The Nasdaq futures are up overnight after printing a normal range on slightly above average but normal nonetheless volume. The premarket economic calendar is empty but at 10am we have US Factory Orders and the Bank of Canada rate decision. Later in the afternoon, at 2pm, The Fed Beige Book will come out. After hours tonight the Bank of Japan is set to release their monetary policy statement and early tomorrow morning there are several central banking activities to keep in mind from both The Bank of England and the ECB.

We discuss day-types often and their implications. Although yesterday was a normal variation with range extension lower, a day which normally would suggest seller control on the session, you have to be aware that none of these market profile terms are concrete. They are simply ideas for us to assess the auction and who is participating and who might be in control and how good of a job they are doing.

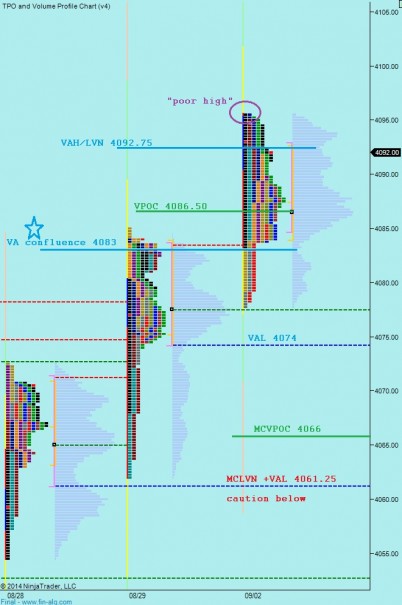

Yesterday we nearly printed a neutral extreme to the upside. The afternoon rally was well timed and buyers were able to sustain their push into the bell. Their force was not overwhelming enough to press through the high, but the high on the session was of poor quality—another feather in the bull cap. Conversely, the taper on the low of the session was clean, the rotations lower were smooth pushes lower as well, nearly perfectly compliant with a wave 3,4,5,a,b,c type reversal. It was fairly clear by the end of lunch that the market had done a good job finding a buyer and the auction could start anew.

This is all hindsight. What the market has done. What else has it done? On a larger timeframe we pressed higher through most of August, based out to end the month, and made a fresh thrust higher to start the month. The beginning of the month has slightly bullish skew for equities, therefore the real intermediate term assessment takes place after 3-4 sessions. For now, I have noted the key composite levels below:

The market appears to be keen on trying higher. Over the last week volume has been stronger on green candles. As far as price history goes, the Nasdaq composite overshot the 14 year gap from 2000 and is now in a bit of a fast zone from back in the dot com mania. The market appears to be trying to find a seller up here by exploring higher.

Finally, I will be using the following market profile levels to aid my hypothesis process in determining what the market is likely to do from here:

If you enjoy the content at iBankCoin, please follow us on Twitter

Great work Raul, much appreciated!

thanks

Primary hypothesis – sellers push off the open before finding responsive buying at the 4100 century mark which tests overnight high 4113.75 before balancing out around 4107

Hypo 2 – sellers push the range gap closed to yesterday HOD 4095.50 where we find responsive buying back up to 4106 and churn before completing the gap fill down to 4092 and a possible test of VPOC at 4086.50

Hypo 3 – gap-and-go drive higher

Hypo 4 – open rejection reversal, push down to yesterday VPOC 4086.50 early find a weak responsive buyer before anther leg down through VA confluence at 4083. Take out Yesterday’s range and test VAL at 4074

Looks like Hypo 4. What’s your score on NQ now?

2.8, neutral with a very slight medium bear tone