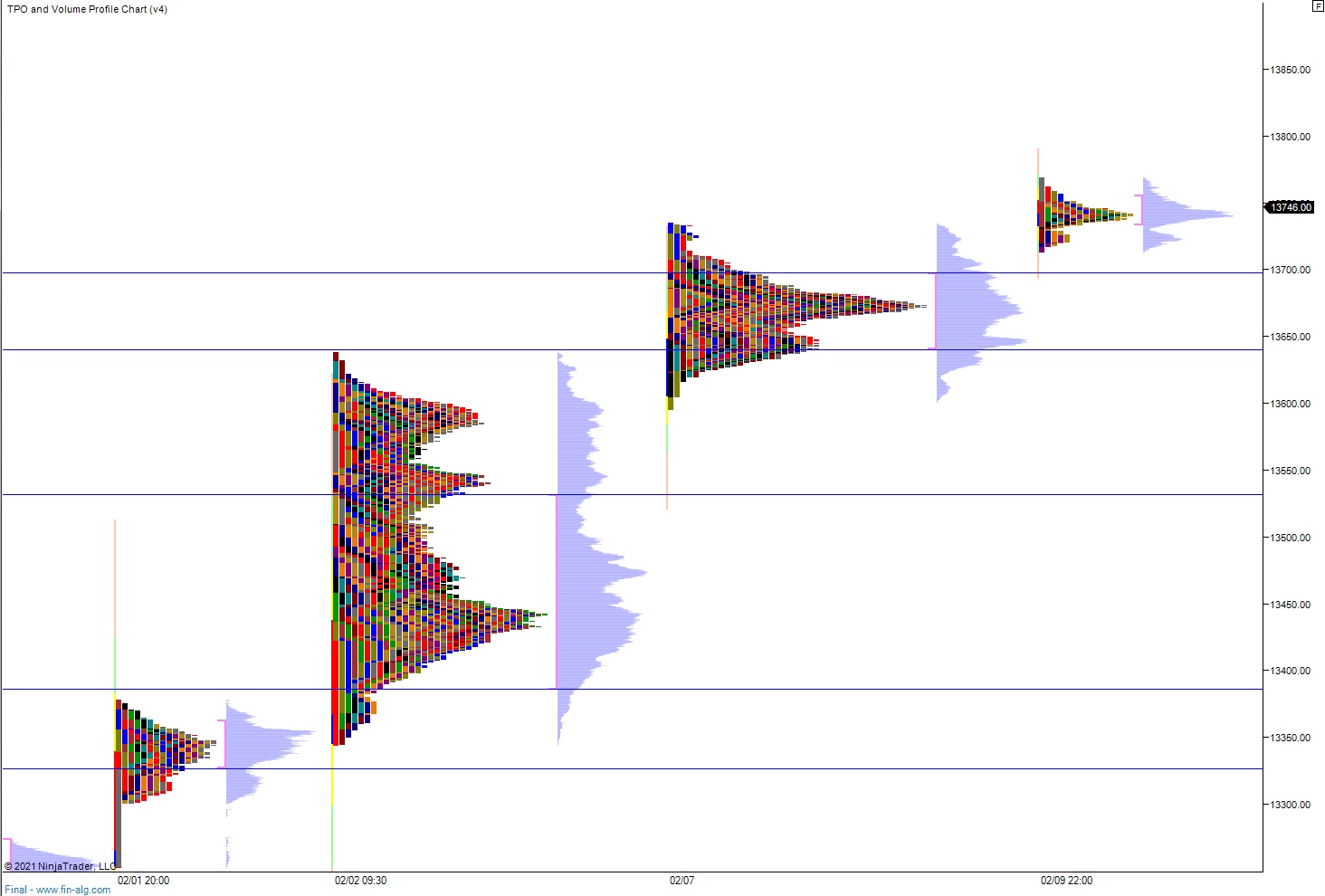

NASDAQ futures are coming into the third day of the second week of Black History Month up a quick +60 after an overnight session featuring elevated volume on extreme range. Price campaigned higher overnight, rallying up beyond the Tuesday high until about 5:30am New York when sellers were able to briefly work price back down into the Tuesday range. At 8:30am CPI data came out below expectations:

The prices are lovely, soft, and weak

And miles to go before overheat. pic.twitter.com/s9Na9cbubU— George "Grants To State & Local Gov NOW" Pearkes (@pearkes) February 10, 2021

As we approach cash open price is back above the Tuesday high.

Also on the economic calendar today we have crude oil inventories at 10:30am, a 10-year note auction at 1pm, then both a speaking engagement from Fed Chairman Powell and a Treasury Statement from Secretary Yellen.

Yesterday we printed a normal variation up. The day began with a gap down in range, with price beginning the day right in the middle of Monday’s range. Buyers drove higher off the open, closing the overnight gap and continuing beyond the Monday high to tag the first of our Fibonacci extensions. Upward price discovery stalled out shortly after going range extension up and we spent the rest of the session chopping along the midpoint, eventually closing right along it.

Heading into today my primary expectation is for buyers to drive away from the Tuesday high 13,735.25 by working up through overnight high 13,769.25 to set up a tag of 13,800. Then look for the third reaction to all the 2pm economic information to dictate direction into the second half of the day.

Hypo 2 stronger buyers sustain trade above 13,807 setting up a run to 13,882.50. Then look for the third reaction to all the 2pm economic information to dictate direction into the second half of the day.

Hypo 3 sellers work into the overnight inventory, reclaiming the Tuesday range 13,735.25 early on and sustaining trade below it to set up a gap fill down to 13,690.25. Sellers continue lower, taking out overnight low 13,664.25. Then look for the third reaction to all the 2pm economic information to dictate direction into the second half of the day.

Levels:

Volume profiles, gaps and measured moves: