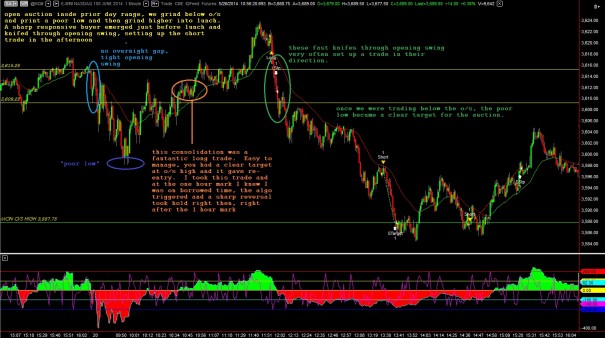

After closing out trade yesterday in the Nasdaq futures with a neutral print, the balance and indecision continued throughout the globex session. The market balanced ahead of GPD and jobless claims information. The expected numbers were -0.5% and 318k. Actual GDP number was -1% and actual claims were 300k. Thus we had a slightly worse than expected GDP number, which was blamed on weather and a slightly better reduction in jobless claims. The premarket reaction is timid.

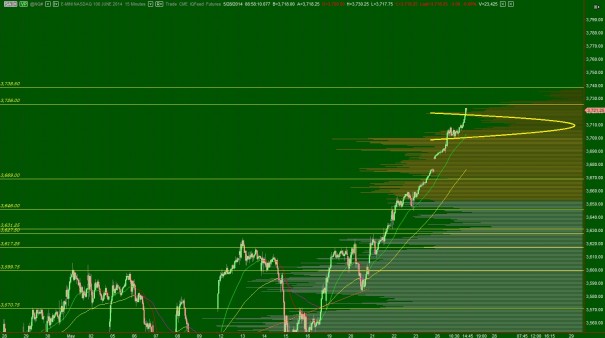

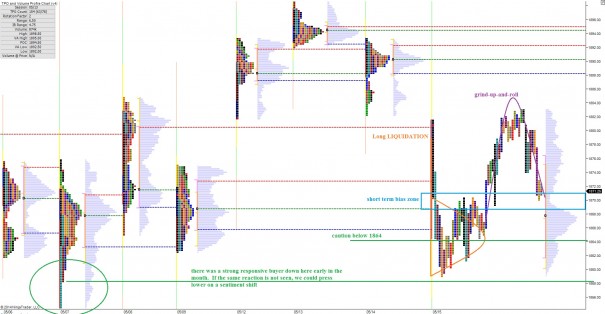

We are currently priced to open in balance and in range suggesting a lower risk environment. Keep in mind however that we started the week with a gap higher and have yet to even attempt filling it. This piece of context in the back of most speculators minds as they position throughout the day. This is either gap and go support, or a more likely fill opportunity.

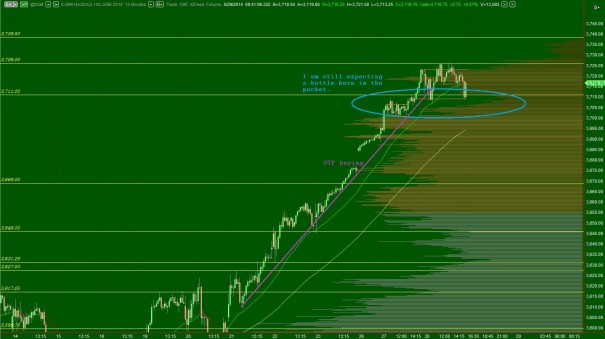

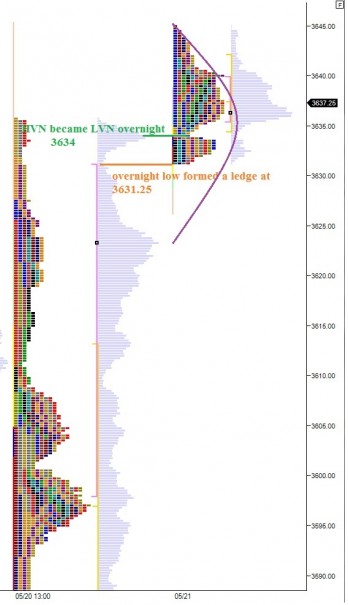

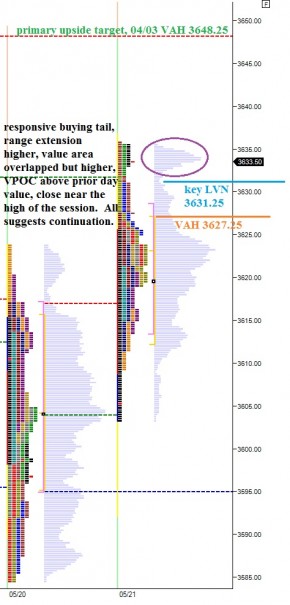

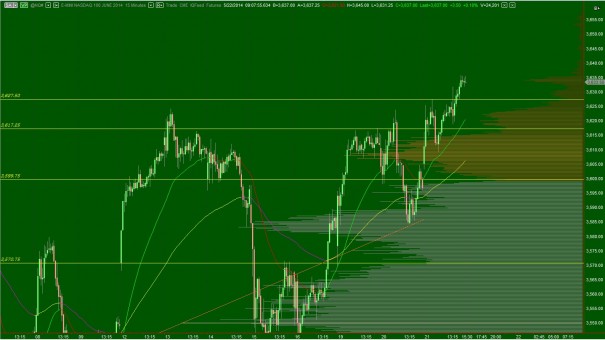

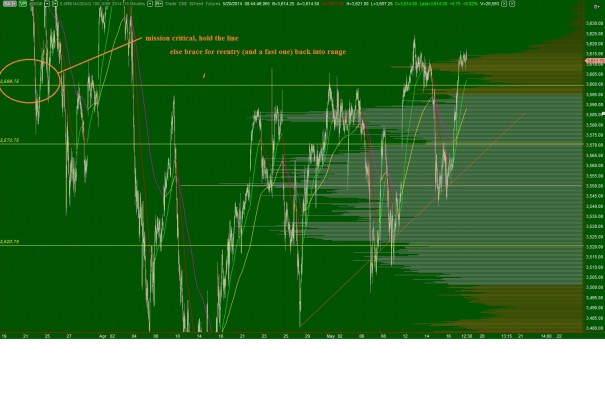

On the intermediate timeframe, we can see the buyers controlled price action for nearly 6 uninterrupted days. The late selling yesterday almost gives the intermediate term a balanced look, but with a slight edge to the buyers. See below:

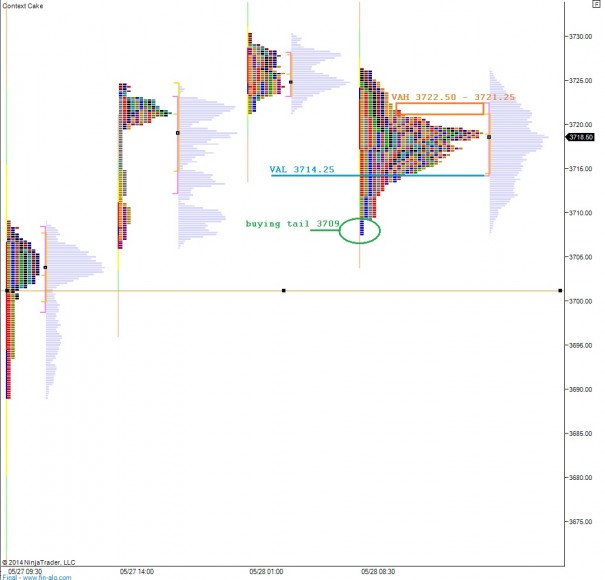

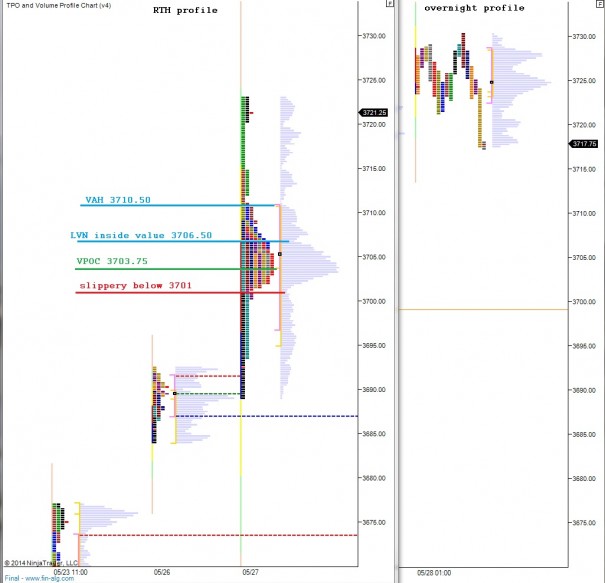

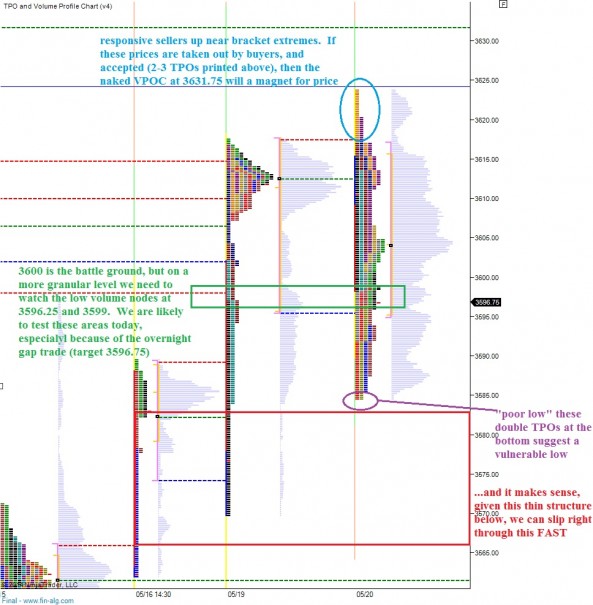

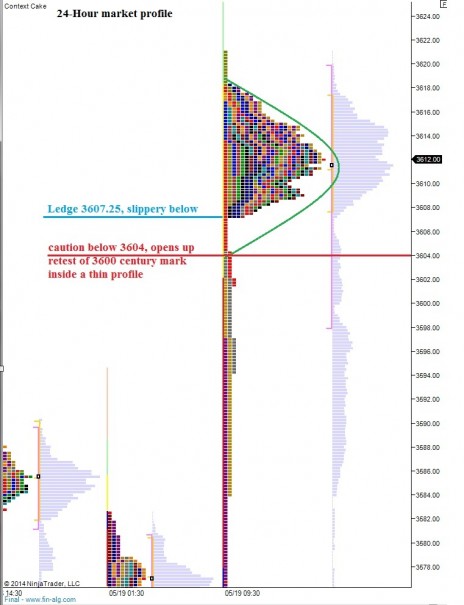

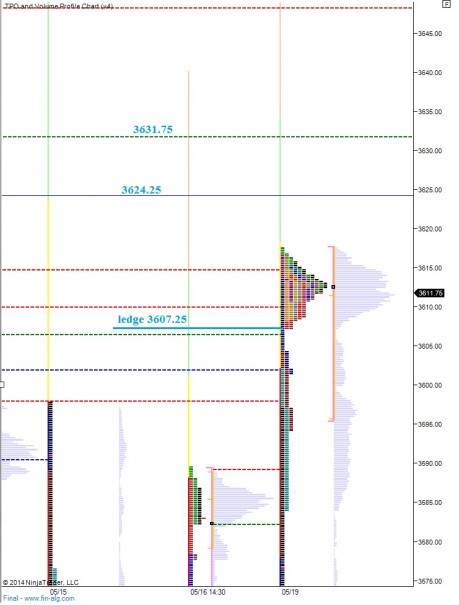

I have merged the overnight market profile into yesterday’s profile so we can see the near perfect balance on the short term. These levels will be in play early on:

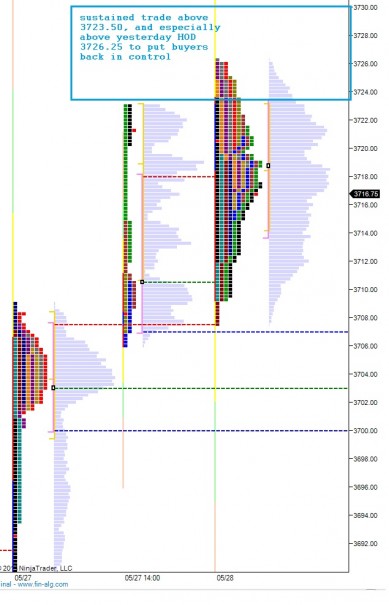

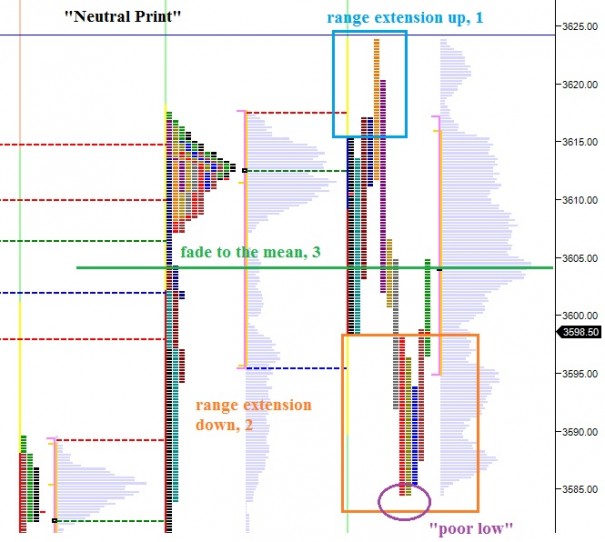

Overall, on the short term, we are coming into balance after squeezing shorts. Whether we continue to squeeze shorts is contingent upon sustaining trade above yesterday’s neutral print. See below

Comments »