If you have been following along, then you have been aware of this big picture technical piece dating back to the year 2000. “The 14 year gap” has been a feature of the premarket analysis since it came into range. I am both satisfied and a bit sentimental that the gap has been filled and is now gone. See below:

Such is life and markets, change is inevitable and we must now be aware that the resistance free environment is complete. How we handle this gap range will still be of interest going forward—whether buyers can sustain trade above the midpoint, whether we use the strong thrust to overshoot, or whether sellers reject us back below. The simple trade was to press longs through the gap which saw little if any media coverage. Simple, but not easy.

Nasdaq futures are down just a bit overnight and we have no major economic data out for the week. There are Gasoline and Crude Oil numbers coming out at 10:30am to be aware of and also 2Q GDP tomorrow before market open.

Intermediate term continues to demonstrate buyer control and I have updated the LVNs to observe below:

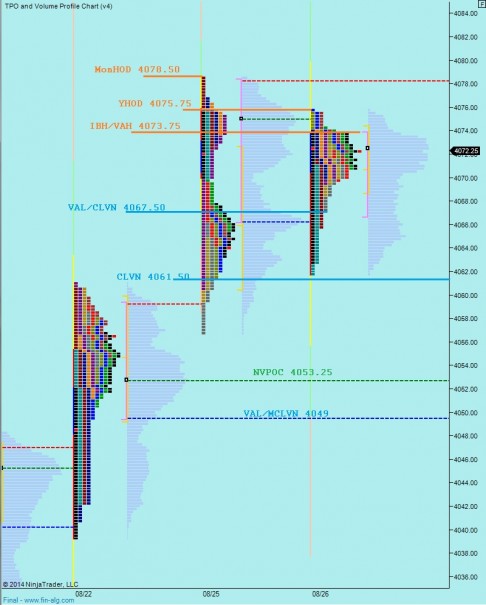

Short term, taking our eyes inside the daily bars and observing the market profile, we can see value overlapping the prior day. This is an early indication that prices are coming into balance. The key question in whether we are pausing or if the market is done finding sellers. Monday was a neutral day and yesterday we traded inside the range and value tightened. This compression may preclude a swing high, however I will be observing the following levels and withholding any judgment until more information is made available:

If you enjoy the content at iBankCoin, please follow us on Twitter

Primary Hypothesis – buyers probe higher off the open and find some resistance at VAH 4073.75 before chopping around inside of yesterday’s value. IF we sustain trade above VAL 4067.50 then a move to test Monday HOD at 4078.50. If we see sustained buying at those levels then measured move targets are 4082.25 then 4084.25

Hypo 2 – sellers push down through VAL 4067.50 and test CLVN at 4061.50 where we find responsive buying back up to ~YClose 4072.25 before making a second rotation lower to target NVPOC at 4053.25 and possibly test through to VAL at 4049

Hypo 3 –buyer make a big push off the open, driving above Monday HOD 4078.50 then markets slow down and chop for rest of session, balancing around 4078

ahhh..

nice..catch it if you can

Hot..Hot..Hot!

http://youtu.be/J91ti_MpdHA

you know the one..

get it baby

😉

I just read your last post…A++ on the picture/caption combo.

“That’s Mowgli (MBLY) punching Baloo in case, nevermind…”

I just bought MBLY yesterday with an option, but may quickly cash it in.

gracias

agreed, ‘Superb Skill’, yoshii