Nasdaq futures pushed higher overnight and achieved a news swing high in the globex hours. The thrust occurred right around 3:30am and does not align with any economic release, thus it is the result of either a news development or simply more buyers than sellers. As we approach US cash open, prices are off the highs of the session.

Personal Consumption statistics came out at 8:30am in line with forecasts which initially has brought little activity into the market where we are holding onto the overnight gains. We have Chicago Purchasing Manager at 9:45am and U of Michigan Confidence numbers at 9:55am.

Yesterday’s auction was effective and methodical. You will often see the Nasdaq futures operating in this manner. It will go about the day resolving unsettled items one after another. The gap higher on Monday did not quite resolve on Monday when prices stopped a tick above the full gap fill. Yesterday we filled the gap before finding a responsive buyer who returned us back into the upper balance formed this week. They closed the weekly gap, then they closed the range gap between Wed/Thurs, then they targeted a full overnight gap fill, stopping just one tick shy of this achievement. It was a very methodical process.

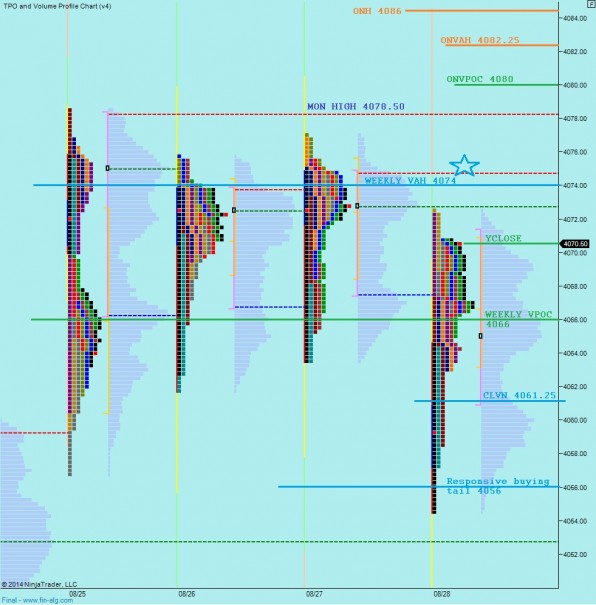

I have highlighted the key LVNs as well as a measured move target which is a point shy of where we printed our overnight high:

I have also noted the short term levels I will be observing on the following market profile:

If you enjoy the content at iBankCoin, please follow us on Twitter

Primary Hypo – sellers push off the open to close the overnight gap to 4070.50 where we find responsive buying back up above weekly VAH 4074 and push higher to target ONVAH 4080 and then ONH 4086

Hypo 2 – buyers push off the open up to ONVAH 4082.25 where we find responsive selling back down to test weekly VAH 4074 before balancing out around 4074 and filling the overnight gap to 4070.50

Hypo 3 – open drive higher, gap-and-go initiative rejection away from 4-day balance. Take out ONH 4086 and press higher through the session

Hypo 4 – open rejection reversal –sellers press hard off the open, close overnight gap to 4070.50 and quickly target yesterday VPOC at 4066. A bit of a buying response cannot get out of yesterday’s value are and we perss down to test CLVN at 4061.25 and then test responsive buyers down at 4056. If still cannot find a bid then a test of 4050

hypo 4- sort of, nice responsive buy near CLVN at 4061.25…seeing if it sticks…

thinking the same, back up to close near open

Who woulda thunk it?

Just sitting here reflecting back on some remarkable moves just under 5yrs.

eg)Just think if you had scooped LNG below 2 in late 2009..you’d be up a whopping 4224%

((Remarkable))..

Thanks,once again, for that one Mr Dan D.

I do hold long core at level mentioned here in the past.

shares below that level are long gone..D@MN~it~All!

Have a super great holiday all you Beautiful People.

if you had invested 37k (20k shares) back then that position would be setting at over 1.56 million buck~a~roos

Sweet Jeezus..

yup..in hindsight.. that kind of makes me sick just thinking about it.

😉

your boy Elon is at it again. His networth sure fluctuates a lot.

Good thing he hardly cares about money, just saving earth and having an escape planet in case he can’t save earth