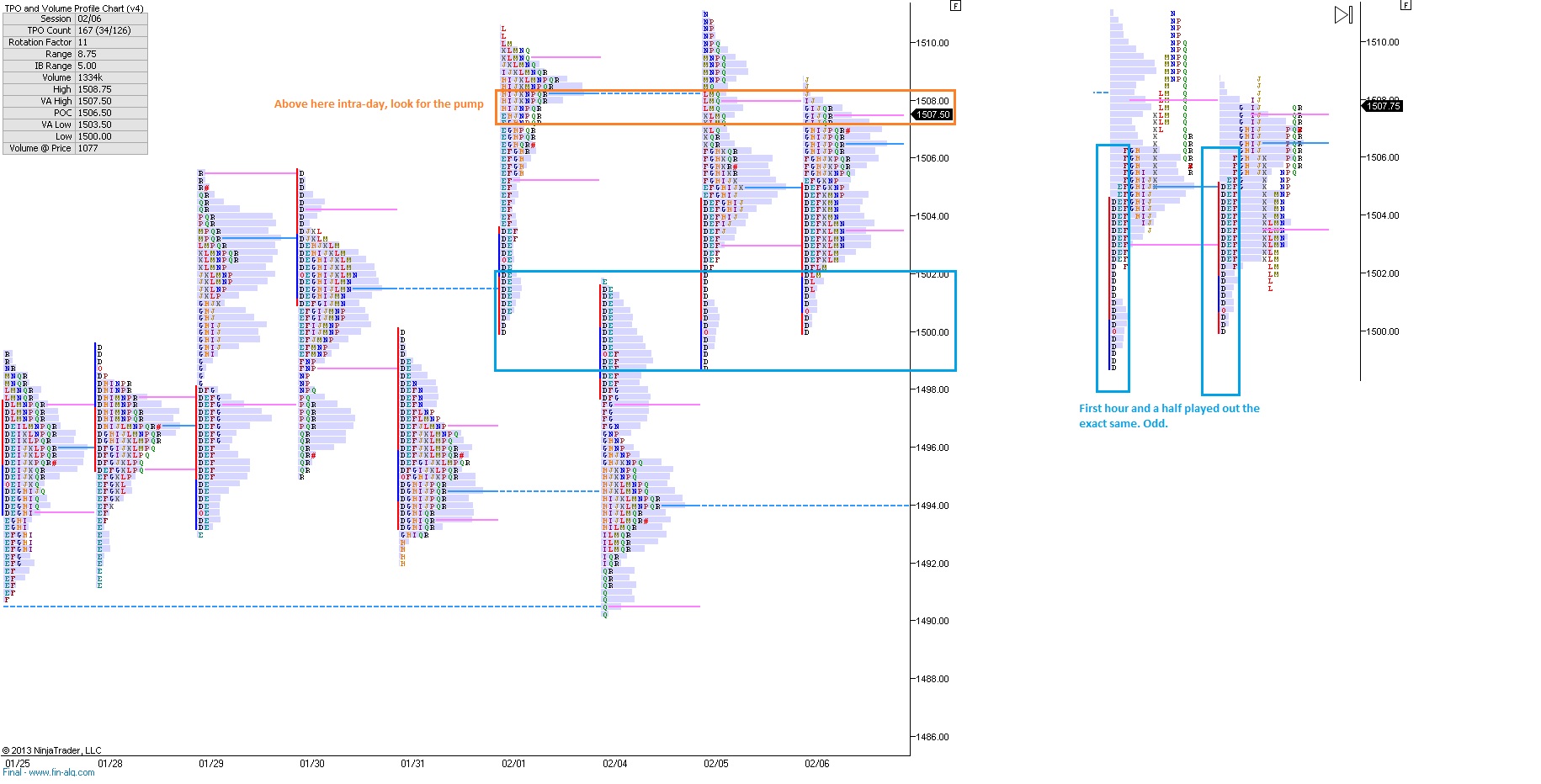

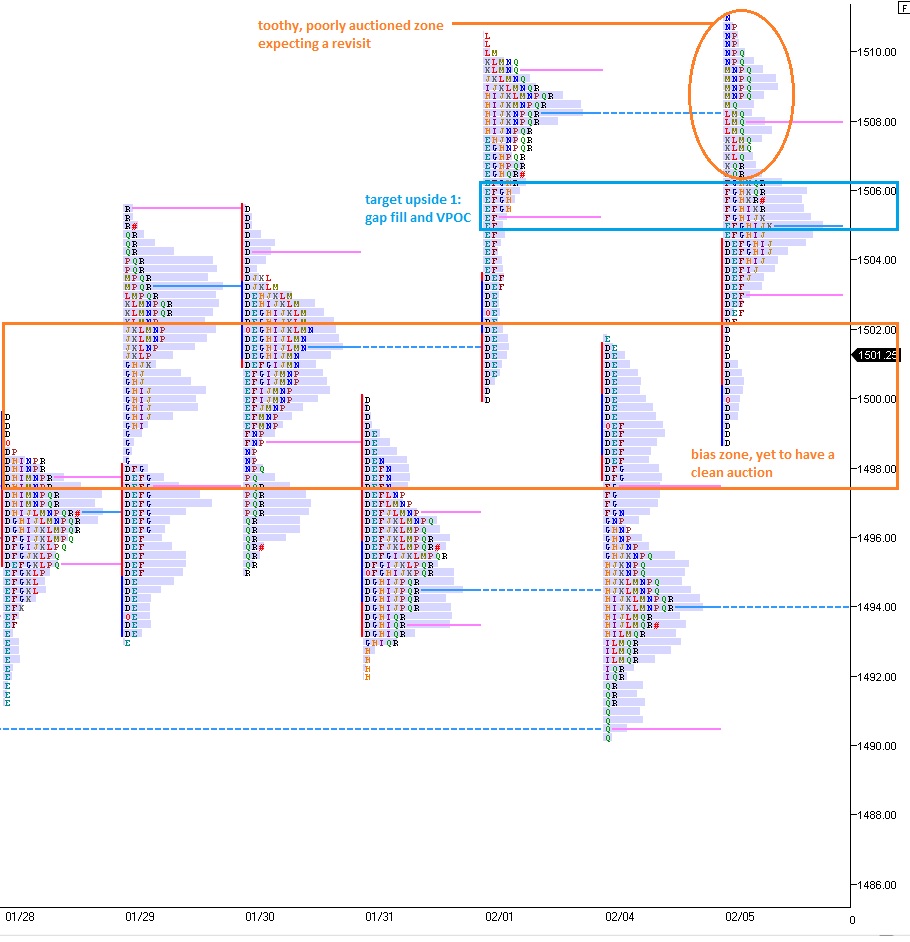

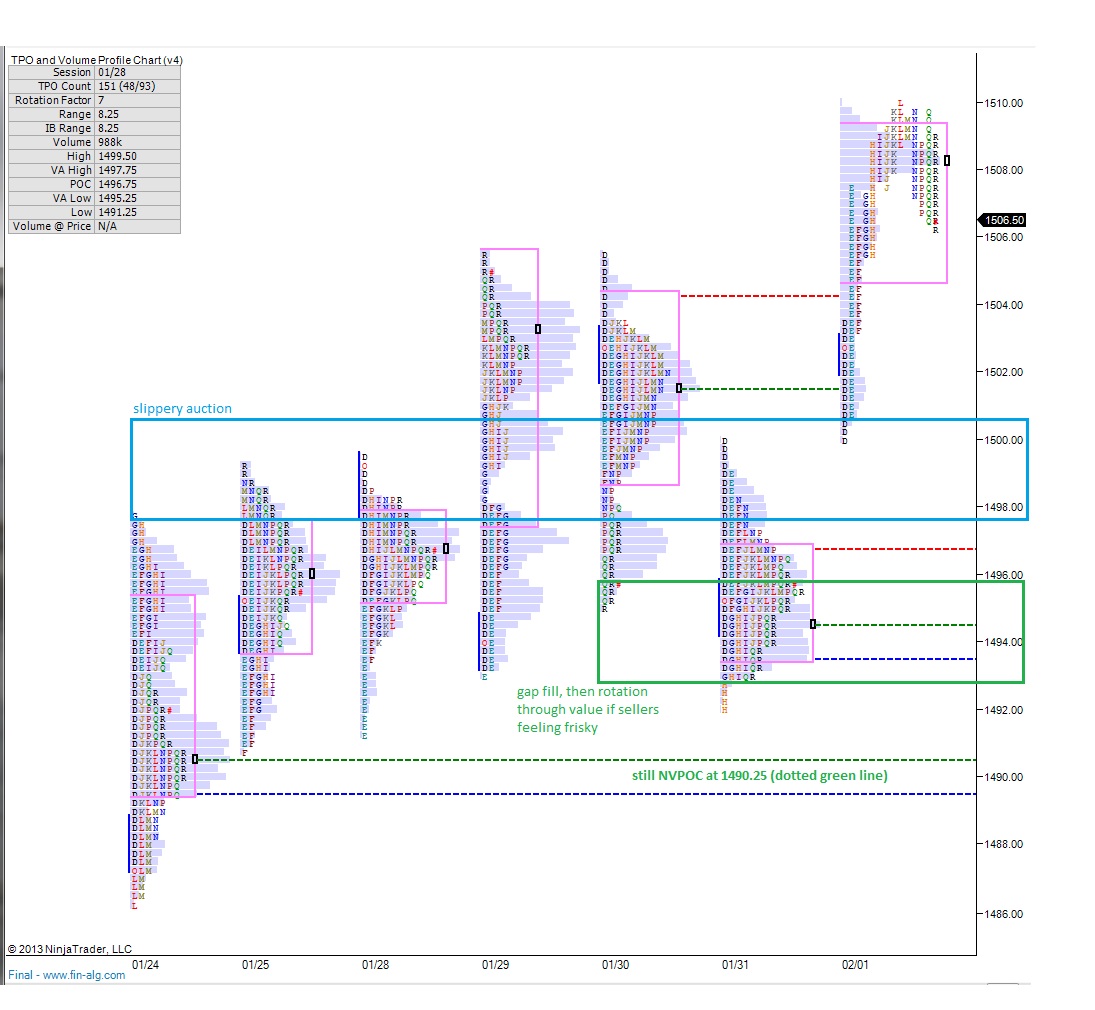

Instead we should focus on key price levels that would tell us overall sentiment has changed and sellers have grabbed the reigns. Taking to the market profile, let’s pay close attention to Friday’s session since it will provide the most immediate feedback as we progress through today.

Friday formed a tight letter P. The P-shaped profile has appeared often this year, and as we’ve discussed it suggests a temporary phenomenon has occurred known as a short squeeze. It suggests the sellers were forced out of their positions, but once they were forced to buy out no new orders entered the market. In a downward trending market, this can be a good opportunity to short. In an up trending market, we take the action with a grain of salt and look at other contextual pieces. What was going on Friday?

There was strength in the morning and then the east coast was freaking out over some snow. Perhaps that explains the benign action of Friday after lunch. They all left. Regardless, we need to see buyers hold off the single prints starting at 1511, if that level is lost, batten down the hatches and prepare for a rotation to 1508 then 1504. If trading back to those levels doesn’t bother you, hold tight and consider the real fight to occur down at 1498. That level is everything. It’s bigger than the 1500 century mark.

Otherwise, if we continue higher keep playing your pumpers if you’re a momo guy and playing your event trades if you’re an event guy. If you’re a value guy, do your thing player. Get on the good foot!

http://youtu.be/1N5jY00z_Sk?t=20s

Comments »