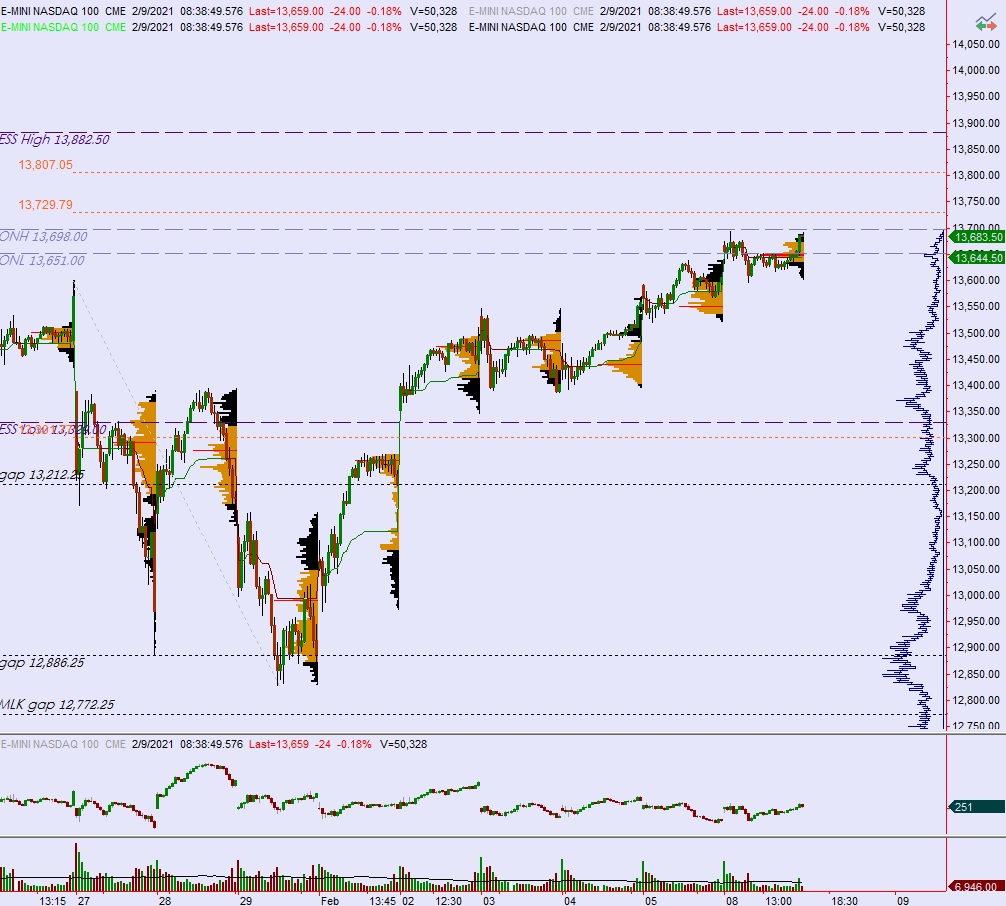

NASDAQ futures are coming into the second day of the second week of Black History Month down a mild -20 after an overnight session featuring normal range and volume. Price worked sideways overnight, essentially marking time after briefly poking above the Monday high around 7:30pm. As we approach cash open price is hovering above the Monday midpoint.

On the economic calendar today we have JOLTS jobs openings at 10am followed by a 3-year note auction at 1pm.

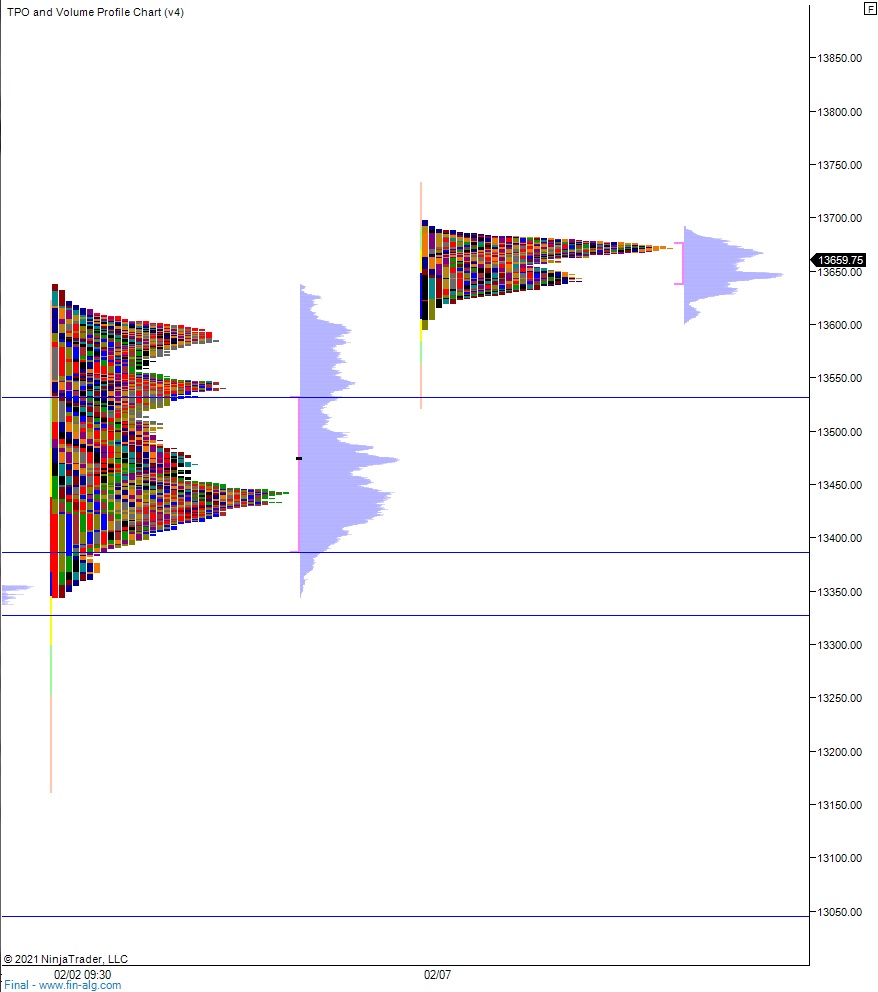

Yesterday we printed normal variation down. The day began with with a gap up above last Friday’s range. There was a brief open two-way auction outside the range before buyers stepped in and took out overnight high. Said buyers stalled out within 45 minutes of the cash markets being open and we formed an excess high. Then sellers reclaimed the mid and after chopping along it once sellers worked the market range extension down, effectively closing the overnight gap and exceeding it by about 10 handles before discovering a responsive bid. Price then rallied back above the mid late in the day and ended above it.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 13,683.50. From here buyers continue higher, up through overnight high 13,698, tagging 13,729.75 before two way trade ensues.

Hypo 2 sellers gap-and-go lower, taking out overnight low 13,651 early on to set up a move down to 13,600 before two way trade ensues.

Hypo 3 stronger sellers trade down to 13.532 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: