Nasdaq futures are up on overnight after starting out rather weak when trade initially opened in Europe. Traders’ attentions were focused on the Euro Zone this morning, where we were set to hear from both the Bank of England and the European Central Bank (ECB). The UK left their rates at historic lows and will remain steady with their asset purchase targets. The surprise came from the ECB who dropped their bank rate 10 basis points to 0.05% as well as decreased their deposit facility rate to -0.20%. The news sent the Euro dollar falling, the US dollar rising, and US equity indexes higher. We also saw initial jobless claims at 8:30am which was a bit higher than expectations.

Nasdaq futures are up on overnight after starting out rather weak when trade initially opened in Europe. Traders’ attentions were focused on the Euro Zone this morning, where we were set to hear from both the Bank of England and the European Central Bank (ECB). The UK left their rates at historic lows and will remain steady with their asset purchase targets. The surprise came from the ECB who dropped their bank rate 10 basis points to 0.05% as well as decreased their deposit facility rate to -0.20%. The news sent the Euro dollar falling, the US dollar rising, and US equity indexes higher. We also saw initial jobless claims at 8:30am which was a bit higher than expectations.

Thus far, the net result was about a 25 point range on normal volume in the Nasdaq globex session.

At 10am we have ISM Non-Manufacturing composite which is listed as a high-impact event. Energy traders will have a whole slew of oil and gasoline data to digest at 11am, and there are some Fed speakers after the market close (no Yellen).

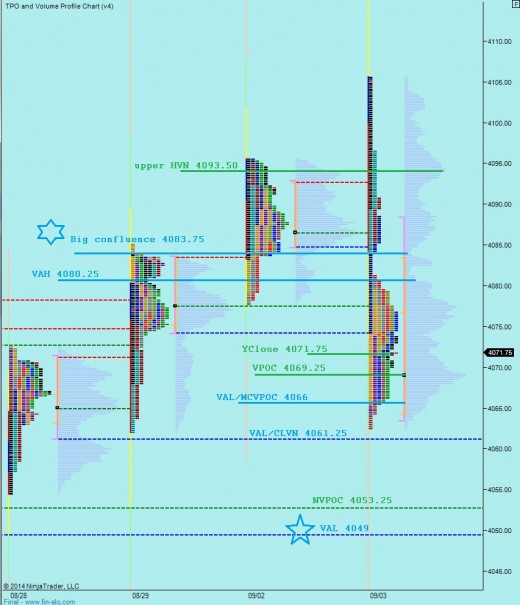

The intermediate term has come into balance. The balance spans 9 sessions and can be seen on the following chart. Below this balance the volume composite is very sparse, and prices below about 4050 are susceptible to fast moves. However, above here, we are likely to see the balancing process age a bit. See below:

I have noted the short term levels I will be observing on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

Surprise…lol

Something tells me the news had a different impression on you

We can’t stop qe without our partners in Japan and Europe taking the baton i found the news totally expected

Would you consider those single prints from yesterday’s liquidation break needing to be filled in still or would you consider them being filled in already with past price history?

I never consider any MP concept as “needing” to happen, but this is simply semantics. I think you are asking whether or not it seems likely to fill higher on those single prints.

They represent a strong responsive seller yesterday morning. They rejected the gap higher. Rather then seeing it as something we can easily trade through, I consider it some tough resistance. However, if the sellers allow us to build acceptance inside those single prints, where they were initially so strong in rejecting, then that would be a notable change in character.

however, the zipper from 83.75 – 80.25 will provide a fast opportunity, likely early on

Primary hypothesis – sellers push off the open, if the hold price below 4080.25 then trade down to fill the overnight gap to 4071.75 and tag the VPOC at 4069.25 before finding responsive buying before another test down to 4066 where we find a stronger responsive buy back up to test 4083.75

Hypo 2 – buyers push off the open take out the confluence at 4083.75 and target the upper HVN at 4093.50. If no responsive seller up here then continue to test Monday high 4105.50

taking out that 4083.75 confluence early might be revealing something here, if we continue sustaining above it, caution shorts

Your midday snapshot painted out pretty well. Given where we are trading, the idea of very low was reached this early morning like 4am ish on this playbook, I assume?

sort of, like I said yesterday, these are broad strokes, right now my primary level is 4083.50, that was a sort of over/under bias line

sorry if this sounds vague, but this strength was a bit unexpected overall. That map was more of an RTH expectation which was modified by the ECB

Not at all. Thank you for doing it. I trade NQ intraday, so your blog is a great help by all means.