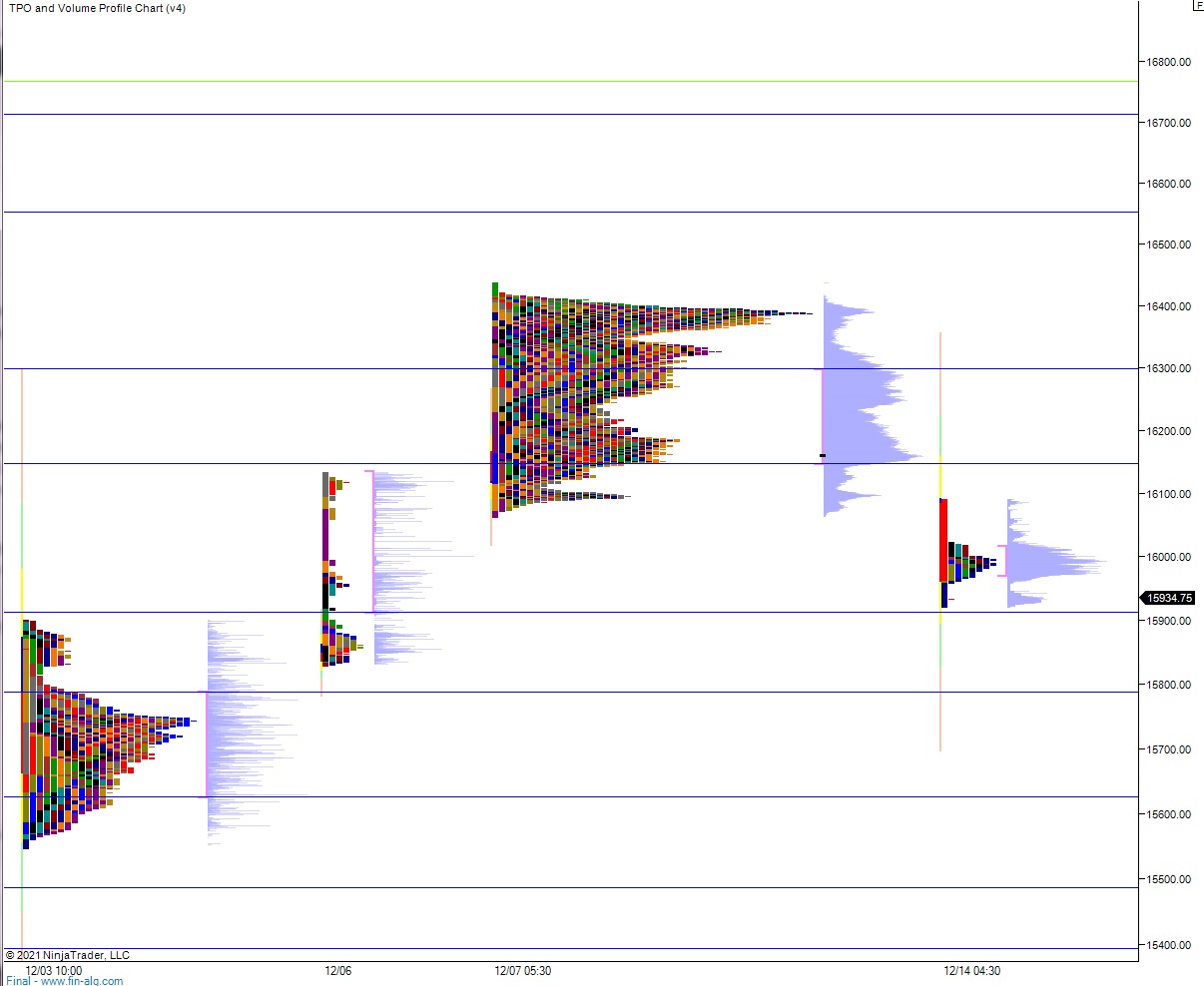

NASDAQ futures are coming into Tuesday of quad-witching week gap down after an overnight session featuring extreme range and volume. Price drove lower overnight, driving down into near last Monday’s high after the 8:30am PPI data showed producer prices higher than expected. As we approach cash open price is floating in the gap zone left behind last week.

There are no other economic events scheduled today.

Yesterday we printed a double distribution trend down. The day was about to begin with a slight gap up but just before opening bell sellers stepped in and started working the tape lower. By the open we were nearly flat and sellers continued their campaign, pressing down into last Friday’s volume point of control. Buyers defended here briefly before sellers resumed control and through steady selling took out last Friday’s low. Then we chopped along that Friday low until a late day push lower sent price down into last week’s pro gap zone.

Heading into today my primary expectation is for buyers to reject a move back into last Monday’s high, perhaps stepping in at the Monday gap level 15,832.75 and reversing the auction higher. Look for buyers to trade up through overnight high 16,132.75 and tag 16,146.50 before two way trade ensues.

Hypo 2 sellers gap-and-go lower, reclaiming 15,900 early on and sustaining trade below it to set up a move down to 15,800.

Hypo 3 stronger buyers sustain trade above 16,200 setting up a run to 16,300.

Levels:

Volume profiles, gaps and measured moves: