The Nasdaq is about to gap up into the week. Conditions are consolidating and bracketed on the intermediate timeframe and a break away from this zone will require some volume and conviction. We can see two high volume nodes on the balance with price trading between the two and plenty of unresolved levels inside the toothy profile. How this resolves will be very telling, although the long term suggests the sellers have a slight edge. Below you can see the key levels within the intermediate term balance, as well as the bracket extremes:

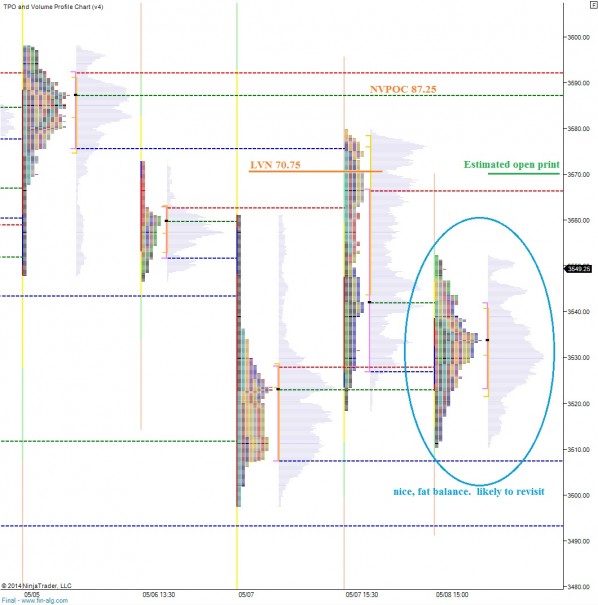

The short term shows the formation of balance Friday, however we are set to open outside of balance, outside of range which suggests we are opening out of balance. In this environment the risk of an opening drive in either direction is high. The gap below should be respected and signs of weakness may suggest the gap fill trade will take hold. This is even more likely given the fat, high quality distribution below, which we are likely to revisit. See below:

If you enjoy the content at iBankCoin, please follow us on Twitter

Scenario 1: Market tests higher, VPOC @ 3575.75, VAH at 3578.50m find sellers and begins rotating down though to 70.75 then lower for gap fill

Scenario 2: gap-and-go, takes out 75.75 and 78.50, targets NVPOC @ 87.50 then VAH at 92

Scenario 3: market tests lower, can’t fill gap, finds buying at 64.25 and chops