NASDAQ futures are coming into Thursday gap down after an overnight session featuring extreme range and volume. Price mostly worked lower overnight after being in balance until about midnight New York. At 8:30am initial/continuing jobless claims data came out better than expected.

Also on the economic agenda today we have factory and durable goods orders at 10am.

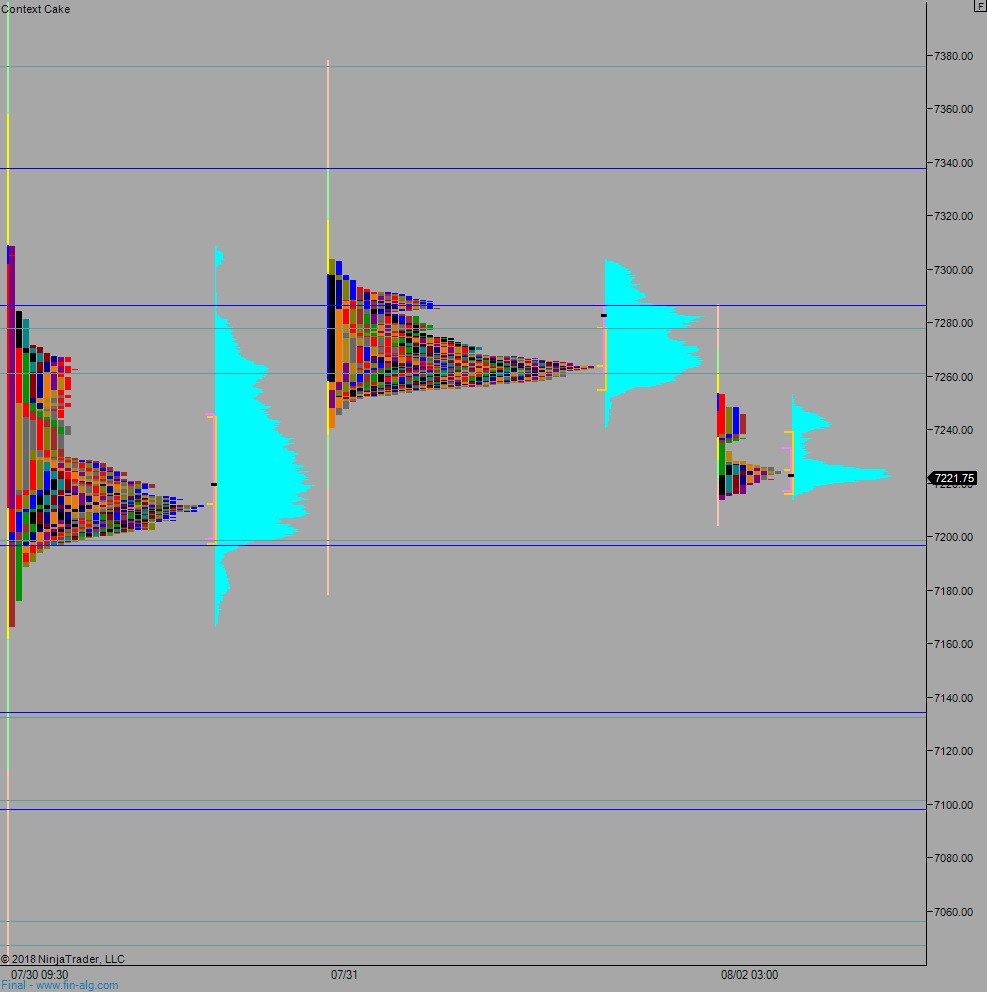

Yesterday we printed a normal variation down. The day began gap up and after sellers closed the gap we spent the first hour of the session auctioning higher. Sellers stepped in before 10:30am, right around where they drove lower from Monday, and high-of-day was set. Price chopped near session low up until the FOMC rate decision.

After the Fed left their benchmark borrowing rate unchanged we saw little reaction but ultimately buyers stepped in late in the session and slowly moved price higher before we fell back to the midpoint by end-of-day.

Heading into today my primary expectation is for buyers to work into the overnight inventory and tag Wednesday low 7241. Sellers reject a move back into the Wednesday range setting up a move to take out overnight low 7214.25. Look for buyers down at 7200 and two way trade to ensue.

Hypo 2 gap-and-go lower, trade down through 7200 and sustain trade below it setting up a move to target 7134.25 before two way trade ensues.

Hypo 3 buyers reclaim Wednesday low 7241 and sustain trade above it setting up a gap fill up to 7272.50. Buyers continue higher, up through overnight high 7293.25. Look for sellers up at 7300 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: