NASDAQ futures are coming into Friday with a slight gap up after an overnight session featuring normal range and elevated volume. Price took out the Thursday high overnight, further pushing into last Friday’s range before sellers stepped in and balance ensued. As we approach cash open price is hovering just above the Thursday high. At 8:30am non-farm payroll data came out better-than-expected.

Also on the economic agenda today we have non-manufacturing/services composite data at 10am.

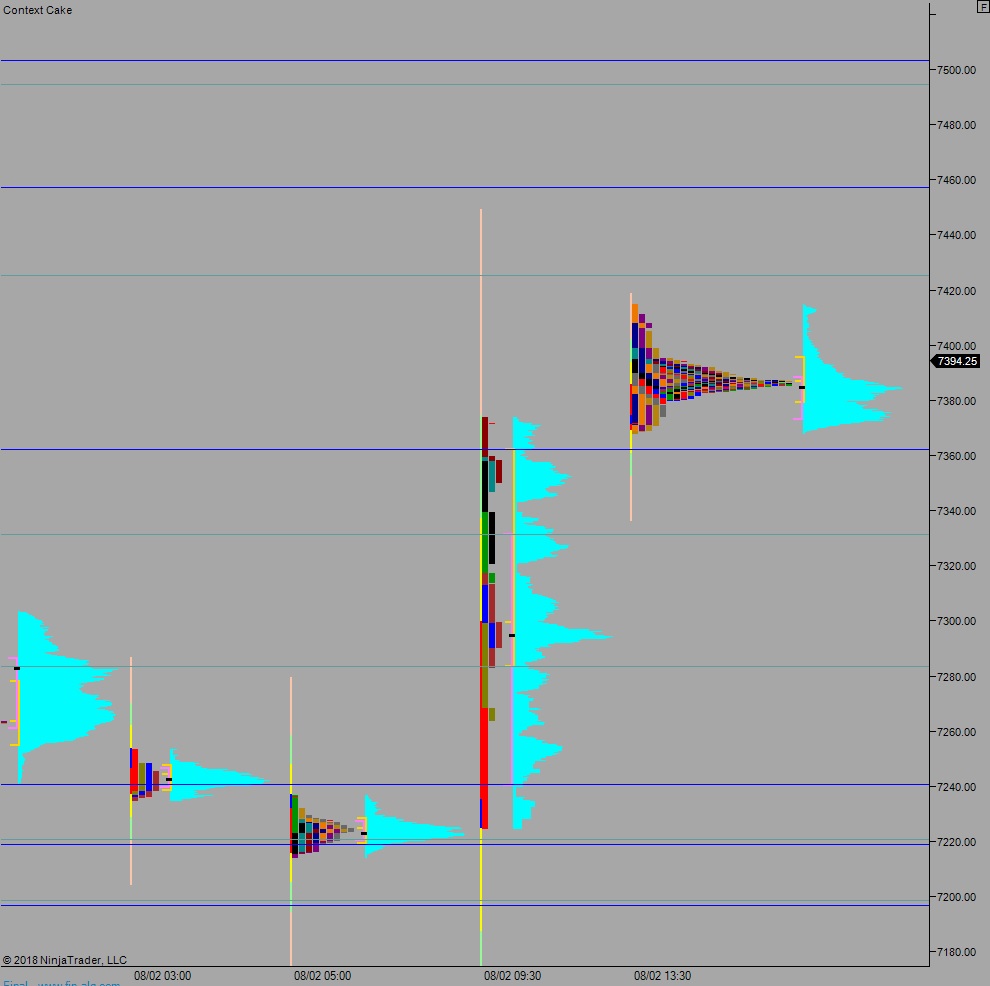

Yesterday we printed a trend up. The day began gap down and buyers drove higher right off the open. Then they took out the Wednesday high. Then they reclaimed most of the losses seen late last week. Price was trend up nearly all day, eventually coming into mini balance along 7375.

Heading into today my primary expectation is for buyers to work up through overnight high 7415 to tag 7425.75 before two way trade ensues.

Hypo 2 stronger buyers trade up to 7457 before two way trade ensues.

Hypo 3 sellers press down through overnight low 7379.25 to tag 7362.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

Love your posts and am still learning auction theory. With your hypos, do you trade the initial moves or wait for the 2 way trade to scalp? Once again, love the posts and am fascinated by your approach.

usually trading the initial moves, if you decide to view the market for what it is, a two-way auction, you may find yourself liberated from all the surrounding noise, g/l feel free to ask questions whenever